Inorganic Fluorides Market Outlook:

Inorganic Fluorides Market size was valued at USD 1.02 billion in 2025 and is expected to reach USD 1.68 billion by 2035, expanding at around 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of inorganic fluorides is evaluated at USD 1.07 billion.

The global inorganic fluorides market's growth is influenced by the increased demand for aluminum in various industries, such as automotive, construction, and packaging. For instance, the automotive industry's growing need for lightweight materials has increased aluminum use, which has increased demand for inorganic fluorides used in smelting aluminum. The increased demand for aluminum necessitates the usage of inorganic fluorides in the manufacturing process. The industry for aluminum's necessary components, such as inorganic fluorides, is growing due to industries' ongoing search for strong and lightweight materials. Their crucial function in contemporary manufacturing and building is highlighted by the interaction between the need for aluminum and the requirement for inorganic fluorides, which propels inorganic fluorides market expansion.

According to the U.S. Department of Energy, vehicle weight reductions of 10% can increase fuel efficiency by 6% to 8%. The weight of a vehicle's body and chassis can be reduced by up to 50% by substituting lightweight materials like high-strength steel, magnesium (Mg) alloys, aluminum (Al) alloys, carbon fiber, and polymer composites for cast iron and conventional steel components. This will also lower the vehicle's fuel consumption. Therefore, material innovation plays a crucial role in achieving sustainability and performance goals.

|

Lightweight Material |

Mass Reduction |

|

Magnesium |

30-70% |

|

Carbon Fiber Composites |

50-70% |

|

Aluminum and AI Matrix Composites |

30-60% |

|

Titanium |

40-55% |

|

Glass Fiber Composites |

25-35% |

|

Advanced High Strength Steel |

15-25% |

|

High Strength Steel |

10-28% |

Source: U.S. Department of Energy

Key industry players, including Navin Fluorine International Limited (NFIL), are engaging in strategic investments to enhance their production capacities and diversify their product offerings. In 2021, NFIL, one of the foremost manufacturers of fluorochemicals, announced that its wholly owned subsidiary, Navin Fluorine Advanced Sciences Limited (NFASL), has secured a multi-year agreement with a prominent multinational corporation for the manufacture and supply of a critical agrochemical fluoro-intermediate. This agreement, valued at approximately USD 96 million, spans five years. This initiative is expected to fortify the product offerings and strengthen customer relationships while providing essential building blocks for future growth.

Key Inorganic Fluorides Market Insights Summary:

Regional Highlights:

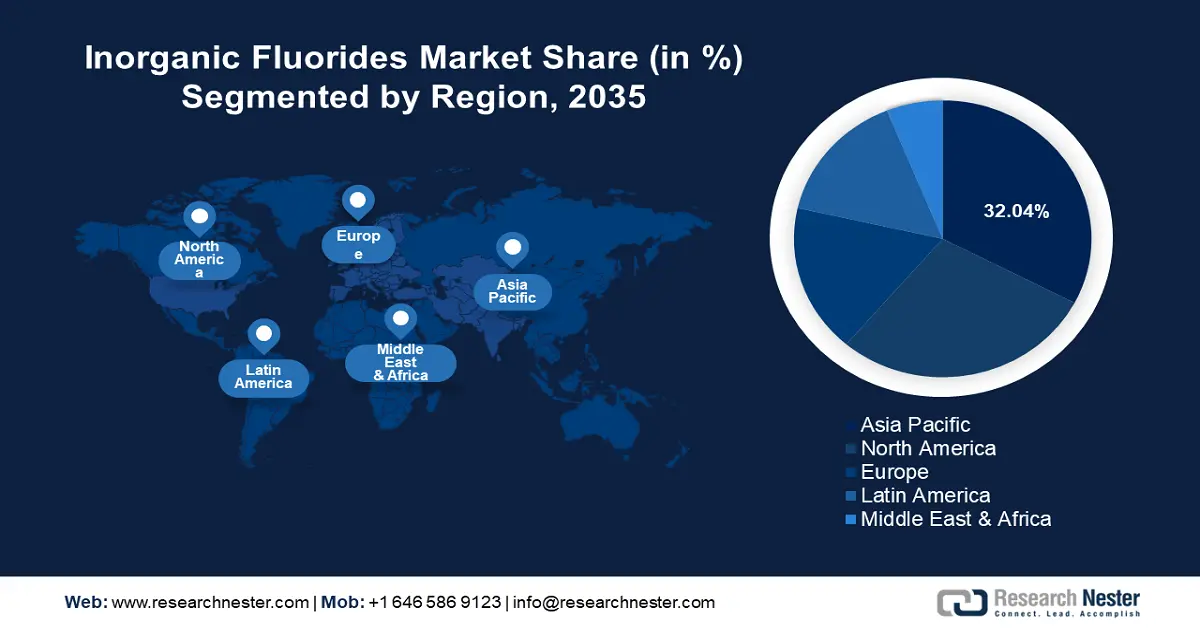

- Asia Pacific leads the Inorganic Fluorides Market with a 32% share, driven by rapid industrialization and aluminum production growth in China and India, ensuring sustained growth through 2026–2035.

- North America's Inorganic Fluorides Market is set for substantial growth by 2035, propelled by increasing demand from automotive and electronic industries.

Segment Insights:

- The Ammonium Hydrogen Fluoride segment is forecasted to achieve a notable share by 2035, propelled by its extensive use in glass etching and cleaning applications.

- The Aluminum segment of the Inorganic Fluorides Market is expected to capture a significant share from 2026 to 2035, fueled by the increasing use of aluminum fluoride in aluminum production to enhance the electrolytic smelting process.

Key Growth Trends:

- Growing demand for refrigerants and air conditioning systems

- Expanding pharmaceutical industry

Major Challenges:

- Strict regulations and environmental concerns

- Health and safety concerns

- Key Players: Solvay, Shanghai Mintchem Development Co., Navin Fluorine International Limited, Aditya Birla Group, Do-Fluoride Chemicals Co., Ltd., Alfa Aesar, Honeywell International Inc., DuPont de Nemours, Inc., Arkema S.A., Shandong Dongyue Chemical Co., Ltd..

Global Inorganic Fluorides Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.02 billion

- 2026 Market Size: USD 1.07 billion

- Projected Market Size: USD 1.68 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, India, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 13 August, 2025

Inorganic Fluorides Market Growth Drivers and Challenges:

Growth Drivers

- Growing demand for refrigerants and air conditioning systems: In the production of refrigerants and air conditioning systems, inorganic fluorides such as hydrogen fluoride and fluorine gas are essential ingredients. The need for inorganic fluorides is predicted to rise with the expanding demand for air conditioning systems in residential and commercial buildings, especially in hotter climates. The International Energy Agency reports that there are currently around 2 billion air conditioners in operation globally. Space cooling plays a significant role in the rising electricity demand for buildings and the growing need to boost generation capacity to handle peak power demands. Notably, nearly 70% of these units are residential.

The requirement for inorganic fluorides, which are necessary to produce effective and efficient refrigerants, is driven by the growing need for cooling systems. The market for these necessary chemicals is expanding as a result of global warming and the necessity for air conditioning in more buildings. According to the National Aeronautics and Space Administration (NASA), Earth's temperature in 2023 was 2.45 degrees Fahrenheit (or 1.36 degrees Celsius) warmer than the preindustrial average of the late 19th century (1850–1900). The warmest years on record have been the last ten. The relationship between the requirement for climate control and the use of inorganic fluoride emphasizes how crucial it is to keep homes and workplaces pleasant, which propels market expansion. - Expanding pharmaceutical industry: The pharmaceutical industry extensively uses inorganic fluorides in the synthesis of several medications and active pharmaceutical ingredients (APIs). The pharmaceutical sector is expanding due to the rising incidence of chronic illnesses and the need for better and newer drug formulations, consequently raising demand for inorganic fluorides. A 2023 study by the National Institutes of Health found that various inorganic nanoparticles (NPs), including silver, zinc, hydroxyapatite, calcium fluoride, titanium, and copper-based NPs, significantly enhance the anti-caries properties of mouthwashes and toothpaste. Moreover, it has been noted that metallic nanoparticles present in dental polishing agents and filling materials can help thwart the development of tooth cavities. These metallic nanoparticles, whether used alone or in composite formulations, exhibit antibacterial and demineralizing properties. They can also be utilized to create dental materials with improved mechanical strength and aesthetic appeal.

