Industrial Sensors Market Outlook:

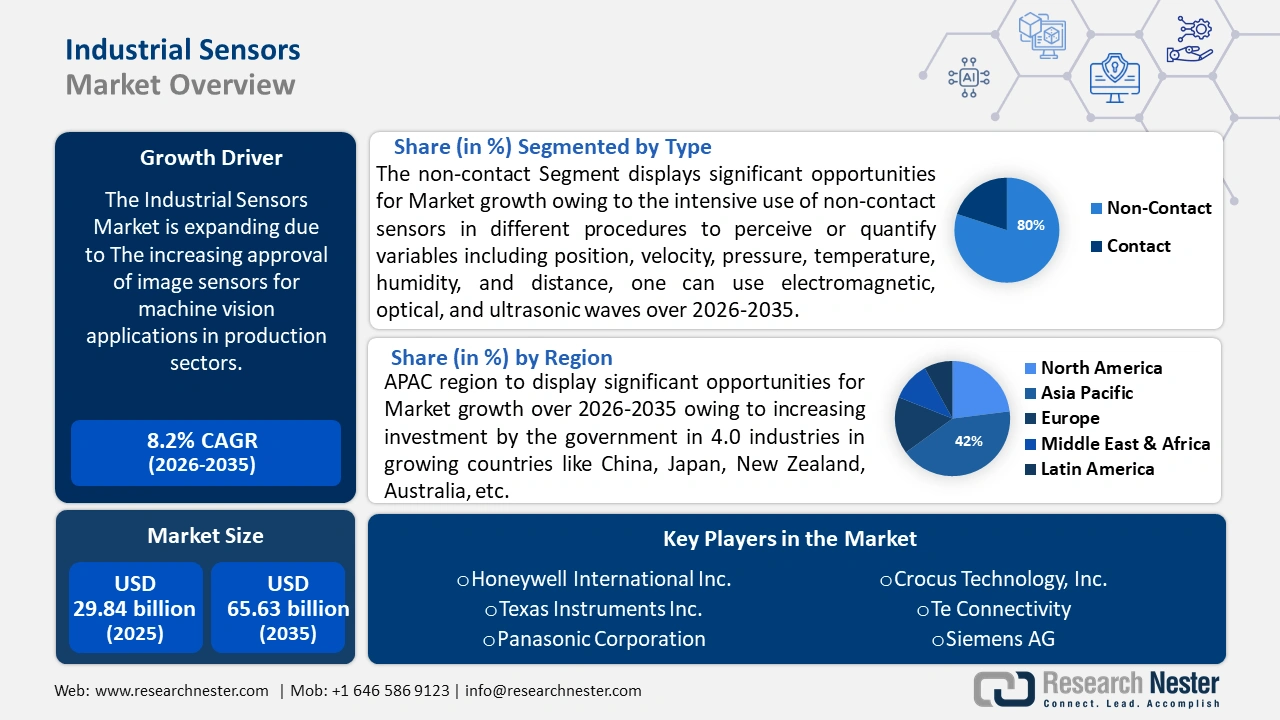

Industrial Sensors Market size was valued at USD 29.84 billion in 2025 and is set to exceed USD 65.63 billion by 2035, registering over 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of industrial sensors is estimated at USD 32.04 billion.

The increasing approval of image sensors for machine vision applications in production sectors and the rising expansion of the production sector will exponentially help the industrial sensors market to grow in the expected CAGR. The World Manufacturing Production Statistics published by the United Nations Industrial Development Organization (UNIDO) demonstrated that, as of the second quarter of 2021, worldwide manufacturing production has grown by 18.2 percent annually. The technology of machine vision inspection has revolutionized multiple manufacturing industries.

