Integrated Marine Audio System Market Outlook:

Integrated Marine Audio System Market size was over USD 1.52 billion in 2025 and is anticipated to cross USD 2.88 billion by 2035, growing at more than 6.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of integrated marine audio system is estimated at USD 1.61 billion.

The expansion of marine leisure activities and growing interest in upscale recreational experiences are driving the demand for better audio systems. To improve their boating experiences, consumers are incorporating cutting-edge audio systems. These systems meet the demands of various nautical conditions by offering exceptional sound quality, smooth connectivity, and longevity. Major players are keen on bringing new products to the market to satisfy the increasing demand. For instance, in June 2022, Fusion Entertainment unveiled the launch of Signature Series 3i maritime speakers. Alongside Fusion's flagship onboard entertainment experience, the Signature Series 3i offers new grille color options, seamless plug-and-play installation, and enhanced protection against the marine environment.

The market for integrated marine audio systems is expanding owing to a large part to technological developments. Consumer interest in maritime audio systems has grown as a result of innovations including wireless connectivity, waterproof speakers, and enhanced sound quality. Boat owners are increasingly choosing these cutting-edge systems as they provide excellent sound quality without sacrificing durability and can survive challenging marine conditions including salt water and sun exposure.

Key Integrated Marine Audio System Market Insights Summary:

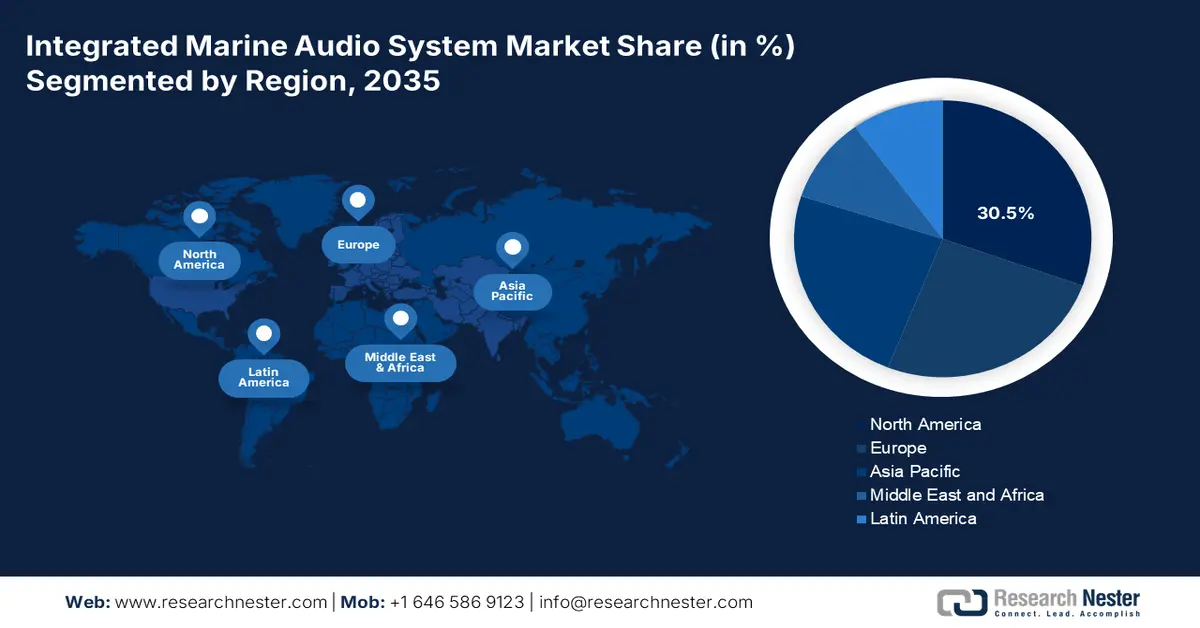

Regional Highlights:

- North America commands a 30.5% share in the integrated marine audio system market, driven by premium marine experiences through 2026–2035.

