Insulated Concrete Form Market Outlook:

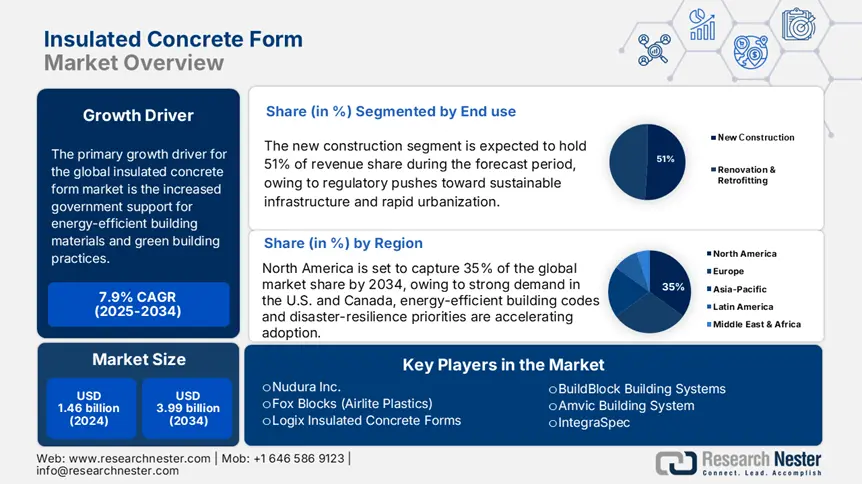

Insulated Concrete Form Market size was valued at USD 1.46 billion in 2024 and is projected to reach USD 3.99 billion by the end of 2034, growing at a CAGR of 7.9% during the forecast period, i.e., 2025-2034. In 2025, the industry size of insulated concrete form market is evaluated USD 1.58 billion.

The primary growth driver for the insulated concrete form market is the increased government support for energy-efficient building materials and green building practices across the world. The U.S. state and federal governments provide incentives to builders to incorporate high-performance insulation systems by issuing programs such as the Energy Star certification, encouraging builders to adopt ICFs to provide enhanced thermal efficiency and reduced carbon emissions. Similarly, Europe's Energy Performance of Buildings Directive (EPBD) and EU Green Deal legislation encourage regulatory incentives and subsidies to accelerate the uptake of ICF in new builds and retrofits, lowering market entry barriers and raising developer confidence.

On the manufacturing and supply chain front, innovations are focused on refining the raw material mix used in ICFs. Large insulation materials like polyurethane foam and expanded polystyrene (EPS) are optimized by advances in recycling technology, in addition to the advent of bio-based and flame retardants for enhanced performance as well as sustainability. Major players such as Fox Blocks and Nudura expanded North American, European, and Asia-Pacific production volumes through support from rising investment in mechanized assembly lines to cope with rising global demand. Trade figures identify rising cross-border movements of major raw material inputs like polystyrene beads and polymer additives under HS codes 3921 and 3907 that show the internationalization of the supply chain. While there are a few individual price indices on ICF products, the overall Producer Price Index (PPI) on building materials has seen a steady growth rate of 7 to 8% annually, based on the rise in raw material costs like styrene and other polymers. These trends compound swelling regulatory pressures and sustainability demands, further solidifying the critical place of ICFs in the future of green construction.