InGaAs Cameras Market Outlook:

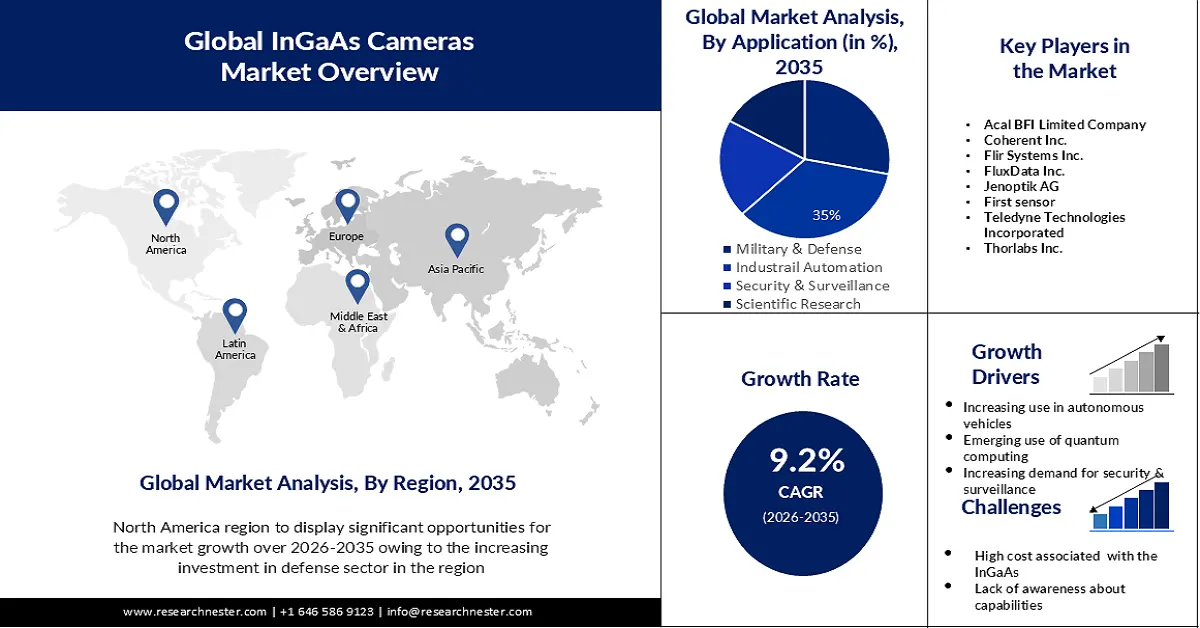

InGaAs Cameras Market size was over USD 161.04 million in 2025 and is poised to exceed USD 388.29 million by 2035, witnessing over 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of InGaAs cameras is estimated at USD 174.37 million.

The growing demand for InGaAs cameras is being driven by increased spending in the defense sector globally on high-tech imaging systems and border control technologies. For example, the US Department of defense budget is set to spend more than USD 16 billion in 2021 on research, development, testing, and evaluation of new imaging technologies.

As a result of the emergence of Industry 4.0, automated processes have been developed for different sectors allowing companies to reap the longer-term benefits from their activities, reducing human involvement and waste, enhancing flexibility, and optimizing decisions. The automated industries are expected to grow over the forecast period as an increasing number of interconnected companies, government initiatives promoting industrial automation and adoption of new technologies such as the Internet of Things and artificial intelligence will drive their growth.

Key InGaAs Cameras Market Insights Summary:

Regional Highlights:

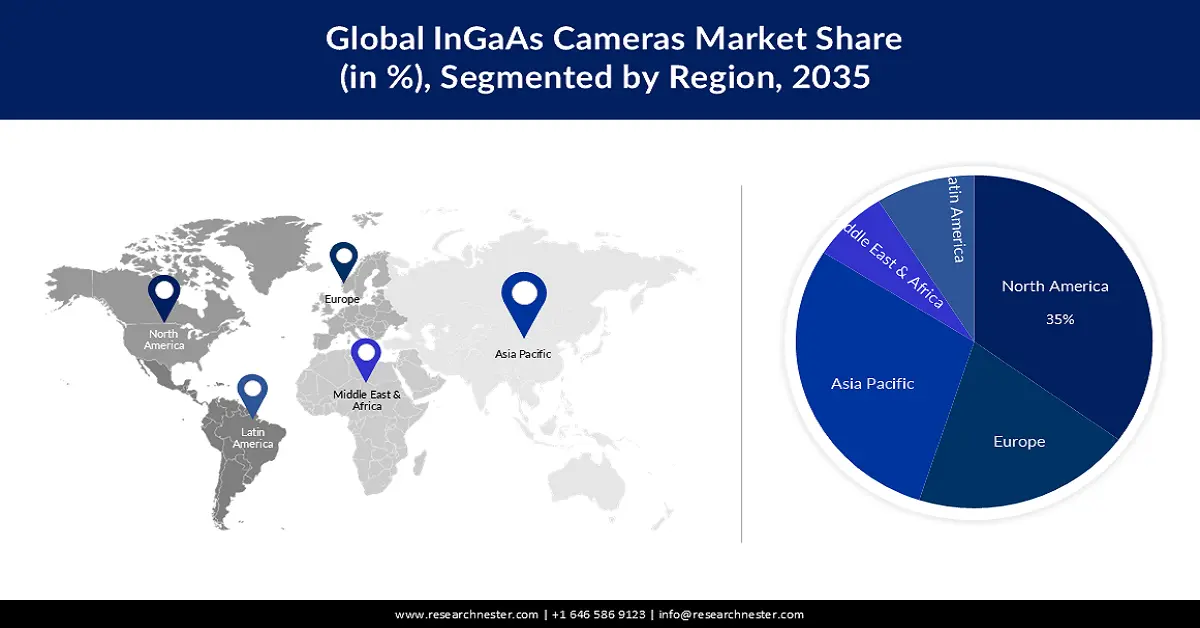

- North America InGaAs cameras market is anticipated to achieve a 35% share by 2035, driven by increased UAV/UGV deployment in defense and industry.

- Asia Pacific market is forecasted to secure a 29% share by 2035, driven by industrial growth and government support for imaging tech.

Segment Insights:

- The uncooled camera segment in the ingaas cameras market is expected to hold a 72% share by 2035, driven by the rising demand for industrial automation and non-destructive testing.

- Industrial automation segment in the ingaas cameras market is anticipated to experience 35% growth by the forecast year 2035, driven by increased adoption of InGaAs cameras in machine vision applications.

Key Growth Trends:

- The emerging use of quantum computing

- Growing applications in food inspection

Major Challenges:

- Compared to the transparent spectrum cameras, it is more costly

Key Players: Acal BFI Limited Company, Coherent Inc., Flir Systems Inc., FluxData Inc., Jenoptik AG, First sensor, Teledyne Technologies Incorporated.

Global InGaAs Cameras Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 161.04 million

- 2026 Market Size: USD 174.37 million

- Projected Market Size: USD 388.29 million by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, Germany, China, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 11 September, 2025

InGaAs Cameras Market Growth Drivers and Challenges:

Growth Drivers

- Use in autonomous cars- The InGaAs cameras market has enormous potential with regard to the introduction of InGaAs cameras in driver assistance systems and autonomous vehicles. SWIR imaging, by detecting pedestrians, road signs and markings etc. allows vehicles to drive safely in foggy conditions at night. Trieye's SWIR imaging sensor has recently been demonstrated to aid driver assistance and autonomous driving. There were some 31 million cars on the road in 2019, which had a minimum level of automation. They are expected to be more than 54 million by 2024.

- The emerging use of quantum computing- A major area of opportunity is the growing research on the use of SWIR photons for quantum computing. InGaAs cameras are capable of detecting a single photon, which can contribute to the development of quantum computers. Developments in this direction are being pursued by companies such as Quantum Opus. The business opportunities would be broadened by partnerships between camera and quantum technology companies.

- Growing applications in food inspection- the potential of InGaAs camera manufacturers to enter the food industry is created by their ability to image with SWIR hyperspectral imaging in a wide variety of tasks, such as quality monitoring and detection of alien objects. In 2021, Resonon entered into a partnership with IMSpec to develop turnkey solutions for food inspection combining SWIR hyperspectral imaging camera with analysis software.

- Increasing demand for security and surveillance- Demand for products has been driven by an increase in the number of installations of security and surveillance systems, as well as increased emphasis on safety and security particularly within the business sector. For the InGaAs cameras it is possible to view with round-the-clock imaging irrespective of low light conditions. Recently, Revel Eye has begun to deploy security cameras for real-time monitoring through SWIR.

Challenges

- Compared to the transparent spectrum cameras, it is more costly- The high cost of InGaAs sensors and cameras compared to silicon visible cameras is caused by the complex manufacturing process in which they are produced. It constitutes a major obstacle to the mass adoption of SWIR cameras across all cost-sensitive sectors, thus limiting growth in the InGaAs cameras market. SWIR camera costs range from about 4 to 5 times the normal cost for plain sight cameras.