Caries, the most common chronic oral disease, pose a challenge since traditional filling materials lack anti-caries properties, making secondary caries more likely. According to the World Health Organization (WHO), an estimated 514 million children worldwide suffer from primary tooth caries, while 2 billion adults worldwide suffer from permanent tooth caries. Nanomaterials have emerged as a promising method for treating caries, as they can inhibit biofilm production. In addition to this, they promote remineralization while reducing demineralization. Recent advancements in nanotechnology have led to significant improvements in anti-caries materials, particularly in the development of nano-adhesives and nano-composite resins. Inorganic nanoparticles are creating a buzz in dental applications due to their ability to disrupt bacterial metabolism and prevent biofilm formation.

Challenges

-

Strict regulations and environmental concerns: To lessen these effects, governments and regulatory agencies enforce strict environmental laws. Significant investments in safer waste management techniques and pollution control technology are necessary to comply with these rules. By raising production costs and deterring investors, the high cost of compliance and the possibility of non-compliance penalties can limit the inorganic fluorides market's expansion for inorganic fluorides.

- Health and safety concerns: Hydrogen fluoride is one of the most harmful and caustic inorganic fluorides. Workers and the surrounding populations are at considerable risk for health problems as a result of exposure to these substances. Strict safety procedures and precautions are necessary to avoid mishaps and health risks, which raises operating expenses. Manufacturers need to invest in emergency response systems, training, and cutting-edge safety gear. These extra expenses have the potential to restrict market expansion by decreasing profitability and raising operational complexity.

Inorganic Fluorides Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 1.02 billion |

|

Forecast Year Market Size (2035) |

USD 1.68 billion |

|

Regional Scope |

|

Inorganic Fluorides Market Segmentation:

Type (Ammonium Hydrogen Fluoride, Calcium Fluoride, Hydrogen Fluoride, Sodium Fluoride, Sulphur Fluoride)

By 2035, ammonium hydrogen fluoride segment is expected to capture over 33.6% inorganic fluorides market share. The segment is growing due to its extensive use in glass etching and cleaning applications. In these procedures, ammonium hydrogen fluoride works incredibly well, offering a clean and accurate finish. Also, to create complex patterns and designs, it is commonly employed in the glass industry to etch glass surfaces. It is also used to clean metal surfaces, improving their functionality and cleanliness. Ammonium hydrogen fluoride's potent etching capabilities enable it to effectively remove undesirable contaminants from metal and glass surfaces, which accounts for its efficacy in these applications. It is a popular option for producers looking for superior finishes because of its capacity to create delicate, intricate etchings.

Application (Aluminum, Oil & Gas, Pharmaceuticals, Electronics)

The aluminum segment in inorganic fluorides market will garner a significant share during the assessed period. The segment growth can be attributed to the growing use of fluorides in aluminum production. Aluminum fluoride in particular is essential for lowering the melting point of aluminum oxide, which makes the electrolytic process of smelting aluminum easier. Fluorides are essential in the aluminum sector due to the efficiency of their production methods. The inorganic fluorides market is also driven by the growing need for aluminum in several industries, including packaging, construction, and the automobile industry. Fluorides used in aluminum production are in great demand since aluminum is a popular material in these industries due to its lightweight and corrosion-resistant properties.

|

Country |

Production Capacity of Aluminum in 2023 (in Thousand Metric Tons) |

Percentage of Global Production |

|

China |

41,000 |

59% |

|

India |

4,100 |

6% |

|

Russia |

3,800 |

5% |

|

Canada |

3,000 |

4% |

|

United Arab Emirates (UAE) |

2,700 |

4% |

|

Bahrain |

1,600 |

2% |

|

Australia |

1,500 |

2% |

|

Norway |

1,300 |

2% |

|

Brazil |

1,100 |

2% |

|

Rest of the World |

9,460 |

14% |

Our in-depth analysis of the global inorganic fluorides market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Inorganic Fluorides Market Regional Analysis:

APAC Market Statistics

In inorganic fluorides market, Asia Pacific region is estimated to capture over 32.04% share by 2035. The regional market growth is driven by rapid industrialization, especially in China and India. Important roles are also played by expanding industrial industries and growing aluminum production. Market expansion is also supported by investments in infrastructure development and advantageous government policies. Moreover, there is a greater need for inorganic fluorides as a result of APAC's growing population and economic growth. The existence of significant end-user sectors like electronics and automobiles propels inorganic fluorides market expansion even more. Competitive advantages are also offered by plentiful raw materials and cheap labor costs.

