Insider Threat Protection Market Outlook:

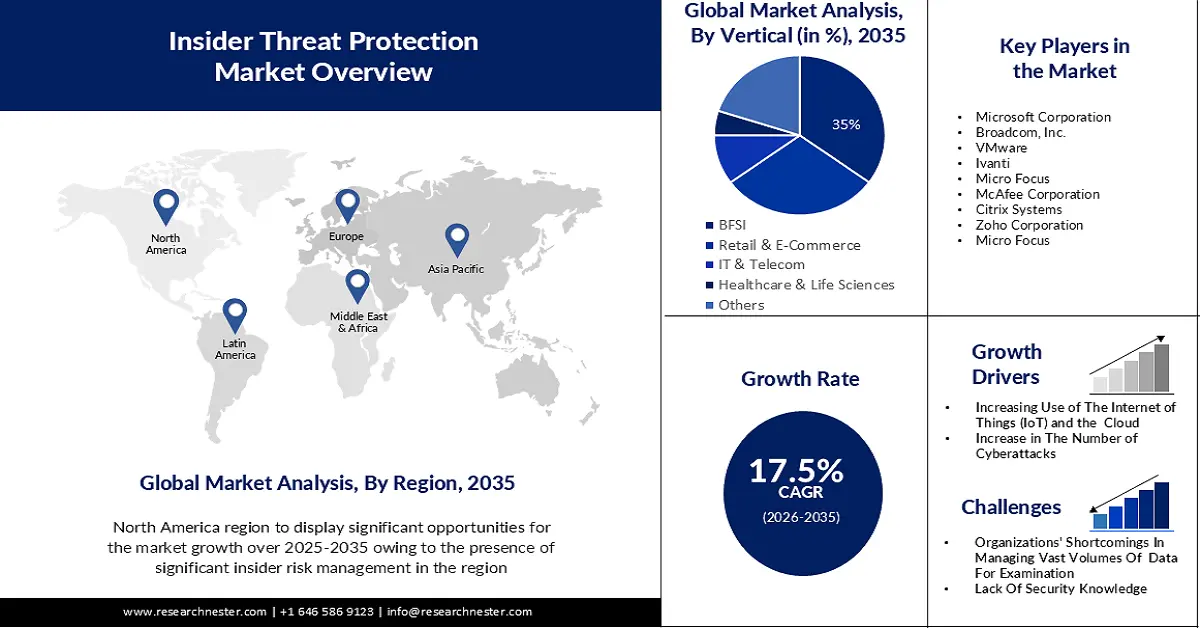

Insider Threat Protection Market size was valued at USD 5.7 billion in 2025 and is set to exceed USD 28.59 billion by 2035, registering over 17.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of insider threat protection is estimated at USD 6.6 billion.

Growing levels of digitization in many sectors of the economy have left modern enterprises vulnerable in many ways, and the present landscape of cyber threats has rendered old preventative security measures ineffective. Bypassing conventional network protections, threats can be detected early thanks to insider threat prevention. 91% of companies are working on a digital project, and 87% of senior company executives believe that digitization should be a top priority, according to a study.

In addition to these, growing information security awareness will drive up demand for the market. Businesses were using security measures primarily to protect and preserve the integrity of vital data. However, due to a sharp growth in data hacking and cybercrimes, businesses are now concentrating on implementing insider threat prevention to safeguard their business apps and lower overall organizational risk.

Key Insider Threat Protection Market Insights Summary:

Regional Highlights:

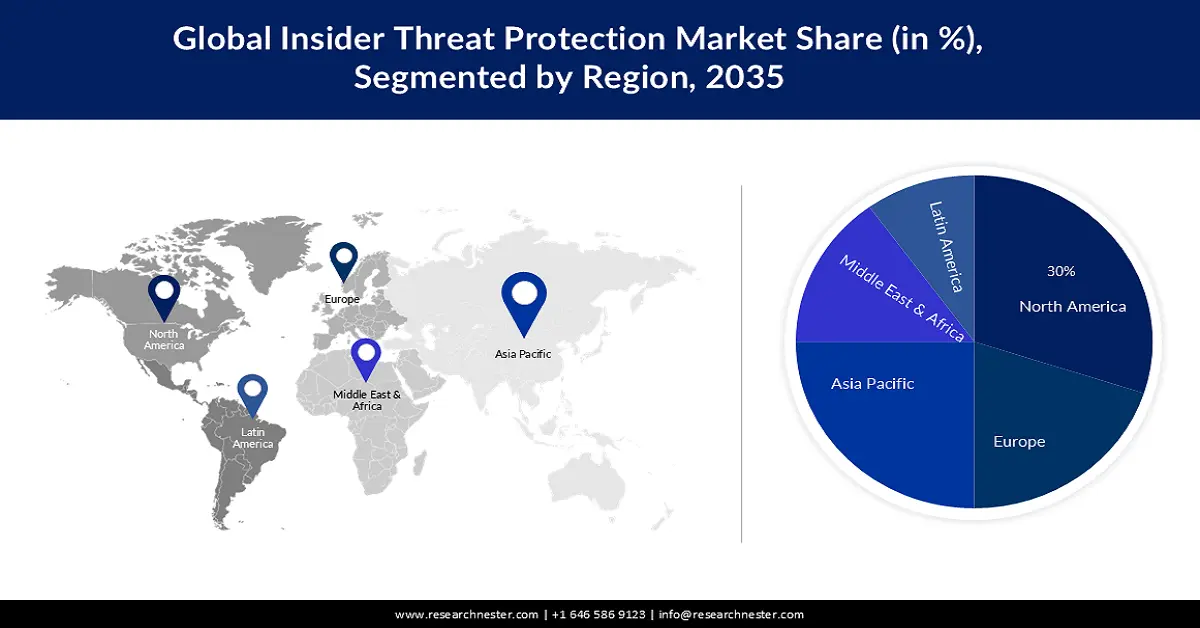

- North America insider threat protection market is expected to capture 30% share, driven by the necessity for data security and the growing popularity of Bring Your Own Device (BYOD) policies, forecast period 2026–2035.

- Asia Pacific market will account for 25% share, fueled by expanding government measures to assist cybersecurity compliances and safeguard data from cyber threats, forecast period 2026–2035.

Segment Insights:

- The software segment in the insider threat protection market is projected to capture a 60% share by 2035, driven by rising adoption of advanced insider threat prevention software solutions.

- The bfsi segment in the insider threat protection market is expected to capture a 35% share by 2035, influenced by the need to protect vast financial data and growing cyberattack vulnerabilities.

Key Growth Trends:

- Increasing Use of the Internet of Things (IoT) and the Cloud

- Increase in The Number of Cyberattacks

Major Challenges:

- Organizations' shortcomings in managing vast volumes of data for examination

Key Players: Microsoft Corporation, Broadcom, Inc., VMware, Ivanti, Micro Focus, McAfee Corporation, Citrix Systems, Zoho Corporation, Micro Focus.

Global Insider Threat Protection Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.7 billion

- 2026 Market Size: USD 6.6 billion

- Projected Market Size: USD 28.59 billion by 2035

- Growth Forecasts: 17.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Germany, China, Japan

- Emerging Countries: China, India, Singapore, South Korea, Malaysia

Last updated on : 16 September, 2025

Insider Threat Protection Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Use of the Internet of Things (IoT) and the Cloud- With the introduction of cloud and IoT technologies, insider threat protection can be deployed. With more and more businesses migrating their systems and applications to cloud services and introducing IoT devices, there is an increasing need for effective threat security tools that can detect and protect these devices and systems. Adoption of the cloud and IoT may increase the need for insider threat prevention solutions by advancing the applications and systems that require security. Over 94% of enterprise organizations have used cloud computing. Over 90% of businesses use the cloud. All of these signs point to the market's growth in the upcoming years.

- Increase in The Number of Cyberattacks - Threats from cyberattacks are growing, as is the financial toll that cybercrime takes on the financial services industry. Even though there have been numerous large-scale cyberattacks over the past 15 years, such as data theft, cyberfraud, distributed denial of service (DDoS), and intellectual property loss, the impact of these attacks has grown faster than the organization's ability to prevent and recover from them. Businesses typically focus on internal risks, although insiders are far more likely to be the source of a cyberattack in the capital markets. Consequently, during the course of the forecast period, these elements are promoting the market's expansion. Annually, about 800,000 individuals become targets of cyberattacks. The rate of cybercrime has risen by 300% since the COVID-19 outbreak started.

- Increasing Focus on Compliance and Data Privacy to Support Market Expansion- Globally, businesses and governments are beginning to examine their current data privacy policies more closely, which could further open up growth prospects for the insider threat prevention industry. Moreover, one of the main reasons propelling the insider threat protection market expansion is the enforcement and introduction of new laws to guarantee greater standards of privacy and information security.

Challenges

- Organizations' shortcomings in managing vast volumes of data for examination- Massive amounts of data coming from numerous scattered sensors (PCs, servers, network tools, etc.) within an organization should ideally be handled by an insider threat protection system. However, the data must be homogeneous in one location and driven by several operating systems and protocols in order to store, study, and analyze the collected data for viewing, storage, and analysis. As such, issues about software, technology, and other aspects arise during the process of collecting and analyzing insider threat prevention data.