- Europe is expected to maintain a stable CAGR in the Integrated Marine Audio System Market from 2026 to 2035, driven by adoption of wireless technologies like Bluetooth and Wi-Fi in marine audio systems.

Segment Insights:

- The Speakers segment is anticipated to hold a 25.5% share by 2035, driven by waterproof, corrosion-resistant designs and superior audio performance.

Key Growth Trends:

- Preference for higher-quality systems

- Rising demand for customized ship components

Major Challenges:

- High cost barrier

- Consumer ignorance impedes market development

- Key Players: Bose Corporation, Elcome International, Boss Audio Systems, Garmin Ltd., Rockford, Riviera srl Genova, Infinity by Harman, Kicker Audio, and Patrick Industries, Inc.

Global Integrated Marine Audio System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.52 billion

- 2026 Market Size: USD 1.61 billion

- Projected Market Size: USD 2.88 billion by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, Japan, South Korea, Singapore, UAE

Last updated on : 14 August, 2025

Integrated Marine Audio System Market Growth Drivers and Challenges:

Growth Drivers

- Preference for higher-quality systems: Boat amplifiers are susceptible to corrosive and destructive effects from saline and humid infiltration, which can also impact maritime systems. There has been a strong demand for high-quality audio systems to guard against these dangers. Manufacturers have been under pressure to create higher-quality systems that can endure these circumstances and operate for longer due to the increasing demand for high-quality marine speakers and amplifiers. Additionally, appropriate stereos have been designed based on the kind of boat in which they are installed.

- Rising demand for customized ship components: The market for integrated marine audio systems is being driven by the availability of customization and integration services. The architecture of contemporary marine audio systems is becoming more and more integrated with the current onboard electronics and infrastructure, including communication and navigation systems. Owners of boats and yachts may now customize their audio systems to meet their own requirements and tastes, improving user convenience and overall enjoyment. Market participants are concentrating on strategic efforts to develop corporate skills and provide innovative services.

For instance, in April 2023, McIntosh and Sonus Fabrication teamed up with Wally Yachts to supply high-end audio systems for the marine sector, particularly for the Wallywhy200 yacht. With this partnership, both firms make a major foray into the marine audio market by fusing high-end sound technology with luxurious boat designs.

Challenges

- High cost barrier: The high price of sophisticated, feature-rich systems is one of the main issues facing the integrated marine audio system market. High-end audio systems with state-of-the-art features like HD screens, sophisticated connection, and excellent sound quality are frequently very expensive. This may make them less appealing to a wider range of people, limiting the market to affluent buyers who are prepared to spend money on upscale goods. Many prospective purchasers may be put off by the high upfront cost, especially those who would value cost over sophisticated features.

- Consumer ignorance impedes market development: Market expansion may be hampered by restraining factors like consumers' ignorance of the product. The market demand may be lowered as a result of consumers in rural and certain urban areas not understanding the value and advantages of marine audio equipment items.

Integrated Marine Audio System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 1.52 billion |

|

Forecast Year Market Size (2035) |

USD 2.88 billion |

|

Regional Scope |

|

Integrated Marine Audio System Market Segmentation:

Product (Head Units, Control Systems, Speakers, Amplifiers, Others)

The speaker segment is anticipated to capture integrated marine audio system market share of over 25.5% by 2035. The waterproof and corrosion-resistant construction of marine speakers ensures their longevity in the face of UV rays, moisture, and saltwater. They include a sturdy design and cutting-edge materials that improve sound quality and endure challenging conditions. Superior audio performance, including balanced bass, clear highs, and complete midranges, is made possible by advancements in speaker technology, which enhances the onboard entertainment experience. High-performance marine speakers are in high demand since recreational and luxury boating environments require dependable, high-quality audio.

