Infusion Catheter Market Outlook:

Infusion Catheter Market size was valued at USD 1.99 billion in 2025 and is likely to cross USD 4.84 billion by 2035, expanding at more than 9.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of infusion catheter is assessed at USD 2.16 billion.

The growth in the infusion catheter market is to a large extent due to some of the most powerful trends and natural factors, which together determine its trajectory. Leading the charge is the increase in incidence of cancers and diabetes and other chronic diseases, which generated a boom in chronic intravenous therapy and injected growth in infusion catheter usage. For instance, in July 2024, according to CDC, in the U.S., 98 million adults have prediabetes, and over 38 million people have diabetes. In addition, 53.2 million adults, or roughly 1 in 5 adults, suffer from arthritis. One in nine adults, 65 and older suffer from Alzheimer's disease. Of these 4.2 million older adults, women make up two-third. People with chronic illnesses account for 90% of the USD 4.5 trillion spent on health care in the country each year.

Moreover, smart catheter technology with the aspect of sensor capability to measure data in real-time and drug delivery without the need for support are also contributing significantly to the enhancement of patient outcomes and driving market growth. For instance, in November 2024, TriSalus Life Sciences Inc. announced the TriNav LV Infusion System and TriGuideTM Guiding Catheter, which revolutionized the treatment of liver and pancreatic tumors by integrating cutting-edge delivery technology. Furthermore, patients who would require complex regimens of treatment in the next few years, drive demand for simple-to-use infusion solutions even further. These trends in combination create an evolving growth profile for the infusion catheter industry.

Key Infusion Catheter Market Insights Summary:

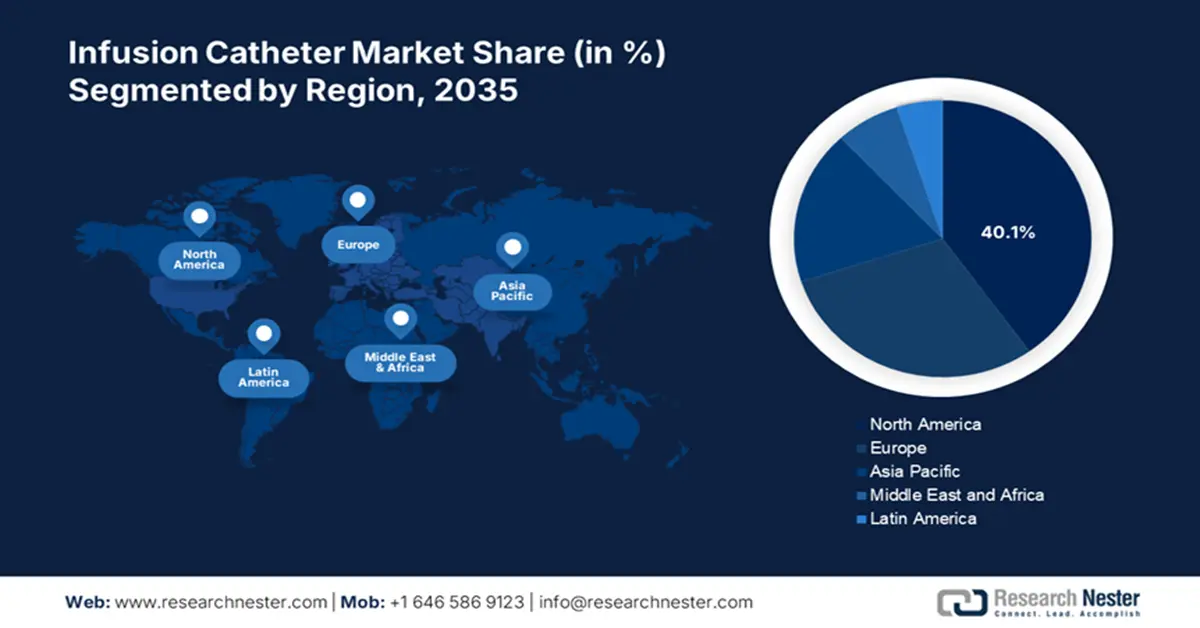

Regional Highlights:

- North America leads the infusion catheter market with a 40.1% share, propelled by the rise in surgical procedures and growth of ambulatory care settings, fostering strong growth prospects through 2035.

- The infusion catheter market in Asia Pacific is experiencing the fastest growth by 2035, attributed to patient-centered healthcare and practical medication delivery outside hospitals.

