Industrial Wax Market Outlook:

Industrial Wax Market size was valued at USD 8.89 billion in 2025 and is expected to reach USD 13.41 billion by 2035, registering around 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of industrial wax is evaluated at USD 9.23 billion.

The growth of the market can be attributed to the increasing demand for wax for the manufacturing of candles. Candles are highly in demand since they are part of several occasions held by people. Additionally, the prevalence of candle gifting is at its peak owing to its safety, product innovation, and ease of use. Furthermore, the demand for candles is also spurred by the vogue trend of home décor. All these factors have initiated expansion in the candle industry, propelling the demand for wax. It was stated that the total worth of the global candle industry stood at approximately USD 3 billion in 2019, which is further projected to increase to around 6 billion by 2027.

The production of industrial wax market is anticipated to be driven by the growing demand in various industries owing to its superior properties such as high gloss, good water repellency, and outstanding chemical resistance. As a result, industrial wax is being highly utilized, in the production processes of candles, cosmetics, rubber, and various other things. Therefore, the high demand for candles is projected to bring lucrative growth opportunities for the industrial wax market. As per the data released by the Observatory of Economic Complexity (OEC), in 2020, candles worth USD 3.38 billion were traded across the world.

Key Industrial Wax Market Insights Summary:

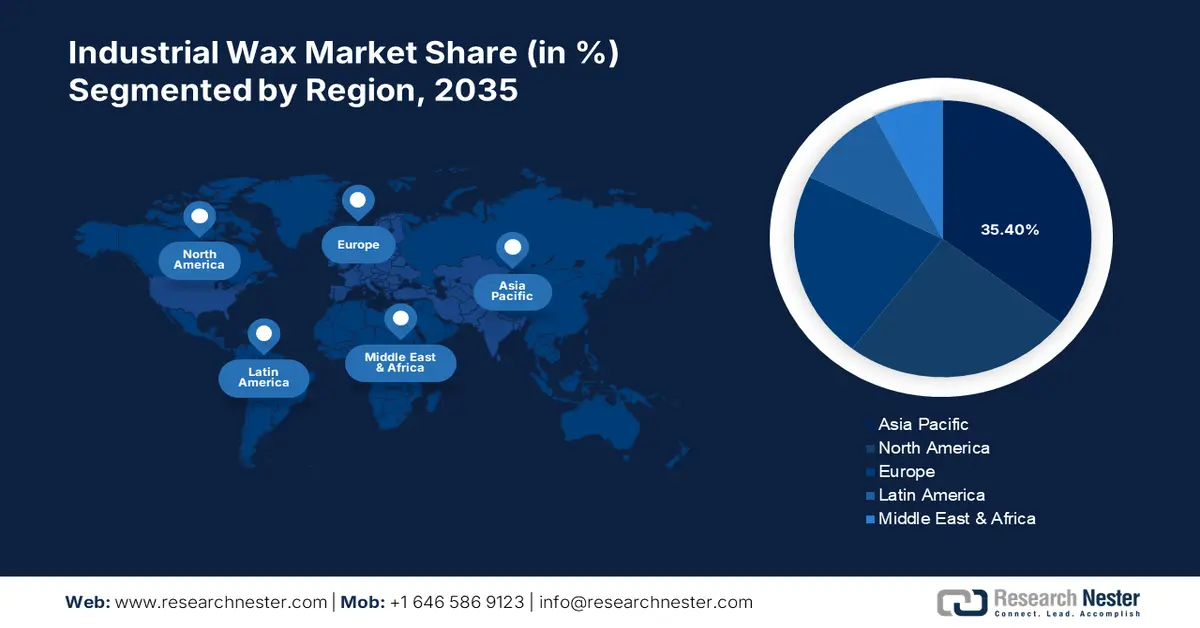

Regional Highlights:

- Asia Pacific industrial wax market achieves a 35.4% share by 2035, driven by rising candle exports and demand in cosmetics and coatings.

Segment Insights:

- The bio-based segment in the industrial wax market is anticipated to achieve a significant share by 2035, propelled by the recyclability and multi-functional benefits of bio-based waxes.

- The candles segment in the industrial wax market is projected to secure the highest market share by 2035, fueled by increasing candle demand and high wax usage in candle production.

Key Growth Trends:

- Significant Expansion in the Chemical Industry to Boost the Demand for Wax

- Rising Demand for Wax in the Packaging Industry

Major Challenges:

- Stringent Regulations Over the Preservation of Resources

- Rising Costs of Bio-based and Synthetic Wax

Key Players: Sasol Limited, Exxon Mobil, Calumet Specialty Products Partners, L.P., Shell group, HF Sinclair Corporation, Numaligarh Refinery Limited, Blayson Olefines Ltd, HCI Wax, Gandhar Oil Refinery (India) Limited.

Global Industrial Wax Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.89 billion

- 2026 Market Size: USD 9.23 billion

- Projected Market Size: USD 13.41 billion by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 10 September, 2025

Industrial Wax Market Growth Drivers and Challenges:

Growth Drivers

- Significant Expansion in the Chemical Industry to Boost the Demand for Wax – The demand for wax in the chemical industry is escalated owing to its utilization in complex formulas, coatings, and plastic colorants, and its resistance to paints.In the year 2021, the world’s chemical industry generated a revenue of approximately USD 5 trillion.

