Infrastructure Asset Management Market Outlook:

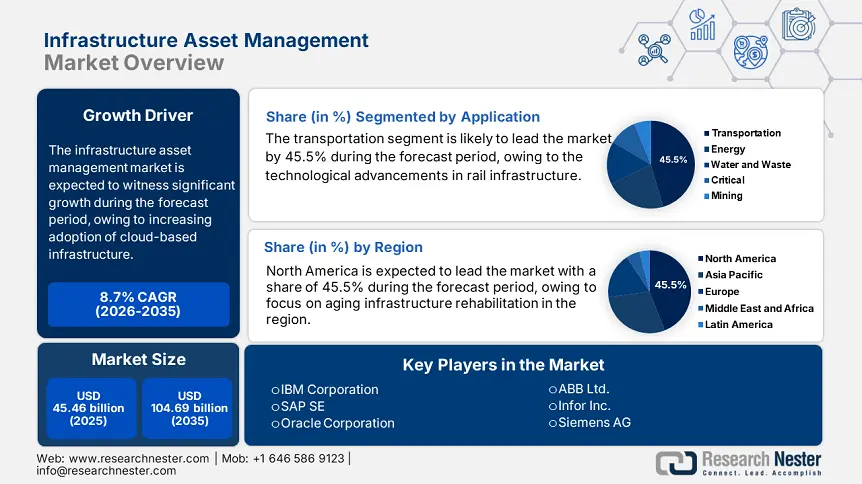

Infrastructure Asset Management Market size was valued at USD 45.46 billion in 2025 and is set to exceed USD 104.69 billion by 2035, registering over 8.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of infrastructure asset management is estimated at USD 49.02 billion.

The surge in government investments in digitalization and smart infrastructure is accelerating the growth of the infrastructure asset management market. According to a January 2025 India Brand Equity Foundation (IBEF) report, India is expected to invest nearly USD 1,727.05 billion in smart infrastructure installations between the fiscal years 2024 and 2030. The substantial investment highlights the country’s acceptance of the integration of Artificial Intelligence (AI) alongside the Internet of Things (IoT) and predictive analytics into infrastructure development for boosting operational efficiency and sustainability.

Various companies are also aligning with the global shift towards smart infrastructure and digitalization, and are investing to develop digital asset management solutions that achieve real-time monitoring and proactive infrastructure asset maintenance. For instance, in March 2025, Brookfield Asset Management introduced its inaugural fund for smaller infrastructure businesses through structured equity and minority equity investments, which reached its capital target of USD 1 billion as of 2025. Private companies are increasingly investing and supporting businesses that require funding to develop infrastructure.

Key Infrastructure Asset Management Market Insights Summary:

Regional Highlights:

- North America commands a 45.5% share in the Infrastructure Asset Management Market, driven by prioritization of extensive rehabilitation projects for aging infrastructure, bolstering growth prospects through 2035.

Segment Insights:

- The Electronic Manufacturing segment is expected to experience steady growth during 2026-2035, driven by the need to meet sustainability requirements and regulatory compliance in industrial operations.

- The Transportation segment is projected to hold over 45.5% share by 2035, driven by investments in sustainable transportation initiatives.

Key Growth Trends:

- Adoption of AI-driven predictive maintenance

- Rising adoption of cloud-based infrastructure

Major Challenges:

- Resistance to digital transformation

- Technical failures and system downtime risks

- Key Players: IBM Corporation, SAP SE, Oracle Corporation, and Schneider Electric SE.

Global Infrastructure Asset Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 45.46 billion

- 2026 Market Size: USD 49.02 billion

- Projected Market Size: USD 104.69 billion by 2035

- Growth Forecasts: 8.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Germany, Japan, Australia

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 12 August, 2025

Infrastructure Asset Management Market Growth Drivers and Challenges:

Growth Drivers

- Adoption of AI-driven predictive maintenance: Companies across various industries are using advanced AI algorithms with machine learning models coupled with big data analytics to predict equipment failures in advance, thus cutting operational costs by minimizing sudden downtime. Companies are forming strategic collaborations to deliver advanced AI-based solutions. For instance, in February 2025, q.beyond and aiomatic partnered to produce AI-based predictive maintenance solutions developed especially for industrial production companies. The companies are using the integrated cloud platform to enable automatic machine monitoring that predicts ideal maintenance periods, minimizing operational setbacks while delivering improved operational efficiency.

- Predictive maintenance based on artificial intelligence is further expanding, with its adoption by various industries such as aviation, energy, and transportation for fleet maintenance, power grid stability, and railway system productivity. Companies are integrating IoT sensors along with digital twins into their predictive maintenance frameworks for real-time monitoring with data-driven decision-making. Cloud-based predictive maintenance platforms are allowing businesses to deploy their AI-driven maintenance solutions efficiently in their worldwide operations. Organizations are focusing on lowering costs and enhancing operational resilience, thereby fueling the adoption of AI-based predictive maintenance.