- Market growth is hampered by the strict export regulations applicable to SWIR cameras in a few countries due to their sensitive use within the defence sector. In order to impede international trade and raise product prices, companies are required to obtain export authorisations for the sale of Infrared cameras.

- The key challenge is that there is a lack of awareness about the capabilities and benefits of InGaAs based SWIR imaging in developing regions.

InGaAs Cameras Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 161.04 million |

|

Forecast Year Market Size (2035) |

USD 388.29 million |

|

Regional Scope |

|

InGaAs Cameras Market Segmentation:

Application Segment Analysis

The industrial automation is expected to account for 35% share of the global InGaAs cameras market during the forecast period. Increasing adoption of machine vision systems is anticipated to lead to an increased demand for InGaAs cameras in the industrial automation sector. The automation of at least 30% of their tasks in a company would be feasible for about 60% of all occupations. By, automation will be able to increase global productivity. Between 8% and 1.4% per year. A smart camera system shall be installed on the production line, where it is used for product inspection in a machine vision environment. The image is captured and analyzed by the camera in accordance with a defined set of criteria. In particular, the IFR foresees that by 2021 industrial robots' operating stock will increase to 3554 million units from 2440 million in 2018. InGaAs cameras are supplied by a wide range of suppliers for use in industry. Tattile s.r.l. provides TAG-7 SWIR. This camera is part of a family of short-wave infrared line scan cameras for advanced machine vision applications in the nonvisible spectrum. The camera is suitable for use in sorting applications, recycling, and semiconductor industries with this feature.

Cooling Technology Segment Analysis

InGaAs cameras market from the uncooled segment is estimated to hold largest share with about 72% during the forecast period. Cryogenic cooling is not required for the image sensor in cooled technology. Military, defense and aerospace, industrial monitoring, food inspection, telecommunications as well as spectroscopy are a few applications of uncooled cameras. In addition, the growth of demand for Uncooled and InGaAs cameras is projected to be supported by increased demand for non-destructive testing, adoption of automation in industry, etc., as well as growing application of machine vision applications throughout the forecast period.

Our in-depth analysis of the global InGaAs cameras market includes the following segments:

|

Cooling Capacity |

|

|

Scanning Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

InGaAs Cameras Market Regional Analysis:

North America Market Insights

InGaAs cameras market in the North America region is expected to hold 35% of the revenue share by the end of 2035. The increased use of robots such as UAVs and UGV in defense and industrial applications is expected to drive demand for InGaAs cameras in the region. By May 2022, the FAA reported that 855,860 drones had been registered in the country. 37% (316,075) of these registrations were for businesses, while 63% (536,183) were for recreational activities. Additionally, the FAA has issued 277,845 certificates for remote pilots. The United States-based Raytheon Co. announced in March 2020 that it would team up with Quantum Imaging Inc. for the acquisition of a high-definition Shortwave Infrared Camera, which will be used to provide tactical imaging purposes. Quantum Imaging is to deliver a high-resolution SWIR camera for Tactical VIS Applications within the Space and Airborne Systems segment under this contract with a value of USD 13.5 million. These InGaAs cameras are expected to be designed with 10-by-10-micron pixel pitch and integral antiblooming.

APAC Market Insights

InGaAs cameras market in the Asia Pacific region is anticipated to account for 29% of the revenue share during the forecast period. Rapid industrialization and government initiatives to take advantage of high-resolution imaging technologies in developing industries have led to InGaAs cameras market growth.

InGaAs Cameras Market Players:

- Allied Vision Technologies GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Acal BFI Limited Company

- Coherent Corporation

- Flir Systems Inc.

- FluxData Inc.

- Jenoptik AG

- First sensor

- Teledyne Technologies Incorporated

- Thorlabs Inc.

- New Imaging Technologies (NIT)

Recent Developments

- NIT launched the HiPe SenS final version with a high level of performance. The HiPe SenS consist of the company’s latest SWIR sensor – NSC1902T-SI. With the innovative design of the InGaAs photodiode array coupled with the high-performance ROIC. This new sensor’s provides low noise operation and ultra-low dark current

- Allied Vision announced to showcase its camera solutions, including the Alvium Camera Series and Goldeye SWIR (Short-Wave Infrared) at SPIE Photonics West 2020 in San Francisco, California at the Moscone Center from February 4-6, 2020.

- Report ID: 5351

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

InGaAs Cameras Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.