Industrial Sensors Market Regional Analysis:

APAC Market Insights

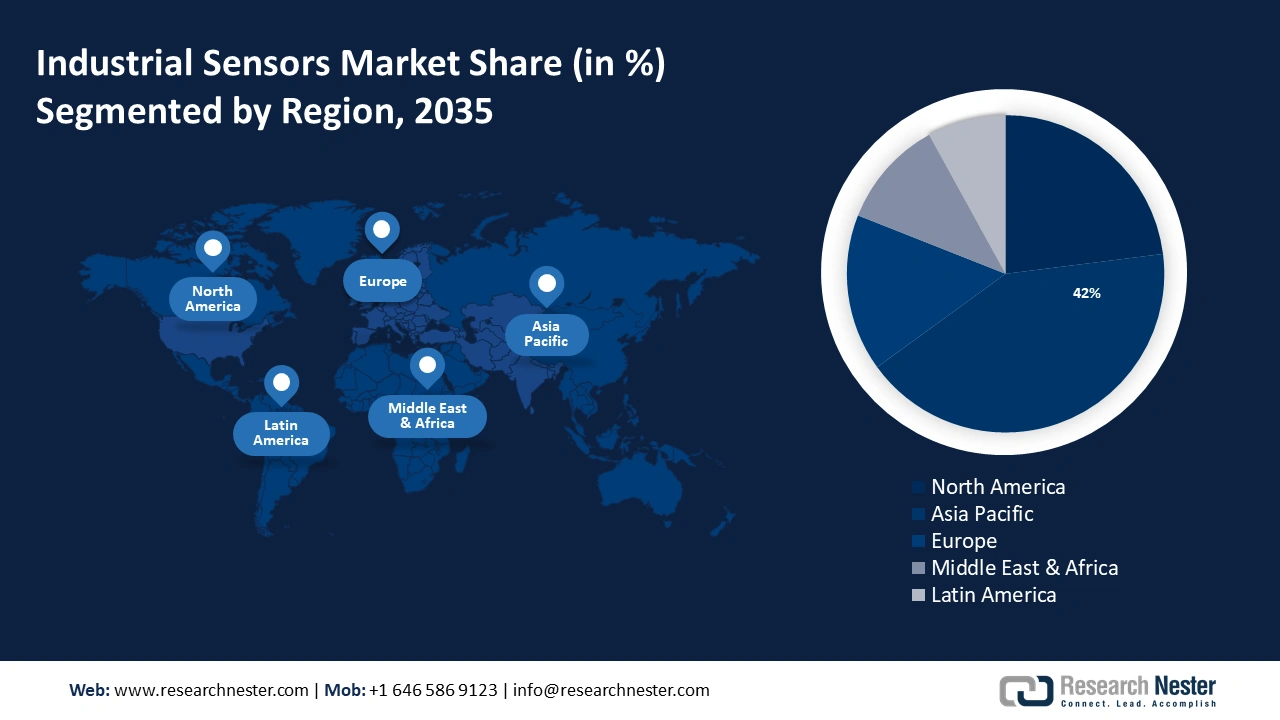

Asia Pacific region in industrial sensors market is estimated to capture revenue share of around 42% by the end of 2035. This growth will be noticed owing to increasing investment by the government in 4.0 industries in growing countries like China, Japan, New Zealand, Australia, etc. Moreover, according to the Asian Productivity Organization, the Internet of Things's capacity to gather and share data connects things, other devices, machines, and people through networks of interconnected computer devices, or the Internet of Things (IoT). These networks allow data to be transferred without requiring human-to-human or human-to-computer communication.

Sensors are widely used in China's food and beverage and electric power-generating industries. According to the International Trade Association, the majority of food and beverage income in China comes from non-franchised locations of food and beverage chemicals, which presents a chance for franchised companies to expand.

In South Korea, the shift to automated or smart manufacturing has quickened as businesses quickly adapt to incorporate Industry 4.0 features since the government is supportive of the business. According to our research, the automotive sector in South Korea is a major contributor to the country's export growth; in 2021, car shipments made up 7% of all export value, or around USD 44.73 billion.

Government regulations and controls are strongly ingrained in industries in Japan, making it a more power-automated industrial hub. With the passage of the Green Transformation Promotion Act by the Diet in May 2023, the government of Japan intends to raise over 150 trillion yen (almost 900 billion USD) in public-private investments over the next ten years.

North American Market Insights

By the end of 2035, North America region in industrial sensors market is poised to hold significant share owing to the rise in the adoption of sensing technologies by the industrial sectors in this region. As per the International Federation of Robotics (IFR), the robotics market in North America has had robust growth overall. Manufacturing installations as a whole increased by 12% to 41,624 units in 2022, nearly matching the record level set in 2018.

High investment in technologies will help to grow the market value of industrial sensors by the end of 2035 in the U.S. With USD 328,548 million invested in AI during the past five years, the US is the nation making the most investments in the field. They have made investments of USD 67,911 million in 2023 alone, up 65.94% from 2019.

Canada will also have huge growth in the industrial sensors industry because of the country's excessive use of industrial automation. For instance, Deloitte opened its smart manufacturing and warehouse in Montreal, Canada, at the beginning of 2023. This facility, according to the business, is a "first-of-its-kind" that is powered only by automated technology.