InGaAs Image Sensor Market Outlook:

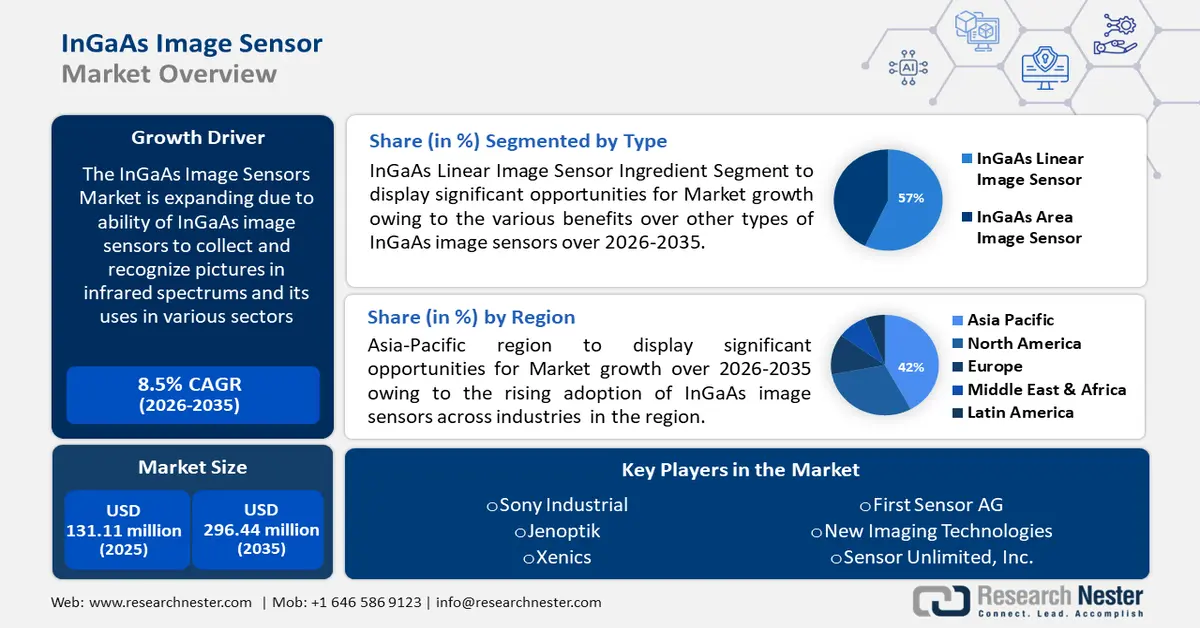

InGaAs Image Sensor Market size was over USD 131.11 million in 2025 and is anticipated to cross USD 296.44 million by 2035, growing at more than 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of InGaAs image sensor is assessed at USD 141.14 million.

The market growth is attributed to the fact that the ability of InGaAs image sensors to identify and collect pictures in infrared spectrums makes them suitable for various uses in industries such as telecommunications and spectroscopy. According to a recent report, global government IT spending amounted to over USD 548 billion in 2022.

In addition, the growing need for better imaging technologies across various industries such as medical imaging, industrial automation, aerospace, and defense boosts the InGaAs image sensor market. Moreover, the rising demand for high-resolution and high-sensitivity imaging technology in dim light situations stimulates market growth in the forecast period.

Key InGaAs Image Sensors Market Insights Summary:

Regional Highlights:

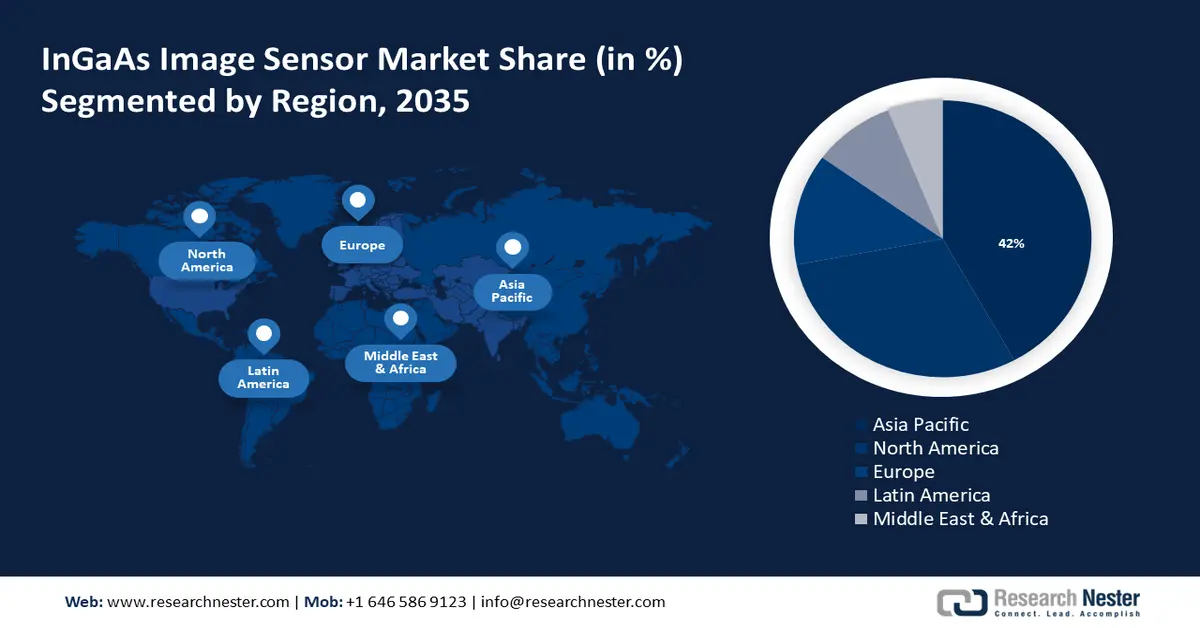

- Asia Pacific ingaas image sensor market is expected to capture 42% share by 2035, driven by rising adoption in automobiles & consumer electronics; availability of raw materials; better infrastructure; rapid growth in India & China; low-cost manufacturing.

- North America market will secure 30% share by 2035, driven by awareness due to energy-efficient regulations; presence of key players (FLIR Systems, Teledyne DALSA); IoT & machine learning adoption; $2 trillion tech sector contribution (2022).

Segment Insights:

- The ingaas linear image sensor segment in the ingaas image sensor market is anticipated to experience significant growth till 2035, attributed to its benefits over CCD and CMOS sensors.

- The security & surveillance segment in the ingaas image sensor market is projected to expand significantly over 2026-2035, fueled by growing use in facial recognition and AI adoption.

Key Growth Trends:

- Advancements in medical imaging technology

- Adoption of InGaAs image sensors in environmental monitoring

Major Challenges:

- High Cost of InGaAs Image Sensors

- Lack of raw materials

Key Players: Sony Industrial, Jenoptik, Sensor Unlimited Inc., OSI Laser Diode Inc., New Imaging Technologies, Xenics, First Sensor AG, Albis Optoelectronics AG, Excelitas Technologies Corp, OSI Optoelectronics Inc..

Global InGaAs Image Sensors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 131.11 million

- 2026 Market Size: USD 141.14 million

- Projected Market Size: USD 296.44 million by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, Germany, China, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

InGaAs Image Sensor Market Growth Drivers and Challenges:

Growth Drivers

-

Advancements in medical imaging technology - The medical industry is witnessing an incredible transformation in imaging sensor technology, and in this transformation, the role of InGaAs image sensors is crucial. Moreover, the censors with optical coherence tomography and near-infrared spectroscopy ensure high-resolution and non-invasive imaging.

Furthermore, the role of InGaAs image sensors in the healthcare sector is crucial in early disease detection, and they also provide accurate and clearer images to medical professionals. These sensors are significant in enhancing patient care and advancing medical research.

In addition, healthcare professionals seek more accurate diagnostic tools to have a clear picture of the disease, so the demand for high-performance InGaAs image sensors is anticipated to expand the InGaAs image sensor market size in the forecast period. - Adoption of InGaAs image sensors in environmental monitoring - There is a growing use of InGaAs image sensor in environmental monitoring due to their ability to detect wavelength which further analyzes chemical composition and environmental conditions. Due to rising environmental concerns globally, the use and role of InGaAs image sensor is significant as it provide accurate data which boosts the market growth.

Moreover, there are several benefits of these sensors such as low power consumption with great efficiency, environmental and eco-friendly that provide sustainable solutions. According to a recent report, worldwide green technology investments reached USD 755 billion in 2021. In addition, InGaAs image sensor are used in applications like remote sensing, and imaging for space applications by keeping the power consumption low leads to stimulating InGaAs image sensor market growth. - Growing level of research and development activities - Continuous and ongoing R&D in the InGaAs image sensors to improve the overall performance and its functionality boost the market. Furthermore, due to the research and innovation in InGaAs image sensors, it is expanding such as the creation of InGaAs image sensors with increasing wavelength ranges and also the integration of image censors with CMOS technology.

In addition, InGaAs image sensors are crucial in various quantum systems enables the detection of individual photons to secure quantum communication.Also, quantum technologies have a wide range of applications from secure communication to quantum computing. Furthermore, with the growing research in quantum technologies, the demand for high-performance stimulates InGaAs image sensor market growth.

