Industrial Sodium Chloride Market Outlook:

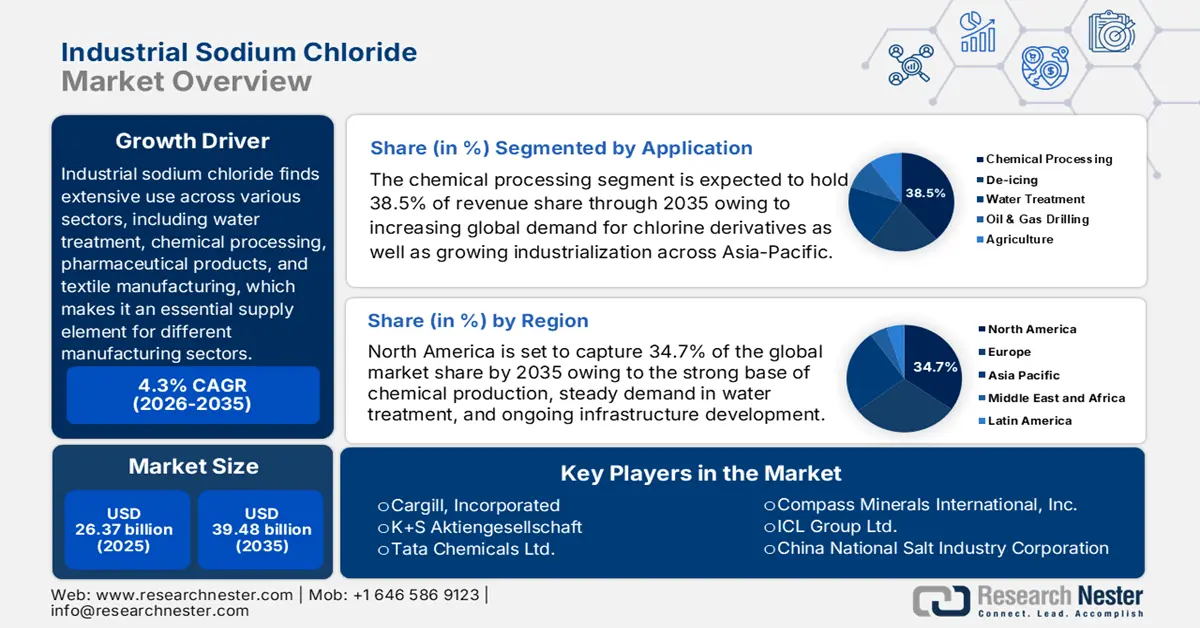

Industrial Sodium Chloride Market size was valued at USD 26.37 billion in 2025 and is projected to reach USD 39.48 billion by the end of 2035, rising at a CAGR of 4.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of industrial sodium chloride is assessed at USD 27.45 billion.

Industrial sodium chloride has extensive applications across various sectors, including water treatment, chemical processing, pharmaceutical production, and textile manufacturing, making it a vital raw material for different manufacturing industries. The U.S. Geological Survey (USGS) reported that the domestic production of salt is estimated to be over 42 million tons during 2023. An estimated 41 million tons of salt were sold or utilized in 2023, with a total estimated worth of $2.6 billion. The market will experience growth because of the increasing chlor-alkali industry alongside growing worldwide requirements for water treatment. Several governments have prioritized self-sufficiency in chemical raw materials, as evidenced by import substitution programs and domestic producer subsidies.

Key Industrial Sodium Chloride Market Insights Summary:

Regional Highlights:

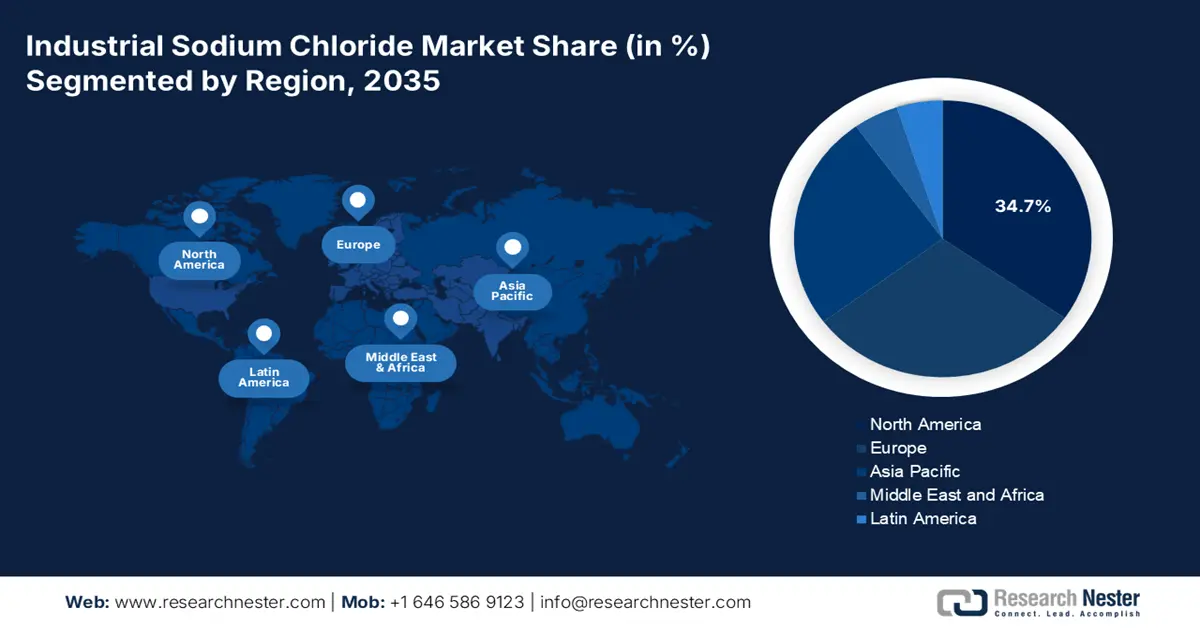

- North America is projected to hold around 34.7% of the industrial sodium chloride market share by 2035, driven by strong demand in chemical processing, water purification, de-icing applications, and established reserves with advanced mining techniques.

- Europe is expected to capture approximately 30.1% of the market share by 2035, supported by extensive applications in chemical production, water treatment, food processing, and compliance with environmental and energy-efficiency regulations.

Segment Insights:

- In the application segment, chemical processing is forecast to secure the largest market share of 38.5% by 2035, reinforced by the rising global demand for downstream chemical products and advancements in refining and sustainable production.

- Within the applications segment, water treatment is set to capture 27.2% of the market by 2035, propelled by urbanization, infrastructure development, regulatory mandates, and technological improvements in desalination and wastewater recycling.

Key Growth Trends:

- Chemical industry expansion

- Sustainability & carbon footprint reduction

Major Challenges:

- Market access barriers

- Sustainability and waste management

Key Players: Cargill Incorporated, K+S Aktiengesellschaft, Tata Chemicals Ltd., Compass Minerals International Inc., ICL Group Ltd., China National Salt Industry Corporation, Cheetham Salt Ltd., INEOS Enterprises, Hanwha Corporation, Akzo Nobel N.V. (Nouryon Salt), Gujarat Heavy Chemicals Ltd. (GHCL), Malaya Salt Berhad, CIECH S.A., Dampier Salt Ltd. (Rio Tinto).

Global Industrial Sodium Chloride Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest region: North America (34.7% share by 2035)

- Fastest growing region: Asia-Pacific

- Dominating countries: United states, Germany, China, United Kingdom, France

- Emerging countries: India, Japan, South Korea, Brazil, Australia

Last updated on : 12 September, 2025

Industrial Sodium Chloride Market - Growth Drivers and Challenges

Growth Drivers

- Chemical industry expansion: The chemical industry is a major consumer of industrial sodium chloride, primarily for the production of chlor-alkali. Highway deicing accounted for about 41% of total salt consumption. Approximately 39% of total salt sales were made by the chemical sector, and 91% of salt used as chemical feedstock was used as brine. The primary users in the chemical sector were caustic soda and chlorine producers. In addition, sodium chloride is required for the production of chlorine, caustic soda, and hydrogen, which are building blocks for a variety of downstream industries, thus driving up demand.

- Sustainability & carbon footprint reduction: Sodium chloride is being positioned as an important industrial feedstock in the transition to greener technologies since it is a part of sustainable chemical processes. Its utilization facilitates global sustainability goals while meeting producers' aspirations in Environmental, Social, and Governance (ESG) commitments. By relying on sodium chloride with its relatively low carbon footprint, the industry can reduce its ecological footprint through efficient production and resource utilization. Sodium chloride is increasingly valuable as a driver of low-emission production pathways and strengthens its value in the contemporary sustainability-driven industrial landscape.