Furthermore, in China, the incidence of dental caries may continue to climb due to changing lifestyles and increased sugar consumption, which will be made worse by limited access to expert care. According to the State Council, by 2030, China is anticipated to consume 16.44 million metric tons of sugar, and during the 2021–2030 timeframe, sugar will be relatively significant. The rising prevalence of oral diseases in China has the potential to become a serious public health issue, resulting in high personal and medical expenses. China's initiatives to improve chronic disease prevention offer an opportunity to integrate oral disease prevention into non-communicable disease (NCD) programs. Research demonstrates that automatic fluoridation, combined with the appropriate use of fluoride-containing toothpaste, is particularly effective. This situation is driving an increasing demand for inorganic fluorides in toothpaste and water, which is anticipated to stimulate inorganic fluorides market growth within the country.

Also, aluminum fluoride is gaining momentum in India due to its growing use in aluminum production. Aluminum fluoride is a crucial additive in aluminum production, as it reduces energy consumption during smelting. Moreover, the growing use of aluminum in diverse sectors will expand the inorganic fluorides market in the country. The Observatory of Economic Complexity revealed that India became the world's second-largest importer of aluminum fluoride in 2022, bringing in USD 82.3 million. In that same year, aluminum fluoride ranked 793rd among India's imports.

North America Market Analysis

The inorganic fluorides market in North America will hold a substantial share during the projected period. The market growth can be attributed to the growing demand for inorganic fluorides in the automotive and electronic industries. Also, advanced manufacturing technologies and strict environmental regulations are contributing to the market expansion. Moreover, in Canada, initiatives to lower energy use and greenhouse gas emissions are aligned with the emphasis on energy-saving measures. The inorganic fluorides market in refrigerant applications is anticipated to increase steadily as consumers and businesses prioritize energy efficiency, making it a major market trend.

In the U.S., inorganic fluorides are gaining traction due to their use in the production of advanced materials including optical fibers, specialized glasses, and high-performance ceramics. The inorganic fluorides market is being driven by the increasing need for these materials in sectors like telecommunications, aerospace, and defense. According to the Aerospace Industries Association report, the U.S. aerospace and defense sector achieved a remarkable milestone in 2023, with sales of over USD 955 billion, an increase of 7.1 percent from 2022. Therefore, these cutting-edge materials provide exceptional durability, performance, and unique qualities that are necessary for innovative applications.

Key Inorganic Fluorides Market Players:

- Solvay

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Shanghai Mintchem Development Co.

- Navin Fluorine International Limited

- Aditya Birla Group

- Do-Fluoride Chemicals Co., Ltd.

- Alfa Aesar

- Honeywell International Inc.

- DuPont de Nemours, Inc.

- Arkema S.A.

- Shandong Dongyue Chemical Co., Ltd.

The businesses in are establishing regional domination, robust worldwide distribution networks, broad product portfolios, and effective production capabilities. Together, these businesses propel the inorganic fluorides market through innovation, strategic global positioning, and a dedication to efficiency and quality, guaranteeing their market dominance and leadership.

Recent Developments

- In January 2022, Honeywell and Navin Fluorine International Limited, part of the Padmanabh Mafatlal Group, established a partnership to manufacture Honeywell's Solstice hydrofluoroolefins (HFO) in India.

- In October 2021, Solvay expanded its innovation capabilities in the electric car sector by developing the next generation of solid-state electrolytes for batteries. On the ground, investments began earlier this year with the establishment of a dry room laboratory in Solvay's research facility near Paris, followed by a new R&D pilot line in La Rochelle.

- Report ID: 7017

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Inorganic Fluorides Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.