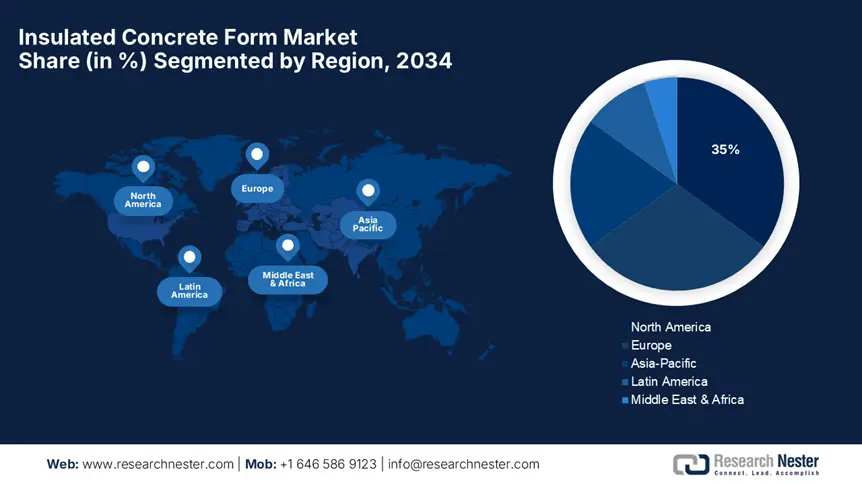

Insulated Concrete Form Market - Regional Analysis

North America Market Insight

North America is expected to hold 35% of the total insulated concrete form market share by 2034, driven by robust U.S. and Canada demand, energy-efficient building codes, and disaster-resilience requirements driving adoption. In the United States, the 2024 International Energy Conservation Code requires continuous insulation for the majority of the country, directly driving ICF adoption. Provinces in Canada, most significantly those that are vulnerable to fire and flood, are adopting green building codes. Technologies such as 3D printed insulating concrete form blocks and Internet of Things-based smart blocks recycle waste by up to 26 %, with some estimating 41% of the new North American projects employing this technology.

The U.S. accounts for 30% of North American ICF revenues in 2034. Construction contributed 4.3% of GDP in 2022, including $92 billion in government expenditure on commercial and $9 billion on single-family home building in 2021. Federal programs inextricably link ICF construction with policy: the Inflation Reduction Act contributed $1.3 billion for effective envelopes in clean building. Additionally, DOE grants have reduced commercial building energy consumption by 16 %. EPA's Green Chemistry program launched 50 green chemical processes in 2023 that cut hazardous waste by 21 % compared with 2021 levels. Federal budgetary spending on chemical-industry programs in 2022 by the United States totaled 3 % or approximately $4 billion for environmental compliance and the application of advanced materials in building construction.

Canada is expected to capture 11% of the North American ICF market revenue in 2034. More than 73,600 new single-family home authorizations were released in 2023, reflecting increasing demand for environmentally responsible construction such as ICFs. Budget 2021 allocated CAN$1.6 billion (≈US$1.2 billion) to transition to clean fuel and federal budgetary expansion; another CAN$777 million was introduced in 2023. Canada Growth Fund (Budget 2022) spent $16 billion on clean technology, some of which enables green-building features, such as ICF systems. Energy Innovation Program and Clean Fuels Fund are independent funds of $25 million/year and CAN$5.6 million clean tech pilot awards. Furthermore, the 2025 EPA-Canada bilateral task force provided C$7.6 million in funding for clean technology projects that provide chemical security and sustainability in building materials.

Europe Market Insight

Europe is forecast to share around 30% of the global ICF market revenue by 2034, dominated by Germany and France. The EU Clean Industrial Deal opens up over €110 billion of decarbonization and clean tech that will back building envelope efficiency, including ICF adoption. The 2024 Energy Performance of Buildings Directive includes new and public buildings with near-zero energy standards, directly stimulating ICF demand. State aid reforms offer between €220 million per project to low-carbon building material producers like ICF systems. The EU Circular Economy Act targets 25% material circularity by 2030, which will positively affect ICF's reusable insulation strategy.

Germany is expected to reach 16% of ICF revenue in Europe by the year 2034. Its €225.6 billion turnover in the construction industry in 2023 and €15 billion R&D investment solidify the support for ICF systems. The Federal Ministry of Economic Affairs and Climate Action allocated €224 million in 2023 towards hydrogen infrastructure and €5 billion towards climate protection contracts to decarbonize energy-intensive sectors such as construction and building materials. Germany’s Carbon Management Strategy launched a €3.4 billion Industrial Decarbonization Fund, with €2 billion in 2024 grants targeting projects achieving ≥45% emissions reductions. The KfW-funded Efficiency House program provided €29.3 billion in climate financing in 2012 and continues to back subsidized loans for energy-efficient building retrofits. These initiatives are driving demand for high-performance building insulation such as ICF by lowering investment costs and raising standards for clean, climate-conscious construction.

France is expected to hold 8% of European ICF turnover in 2034. Of the €42 billion in EU Next Generation funding provided through the France Relance plan, 51% has been directed toward environmental transition particularly the construction and renovation of low-energy buildings. The MaPrimeRénov scheme had already received 231,000 applications by May 2021, significantly accelerating sustainable building renovations. The EU Recovery and Resilience Facility, with €723.9 billion in funding, supports the green and digital transformation and is a key driver in France’s adoption of low-carbon construction practices. Additionally, the EU Transition Pathway outlines over 151 activities, including public procurement criteria favoring low-carbon building materials such as ICF. As a result, government-backed renovation incentives and procurement policies are fostering widespread ICF adoption in both residential and public sector construction.

