Instrumentation Cables Market Outlook:

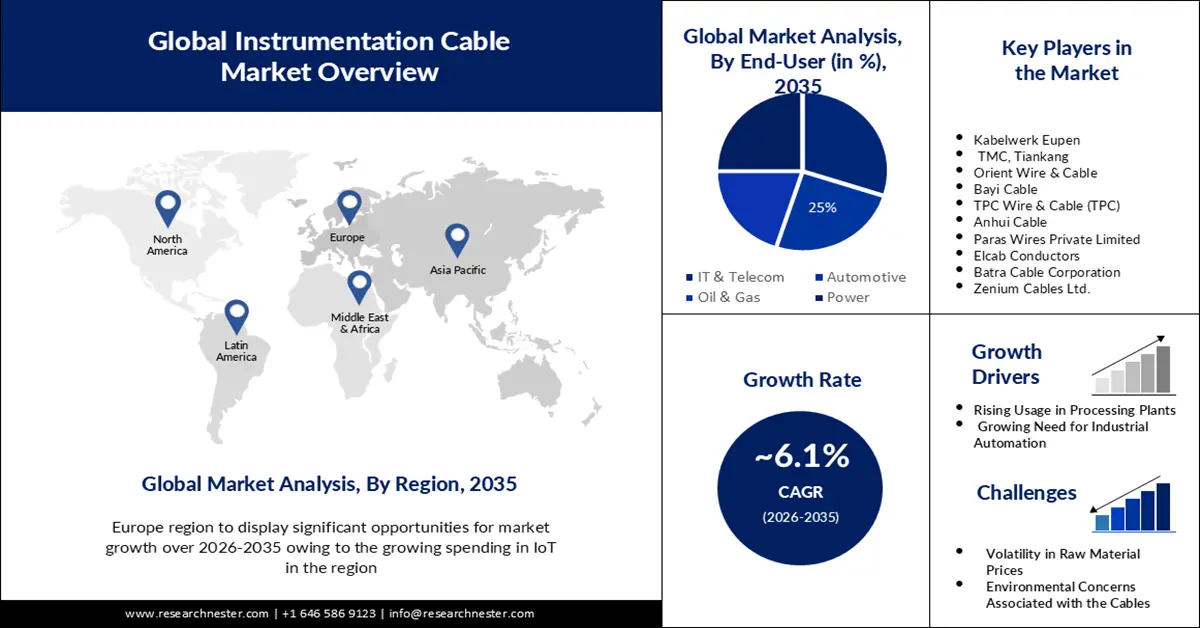

Instrumentation Cables Market size was over USD 9.44 billion in 2025 and is projected to reach USD 17.07 billion by 2035, growing at around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of instrumentation cables is evaluated at USD 9.96 billion.

The reason behind the growth is due to the growing demand for energy across the globe. The industrialization and advancements in both developed and emerging nations caused by an increasing number of people and greater wealth are to blame for the continuous rise in the world's energy usage. For instance, by 2050, global demand is expected to reach over 640 quadrillion Btu, an increase of around 14% from 2021.

The growing developments in smart grid infrastructure are believed to fuel the market growth. The need for instrumentation cables to link and interface these devices is rising in tandem with the expansion of smart grids as they enable more effective management of electricity generation, transmission, and distribution, and can send data reliably and precisely over great distances that are frequently needed for these systems.

Key Instrumentation Cables Market Insights Summary:

Regional Highlights:

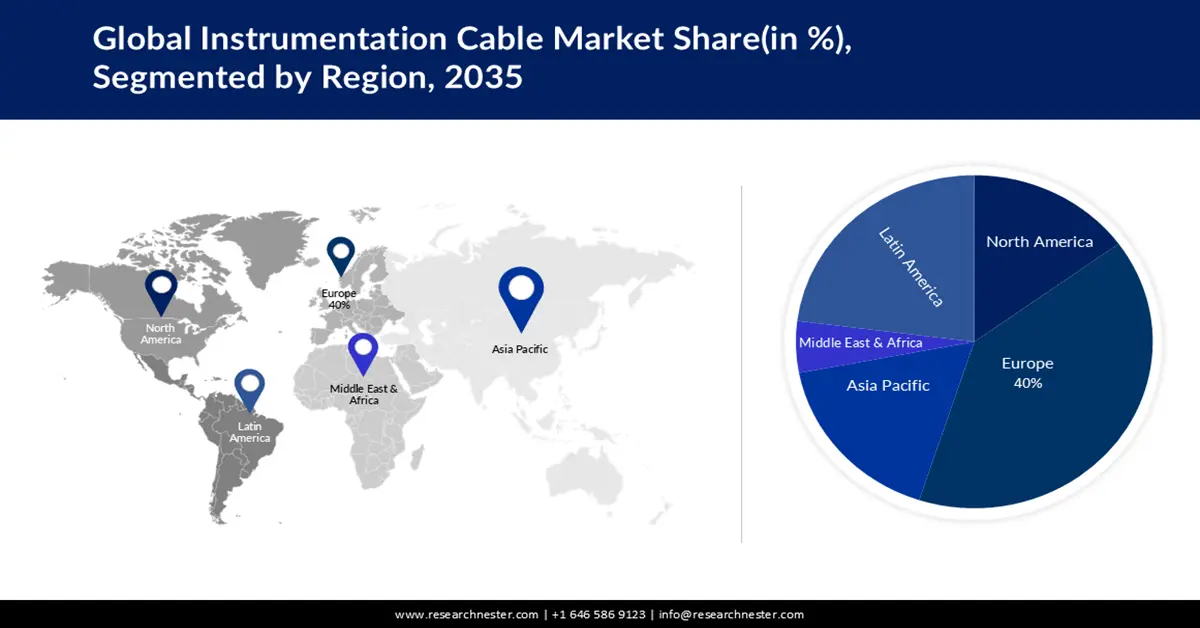

- Europe instrumentation cables market is expected to capture 40% share by 2035, fueled by rising IoT investments and automation across industries.

- Latin America market will secure the second largest share by 2035, fueled by the strength of the regional oil and gas sector.

Segment Insights:

- The it & telecom segment in the instrumentation cables market is anticipated to secure a 30% share by 2035, driven by demand for data transmission in telecommunications networks.

Key Growth Trends:

- Rising Usage in Processing Plants

- Growing Need for Industrial Automation

Major Challenges:

- Volatility in Raw Material Prices

- Compliance with industry regulations can be challenging

Key Players: General Cable, RSCC Wire & Cable, Habia Cable, Kabelwerk Eupen, TMC, Tiankang, Orient Wire & Cable, Bayi Cable, Anhui Cable, Paras Wires Private Limited, Elcab Conductors, Batra Cable Corporation, Zenium Cables Ltd..

Global Instrumentation Cables Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.44 billion

- 2026 Market Size: USD 9.96 billion

- Projected Market Size: USD 17.07 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 16 September, 2025

Instrumentation Cables Market Growth Drivers and Challenges:

Growth Drivers

- Rising Usage in Processing Plants – Process facilities can benefit from the use of instrumentation cables to link and communicate amongst various instruments, and aid in providing clear signals in challenging settings and for various production tasks.

- Growing Need for Industrial Automation- Instrumentation cable serves as a reliable means of connecting control devices and transmitting power and electrical signals in industrial automation to endure electrical interference from noisy surroundings.

- Increasing Oil and Gas Industry- Instrumentation Cable often works in refineries or petroleum reserves for the transmission of a.c. and d.c. analog signals in extra-low voltage applications found in petroleum and petrochemical operations. For instance, the annual production of oil in the world exceeds 3 billion metric tons.

- Surging Production of Steel- Steel is a conductor that is encased in an aluminum or copper shell, and these conductors are used to make instrumentation cables.

Challenges

- Volatility in Raw Material Prices - Multiple conductors made of bare or tinned copper that meet conductor specifications make up an instrumentation wire. Copper is used as the conductor material in the cable owing to its well-known superior electrical conductivity, and as it is heavier and denser than aluminum. Global economic conditions have a significant impact on copper prices, which are also possibly affected by variations in exchange rates. Moreover, global copper prices change according to the state of the market, and since copper and aluminum make up the majority of wire and cable conductors, prices vary daily as part of commodity trade.