- Rapid desalination build-out: Desalination enhances the chemical treatment water ecosystem reliant on chlor-alkali supply of easily accessible saline sources, such as dissolved salt. According to the World Bank, global installed desalination capacity reached 70.6 million m³/day in 2023, and an additional capacity of 19.51 million m³/day is predicted to come online (2019–2023 growth of +10%). Globally, over 20,000 plants in more than 150 countries are currently providing water to ~300 million people, which solidified the demand for a pretreatment and disinfection chain consistent with industrial NaCl.

1. Salt Production by Country (Mine Production, 2023 & 2024)

|

Country |

2023 (thousand tons) |

2024 (thousand tons) |

|

United States |

42,000 |

40,000 |

|

Australia |

12,000 |

13,000 |

|

Belarus |

2,000 |

2,100 |

|

Brazil |

6,600 |

6,600 |

|

Bulgaria |

3,000 |

3,000 |

|

Canada |

12,000 |

12,000 |

|

Chile |

10,000 |

11,000 |

|

China |

54,000 |

55,000 |

|

Egypt |

2,300 |

2,300 |

|

France |

4,600 |

5,000 |

|

Germany |

15,000 |

16,000 |

|

India |

27,000 |

28,000 |

|

Iran |

2,700 |

2,700 |

|

Italy |

1,800 |

1,900 |

|

Mexico |

8,700 |

9,000 |

|

Netherlands |

5,300 |

6,000 |

|

Pakistan |

3,100 |

3,000 |

|

Poland |

4,500 |

4,600 |

|

Russia |

8,200 |

8,000 |

|

Saudi Arabia |

2,500 |

2,400 |

|

Spain |

3,900 |

4,000 |

|

Turkey |

9,100 |

9,000 |

|

United Kingdom |

2,700 |

2,800 |

|

Other countries |

27,000 |

28,000 |

|

World Total (rounded) |

270,000 |

280,000 |

Source: USGS

2. Exporters of Salt and Pure Sodium Chloride

|

Exporter |

Trade Value (US$ thousands) |

Quantity (kg) |

|

European Union |

408,813.74 |

2,219,240,000 |

|

Netherlands |

407,450.23 |

3,452,850,000 |

|

Germany |

382,889.65 |

3,730,460,000 |

|

India |

333,431.28 |

13,726,100,000 |

|

United States |

258,185.20 |

2,307,220,000 |

|

Spain |

162,540.38 |

1,048,050,000 |

|

Canada |

154,874.83 |

3,896,080,000 |

|

China |

129,966.18 |

1,600,780,000 |

|

Mexico |

123,846.04 |

4,430,070,000 |

Source: WITS

Challenges

- Market access barriers: Trade restrictions and tariffs set by organizations like the World Trade Organization (WTO) hinder global sodium chloride exports, limiting competitiveness for suppliers. In 2022, China’s postponement of updated safety standards delayed industrial sodium chloride chemical approvals, creating a six-month market entry barrier. Such regulatory delays reduce supply chain efficiency, increase compliance costs, and slow international trade momentum, significantly affecting producers and exporters seeking timely access to expanding global demand.

- Sustainability and waste management: Environmental regulations around waste disposal and eco-friendly mining methods drive up operational costs in the sodium chloride sector. In the U.S., salt mining faces strict environmental scrutiny, prompting companies to adopt solar evaporation over traditional extraction. While these measures reduce ecological impact, they also require higher capital investment and process adaptation. This shift demonstrates how sustainability compliance, though vital, increases financial burdens and operational complexities for salt producers.

Industrial Sodium Chloride Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 26.37 billion |

|

Forecast Year Market Size (2035) |

USD 39.48 billion |

|

Regional Scope |

|

Industrial Sodium Chloride Market Segmentation:

Application Segment Analysis

The chemical processing segment is predicted to gain the largest industrial sodium chloride market share of 38.5% during the projected period by 2035. Sodium salt, particularly sodium chloride, is a key raw material in the production of essential chemicals like chlorine, caustic soda, and soda ash, which are foundational to industries ranging from plastics to pharmaceuticals. The chlor-alkali process, which relies heavily on sodium chloride, continues to expand due to rising global demand for downstream chemical products. As industrial activity intensifies, especially in emerging economies, the need for high-purity salt in chemical synthesis grows. Technological advancements in refining and sustainable production methods are further boosting adoption. This sustained demand reinforces chemical processing as the core segment propelling the industrial sodium salt market forward.