Segment Insights:

- The Thermodilution Catheter segment is expected to maintain a 35.40% market share by 2035, driven by its accuracy facilitating early clinical decision-making and better outcomes.

- The Hospital segment is expected to dominate by 2035, driven by its critical patient pool and high-tech interventions.

Key Growth Trends:

- Growing geriatric population

- Innovative healthcare models

Major Challenges:

- Patient compliance issues

- Risk of infections

- Key Players: Johnson & Johnson, Becton, Dickinson and Company, Teleflex Incorporated, Smiths Medical, Nipro Corporation, and more.

Global Infusion Catheter Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.99 billion

- 2026 Market Size: USD 2.16 billion

- Projected Market Size: USD 4.84 billion by 2035

- Growth Forecasts: 9.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Infusion Catheter Market Growth Drivers and Challenges:

Growth Drivers

- Growing geriatric population: One of the strongest drivers in the infusion catheter market is an aging population. For instance, in December 2023, it was published by the UNFPA India, by 2050, there will be an astounding 347 million elderly people (those 60 and older), up from the current 153 million. Geriatric patients develop chronic diseases which require the need for long-term medical treatment and intravenous infusion. Such a trend among patients makes the efficacy of high-quality infusion solutions capable of meeting aggressive treatment regimens evident. This helps in enhanced growth of the market in a more effective mode of treating these geriatric patients with the maximum possible therapeutic benefit.

- Innovative healthcare models: The key driving force in the infusion catheter market is support value-based models of care that emphasize the outcome of the patient and less on the service volume. For instance, in December 2024, according to a licensing agreement between XyloCor Therapeutics, Inc. and SmartCella Holding AB for the use of Extroducer Infusion Catheter System, a first-of-its-kind endovascular device that delivers cutting-edge therapies straight into the heart. These models are effective, cost-friendly, and quality-oriented, and therefore enable healthcare organizations to implement newer lower-hospitalization-rate infusion therapies and better patient care.

Challenges

- Patient compliance issues: A considerable population of patients for whom it is not feasible to maintain appointment calendars for administration and application of the treatment, creates a challenge in infusion catheter market. Consequently, it raises a required basis with resultant below-par treatment with consequent risk of complications. Such non-compliance not only raises the issue of the efficacy of infusion therapy but also puts extra workload on hospital infrastructures and staff to meet the backlogs, thereby impacting resource allocation and patient management in the health care system. As infection risk continues to rise, the catheter-related bloodstream infections (CRBSIs) are left in place for extended periods.

- Risk of infections: The increasing rate of infection poses a significant challenge in the infusion catheter market. Furthermore, new infusion catheter products have a longer time to market due to strict regulatory approval requirements. Innovative catheter technologies may not be able to enter the market on time due to the stringent evaluation and approval procedures, which could postpone product launches. In addition to limiting industry innovation, this delay also makes it harder for patients and healthcare professionals looking for safer and more effective treatment options to obtain sophisticated catheters.

Infusion Catheter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.3% |

|

Base Year Market Size (2025) |

USD 1.99 billion |

|

Forecast Year Market Size (2035) |

USD 4.84 billion |

|

Regional Scope |

|

Infusion Catheter Market Segmentation:

Type (Thermodilution Catheter, Pressure Monitoring Catheter, Central Venous Catheter, Anesthesia Catheter)

Based on the type, the thermodilution catheter segment is expected to account for more than 35.4% infusion catheter market share by the end of 2035. The degree of accuracy is beneficial to the clinician in managing critically ill patients because it facilitates early and informed clinical decision-making regarding fluid resuscitation and therapeutic intervention and ultimately leads to better patient outcomes. For instance, in March 2022, CATHI introduced a new Right Heart Catheter simulator that has all the features of the company's original RHC simulator. In addition, it has the ability to work with real liquids (S-HUB) and wire-assisted navigation, enabling thermodilution. Their role in transforming medical monitoring and treatment is also supplemented by the introduction into other medical institutions with high success rates.