- Another reason that obstacle to the insider threat protection market expansion are the detection of sophisticated threats and a lack of security knowledge.

- One of the other reasons that could prevent the insider threat prevention market from expanding is small businesses' reluctance to implement the technology because of financial constraints.

Insider Threat Protection Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

17.5% |

|

Base Year Market Size (2025) |

USD 5.7 billion |

|

Forecast Year Market Size (2035) |

USD 28.59 billion |

|

Regional Scope |

|

Insider Threat Protection Market Segmentation:

Vertical Segment Analysis

Based on vertical, the BFSI segment in the insider threat protection market is anticipated to hold the largest revenue share of about 35% during the forecast period. Because the BFSI sector is in charge of holding significant amounts of vital data, businesses are always vulnerable to cyberattacks. Furthermore, the fact that financial institutions are spending a lot of money to provide digital services across a variety of channels is leading to the creation of new vulnerabilities. As per the 2020 VMware Carbon Black Threat Data report, there was a roughly 240% global increase in cyberattacks targeting the financial industry between February and April 2020. In order to safeguard apps and digital assets against fraud and manipulation, businesses in the BFSI industry are heavily integrating application security testing technologies and services.

Solution Segment Analysis

Based on solution, the software segment in the insider threat protection market is attributed to hold the largest revenue share of about 60% during the forecast period. The segment is growing as the best degree of protection features, including cloud-based endpoint detection, threat understanding and intelligence, behavioral protection, and a range of security analytics approaches, are offered by insider threat prevention software. For example, in April 2023, DTEX Systems—a provider of insider risk and threat management solutions—announced that one of the world's largest banks had chosen DTEX InTERCEPT, an insider risk management program, to increase regulatory compliance and enhance perceptibility into insider threat management. The bank will be able to improve insider risk management within the company with the help of this cybersecurity technology. During the projection period, the segment's growth would be further propelled by such innovations.

Our in-depth analysis of the global market includes the following segments:

|

Solution |

|

|

Deployment |

|

|

Enterprise Size |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Insider Threat Protection Market Regional Analysis:

North American Market Insights

The insider threat protection market in the North America region is projected to hold the largest revenue share with about 30% during the forecast period. The necessity for data security, the growing popularity of Bring Your Own Device (BYOD) policies, and the expanding use of servers, PCs, and mobile devices are driving the insider threat prevention industry in North America. With more than 310 million smartphone users as of 2023, the US has one of the largest smartphone markets in the world. Because of the high rate of adoption of these devices and the presence of significant insider risk management providers in the area, the United States is anticipated to have the greatest share of the market over the projected period. Numerous significant industry participants, such as Palo Alto Networks, SentinelOne, and Broadcom, Inc., are well-represented in North America. These businesses provide a range of ITP solutions that assist businesses in implementing strong security measures to protect their systems, networks, and data from online threats.

APAC Market Insights

Insider threat protection market in Asia Pacific region is expected to hold second-largest revenue share of about 25% during the forecast period. The Bring Your Own Device (BYOD) movement has become increasingly popular in the area. Insider risk management solutions are also required in light of the expanding government measures to assist cybersecurity compliances and safeguard data from cyber threats. A legislative framework for the upkeep of national cybersecurity was established in Singapore in 2018 with the passage of the Cybersecurity Act (CSA). It monitors illegal activities including phishing, malware attacks, denial-of-service attacks, and hacking across 32 jurisdictions. During the projection period, such actions by regional governments will further propel the expansion of the regional market.

Insider Threat Protection Market Players:

- Cisco Systems, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft Corporation

- Broadcom, Inc.

- VMware

- Ivanti

- Micro Focus

- McAfee Corporation

- Citrix Systems

- Zoho Corporation

- Micro Focus

Recent Developments

- Zoho Corporation introduced Ulaa, a privacy-centered browser built specifically for securing personal data with pre-built capabilities that block tracking and website surveillance universally. The privacy-focused browser is outfitted with features that enable privacy customization, integrated user profile modes, and productivity tools, all while maintaining user data security and privacy. Users can also smoothly use several devices for the same online session by syncing browsing sessions between them either a full browser window or a single tab.

- Microsoft Corporation announced a partnership with Cloudflare, Inc., an IT service management company, to intensify zero trust security. Through this partnership, Cloudflare One capability would be combined with Microsoft Azure Active Directory enabling Microsoft to deliver businesses a solution where they would be able to deploy zero trust security efficiently without altering a line of code.

- Report ID: 5739

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Insider Threat Protection Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.