Industrial Vacuum Cleaner Market Outlook:

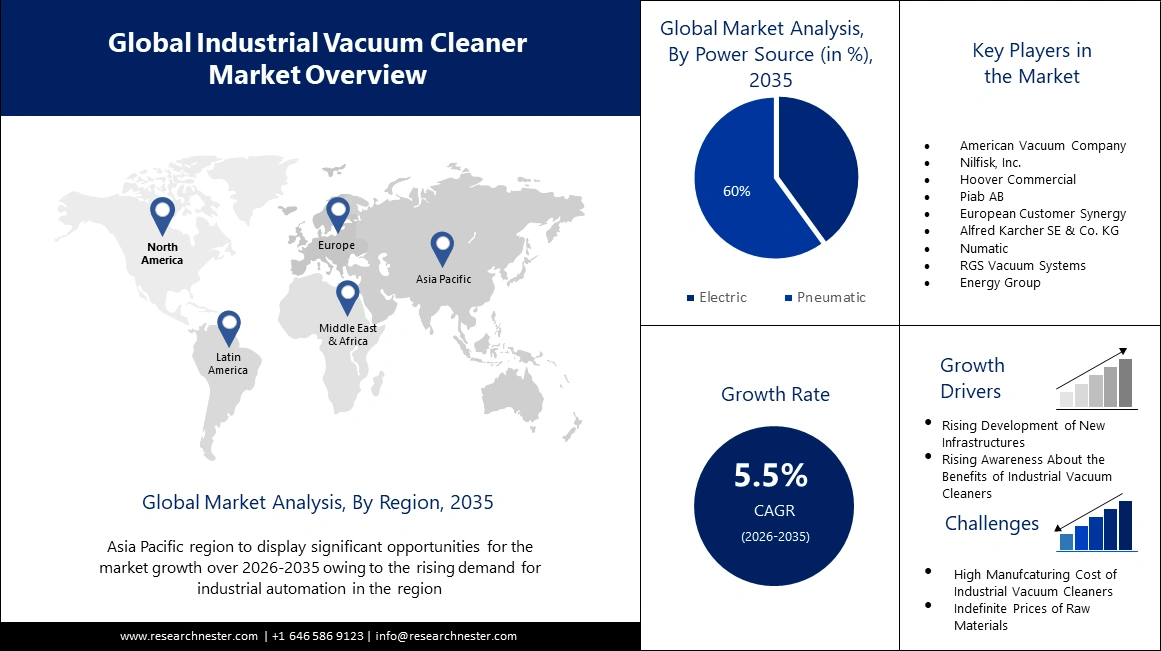

Industrial Vacuum Cleaner Market size was over USD 1.08 billion in 2025 and is anticipated to cross USD 1.84 billion by 2035, witnessing more than 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of industrial vacuum cleaner is assessed at USD 1.13 billion.

The growth of the market can be attributed to the growing need for a clean workplace. One of the most significant benefits of maintaining a clean workplace is increased productivity. Employees who work in a clean and organized environment are up to 15% more productive than those who work in a crowded and dirty setting, according to a recent study. Furthermore, workers treated in a hygienic workplace took 24% fewer sick days on average than those who were not subjected to a clean workplace.

In addition to these, factors that are believed to fuel the market growth of industrial vacuum cleaner is the development of autonomous industrial vacuum cleaners. For instance, in 2021, Brain Corp announced the development of an advanced and professionally used autonomous vacuum cleaner, KIRA CV 60/1 in collaboration with Karcher. It provides smart cleaning solutions to businesses. The equipment is installed with Brain OS operating and it is best suited for vacuuming large-scale infrastructures, such as airports, offices, hotels, schools, and others. It has advanced cameras and sensors that have quick adaptability to the environment and is powered by a lithium-ion battery that has a faster charging speed. Moreover, the vacuum bag is HEPA-rated and provides optimal health protection.

Key Industrial Vacuum Cleaner Market Insights Summary:

Regional Highlights:

