Inhalable Drugs Market Outlook:

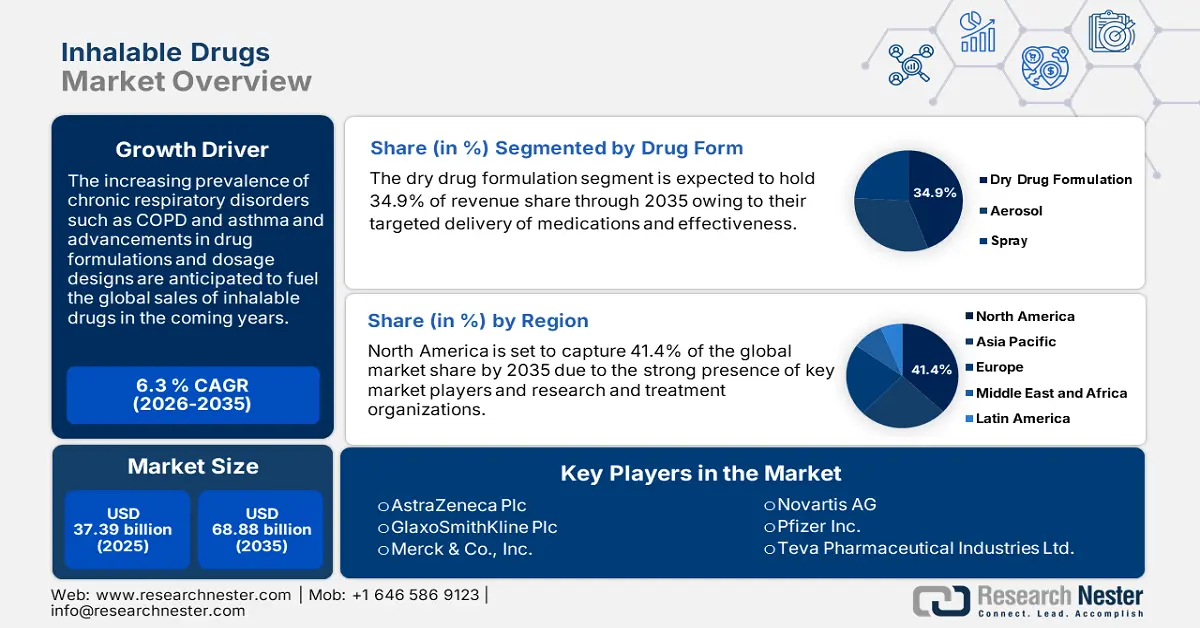

Inhalable Drugs Market size was over USD 37.39 billion in 2025 and is poised to exceed USD 68.88 billion by 2035, growing at over 6.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of inhalable drugs is estimated at USD 39.51 billion.

The inhalable medicines are anticipated to exhibit high demand during the forecasted period owing to their ease of use and quick effectiveness. The rising prevalence of chronic respiratory problems such as asthma, pulmonary hypertension, chronic obstructive pulmonary disease (COPD), and occupational lung diseases are prime factors fuelling the sales of inhalable drugs.

Research and development focused on the production of advanced medications is set to fuel the sales of modern inhalable drugs in the coming years. For instance, according to the World Health Organization analysis, COPD is the leading cause of death, and around 70% of COPD cases in high-income countries occur due to excessive smoking. Also, asthma is the most common chronic respiratory disease among children. The rising awareness of asthma and treatment is augmenting the demand for inhalers such as bronchodilators and steroids.

Excess intake of psychoactive substances such as alcohol and tobacco coupled with air pollution and chemicals and dust are some of the common factors of chronic respiratory diseases. According to the National Institutes of Health (NIH), alcohol is the major cause of several disorders in underdeveloped and developing countries. For instance, the World Health Organization (WHO) estimates that around 7% of the population across the world above 15 years of age are living with alcohol-related disorders.