Application (Hospitals, Clinics)

Based on application, the hospital segment is anticipated to dominate the infusion catheter market throughout the projected timeframe. Their union to monopolize the market and its densest pool of critically ill patients and high-technology interventions is their greatest service. For instance, in May 2024, new guidelines issued by WHO for reducing bloodstream infections from catheter use stated that peripherally inserted catheters (PIVCs) are necessary for up to 70% of all inpatients at some point during their hospital stay. These catheters are placed into a peripheral vein or artery. The hospitals are the health care venue through which infusion therapy is most frequently administered for treating complicated cases, which involve a range of catheter applications.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Infusion Catheter Market Regional Analysis:

North America Market Statistics

North America infusion catheter market is predicted to capture revenue share of over 40.1% by 2035. Infusion catheters are in high demand in the medical market due to the rise in surgical procedures and the growth of ambulatory care settings. More surgical procedures are being performed, particularly in areas such as pain management and oncology, which calls for accurate medication administration both during and after operations in the region.

The U.S. infusion catheter market is likely to unveil lucrative growth opportunities during the projected timeframe attributable to the advanced tools. For instance, in April 2022, the next-generation ACUSON, AcuNav Volume 4D Intracardiac Echocardiography Catheter was introduced by Siemens Healthineers in the US. The company claimed that by making it possible to treat patients who were previously unable to have structural heart procedures done, the AcuNav Volume ICE catheter revolutionizes the way that care is delivered.

In Canada, the infusion catheter market is exponentially increasing its footprint owing to the regulatory approvals within the country. For instance, in June 2023, Health Canada approved FemCath, the first intrauterine catheter that enables selective evaluation of a fallopian tube with contrast, manufactured by Femasys Inc. It is a diagnostic test based on ultrasound is performed as part of an infertility evaluation using FemCath and Femasys' FemVue device. Hence, fueling the demand for market growth.

Asia Pacific Market Analysis

The infusion catheter market in Asia Pacific is likely to witness the fastest growth during the stipulated timeframe. In keeping with the movement toward patient-centered, easily accessible healthcare, infusion catheter in the region provides a practical way to deliver medications outside of conventional hospital settings. Owing to their adaptability and versatility, infusion catheters are essential tools for meeting the changing needs of contemporary medicine, meeting the need for efficient and minimally invasive solutions in both surgical and ambulatory care settings.

In India, the infusion catheter market is likely to witness robust growth owing to healthcare infrastructure getting equipped with innovative medications and technologies. For instance, in April 2024, to treat arrhythmia, a heart condition, Sri Ramakrishna Hospital introduced the Cardiac Cryoablation Catheter System. By focusing on the cells that cause irregular heartbeats (Atrial Fibrillation, or AF), cryoablation is a technique used to restore normal rhythm. Thus, such innovations advance the treatments, and patient outcomes are improved.

The Australia infusion catheter market is likely to flourish at a fast pace during the stipulated timeline owing to the systematized regulatory framework. For instance, in January 2022, Greg Hunt, Australia's Federal Minister for Health, announced two new research centers. This would be funded by the Medical Research Future Fund (MRFF) and the MTPConnect Targeted Translation Research Accelerator Scheme. In addition to this, a report by MTP connect was released which stated that, the MRFF is supporting translational research to develop new products and treatments for diabetes and cardiovascular disease. It invested USD 47 million Targeted Translation Research Accelerator (TTRA) program.

Key Infusion Catheter Market Players:

- Medtronic

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- B. Braun Melsungen AG

- Terumo Corporation

- Johnson & Johnson

- Becton, Dickinson and Company

- Teleflex Incorporated

- Smiths Medical

- Nipro Corporation

- C.R. Bard (acquired by Becton, Dickinson and Company)

- AngioDynamics, Inc.

- Cook Medical

- ICU Medical, Inc.

- Vygon SA

- Fresenius Kabi AG

- Merit Medical Systems, Inc.

The infusion catheter market is experiencing significant growth owing to the evolving players in the market. For infusion catheters to reach their full potential as safe and efficient medical devices, the companies are working together to overcome obstacles in order to reduce infection risks and expedite regulatory procedures. For instance, in January 2023, Bentley introduced the BeBack crossing catheter, which is intended to treat severely calcified lesions. It specializes in the endovascular treatment of aortic and peripheral vascular disease.

Here's the list of some key players:

Recent Developments

- In February 2025, Johnson & Johnson MedTech introduced the CEREGLIDETM 92 Catheter System, a next-generation.092 catheter with the INNERGLIDETM 9 delivery. It is intended to help with the insertion and guidance of interventional devices in the neurovascular system.

- In November 2024, VIVOLTA partnered with Neurochase in order to produce electrospun micro-catheters that will deliver cutting-edge treatments to the brain.

- Report ID: 7203

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Infusion Catheter Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.