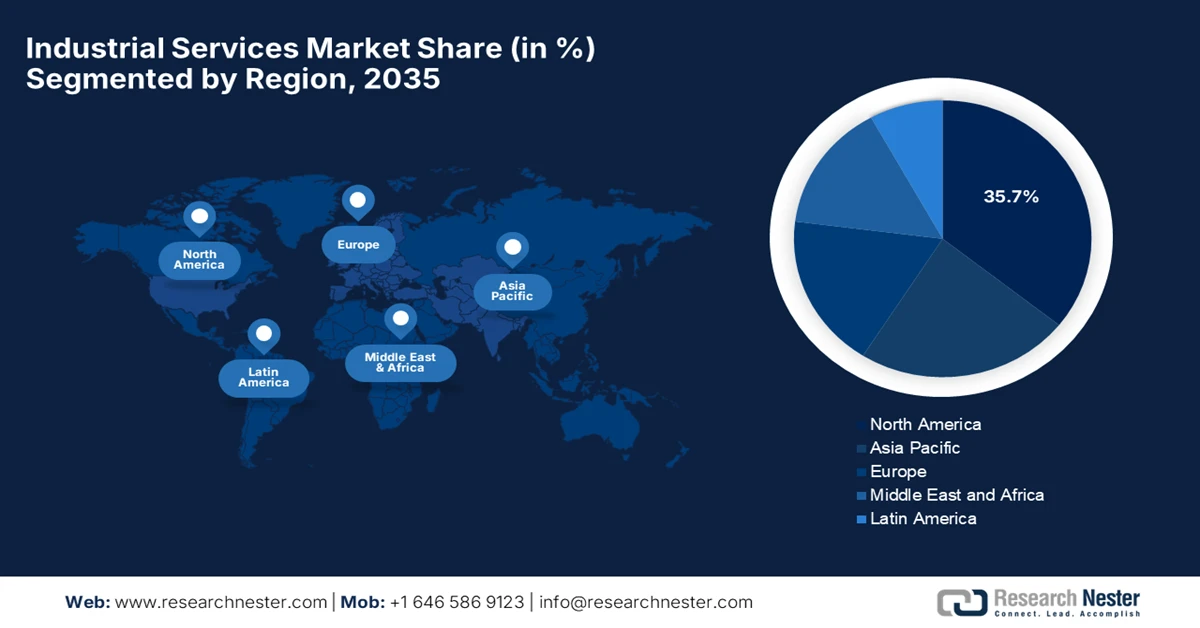

Industrial Services Market - Regional Analysis

North America Market Insights

The North America industrial services market is anticipated to lead, capturing the largest revenue share of 35.7% by the end of 2035. The advanced industrial infrastructure and increasing adoption of digital and automation services are the key factors behind the region’s leadership in this field. The region also benefits from the presence of a high-skilled workforce and a strong ecosystem of technology providers that continuously innovate with a collective goal to enhance operational efficiency. In February 2025, Babcock & Wilcox declared that its subsidiary, Babcock & Wilcox Construction Co., LLC, secured USD 35 million in contracts for maintenance, refurbishment, and installation services at power plants and industrial facilities across North America, adding to a USD 160 million construction backlog. Besides the project's aim to ensure peak performance, energy security, and grid reliability for utilities and manufacturers, thereby fostering steady market growth.

The U.S. industrial services market represents extensive growth in the regional landscape and is closely linked to smart manufacturing and Industry 4.0 initiatives, wherein the factories are adopting MES, cloud computing, and IoT-enabled monitoring systems. The market growth in the country is also fueled by heightened demand from automotive, aerospace, and energy sectors, which are looking to improve uptime and reduce operational risks. In October 2024, Cemtrex reported that its subsidiary, Advanced Industrial Services (AIS), secured a USD 4.5 million contract for the Elizabethtown Training Academy project, covering HVAC renovations in Phase 1 and boiler, piping, and fire protection upgrades in Phase 2, which were set for completion in FY 2025. Hence, such projects highlight AIS’s growing capacity, followed by its 2023 acquisition of Heisey Mechanical, thereby strengthening its ability to deliver large-scale industrial services.

The Canada market has gained increased visibility, with a strong focus on energy infrastructure, mining, and utility services. At the same time, the adoption of digital twins, remote monitoring, and smart sensors across the country—primarily aimed at optimizing production and resource management—supported by government incentives for modernization and sustainable operations, is creating a lucrative business environment. For example, in June 2025, Blackstone Industrial Services announced that it had acquired Trican Pipeline & Industrial Services, primarily to expand its presence in pipeline and critical equipment services. Additionally, this deal boosts the company’s technical capabilities and strengthens its position in the midstream and industrial sectors. Moreover, the acquisition improves technical expertise, broadens service offerings, and extends sector reach, effectively driving increased demand and overall market growth in Canada.

