Inflammatory Bowel Disease Treatment Market Outlook:

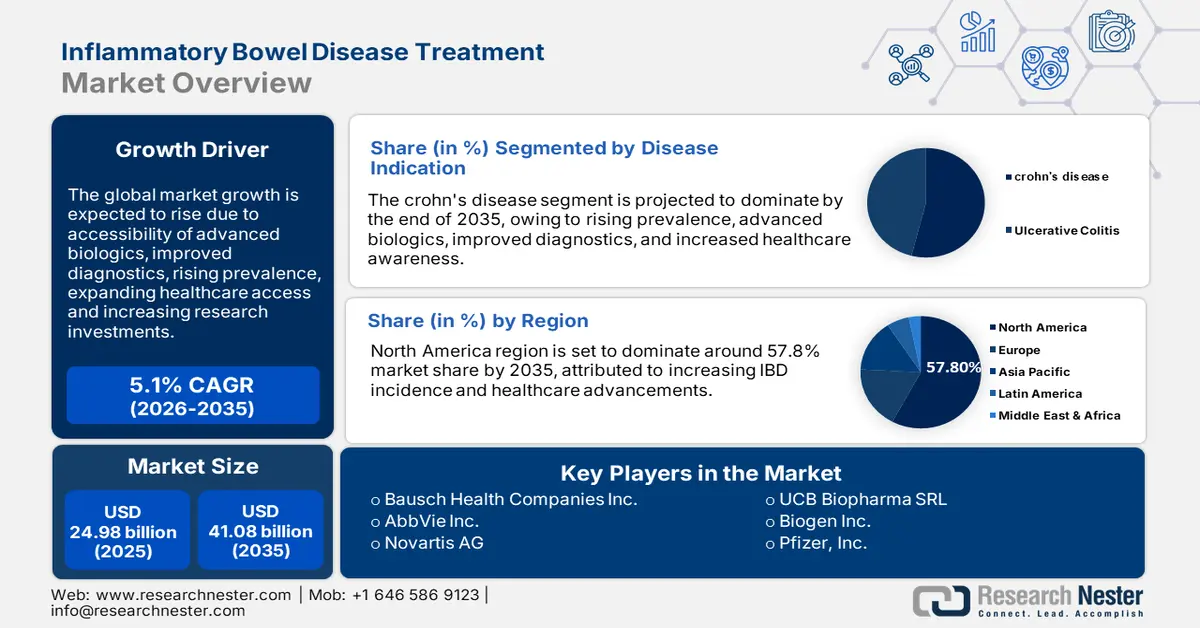

Inflammatory Bowel Disease Treatment Market size was over USD 24.98 billion in 2025 and is poised to exceed USD 41.08 billion by 2035, witnessing over 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of inflammatory bowel disease treatment is estimated at USD 26.13 billion.

The growth of the market is highly attributed to the increasing number of related medical conditions, including fecal incontinence (FI), diarrhea, and constipation, across the world. Approximately 1 in every 12 adult habitats in the world suffered from FI in 2023, as per an NLM study. Annually, over 1.7 billion cases of childhood diarrheal disease are registered worldwide, according to the 2024 WHO report. Simultaneously, 12.0% of the global population reported having self-defined constipation in 2023 (NLM). In addition, the growing sedentary lifestyle is fueling the enlargement of this patient pool. Thus, this demography highlights the significance of this category by increasing demand for solutions available in this sector.

According to a study published by ScienceDirect in February 2025, the direct expenses on inflammatory bowel disease (IBD) care ranged between USD 9000.0 and USD 12,000.0 for each patient. This indicates a significant financial expenditure on individuals with these ailments, creating a surge for therapeutics with affordable payers’ pricing to reduce this burden. This is pushing pioneers in the market to develop more cost-efficient solutions, propelling innovation in this category. Currently, the emergence of biosimilars is helping public authorities mitigate this economic disparity and improve access to advanced and effective care.

Key IBD Treatment Market Insights Summary:

Regional Highlights:

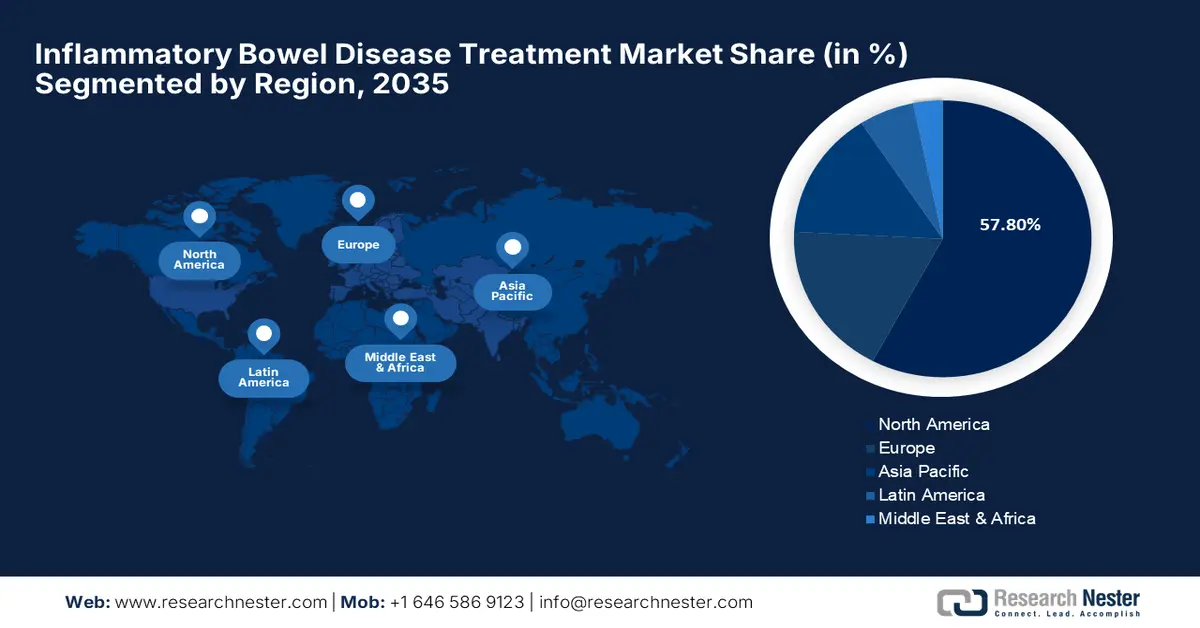

- North America inflammatory bowel disease treatment market will dominate more than 57.8% share by 2035, driven by increasing IBD incidence and healthcare advancements.

- Asia Pacific market will achieve notable growth during the forecast timeline, driven by R&D innovations and affordable biologic therapies.

Segment Insights:

- The crohn’s disease segment in the inflammatory bowel disease treatment market is forecasted to capture the largest share by 2035, fueled by increasing global prevalence and awareness programs promoting early diagnosis.

- The hospital pharmacies segment in the inflammatory bowel disease treatment market is anticipated to hold a significant share by 2035, driven by rising hospital patient flow and increasing global healthcare spending.

Key Growth Trends:

- Rising awareness and advancements in early diagnosis

- Introduction of biologics and targeted therapies

Major Challenges:

- Economic disparities in various regions

Key Players: Bausch Health Companies Inc., AbbVie Inc., Novartis AG, UCB Biopharma SRL, Biogen Inc., Pfizer, Inc., Janssen Pharmaceuticals, Inc., Takeda Pharmaceutical Company Limited.

Global IBD Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 24.98 billion

- 2026 Market Size: USD 26.13 billion

- Projected Market Size: USD 41.08 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (57.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Inflammatory Bowel Disease Treatment Market Growth Drivers and Challenges:

Growth Drivers

-

Rising awareness and advancements in early diagnosis: As investments and involvements in tech-based medical commodities increase, the pace of adoption in the inflammatory bowel disease treatment market accelerates. The penetration of advanced technologies such as AI and automatic monitoring systems is revolutionizing patient outcomes in therapeutic applications. On this note, in February 2025, Crohn's & Colitis Foundation allocated a supportive fund to Mobius Care to create an AI-powered pathology tool for predicting and identifying the response to using IBD therapies. In addition, spreading knowledge about the benefits of early detection in acquiring long-acting and faster effects from medicines is inflating demand in this category.

-

Introduction of biologics and targeted therapies: The development of novel drugs is anticipated to boost growth in the market. Several clinical studies have demonstrated the efficacy of new biological medicines, such as monoclonal antibodies and inhibitors, which are helping companies attain maximum regulatory approvals. For instance, in February 2025, Sanofi, in collaboration with Teva Pharmaceuticals, released promising results from the RELIEVE UCCD phase IIb trial on duvakitug for using it in treating moderate-to-severe ulcerative colitis (UC) and Crohn’s disease (CD). This human IgG1-λ2 monoclonal antibody showcased 36% & 48% and 26% & 48% response rates for 450 mg & 900 mg doses in UC and CD, respectively.

Challenges

-

Economic disparities in various regions: Being associated with the chronic disease family, treatment for IBD becomes expensive for the majority population from underserved areas. The treatment includes surgery, medicines, bowel rest, and others for a prolonged time since no single treatment is completely able to cure patients. Thus, the whole procedure may be financially exhausting for residents, particularly in low- and middle-income countries. As a result, this barrier restricts wide adoption and global expansion in the market.

Inflammatory Bowel Disease Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 24.98 billion |

|

Forecast Year Market Size (2035) |

USD 41.08 billion |

|

Regional Scope |

|

Inflammatory Bowel Disease Treatment Market Segmentation:

Disease Indication Segment Analysis

The Crohn’s disease segment is estimated to gain the largest market share in the inflammatory bowel disease treatment market over the analyzed timeframe. The growth of the segment is backed by the increasing worldwide instances of this condition compared to UC. According to an NLM report from October 2024, CD prevalence ranged between 4.1 and 22.7, 0.0 and 3.6, 13.2 and 26.0, 0.0 and 0.6 per 100,000 in Europe, Asia & the Middle East, Oceania, and South America, respectively. Furthermore, the launch of several awareness programs and government campaigns, promoting early diagnosis and intervention, is propelling engagement in this segment.