- Rising adoption of cloud-based infrastructure: Organizations are switching their asset management operations to cloud systems from conventional systems, owing to the ability of the cloud to offer scalability together with instant data access and operating cost reductions. Several organizations benefit from Software-as-a-Service models by obtaining flexible and efficient solutions for managing their infrastructure assets. This has allowed players to roll out new solutions by strategic acquisitions, collaborations, and launches to further consolidate their market share. For instance, in September 2024, BNY Mellon reached an agreement with Archer to acquire the technology and operations service provider to strengthen its asset and wealth management services through managed accounts. The acquisition of Archer by BNY is leveraging the industry trend toward cloud-based platform services for infrastructure asset management solutions.

- The cloud-based asset management solutions are also receiving additional support from artificial intelligence and machine learning, which can enhance predictive analytics capabilities and decision support functions on these platforms. In addition, companies including Freshservice are providing cloud-based IT asset management platforms and solutions that deliver automated tools for simple asset tracking and real-time information about assets.

Challenges

- Resistance to digital transformation: Various organizations, particularly from sectors involving transportation and utilities and public infrastructure, avoid digital-asset-management transitions due to concerns about operational disturbances, expensive training costs, and complicated learning curves. The transition to advanced artificial intelligence-driven and cloud-based systems poses a challenge to employees working with traditional methods as they face difficulties adapting to these technologies, resulting in delayed adoption. Fear of digital transformation implementation problems combined with questions about return on investment is also making businesses hesitant to invest in digital transformation, further hindering infrastructure asset management market growth.

- Technical failures and system downtime risks: The integration of cloud computing with IoT networks alongside AI-driven analytics is creating vulnerabilities for digital asset management platforms due to technical issues, software bugs, and network connectivity problems. System failures that occur unexpectedly disturb real-time asset observing and scheduling procedures, thus resulting in operational shortcomings and financial damage. Also, security incidents, along with server outages and legacy system implementation issues, are collectively diminishing the reliability of the system. The trust in automated asset management solutions is reducing substantially due to these risks, resulting in the organizations' hesitating to adopt full digital transformation for infrastructure management.

Infrastructure Asset Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.7% |

|

Base Year Market Size (2025) |

USD 45.46 billion |

|

Forecast Year Market Size (2035) |

USD 104.69 billion |

|

Regional Scope |

|

Infrastructure Asset Management Market Segmentation:

Application (Transportation Infrastructure, Energy Infrastructure, Water and Waste Management, Critical Infrastructure, Mining)

Transportation segment is estimated to dominate infrastructure asset management market share of over 45.5% by 2035, as organizations are increasingly investing in sustainable transportation initiatives. Governmental institutions and financial organizations are opting for green financing solutions and sustainability-linked bond programs to build robust climate-resistant transport infrastructure. The initiatives are modernizing road networks, which is resulting in long-term resource viability combined with reduced environmental impact. In February 2025, the International Finance Corporation invested approximately USD 98.35 million toward India's initial sustainability-linked bond in the road sector issued by Cube Highways Trust. Through this investment, the targeted infrastructure is receiving financial support, further enhancing road strength and climate safety in line with global environmental objectives.

The growth of the segment is also fueled by technological developments that are strengthening rail power systems and improving operational efficiency as well as operational resilience. Increasing transportation requirements are driving rail operators to use digital systems alongside advanced AI maintenance techniques and network electrification for their aging rail infrastructure. The adaptation of infrastructure to climate conditions is a joint priority between public authorities and private sector businesses for minimizing the impact of severe weather events. For instance, in January 2025, Hitachi Rail acquired Omnicom, and the acquisition is aimed at improving Hitachi Rail’s HMAX digital asset management suite that optimizes railway operations and maintenance performance. Omnicom analyzes trillions of bytes through its data analytics platform and monitoring system, optimizing trackside maintenance operations every day.

Service (Strategic Asset Management, Operational Asset Management, Tactical Asset Management)

The electronic manufacturing segment is expected to witness steady growth attributed to the industry’s need to meet sustainability requirements and new regulatory standards. Various industries are bound by strict environmental safety and operational requirements that are driving them toward complete asset management systems. The services provided by operational asset management help companies maintain compliance through systematic evaluation frameworks and assessment systems that document adherence to regulations. For instance, in September 2023, Infrastructure Data Solutions partnered with Benesch to deliver specialized analytical tools used in asset lifecycle planning that help clients implement sustainable practices.

Industrial operations are adopting smart connected assets, which is another factor fostering the segmental growth. The integration of IoT, cloud computing, and AI-driven analytics systems is allowing organizations to perform live monitoring and forecast maintenance activities, leading to better operational outcomes. These technologies are also allowing organizations to detect upcoming failures, so they can minimize machine stoppage while improving resource usage.