Key Inhalable Drugs Market Insights Summary:

Regional Highlights:

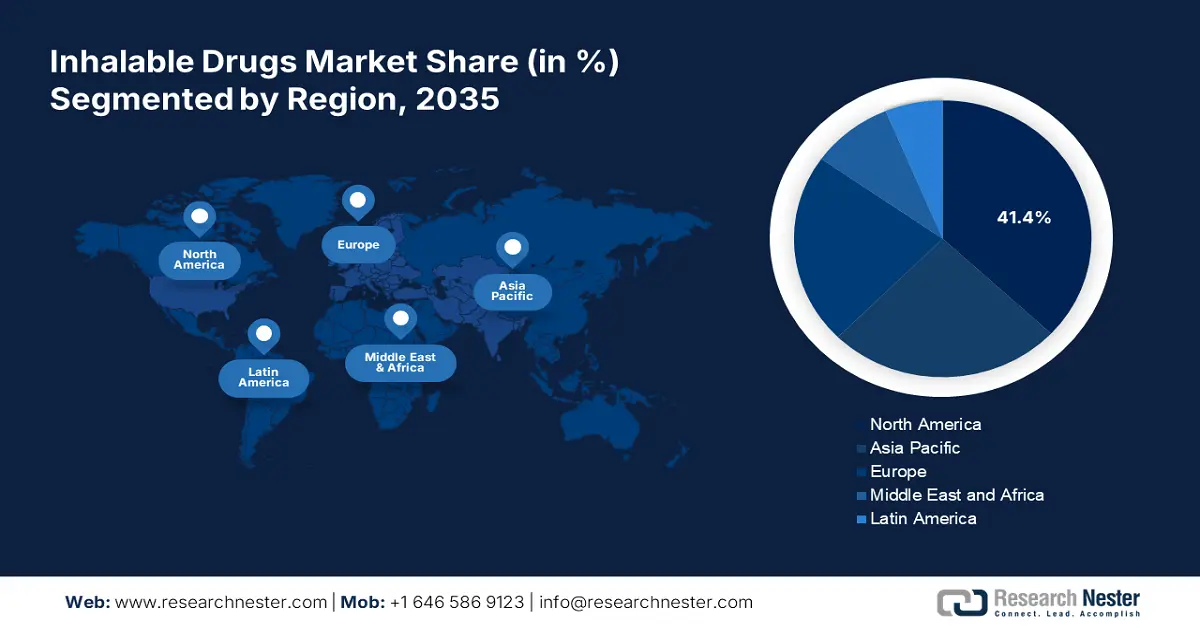

- North America dominates the Inhalable Drugs Market with a 41.4% share, fueled by high R&D investments and increasing chronic diseases, solidifying its leadership through 2026–2035.

- The Inhalable Drugs Market in Asia Pacific is expected to grow rapidly by 2035, propelled by rapid healthcare investment and drug manufacturing.

Segment Insights:

- The Respiratory Diseases segment is poised for substantial growth from 2026 to 2035, driven by rising global cases of asthma, COPD, and occupational lung diseases, capturing a 76.50% market share.

- The Dry Powder Formulation segment is set for substantial growth from 2026-2035, driven by quick effectiveness and patient comfort in respiratory treatment.

Key Growth Trends:

- Introduction of smart inhalers

- Development of novel drugs

Major Challenges:

- Strict regulatory challenges

- High investment costs

- Key Players: AstraZeneca Plc, C.H. Boehringer Sohn AG & Co. KG., Cipla Limited, GlaxoSmithKline Plc, MannKind Corporation, and Merck & Co., Inc.

Global Inhalable Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 37.39 billion

- 2026 Market Size: USD 39.51 billion

- Projected Market Size: USD 68.88 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Inhalable Drugs Market Growth Drivers and Challenges:

Growth Drivers:

-

Introduction of smart inhalers: The integration of digital technologies such as the Internet of Things and connectivity platforms such as Bluetooth and mobile apps is leading to the development of smart inhalers. These inhaler devices provide a connected solution beyond traditional inhalers owing to their real-time monitoring, alerts, reminders, and feedback mechanisms. Smart inhalers are equipped with sensors that record each use, tracking when and how the inhaler is utilized. Also, smart inhalers are connected to mobile applications that provide insights into usage patterns.