- Compliance with industry regulations can be challenging

- Environmental concern associated with the cables owing to the usage of harmful materials such as Polyethylene (PE), cross-linked Polyethylene (XLPE), Polyvinyl Chloride (PVC), or Silicone (Si) insulated.

Instrumentation Cables Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 9.44 billion |

|

Forecast Year Market Size (2035) |

USD 17.07 billion |

|

Regional Scope |

|

Instrumentation Cables Market Segmentation:

End-User Segment Analysis

The IT & Telecom segment is estimated to hold 30% share of the global instrumentation cables market by 2035. Transferring digital or analog data back and forth between devices is known as data transmission, which is one of the essential procedures for information transmission and communication in telecommunications networks. Instrumentation cables are found in a wide range of applications but are primarily used in communications and telecoms to transfer data. Moreover, the instrumentation Cable, which has several conductors facilitates the transmission of low-energy signature signals to transfer data or electricity.

In addition, ethernet, VFD, and control and instrumentation cables are the three most popular types of cables used in oil and gas applications, amongst which the oil and gas sector relies heavily on instrumentation cables as they facilitate the transmission of precise measurement signals from sensors.

Product Type Segment Analysis

The PLTC & PLTC-ER cable segment in the instrumentation cables market is set to garner a notable share shortly. PLTC is an acronym for Power Limited Tray Cable which is ideally utilized in power-limited circuits for alarm, audio, intercom, and energy management systems. The most widely available rating for PLTC cables, which includes ITC cables, is 300V, which are made especially for power-limiting circuits, and are suitable for new installations, equipment upgrades, and the replacement of existing cables in cases where failure rates are high.

In addition, process and control signals in 600-volt applications are carried out via shielded TC-ER instrumentation cables, which are made of nylon insulation and a PVC jacket that resists sunlight, making it ideal for use in exposed runs.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Instrumentation Cables Market Regional Analysis:

European Market Insights

Europe industry is set to hold largest revenue share of 40% by 2035, impelled by the growing spending in IoT. IoT is being increasingly adopted by organizations across Europe driven by industrial, utility, and professional services industries. For instance, in 2023, European businesses invested over USD 225 billion in Internet of Things (IoT) technologies. In addition, the use of automation will become ubiquitous in Europe; by 2030, over 45% of all labor may be replaced by machines. Moreover, between 2021 and 2027, the EU will provide around 150 billion euros in investment support for digitalization and automation technologies. These factors are expected to drive market growth in the region.

Latin America Market Insights

The Latin America instrumentation cables market is estimated to be the second largest, during the forecast timeframe led by the massive oil and gas industry. Nearly one-fifth of the world's oil reserves are found in Latin America, which is also home to numerous significant oil-producing nations. For instance, the state-owned oil business of Brazil, Petrobras, generated around USD 134 billion in income in 2022, making it the top oil and gas corporation in Latin America.

Instrumentation Cables Market Players:

- General Cable

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nexans

- RSCC Wire & Cable

- Habia Cable

- Kabelwerk Eupen

- TMC, Tiankang

- Orient Wire & Cable

- Bayi Cable

- TPC Wire & Cable (TPC)

- Anhui Cable

- Paras Wires Private Limited

- Elcab Conductors

- Batra Cable Corporation

- Zenium Cables Ltd.

Recent Developments

- Nexans acquired Reka Cables to open up new possibilities and strengthen its position to support the expansion and have the chance to advance and flourish in the future.

- RSCC Wire & Cable delivered safety-related replacement cables (class 1E) to meet the urgent demand for qualified replacement cables for the Shin Kori Unit 3 nuclear power plant.

- TPC Wire & Cable (TPC) a leading designer and provider of high-performance wire, and cable, introduced Thermo-Trex 2000 Shielded Multi-Conductor and Multi-Pair Cable and Thermo-Trex 2800 RTD Cable to offer a dependable option for applications that can tolerate flash heat and require a constant temperature.

- Report ID: 5680

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Instrumentation Cables Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.