Europe Insulated Concrete Form Market Breakdown by Country (2034)

|

Country/Region |

Market Share (2034) |

CAGR (2025–2034) |

Government Initiatives |

Notable Funding / Programs |

|

Germany |

28% |

11% |

EU Green Deal, Energy Performance of Buildings Directive (EPBD), National Energy Efficiency Strategy |

€2.5B BMWK funding for energy-efficient construction, Horizon Europe grants for sustainable building materials |

|

France |

20% |

12% |

France Relance Plan, EPBD compliance incentives, Climate and Resilience Law |

€1.1B France Relance for green building upgrades, ADEME funding for innovative insulation solutions |

|

Netherlands |

10% |

10% |

Circular Economy Action Plan, National Renovation Strategy |

€70M public-private partnerships for sustainable construction innovation |

|

Italy |

8% |

8% |

EU Structural Funds, National Recovery and Resilience Plan (PNRR) |

€50M EU Regional Development Fund for energy-efficient buildings |

|

Spain |

8.1% |

8.2% |

Spanish National Energy and Climate Plan (NECP), Industrial Modernization Programs |

€35M Ministry of Industry grants for green building technologies |

|

Poland |

7% |

9.1% |

EU CAP Industrial Innovation, National Energy Efficiency Action Plan |

€30M Structural Funds for sustainable housing initiatives |

|

Russia |

% |

7.% |

National Energy Efficiency Program, Construction Sector Modernization Plan |

RUB 1.2B government funds for eco-friendly building material R&D |

|

Rest of Europe |

14% |

7.6% |

Horizon Europe Cohesion Policy, National Green Building Incentives |

Multi-country EU Recovery & Innovation Funds for construction sustainability |

Asia Market Insight

Asia Pacific would have accounted for about 20% of the global ICF market revenue by 2034, buoyed by rapid urbanization and climate-resilient constructions. From 2020 to 2024, green building projects in the region recorded an expansion of over 33%, with China issuing more than 2,300 green building labels in 2023. More than 110 urban centers have been involved in India's smart city initiative, also contributing to the demand for sustainable wall systems. It is gaining acceptance because of stringent energy codes and buildings being constructed at a comparatively 41% faster rate in congested urban areas. ICF adoption is also benefiting from infrastructure investment growth and the need to enhance resilience against extreme weather events. Nearly 62% of new construction in China's pilot green cities featured energy-efficient wall systems such as ICF in 2023. Regional authorities have been promoting disaster-resilient and energy-efficient construction, which will further accelerate ICF usage. This is, in turn, supported by increased investments in low-carbon building materials and digital construction technologies.

Asia Pacific Insulated Concrete Form Market Country-wise Overview (2025–2034)

|

Country |

Market Share (2034 est.) |

Key ICF Demand Drivers |

Government Programs & Investments |

Notable Developments |

|

China |

21% of APAC share |

Urban housing expansion, green building codes, and disaster resilience |

National Green Building Action Plan; RMB 800 billion investment in energy-efficient construction by 2030 |

Over 3,000 large-scale eco-friendly housing projects incorporating ICF; pilot smart city projects with modular ICF walls |

|

India |

15% of APAC share |

Affordable housing, smart cities, energy efficiency mandates |

₹5 lakh crore Smart Cities Mission; Energy Conservation Building Code (ECBC) enforcement; Tax incentives for green materials |

Rapid growth in prefabricated housing; government grants for climate-resilient building materials use in 100+ cities |

|

Japan |

8% of APAC share |

Earthquake-resistant construction, retrofitting regulations |

METI subsidies for seismic retrofit; Japan Green Building Program |

Adoption of lightweight ICF panels in residential high-rises; advances in fire-resistant ICF materials |

|

South Korea |

5% of APAC share |

Urban redevelopment, energy-saving building mandates |

Ministry of Land, Infrastructure and Transport green building subsidies |

Large-scale ICF use in new commercial complexes in Seoul; integration with smart building tech |

|

Australia |

5% of APAC share |

Sustainable residential construction, bushfire resilience |

AUD 3 billion National Construction Code upgrades; Clean Energy Finance Corporation grants |

Increasing ICF adoption in wildfire-prone regions; modular ICF kits for remote construction projects |

|

Indonesia |

3% of APAC share |

Affordable housing, tropical climate adaptation |

National Housing Program; subsidies for climate-resilient materials |

Pilot projects in Jakarta using ICF for flood-resilient homes; local manufacturer partnerships |

|

Malaysia |

3.6% of APAC share |

Industrial parks, green building codes |

Green Technology Financing Scheme; MIDA incentives for eco materials |

New ICF production plants in Selangor; collaboration on sustainable construction with local universities |

|

Vietnam |

3.1% of APAC share |

Rapid urbanization, energy-efficient, affordable housing |

National Green Growth Strategy; foreign investment in green construction |

Growth in ICF use for mid-rise residential complexes in Ho Chi Minh City and Da Nang |

|

Thailand |

2.6% of APAC share |

Flood-resistant housing, industrial facility insulation |

Bio-Circular-Green Economy Fund; BOI incentives for sustainable construction |

Incorporation of ICF in flood-prone Rayong province housing; growing local supply chain for ICF materials |

|

Rest of APAC |

14% combined |

Basic infrastructure, disaster resilience |

Various national housing schemes; ASEAN Green Building Network |

Emerging markets like the Philippines and Myanmar are adopting ICF in pilot projects, growing SME involvement |