Sales Channel (OEM, Aftermarket)

Based on the solution, the shift by wire segment is likely to hold a significant share by the end of 2035. The goal of the aftermarket sales channel is to offer solutions for existing marine audio systems that are replaced, upgraded, and enhanced. This channel offers a variety of audio systems and components designed for maritime environments through specialty stores, internet marketplaces, and marine accessories stores. For boat and yacht owners looking for better performance, customization, or repair alternatives, aftermarket solutions are available. Growing consumer demand for customized audio experiences and the desire to adopt cutting-edge technology are the main drivers of this channel's expansion.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Sales Channel |

|

|

Distribution Channel |

|

|

Vessel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Integrated Marine Audio System Market Regional Analysis:

North America Market Analysis

By 2035, North America integrated marine audio system market is likely to account for around 30.5% share. The market in North America is fueled by rising demand for premium marine experiences, yachting, and recreational boating. The need for cutting-edge audio systems with exceptional sound quality and longevity is fueled by the region's strong emphasis on high-end, high-performance maritime equipment.

The market's expansion is further supported by the well-established marine industry infrastructure in the U.S. and consumer preferences for premium, tailored marine audio systems. The region's dynamic market landscape is further enhanced by the presence of top producers of audio equipment and a thriving aftermarket. For instance, in February 2023, together with Barletta Boats, HARMAN International integrated Harman Kardon Marine sound systems into the 2023 Barletta Reserve, a high-end pontoon boat. The sound system will have two 10-inch subwoofers and ten 6.5-inch speakers with an RMS power of 2,800 watts.

Recreational boating and water-based activities are popular among individuals and families in Canada, which has a strong boating culture. The need for an integrated marine audio system to improve the onboard entertainment experience is driven by this cultural love for boats. There are many boating opportunities due to the variety of water settings, which also generates a strong market for integrated marine audio systems.

Europe Market Analysis

Europe is expected to experience a stable CAGR during the forecast period. Wireless technological developments are a major factor propelling the Europe-integrated marine audio system market expansion. Adding state-of-the-art wireless technologies like Bluetooth, Wi-Fi, and sophisticated digital streaming improves marine audio systems' use and functionality. The move toward wireless solutions is in line with broader customer preferences for smart technology and convenience, which is fueling the market for contemporary, integrated marine audio systems.

Numerous boat and engine manufacturers, as well as the general growth of the boating sector in the UK, are expected to increase the sales of advanced marine audio systems. Increases in consumer income and spending on leisure activities are other contributing factors to the market's expansion in the country.

In Germany, public and private organizations are making significant investments in the construction and modernization of marinas, docking facilities, and infrastructure related to recreational boating throughout the region. These expenditures frequently include upgraded facilities and contemporary conveniences to draw in both domestic and foreign boaters. The use of integrated marine audio solutions is being driven by improved marinas and recreational areas that aim to provide better onboard experiences.

Key Integrated Marine Audio System Market Players:

- Elettromedia

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bose Corporation

- Elcome International

- Boss Audio Systems

- Garmin Ltd.

- Rockford

- Riviera srl Genova

- Infinity by Harman

- Kicker Audio

- Patrick Industries, Inc

The key players in this market concentrate on growing their R&D expenditures, manufacturing facilities, infrastructure, and chances for value chain integration. Integrated marine audio businesses use these tactics to meet growing consumer demand, maintain competitive efficacy, create cutting-edge goods and technology, lower manufacturing costs, and grow their clientele.

Here are some leading players in the integrated marine audio system market:

Recent Developments

- In July 2024, Garmin and Independent Boat Builders, Inc. (IBBI) announced its plans to be the sole marine electronics and audio providers through 2029. Through this partnership, Garmin's entire range of marine electronics and audio solutions, including those made by JL Audio, Fusion, and Clarion Marine, were made available to IBBI member-owners.

- In March 2024, Elettromedia, a sound systems specialist located in Italy, entered into a sales agreement with Elcome International, a prominent electronics and navigation equipment supplier to the maritime industries. Through the partnership, Elcome can distribute and set up Elettromedia's renowned Hertz maritime audio systems throughout the Middle East.

- Report ID: 6756

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.