Challenges

-

High Cost of InGaAs Image Sensors- The high cost of the production of InGaAs image sensors restricts its use in industries that are cost-sensitive and financially restricted ultimately hinders the market growth

- Lack of raw materials - Limited availability of raw materials such as indium and gallium and complex process of manufacturing InGaAs image sensors. Additionally, there is a lack of awareness about InGaAs image sensors’ benefits and their limited availability in some regions.

InGaAs Image Sensor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 131.11 million |

|

Forecast Year Market Size (2035) |

USD 296.44 million |

|

Regional Scope |

|

InGaAs Image Sensor Market Segmentation:

Type Segment Analysis

The InGaAs linear image sensor segment is projected to capture around 57% InGaAs image sensor market share by the end of 2035. The segment growth can be attributed to the factor that InGaAs linear image sensors have various benefits over other types of InGaAs image sensors such as CCD and CMOS sensors.

In addition, InGaAs linear image sensors can easily detect light in near-infrared regions as it is suitable for night vision, and surveillance that demands a low-light environment. Moreover, InGaAs linear image sensors have many features which include low noise and high quantum efficiency making it suitable for various applications that boost segment growth.

Application Segment Analysis

By the end of 2035, security & surveillance segment is anticipated to hold over 52% InGaAs image sensor market share. The segment growth can be attributed to the factor that the use of InGaAs image sensors in security & surveillance applications such as facial recognition, and video surveillance. Moreover, there is growing use of security & surveillance in various sectors like transportation, government, and commercial for ensuring security and safety.

In addition, the inclusion of artificial intelligence and machine learning in the security & surveillance system is anticipated to boost the segment growth. According to a recent report, in 2022, 53% of global IT companies reported accelerated AI adoption.

Our in-depth analysis of the InGaAs image sensor market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

InGaAs Image Sensor Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to dominate majority revenue share of 42% by 2035, The regional growth is attributed to the rising adoption of InGaAs image sensor in various industries such as automobiles and consumer electronics like cameras and mobile phones.

Moreover, there is a huge availability of raw materials and better infrastructure for manufacturing InGaAs image sensor with a large amount of workforce leads to boosting the market growth in the region. In addition, due to rapid economic growth in India and China, the demand for advanced and high-performing imaging solutions has increased. Furthermore, the availability of low-cost InGaAs image sensor manufacturing expands its usage in all industries stimulating market growth in the region.

North America Market Insights

By 2035, North American InGaAs image sensor market is predicted to hold more than 30% revenue share. The market’s expansion can be attributed to the factor that people in the region are more aware of the uses and benefits of InGaAs image sensor due to energy-efficient regulations in the region. Moreover, the region has many users and manufacturers of imaging solution which includes FLIR systems and Teledyne DALSA which is anticipated to boost the market.

In addition, manufacturers of InGaAs image sensor are focusing on advanced technologies which include the Internet of Things and machine learning to build better imaging solutions for domestic and industrial applications that stimulate market growth in the region. According to a recent report, the United States tech sector contributed nearly USD 2 trillion to the country’s overall GDP in 2022

InGaAs Image Sensor Market Players:

- Sony Industrial

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Jenoptik

- Sensor Unlimited, Inc.

- New Imaging Technologies

- OSI Laser Diode, Inc

- Albis Optoelectronics AG

- Xenics

- First Sensor AG

- Excelitas Technologies Corp.

- OSI Optoelectronics, Inc.

The Market is highly competitive and various key players in the InGaAs Image Sensor Market are Sony Industrial, Jenoptik, New Imaging Technologies, Sensor Unlimited, Inc., and First Sensor AG among others.

Recent Developments

- Albis Optoelectronics AG - Albis Optoelectronics AG is a manufacturer of high-speed photodiode chips and HiLight Semiconductor which is a fabless chip company specialized in deep submicron CMOS demonstrated a high-performance, cost-effective receiver solution for 10G-PON ONU’s. This combined performance delivered a top-class sensitivity level of -34dBm and -28dBm in a straightforward TO- can build with negligible optical sensitivity. In addition, the active noise cancellation circuitry of TIA enables the usage of minimal APD supply components within the BOSA TO-can. Moreover, Albis Optoelectronics’ APD10F1 is the most recent addition to its successful 10G APD family.

- Excelitas Technologies Corp. - Excelitas Technologies Corp. is a leading technology manufacturer that focuses on innovative photonic solutions launched third generation TDG3AD1S09 905NM pulsed laser diode. This TDG3AD1S09 905NM pulsed laser diode offers a high output power of 120 W for long-distance range finding and power efficiency for short to mid-range systems. In addition, there are various additional features of TDG3AD1S09 905NM pulsed laser diode such as cost-effective SMD packaging for high volume industrial applications, 225 um contact stripe width, and capability to mount horizontally and vertically on the PCB.

- Report ID: 6130

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

InGaAs Image Sensors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.