Mobile applications help patients view their adherence levels, receive dosage reminders, and access educational resources about their condition. For instance, in 2018 the world’s first and new digital inhaler ProAir Digihaler was developed by Teva Pharmaceutical Industries Ltd. This smart inhaler with built-in sensors was approved by the U.S. Food and Drug Administration (FDA), which seamlessly connects with mobile applications and shares information related to inhaler use with patients and healthcare providers. - Development of novel drugs: The ongoing advancements in drug formulation for inhalation are leading to the development of advanced delivery systems and formulations such as dry powder inhalers and nebulizers. These advanced solutions are enhancing the therapeutic effects of inhaled medications leading to better patient comfort. Dry powder inhalers deliver medication in powder form and are portable, making them convenient for daily use by eliminating the need for propellants. According to a ScienceDirect report, GlaxoSmithKline's Advair and AstraZeneca's Symbicort are the most demanded dry powder drugs with annual sales of over USD 1 billion. Also, children with respiratory issues are widely treated using nebulizers as these solutions allow for longer inhalation times and easier delivery of mechanisms.

Challenges

-

Strict regulatory challenges: The approval process for inhalable drugs is quite complex due to the involvement of several steps and strict approval procedures, which significantly delay market entry and increase product development costs. Several regions have various regulatory requirements such as the Food and Drugs Administration in the U.S. and the European Medicines Agency in Europe that governs the approval of drugs. The presence of several regulatory bodies makes it complex for manufacturers to launch their products, hampering their market shares.

- High investment costs: The production of advanced inhalable drugs requires significant investments in research and development activities. R&D processes often involve several trials and errors to achieve the right formulation. Extensive laboratory studies required to ensure safety before human trials are both time-consuming and expensive. Small-scale pharma companies often fail to invest in the production of advanced solutions or delivery systems owing to limited budgets.

Inhalable Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 37.39 billion |

|

Forecast Year Market Size (2035) |

USD 68.88 billion |

|

Regional Scope |

|

Inhalable Drugs Market Segmentation:

Drug Form (Aerosol, Dry Powder Formulation, Spray)

The dry powder formulation segment in the inhalable drugs market is anticipated to hold a revenue share of 34.9% through 2035 owing to their quick effectiveness and patient comfort. Dry powder formulations are targeting solutions that deliver medications directly to the lungs, allowing for rapid absorption into the bloodstream. This direct delivery is crucial for managing respiratory diseases such as asthma and COPD as it quickly and effectively alleviates symptoms such as wheezing and shortness of breath. Dry drug formulations offer several benefits such as improved patient care owing to their easier administration and better stability compared to liquid formulations. Some of the pure powder drug formulations available in the inhalable drugs market are AstraZeneca's Bricanyl Turbuhaler, Pulmicort Turbuhalers, and Teva Pharmaceutical Industries Ltd’s Adasuve.

Application (Respiratory Diseases, Non-respiratory Diseases)

The respiratory diseases segment is forecasted to account for 76.5% of the global inhalable drugs market share through 2035. The increasing cases of respiratory disorders such as occupational lung diseases, COPD, and asthma worldwide are pushing the demand for advanced inhalable medications. High intake of toxic substances such as tobacco and alcohol, air pollution, and allergic chemicals and drugs primarily contribute to respiratory diseases. For instance, according to the Institutes of Health Metrics and Evaluation, in 2019, the prevalence of chronic respiratory diseases was around 454.6 million cases globally. The trend towards combination inhalers such as steroids with long-acting bronchodilators that offer enhanced therapeutic is contributing to the segmental growth.

