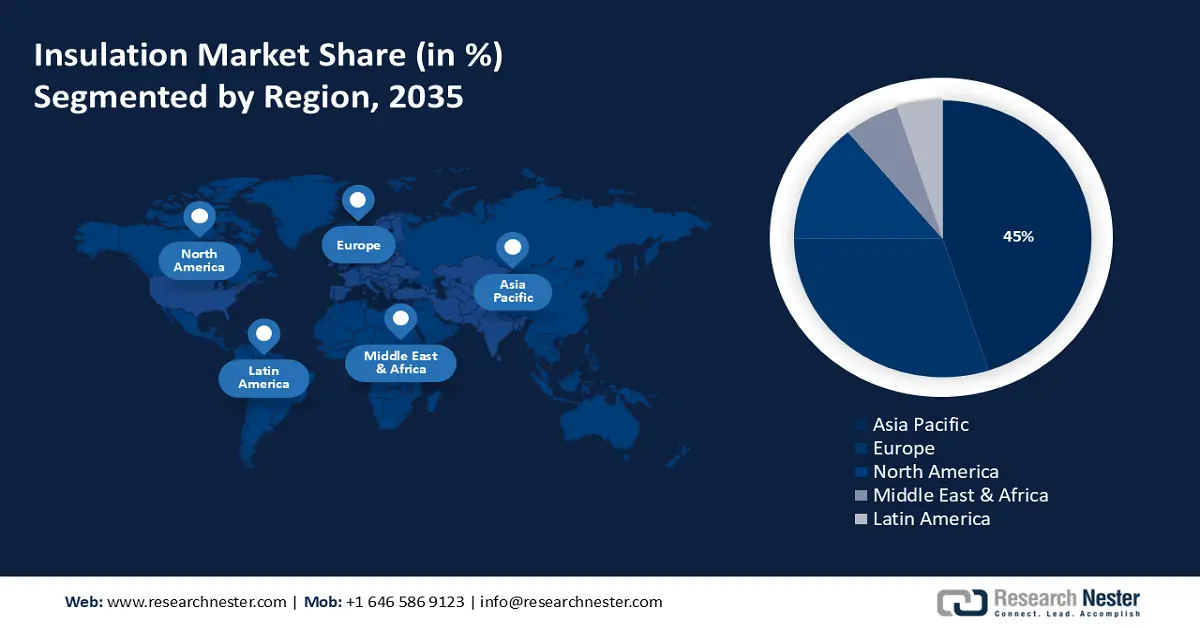

Insulation Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to hold largest revenue share of 45% by 2035. In this region, there has been a significant surge in oil output, leading to an increasing demand for insulation. The oil production business requires insulation solutions to prevent energy wastage. The reason for this is the increasing oil output in the economies of China and India, as well as growing worries about major energy waste and the demand for materials in refurbishment and restoration.

The insulation market in India is projected to have rapid growth, driven by the strong expansion of building construction. This growth is particularly attributed to the increasing emphasis on energy efficiency, which would result in higher installation of insulation materials in each building. In addition, the reasons contributing to the recovery in industrial equipment production include strong recoveries in HVAC systems, transportation equipment, and appliance manufacturing. Furthermore, manufacturers are using more insulation per product to enhance their quality and improve their competitiveness in the worldwide market.

The China insulation market has been seeing substantial growth and is projected to sustain its expansion in the foreseeable future. The transportation sector in China has witnessed substantial growth and demand, hence driving the expansion of the insulating materials market. In addition, the government has enforced a set of mandatory energy conservation standards and procedures to meet energy-saving goals. This has also stimulated market growth for refurbishment and remodeling projects.

The insulation market in Japan is currently experiencing transformations, with a rising focus on the significance of insulation in terms of energy efficiency, health, and sustainability. Despite the presence of obstacles including differing insulation requirements and market fluctuations, the business nevertheless presents prospects for expansion and advancement. Nippon aqua, specializes in spray polyurethane foam (SPF) insulation. It operates in more than 30 locations around Japan and is a subsidiary of Hinokiya Holdings, a prominent residential home builder. Thus, such firms propel the market expansion.

Europe Market Insights

By the end of 2035, Europe insulation market is set to hold over 30% share. Due to the fast industrialization and the existence of important insulation product manufacturers, this region is expected to be an early user of developing insulation materials. The market expansion is also ascribed to the rising number of residential and commercial structures, together with governmental programs aimed at mitigating carbon emissions.

The UK insulation market consists of a range of different insulating materials and is influenced by factors including market size, predictions, construction activity, and industry developments. Knauf Insulation is delighted to declare a significant investment of around USD 200 million in a cutting-edge rock mineral wool production, specifically designed to cater to the UK market on May 14, 2024. This shows a strong dedication to meeting the increasing need for sustainable insulating solutions that do not produce combustion.

The insulation market in France is now growing due to numerous factors, including rapid economic expansion, increased investment in building, and a strong demand for acoustic and thermal insulation. Moreover, In December 6, 2023, Soprema Group has entered into an agreement with SaintGobain to acquire a controlling interest in the Polyisocyanurate insulation (PIR) business assets in france, namely under the Celotex brand.

The Germany insulation industry is marked by notable advancements and breakthroughs in insulation technologies, propelled by the need for energy-efficient solutions and environmentally friendly construction methods. The Ziegler Group now has a fully operational wood fiber insulation board (WFIB) factory, which was supplied by DIEFFENBACHER, a company situated in Eppingen. Production of the rigid WFIB line commenced on August 30, 2022. Ziegler Group submitted its order to DIEFFENBACHER on April 1, 2021.