Our in-depth analysis of the global infrastructure asset management market includes the following segments:

|

Application |

|

|

Service |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Infrastructure Asset Management Market Regional Analysis:

North America Market

North America infrastructure asset management market is estimated to capture revenue share of over 45.5% by 2035 as organizations are prioritizing extensive rehabilitation projects for their aging infrastructure in the region. Government and private stakeholders are investing in rebuilding roads, bridges, and utilities to extend their lifespan and ensure safety. Organizations are extensively deploying AI-based predictive maintenance integrated with digital twin solutions for asset management.

The infrastructure asset management market in the U.S. is anticipated to increase at a fast pace due to the integration of smart infrastructure technology that is enhancing urban planning along with asset operational performance. Many cities in the country are implementing IoT sensors, AI analysis, and cloud-based platforms for the optimized management of their transportation framework utilities and public structures. The integration of these technologies provides instant data acquisition, which optimizes asset operation and anticipates maintenance requirements. The infrastructure asset management market is also expanding in the country, attributed to rising governmental emphasis on elemental asset endurance and emergency readiness initiatives. Federal and state agencies in the country are implementing more demanding policies towards infrastructure durability due to extreme weather occurrences such as hurricanes, fires, and flooding.

The Canada infrastructure asset management market is expanding at a significant pace due to government support for sustainable manufacturing. Asset managers are deploying sustainable approaches such as energy-efficient advancements, smart grids, and environment-friendly building materials with the government’s environmental and climate resilience projects. Federal programs and investment initiatives are prompting private entities in the country to use digital asset management solutions that boost infrastructure asset efficiency while improving environmental outcomes for the long term. Rural and indigenous infrastructure development projects in the country also occupy a significant position in the country.

Asia Pacific Market Analysis

The Asia Pacific infrastructure asset management market is experiencing rapid growth due to the increasing expansion of infrastructure throughout the region. Governments across China, India, and other countries are investing in building smart cities and electronic transportation networks, and energy infrastructure to support their economic growth. The infrastructure development requires effective asset management tools that is driving sustainable operations alongside cost-efficient maintenance budgets and operational effectiveness.

Digital asset management platforms alongside predictive maintenance technologies and AI-driven analytics are also witnessing a rising need attributed to their ability to maximize asset performance efficiencies. The market is expanding as more organizations are forming public-private partnerships to develop infrastructure projects. Many companies in the region are collaborating to operate large infrastructure systems for improved financial stability and extended operational effectiveness.

The China infrastructure asset management market is experiencing a steady growth due to the rising privatization of infrastructure projects in the country. The local government is encouraging private sector participation in infrastructure development in order to reduce the financial burden on public funds. Another factor accelerating the market growth includes the increasing emphasis on risk management as well as regulatory compliance in infrastructure projects. Infrastructure asset managers in China are focusing on robust governance frameworks to mitigate financial, operational, and environmental risks, with stricter government policies and evolving industry standards. Companies are increasingly leveraging technology-driven solutions, such as AI-based risk assessment tools and blockchain for secure record-keeping, to ensure compliance and transparency.

The infrastructure asset management market in India is highlighting a significant expansion, owing to the government's robust asset monetization initiatives. These initiatives are creating profits while ensuring better efficiency for the private sector to optimize asset lifecycle procedures and operational effectiveness. The initiatives are also driving industries including highways, railroads, and airports to adopt leading-edge infrastructure management systems and best practices. The increase in foreign investments toward infrastructure is also propelling the infrastructure asset management market growth in the country. Financial institutions, together with global investors, are actively investing in infrastructure projects in India, driving better asset management practices in the country.

Key Infrastructure Asset Management Market Players:

- IBM Corporation

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SAP SE

- Oracle Corporation

- Schneider Electric SE

- Bentley Systems Incorporated

- ABB Ltd.

- Siemens AG

- Infor Inc.

- eMaint (Fluke Corporation)

- IPS-Intelligent Process Solutions

- Dude Solutions, Inc.

- Cityworks (Trimble Inc.)

- Hexagon AB

- Mott MacDonald Group Limited

The competitive landscape of the infrastructure asset management market is rapidly evolving, attributed to the adoption of AI-driven predictive maintenance by service providers. They are focused on developing new strategies catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies, such as mergers and acquisitions, joint ventures, partnerships, and novel technology launches, to enhance their base and strengthen their market position. Here are some key players operating in the global infrastructure asset management market:

Recent Developments

- In April 2023, Siemens Digital Industries Software and IBM expanded their long-term partnership to develop a combined software solution integrating systems engineering, service lifecycle management, and asset management. The collaboration aims to enhance traceability, optimize product lifecycles, and support sustainable product designs, enabling organizations to improve quality, reduce costs, and accelerate innovation.

- In November 2022, Honeywell introduced Honeywell Forge Performance+ for Industrials and expanded capabilities. The new solution enhances operational productivity and reduces costs by optimizing asset and process performance. This expansion of Honeywell Forge aims to accelerate digital transformation in industrial operations.

- Report ID: 7480

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.