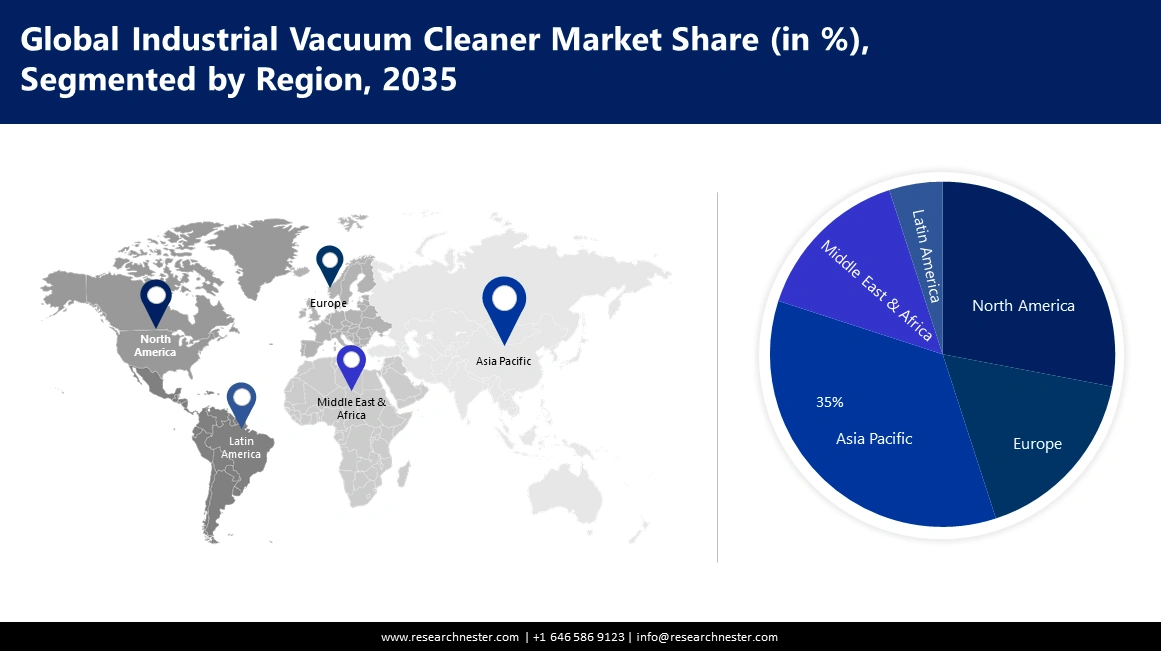

- Asia Pacific industrial vacuum cleaner market is projected to capture a 35% share by 2035, driven by rising investment by leading companies in the automation of machinery.

- North America market is anticipated to achieve a 28% share by 2035, driven by growing capacity of manufacturing and food & beverage industries.

Segment Insights:

- The pneumatic segment segment in the industrial vacuum cleaner market is forecasted to secure a 60% share by 2035, driven by the popularity of compressed air-driven systems that are low-maintenance and reliable.

- The food & beverages segment in the industrial vacuum cleaner market is projected to experience robust growth through 2035, attributed to rising use in disinfecting, vacuuming, and compliance with strict hygiene regulations.

Key Growth Trends:

- Myriad of Benefits of Industrial Vacuum Cleaners

- Increasing Construction of Buildings

Major Challenges:

- Huge structure of vacuum cleaners.

- Highly competitive market all across the world.

Key Players: Tennant Company, American Vacuum Company, Nilfisk, Inc., Hoover Commercial, Piab AB, European Customer Synergy, Alfred Karcher SE & Co. KG, Numatic, RGS Vacuum Systems, and Energy Group.

Global Industrial Vacuum Cleaner Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.08 billion

- 2026 Market Size: USD 1.13 billion

- Projected Market Size: USD 1.84 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, Italy

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 11 September, 2025

Industrial Vacuum Cleaner Market Growth Drivers and Challenges:

Growth Drivers

- Myriad of Benefits of Industrial Vacuum Cleaners– Beyond regular vacuuming, industrial vacuum cleaners are generally thought to be specialized. They provide additional features such as quicker vacuuming of heavy or problematic debris, large-volume dust collection, or having the capacity to cope with peculiar or hazardous dust. Some vacuums are used to extract liquids or slurry. When facilities go from dusting to vacuuming, the cleanliness, safety, and operational effectiveness improve dramatically. These are heavy-duty choices that have been optimized to cover large areas in a brief amount of time while also allowing for effective waste disposal. Moreover, in the large area that has to be cleaned on a regular basis and problematic sections that call for human sweeping, using a device intended for the task will help save you time and money.

- Increasing Construction of Buildings– It is anticipated that 1.6 billion new buildings will be constructed by 2050, for an altogether of 2.6 billion buildings worldwide. The industrial vacuum cleaners are perfect for sweeping floors, walls, and other surfaces to minimize dust buildup, which can create respiratory issues in workers. Furthermore, industrial dust vacuum cleaners can remove significant quantities of trash, such as small construction materials, sawdust, and other garbage. Industrial vacuum cleaners can also be utilized for extensive post-construction cleanup once construction projects are completed.

- Growing Setup of Sensitive Research Labs- The rising use of industrial vacuum cleaners in scientific labs can be ascribed to their usefulness in keeping the laboratory clean and safe. These vacuum cleaners are intended to handle many sorts of detritus, especially hazardous chemicals, which is critical for maintaining experiment integrity and assuring researcher safety. Furthermore, they frequently include specialized filters and capabilities to collect tiny particles and prevent contamination, making them a vital resource in research settings.

- Government Initiatives to Ensure Worker’s Health Safety- The Subsidiary agency of the United States Department of Labour, Occupational Safety and Health Administration (OSHA) has implemented the new regulations for ensuring cleanliness and hygiene at the workplace. This has also prompted manufactured to develop the industrial vacuum cleaner adhering to the standards of OSHA.