Our in-depth analysis of the inhalable drugs market includes the following segments:

|

Drug Form

|

|

|

Application |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Inhalable Drugs Market Regional Analysis:

North America Market Forecast

North America industry is likely to hold largest revenue share of 41.4% by 2035,owing to the presence of industry giants and next-gen research and treatment organizations. The high investments in research and development activities, rising cases of chronic respiratory disorders, and the emergence of several start-ups are contributing to the market growth. The U.S. is leading the regional sales of inhalable drugs followed by Canada.

The U.S. inhalable drugs market is foreseen to register rapid growth owing to the existence of advanced healthcare infrastructure and rapid advancements in drug formulations. According to the Centers for Disease Control and Prevention, in 2022, around 4.6% of adults were diagnosed with either emphysema, COPD, or chronic bronchitis. The rising awareness campaigns to educate and equip those with chronic respiratory disorders are also positively influencing the U.S. inhalable drugs market growth. For instance, the COPD foundation launched COPD awareness month in November 2023 and invited people to participate in events to spread awareness related to lung health among the public at large.

Similarly in Canada, the presence of advanced research organizations such as the Lung Health Foundation and Canadian Lung Association and advancements in drug formulation are augmenting the inhalable drugs market growth. For instance, in July 2024, the Government of Canada invested around USD 19.3 million to support 9 research teams in the analysis of ongoing, new, and emerging threats to lung health.

Asia Pacific Market Statistics

The Asia Pacific inhalable drugs market is set to increase at a fast pace during the forecasted period owing to rapid investments in healthcare infrastructure development and rising drug manufacturing units. China and India are witnessing the rapid entrance of international pharma companies, which is set to boost the regional market growth. Forefront at innovations, Japan and South Korea are anticipated to offer lucrative opportunities to inhalable drug manufacturers in the coming years.

In India, the rapid expansion of pharmaceutical companies, including the introduction of generic inhalable drugs is making treatments, more affordable and accessible. For instance, according to the India Brand Equity Foundation, India has low pharma manufacturing costs, 30%-35% lower than in the U.S. and Europe, affordable labor, and about 87% less investments in R&D compared to developed markets.

Severe air quality issues in major cities of China are leading to rising incidences of respiratory disease, which is ultimately boosting the demand for advanced inhalable medications. China’s rapidly expanding aging population and government reforms to improve healthcare accessibility and affordability are fuelling the inhalable drugs market growth.

Key Inhalable Drugs Market Players:

- AstraZeneca Plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- C.H. Boehringer Sohn AG & Co. KG.

- CHIESI Farmaceutici S.p.A.

- Cipla Limited

- GlaxoSmithKline Plc

- MannKind Corporation

- Merck & Co., Inc.

- Mundipharma International Limited

- Novartis AG

- Pfizer Inc.

- Pulmatrix, Inc.

- Philip Morris International Inc.

- Sanofi

- Teva Pharmaceutical Industries Ltd.

- Viatris, Inc.

Key players in the inhalable drugs market are adopting several organic and inorganic strategies such as innovation in drug formulations, strategic partnerships & collaborations, regional expansions, digital technologies integration, and more to earn high profits. Leading companies are investing heavily in research and development activities to enhance drug delivery efficiency and patient compliance. They are also entering emerging markets with high unmet medical needs to cater to a larger audience base. Partnerships with other players and collaborations with research organizations are aiding them in co-developing innovative inhalable formulations.

Some of the key players include:

Recent Developments

- In January 2024, AstraZeneca Plc announced the commercial availability of AIRSUPRA in the U.S. The medications help prevent sudden severe breathing issues such as asthma attacks in patients above 18 years of age.

- In July 2023, Viatris Inc. and Kindeva Drug Delivery L.P. revealed the launch of Breyna an inhalation aerosol. Breyna is the first generic version of AstraZeneca's Symbicort a U.S. Food and Drug Administration-approved drug.

- Report ID: 6562

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Inhalable Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.