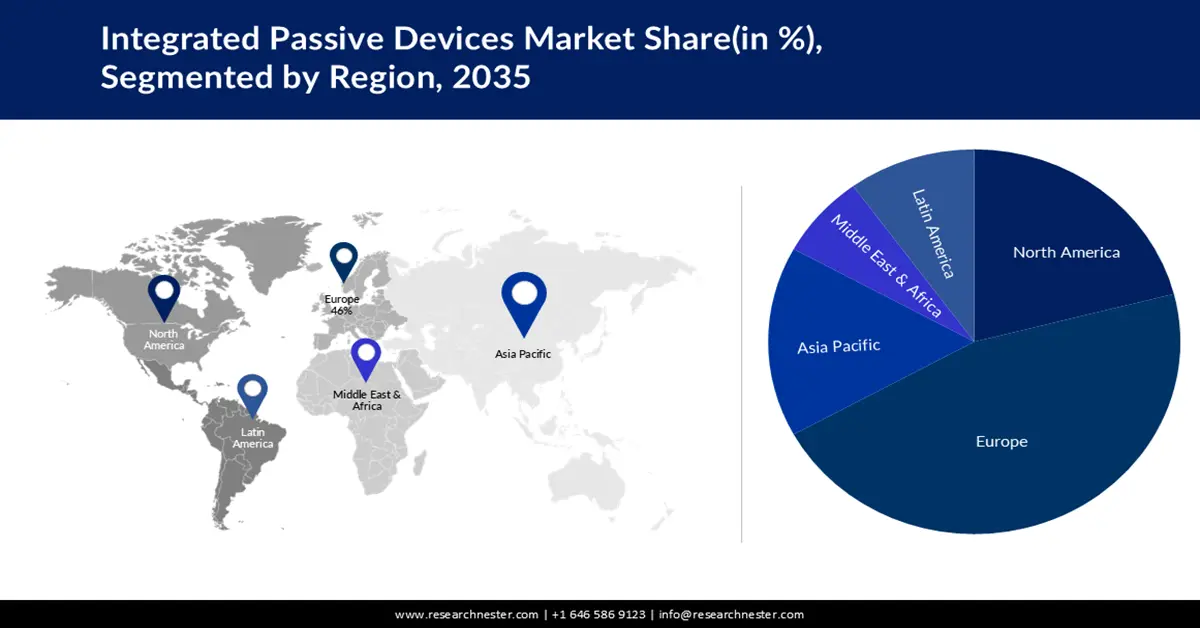

Integrated Passive Devices Market Regional Analysis:

European Market Insights

Europe industry is set to hold largest revenue share of 46% by 2035. The market’s growth in the region is fuelled by technological prowess, industrial diversity, and a commitment to cutting-edge electronics. With a solid foundation in semiconductor research and manufacturing, European nations drive innovations in IPD technology, enabling the integration of various passive components into compact, high-performance chips. This integration finds significant applications in Europe’s automotive sector, facilitating advancements in electric vehicles, connected cars, and industrial automation. Additionally, the region’s focus on 5G technology and telecommunications infrastructure fuels the demand for IPDs in high-frequency RF components. The availability of continuous 5G wireless broadband service for all urban areas and transit routes by 2025 and 5G coverage of all populated areas by 2030 are among the primary connectivity goals set forward by the EU. 72% of EU citizens are currently covered with 5G, according to official figures. Collaborations among research institutions, industries, and government initiatives bolster the development of specialized Integrated Passive Devices solutions, ensuring Europe's position as a pivotal player in shaping the future of integrated passive devices across multiple sectors.

North American Market Insights

North America integrated passive devices market is expected to garner noteworthy revenue share. North America is a driving force in integrated passive devices (IPD) technology. The region's focus on cutting-edge semiconductor manufacturing and design capabilities, along with a robust consumer electronics market, leads to a high demand for compact, feature-rich devices such as smartphones, wearables, and IoT gadgets. Furthermore, the rapid deployment of 5G networks and North America's leadership in telecommunications fuel the need for IPDs in high-frequency RF components. The automotive sector also leverages IPDs for innovations in electric vehicles and connected car technologies. Through collaborations between tech giants, research institutions, and semiconductor companies, North America pushes the boundaries of IPD advancements, shaping the electronics industry across industries.