End use Segment Analysis

The water treatment segment is anticipated to hold a 27.2% share by 2035. Sodium salts like sodium chloride and sodium carbonate are widely used in municipal and industrial water systems to remove hardness and neutralize contaminants. As urbanization and infrastructure development accelerate, especially in Asia-Pacific and North America, the demand for reliable water treatment solutions continues to rise. Regulatory mandates for clean water and environmental compliance further boost adoption of sodium-based treatment agents. Technological advancements in desalination and wastewater recycling also expand the scope of sodium salt applications. This sustained demand positions water treatment as a key growth engine within the industrial sodium salt market.

Product Type Segment Analysis

The rock salt segment is anticipated to hold a 23.2% share by 2035, mainly to its widespread use in chemical manufacturing, de-icing, and water treatment applications. Its abundance and cost-effectiveness make it a preferred raw material for producing soda ash and caustic soda, which are essential in various industrial processes. The rising demand for de-icing solutions in cold regions further boosts consumption, especially in North America and Europe. Additionally, rock salt’s role in treating industrial wastewater and maintaining infrastructure adds to its utility. As infrastructure development and environmental regulations intensify, the need for reliable and scalable salt sources grows. These factors collectively position rock salt as a cornerstone of industrial sodium salt market expansion.

Our in-depth analysis of the global industrial sodium chloride market includes the following segments:

|

Segment |

Subsegment |

|

Application |

|

|

End use |

|

|

Product Type |

|

|

Distribution Channel |

|

|

Grade |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Sodium Chloride Market - Regional Analysis

North America Market Insights

North America will hold around 34.7% of the overall industrial sodium chloride market share by 2035. This is primarily driven by strong demand in chemical processing, water purification, and de-icing applications. Also, North America has the market advantage of current large reserves, developed mining techniques, and good regional industrial use. There are strict regulatory practices on sustainable mining and environmentally friendly production processes. Demand for sodium chloride increases in the pharmaceutical, textiles, and food processing sectors. Regional trading policies and business supply chain, across the border, aid production and distribution capabilities.

The U.S. chemicals industry relies heavily on sodium chloride for chlor-alkali production, deicing, and industrial processing. Salt production benefits from diverse sources, including rock salt, solar evaporation, and vacuum salt. Environmental regulations encourage a shift toward eco-efficient methods, impacting production strategies. Sodium chloride demand is heightened in water softening, road de-icing, and food processing. Federal initiatives emphasizing green manufacturing push industries to adopt catalytic membrane electrolysis. Strong logistics and established supply networks reinforce the U.S. role as a leading industrial sodium chloride producer.

U.S. Salt: Production, Use, Imports, Exports, Prices & Employment

|

Category |

2020 |

2021 |

2022 |

2023 |

2024 (e) |

|

Production (thousand metric tons) |

42,600 |

39,300 |

39,400 |

e42,000 |

40,000 |

|

Sold or Used by Producers |

39,600 |

39,800 |

40,600 |

e41,000 |

39,000 |

|

Imports for Consumption |

15,800 |

17,700 |

18,300 |

15,700 |

14,000 |

|

Exports |

1,250 |

1,010 |

886 |

2,260 |

1,900 |

|

Apparent Consumption (Sold / Used + Imports – Exports) |

54,200 |

56,400 |

58,000 |

e54,000 |

51,000 |

|

Reported Consumption |

44,000 |

47,100 |

45,300 |

e45,000 |

43,000 |

|

Price (USD per metric ton): Vacuum & Open-pan Salt |

212.21 |

203.72 |

217.58 |

e220 |

230 |

|

Solar Salt Price |

122.77 |

153.52 |

128.87 |

e140 |

140 |

|

Rock Salt Price |

61.71 |

59.88 |

56.86 |

e56 |

56 |

|

Salt in Brine Price |

8.36 |

8.14 |

9.11 |

e9 |

10 |

|

Employment (mining & plant staff) |

4,000 |

4,000 |

4,100 |

4,100 |

4,100 |

|

Net Import Reliance (% of Apparent Consumption) |

27% |

30% |

30% |

25% |

24% |

Source: USGA

Europe Market Insights

Europe will hold around 30.1% of the overall industrial sodium chloride market share by 2035, due to an increase consistently based on its vast applications in chemical production, water treatment, and food processing. Producers continue shifting from mercury cells to membrane electrolysis to meet environmental and energy-efficiency rules, supported by EU chemicals and industrial decarbonization policies. Major drivers are rising demand for chlor-alkali products in France and Germany, government spending on desalination facilities in Spain and Italy, and environmental laws promoting eco-friendly sodium chloride extraction processes.