Challenges

- Fluctuating Prices of Raw Materials Employed in Industrial Vacuum Cleaners - The manufacturing of industrial vacuum cleaners depends on several raw materials, such as plastics, metals, and many electrical components. The changing cost can lead to overall cost uncertainty of the products, therefore it imposes challenges for companies to make a budget and prices strategies more efficiently. Moreover, in the case of increasing prices of raw materials, manufacturers are forced to produce them at higher costs and then sell them to the customers at elevated prices. This impacts the profit margins and market competitiveness. It also deters the potential buyers since the customers in the industrial sector are highly sensitive to prices and they move toward the products of lower cost available in the market.

- Huge structure of vacuum cleaners.

- Highly competitive market all across the world.

Industrial Vacuum Cleaner Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 1.08 billion |

|

Forecast Year Market Size (2035) |

USD 1.84 billion |

|

Regional Scope |

|

Industrial Vacuum Cleaner Market Segmentation:

Power Source Segment Analysis

The pneumatic segment is estimated to account for 60% share of the global industrial vacuum cleaner market by 2035. The growth of the segment can be attributed to the rising popularity of pneumatic industrial vacuum cleaners. Pneumatic technology is the market's fastest-growing category, as these systems rely on compressed air-driven pumps that operate on Bernoulli's principle. Pneumatic vacuums have no moving components because they are driven by compressed air. A venturi system is used to create the suction. As a result, pneumatic hoover systems are an excellent choice for hazardous items, including burning compounds. Moreover, owing to the absence of moving parts, there are low instances of wear and tear and therefore less failure and they are easy to maintain.

End User Segment Analysis

Industrial vacuum cleaner market from the food & beverages segment is expected to garner a significant share of around 40% in the year 2035. The growth of the segment is majorly attributed to the rising use of industrial vacuum cleaners in the food & beverage industry for various purposes. Industrial vacuum cleaners are used in the food and beverage industry not only for disinfecting the production area, production lines, grills, and testing facilities but also for shipping powders and granules, vacuuming of food waste, and removing scraps and cuttings from packaging machines. The strict government rules concerning safety and hygiene in the food and beverage industry have shown to be a crucial driver for the market expansion of industrial vacuum cleaners. The organizations supporting these worldwide standards hope to build an integrated food supply chain and an umbrella framework for all food suppliers to tackle food safety challenges. International organizations and governmental entities set standards that are used to inspect food companies and assure compliance.

Our in-depth analysis of the global industrial vacuum cleaner market includes the following segments:

|

Power Source |

|

|

Product Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Vacuum Cleaner Market Regional Analysis:

APAC Market Insights

The industrial vacuum cleaner market in Asia Pacific is projected to hold 35% of the revenue share by the end of 2035. The growth of the market can be attributed majorly to the rising investment by leading companies in the automation of machinery. Dyson, the developer of the bagless vacuum cleaner, announced a USD 1.1 billion investment in Singapore over the next four years in March 2022, the latest part of a USD 3.5 billion global investment plan. Furthermore, the establishment of new small and medium-sized businesses is expected to increase the demand for automated industrial machinery, such as industrial robots, and industrial vacuum cleaners in the regions.

North American Market Insights

The North America industrial vacuum cleaner market is estimated to be the second largest, registering a share of about 28% by the end of 2035. The growth of the market can be attributed majorly to the growing capacity of manufacturing and food & beverage industries. The two countries in the region, the United States and Canada are the leading high-income countries, which has majorly increased the demand for manufactured goods. Moreover, it is also signing agreements to boost further manufacturing, for instance, in July 2021, the United States-Mexico- Canada Agreement (USMCA) a partnership of three countries, will increase the production of automotive components, and with this agreement, of around 75% of automotive manufacturing will be done in North America.

Industrial Vacuum Cleaner Market Players:

- Tennant Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- American Vacuum Company

- Nilfisk, Inc.

- Hoover Commercial

- Piab AB

- European Customer Synergy

- Alfred Karcher SE & Co. KG

- Numatic

- RGS Vacuum Systems

- Energy Group

Recent Developments

- Piab AB recently released a vacuum cleaner and gripper for use in the food industry. The piSoftgrip100-4 has four grasping fingers and a sealed vacuum cavity, allowing it to suction-clean objects up to 100 mm wide. It is constructed in one single piece, resulting in a sturdy and easy product. The suction gripper is capable of handling and disinfecting fresh, unpackaged, and fragile food products without the possibility of destroying them. The piSoftgrip vacuum cleaner is a durable option for delicate and sensitive objects.

- Alfred Karcher SE & Co. KG has announced the collaboration with European Customer Synergy (ECS). Karcher and ECS will further develop the partnership and promote innovation in the future years, with the goal of lowering ECS's operational expenses and increasing sustainability. Karcher provides an internet-based solution that digitally maps all tasks performed by building service companies. Karcher offers an extensive, integrated assortment of cleaning machines, digital devices, cleaning solutions, and physical instruments for this purpose.

- Report ID: 5308

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial Vacuum Cleaner Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.