Distribution Channel Segment Analysis

The hospital segment is expected to garner a significant share in the inflammatory bowel disease treatment market by 2035. The progress in this segment is ascribed to the rising patient flow in the hospitals and increasing spending on the medical system around the globe. This can be testified by a 2022 NLM article, stating that the proportion of hospital pharmaceutical expenditure in the total pharma spending accounted for up to 50.0% in Europe. Additionally, IBEF reported that hospitals in India secured USD 1.5 billion worth of foreign direct investment (FDI) in 2023, exhibiting a 24.0% and 43.0% increment from 2021 and 2020. This indicates a continuous capital influx and enlarging exposure in this segment.

Our in-depth analysis of the global inflammatory bowel disease treatment market includes the following segments:

|

Drug Class |

|

|

Disease Indication |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Inflammatory Bowel Disease Treatment Market Regional Analysis:

North American Market Insights

North America region is set to dominate around 57.8% market share by 2035, attributed to increasing IBD incidence and healthcare advancements. According to NLM, the incidence of IBD was 29.9 per 100,000 in 2023 and is poised to reach 31.2 per 100,000 by 2035. Higher occurrences were observed among children aged up to 18 and older citizens, accounting for 843 per 100,000 (predicted to be 1,098 per 100,000 by 2035) and 1,174 per 100,000 in 2023, respectively. Furthermore, the developed healthcare systems and high risk of lifestyle-related comorbidities, such as hypertension, obesity, and alcohol consumption, are propelling demand in this sector.

3.0% to 5.0% of the total pediatric visits in the U.S. comprised of constipation-related complaints, and 33.3% of them continue to suffer beyond their childhood. Moreover, 15.0% of the country’s population had chronic constipation during the same time, as per a 2023 NLM article. Thus, nationwide authorities are utilizing academic excellence and technological advancements, coupled with government initiatives, to combat these risk factors of IBDs with early diagnosis and novel medicines. On this note, in January 2025, Hackensack University Medical Center (HUMC) inaugurated a comprehensive program, the Center for Inflammatory Bowel Disease (CIBD), to offer specialized care for IBD patients. Such events are fueling growth in the domestic market.

APAC Market Insights

Asia Pacific is poised to drive the inflammatory bowel disease treatment market at a notable pace during the forecast timeframe. This region is home to several global biologic developers and producers, who are meticulously conducting R&D projects to create more effective solutions. In addition to their contribution, several academic institutions are also engaged in procuring affordable curatives to make this sector more accessible for everyone. On this note, in February 2025, a team of researchers at the Hudson Institute of Medical Research started clinical trials on a cost-effective alternative to expensive stem cell treatments for IBD patients. They identified the potential of extracellular vesicles, curated from human amniotic epithelial cells, in delivering the same benefits as the traditional cell-based solutions at a lower cost.

Japan is augmenting the market with its strong emphasis on MedTech advancements. The country’s full-fledged AI integration in drug development and the patient care system is evolving this landscape into an innovation hub for this merchandise. For instance, in July 2024, nference formed a research alliance with Takeda Pharmaceuticals to utilize AI in optimizing IBD management. The team commenced Project Systematic UC & Crohn’s INformatics Clinical Toolkit (SUCCINCT), helping residents determine the most effective treatment options as per individuals' needs. Similar discoveries are further attracting more pioneers to participate in this landscape by fostering a progressive business atmosphere and new revenue-generation opportunities.

Inflammatory Bowel Disease Treatment Market Players:

- The Bristol-Myers Squibb Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bausch Health Companies Inc.

- AbbVie Inc.

- Novartis AG

- UCB Biopharma SRL

- Biogen Inc.

- Pfizer, Inc.

- Janssen Pharmaceuticals, Inc.

- Takeda Pharmaceutical Company Limited

- Celltrion Healthcare Co., Ltd.

The market is evolving with the penetration of technological escalation and rigorous R&D cohorts. Key players in this sector are significantly contributing to this scenario by forming strategic partnerships, global-scale commercialization, and enhanced production. They are continuously developing innovative therapeutics to offer personalized care to every individual. For instance, in October 2023, Pfizer attained clearance from the FDA to market its oral, once-daily, receptor modulator, VELSIPITY (etrasimod). The recommended 2 mg dose of this medicine has been proven to be effective for treating adults with moderately to severely active ulcerative colitis. Such key players are:

Recent Developments

- In January 2025, Eli Lilly and Company received approval from the FDA to commercialize its Omvoh (mirikizumab-mrkz) in the U.S. market. This biologic treatment has proven its effectiveness in treating moderately to severely active Crohn's disease in adults by disclosing two-year phase III efficacy data.

- In June 2024, AbbVie attained marketing clearance for its IL-23 specific inhibitor, SKYRIZI (risankizumab-rzaa), from the FDA. This regulatory compliance for usage in treating moderately to severely active ulcerative colitis made this therapy a first-line treatment for 4 IBD indications.

- Report ID: 4685

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

IBD Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.