- Rising Demand for Wax in the Packaging Industry – Industrial wax is used in laminating, coating, impregnation, and treating primary food contact material such as aluminum, paper, and others. In addition, it is used in flexible packaging that can be molded according to the product’s shape and size. Therefore, it is anticipated to surge the growth of the global industrial wax market. It was noticed that the packaging industry in the United States was valued at USD 190 billion in 2021 and is forecasted to reach USD 220 billion by 2027.

- Increasing Utilization of Wax in the Personal Care Industry – The recent study revealed that the global beauty industry is projected to generate a revenue of USD 716 billion by 2025. Further, it is being disclosed that in 2020, the global spending of the beauty industry amounted to USD 485 billion.

- Production of Candles Across the Globe - Candles are part of nearly every occasion since there are several types of candles available in the market based on the requirement. Candles have been a source of light from ancient times, and even though there are many other methods of lighting available in modern times, people cannot turn their backs on the use of candles. People buy candles in large quantities as a result, and given that candles are entirely formed of wax, this is anticipated to boost industrial wax market growth during the forecast period. Between 2019 and 2020, the exports of candles grew by 5.02%, from USD 3.22 billion to USD 3.38 billion, as per the Observatory of Economic Complexity.

Challenges

- Declining Use of Paraffin Wax in Numerous ApplicationsA remarkable decline in the utilization of paraffin wax is estimated to limit market growth over the forecast period. It was also noticed that paraffin-based candles also emitted benzene and toluene, which had major toxic properties.

- Rising Costs of Bio-based and Synthetic Wax

- Stringent Regulations Over the Preservation of Resources

Industrial Wax Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 8.89 billion |

|

Forecast Year Market Size (2035) |

USD 13.41 billion |

|

Regional Scope |

|

Industrial Wax Market Segmentation:

Application Segment Analysis

The global industrial wax market is segmented and analyzed for demand and supply by application into candles, packaging, coatings & polishing, hot melt adhesives, tire & rubber, cosmetics & personal care, food, and others. Out of these, the candle segment is attributed to garner the highest market share by 2035, owing to the rising demand for candles by the burgeoning population. A significant amount of wax is being used in producing candles, thus expanding the industrial wax market size. Candles have an ignitable wick that provides light and fragrance. Moreover, candles are the classic solution for eliminating darkness, and it is anticipated to drive the segment’s growth in the market. A report published in 2022, calculated that the candle industry consumes over 1 billion pounds of wax in producing candles in the United States every year.

Type Segment Analysis

The global industrial wax market is also segmented and analyzed for demand and supply by type into type {fossil-based (mineral wax, paraffin wax, and microcrystallion), synthetic (fischer-topsch, and others), and bio-based}. Out of these segments, the bio-based segment is estimated to hold a significant share of the market over the forecast period. Bio-based wax is a renewable replacement for fossil-based waxes, and also provides thermal stability, mechanical protection, hydrophobicity, scratch resistance, and others. A major benefit of bio-based wax is that it can be recycled easily after utilization. Moreover, it is also used in skin treatments to remove dead skin cells. Hence, such factors are estimated to hike segment growth over the forecast period.

Our in-depth analysis of the industrial wax market includes the following segments:

|

By Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Wax Market Regional Analysis:

APAC Market Insights

Asia Pacific region is poised to dominate around 35.4% market share by 2035, due to rising candle exports and demand in cosmetics and coatings. In rural areas, candles are highly used to deal with frequent electricity breakouts. However, the rising trend of gifting candles, especially scented candles that are used as an air freshener, is also projected to up-surge the purchase volume of candles in the region. As per the Observatory of Economic Complexity, China was the 2nd exporter of candles in 2020, with USD 618 million. Furthermore, the boom in end-use industries of industrial wax market, such as cosmetics, coatings & polishing, and others, in the region is anticipated to be another growth factor. Additionally, beeswax is highly used in cosmetics, along with olive oil and water, to make an ointment for healing skin problems. The cosmetic products that have wax properties are, lipstick, eye & facial makeup, baby products, nail care products, sunscreen, fragrances, and others. It was estimated that Asia Pacific accounted for almost 45% of the global cosmetics industry in 2020. Hence, all these factors are projected to hike the market growth over the forecast period.

Industrial Wax Market Players:

-

·The PJSC Lukoil Oil Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sasol Limited

- Exxon Mobil

- Calumet Specialty Products Partners, L.P.

- Shell group

- HF Sinclair Corporation

- Numaligarh Refinery Limited

- Blayson Olefines Ltd

- HCI Wax

- Gandhar Oil Refinery (India) Limited

Recent Developments

-

The PJSC Lukoil Oil Company announces its acquisition of Russian retail and lubricants assets. The acquired assets combine a large chain of filling stations that are situated in the Central and Northwestern federal districts of Russia. Russia's federal antimonopoly service approved the sale.

-

Sasol Limited and ArcelorMittal South Africa have joined hands under a joint development agreement (JDA) to develop carbon capture technology to produce sustainable fuels and chemicals, and green steel production through green hydrogen and derivatives.

- Report ID: 4661

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial Wax Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.