APAC Market Insights

The Asia Pacific industrial services market is expected to register the fastest growth during the forecast period, owing to the rapid pace of industrialization across countries. The aspects of urbanization, infrastructure development, and manufacturing growth are also accelerating the regional market expansion. For instance, in July 2025, Mahindra Industrial Park Chennai Limited and Sumitomo Corporation together announced that they had signed a strategic cooperation agreement with Osaka Prefecture to support Japan-specific companies entering India. Therefore, this partnership aims to facilitate market entry by providing consultation, regulatory support, and infrastructure access, thereby positioning Chennai as a hub for international manufacturing. In addition, this collaboration strengthens India’s industrial ecosystem by attracting foreign investment and driving consistent growth in industrial services across the region.

The industrial services market in China has acquired a strong position in the regional landscape, facilitated by the government-backed initiatives for smart factories and continuous industrial upgrades. In November 2024, the General Office of China’s Ministry of Industry and Information Technology (MIIT) announced the 2024 pilot cities for the integration and application of 5G + industrial internet, including Nanjing, Wuhan, Qingdao, Shenzhen, Suzhou, Shanghai, Ningbo, Guangzhou, Shenyang, and Chengdu. These cities are tasked with driving digital transformation in industries such as electronics, automotive, petrochemicals, and equipment manufacturing, through 5G-enabled smart factories, industrial internet infrastructure, and innovative application instances. Additionally, the initiative also aims to strengthen industrial clusters, promote large-scale deployment of 5G solutions, and foster collaboration between industry, academia, and research institutions, hence enhancing the overall competitiveness of China’s market.

India industrial services sector is maintaining a strong position due to rapid manufacturing and infrastructure growth, particularly in the automotive, power, and chemical industries. In August 2025, VinFast reported that it inaugurated its 400-acre electric vehicle assembly plant at SIPCOT Industrial Park, Tamil Nadu, which marks its first facility outside Vietnam. Besides, the plant leverages advanced automation and multiple workshops and will initially assemble 50,000 EVs on a yearly basis, supporting VinFast’s goal of 1 million vehicle sales in India by the conclusion of 2030. In addition, the company is collaborating with local suppliers, dealer networks, and battery partners, and it aims to foster supply chain localization, workforce upskilling, and sustainable EV development. Hence, such instances boost the market growth, driving demand for local supply chains, logistics, maintenance, quality control, and workforce training.

Europe Market Insights

Europe is solidifying its position in the global landscape, facilitated by the strong emphasis on sustainability, compliance, and modernization of legacy industrial systems. The region is witnessing increasing adoption of digital solutions, cloud-based monitoring, and predictive maintenance, wherein the service providers are supporting energy, automotive, and chemical sectors. In April 2025, Deutsche Telekom and NVIDIA announced the world’s first-ever industrial AI cloud, which is a USD 1.08 billion (approximately €1 billion) initiative aimed at providing sovereign, secure AI infrastructure for Germany and Europe. It also mentioned that the platform is supported by SAP’s business technology platform, and it enables large organizations, SMEs, and start-ups to develop and deploy AI across all manufacturing applications, from design to robotics. Furthermore, with more than 10,000 NVIDIA GPUs installed in a renovated Munich data center, the project forms a flagship of the made 4 Germany initiative, involving more than 100 companies, including Siemens and Agile Robots.

Germany industrial services market has registered itself as a manufacturing powerhouse, relying on industrial services for advanced automation, robotics integration, and Industry 4.0 solutions. The country’s market also benefits from the presence of a skilled workforce and innovation, and is all set for continued expansion, especially with AI and ML integration. In this context, Leadec in October 2025 reported that it has restructured its services to strengthen factory logistics by focusing on production-associated tasks such as warehousing, production supply, pre-assembly, and waste management, and by also integrating automation & digital solutions. The company supports more than 800 factories across the world by providing suitable logistics, maintenance of systems and automated guided vehicles, and real-time digital tracking to ensure smooth operations. The company generated more than USD 1.41 billion (about €1.3 billion) in 2024, offering services across installation, automation, maintenance, logistics, and facility management through its digital platform called Leadec. os.

The UK industrial services market is mainly driven by energy, manufacturing, and utilities modernization, and there has been increasing adoption of digital monitoring, MES platforms, and cloud-based management solutions. In this context, the UK Power Networks in March 2024 announced that it has extended and expanded its IT modernization partnership with Kyndryl for four more years, now including its new role as a distribution system operator. The collaboration enables a Microsoft Azure cloud-based environment, leveraging automation, Infrastructure as Code, and cloud-native builds to enhance operational efficiency, innovation, and resilience across the network serving around 8.5 million customers. Furthermore, this initiative demonstrates the country’s prominence in digital and cloud-based modernization in the industrial services sector, thereby improving asset lifecycle management, service delivery, and green electricity integration.