The U.K. is primarily influenced by chlor-alkali plants, pharmaceuticals, and UK domestic food and drink manufacturing. Purity requirements for membrane electrolysis and regulated food grades guide specification and approach to sourcing. Import reliance, proximity to ports for imports, and storage flexibility are all important, along with recurring domestic production ebbs and flows. Environmental regulations governing the brine extraction process and brine discharge governance, plus requirements from the water industry, add further stability to baseline usage. Considerable energy and rational site location costs impact route economics, whereas downstream demands by pharma and robust food processing help sustain stable mid-term consumption for industrial salt. The exports reflect the UK’s trading relationships in the salt sector and highlight its key partners for this essential commodity.

Top UK Salt Exports and Imports (2024)

|

Import |

Value (in £ M) |

Export |

Value (in £ M) |

|

Ireland |

21.1 |

Rest of the world |

46.1 |

|

Belgium |

13.2 |

Spain |

12.3 |

|

United States |

8.76 |

Turkey |

9.33 |

|

Netherlands |

4.85 |

Germany |

8.68 |

|

Spain |

3 |

Belgium |

7.63 |

Source: OEC

Asia Pacific Market Insights

Asia Pacific will hold around 25.3% of the overall industrial sodium chloride market share by 2035, due to growth in manufacturing automation, construction equipment, and heavy machinery. Regional growth is being supported by strong demand driven by mining and infrastructure spending in China, India, and Southeast Asia. Demand for advanced hydraulic actuators as smart factories and robotics evolve will add fuel to the fire. There is also continued to see funding from governments to support infrastructure and defense programs, resulting in hydraulic applications across transport, aerospace, and industrial equipment, and making APAC the driving growth region until 2035.

Top 7 Export Destinations of Indian Salt

|

Year |

Export Partner |

Export Value (USD 1,000) |

Quantity (Kg) |

|

2023 |

China |

125,783.40 |

5,986,990,000 |

|

2023 |

Republic of Korea |

43,902.99 |

2,226,360,000 |

|

2023 |

Japan |

26,440.00 |

1,183,480,000 |

|

2023 |

Indonesia |

16,865.16 |

671,615,000 |

|

2023 |

Vietnam |

16,728.64 |

668,526,000 |

|

2023 |

Qatar |

16,463.26 |

657,253,000 |

|

2023 |

Bangladesh |

16,096.95 |

611,877,000 |

Source: WITS

Key Industrial Sodium Chloride Market Players:

- Cargill, Incorporated

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- K+S Aktiengesellschaft

- Tata Chemicals Ltd.

- Compass Minerals International, Inc.

- ICL Group Ltd.

- China National Salt Industry Corporation

- Cheetham Salt Ltd.

- INEOS Enterprises

- Hanwha Corporation

- Akzo Nobel N.V. (Nouryon Salt)

- Gujarat Heavy Chemicals Ltd. (GHCL)

- Malaya Salt Berhad

- CIECH S.A.

- Dampier Salt Ltd. (a Rio Tinto Company)

The industrial sodium chloride industry is extremely concentrated, with dominant players utilizing size, technology, and local strengths to stay competitive. U.S. giants like Cargill and Compass Minerals dominate in automation and sustainability, while India's Tata Chemicals and GHCL emphasize vertical integration and green energy investments. European players such as K+S and INEOS emphasize environmental regulations and digitalization. Asian players from Malaysia, South Korea, and Japan are increasing exports and building recycling and clean processing technologies. Strategic actions involve acquisitions, R&D of salt-based specialty applications, and green initiatives led by the government, prompting leading manufacturers to position themselves according to international industrial demand and environmental standards.

Here is a list of key players operating in the industrial sodium chloride market:

Recent Developments

- In January 2024, Dampier Salt, an Australian salt producer majority-owned by Rio Tinto (68% stake), announced the sale of its Lake MacLeod production site to Leichhardt Industrials Group for USD 251 million. The site is one of Dampier Salt’s three key facilities, and the transaction highlights Leichhardt’s growing presence in the Australian industrial minerals sector while marking a strategic divestment move by Rio Tinto.

- In January 2022, B. Braun announced FDA approval for its pharmaceutical manufacturing facility in Daytona Beach, Florida. The plant will produce 0.9% sodium chloride injection solutions, available in 1,000 ml and 500 ml Excel Plus IV bags. These products will be distributed from the company’s Bethlehem, Pennsylvania, base. The development enhances B. Braun Medical’s U.S. production capacity for critical IV solutions in healthcare supply chains.

- Report ID: 853

- Published Date: Sep 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial Sodium Chloride Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.