Key Industrial Sensors Market Insights Summary:

Regional Highlights:

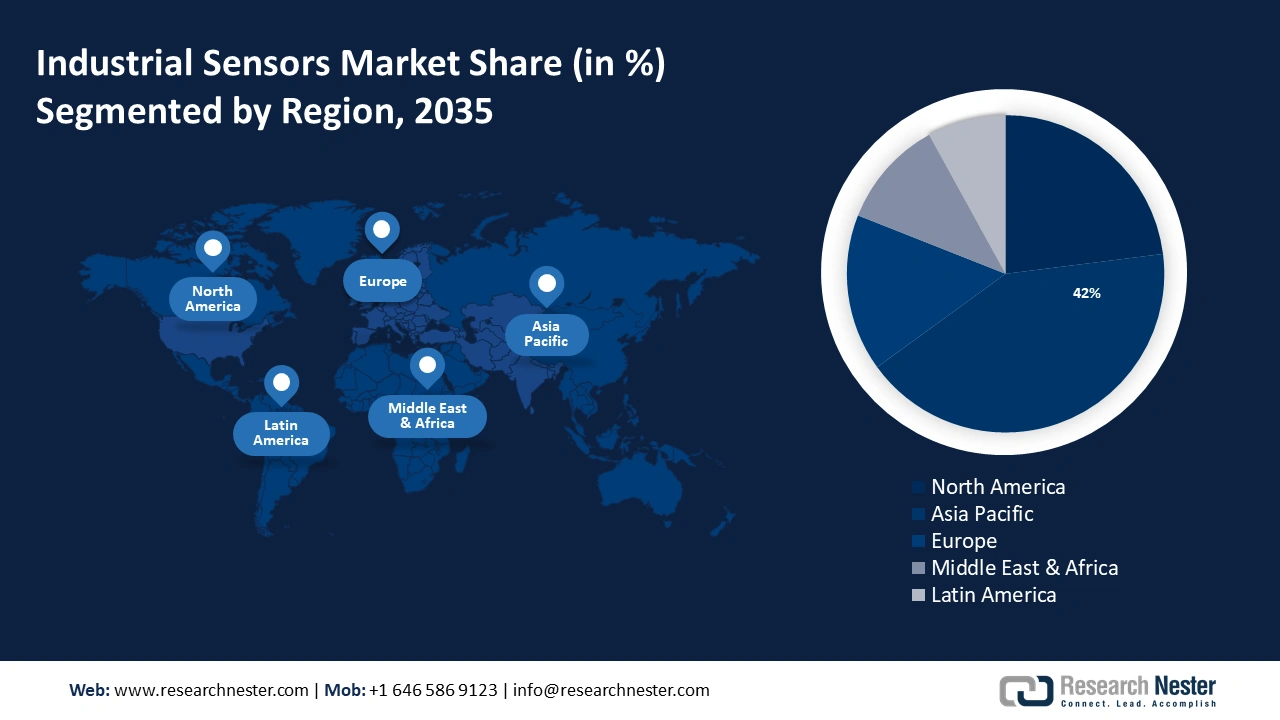

- Asia Pacific industrial sensors market will hold more than 42% share by 2035, driven by increasing government investment in Industry 4.0 technologies.

- North America market will register significant revenue share by 2035, driven by the rise in adoption of sensing technologies in industrial sectors.

Segment Insights:

- The non-contact segment in the industrial sensors market is projected to achieve remarkable growth through 2035, driven by intensive use of non-contact sensors in various procedures.

- Manufacturing segment in the industrial sensors market is anticipated to achieve 39% growth by the forecast year 2035, influenced by the global expansion of manufacturing industries.

Key Growth Trends:

- Rising adoption of Industry 4.0 globally

- The rising implementation of the Internet of Things to push the demand for sensing materials

Major Challenges:

- The excessive price of industrial sensors

- Complicacy of design of industrial sensors

Key Players: Rockwell Automation Inc., Business PlanningMain Product OfferingsFinancial ExecutionMain Performance IndicatorsHoneywell International Inc., Texas Instruments Inc., Panasonic Corporation, Crocus Technology, Inc., Te Connectivity, Siemens AG, Amphenol Corporation, Dwyer Instruments, Inc., Bosch Sensortec GMBH.

Global Industrial Sensors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 29.84 billion

- 2026 Market Size: USD 32.04 billion

- Projected Market Size: USD 65.63 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, Japan, South Korea, India, Taiwan

Last updated on : 17 September, 2025

Industrial Sensors Market Growth Drivers and Challenges:

Growth Drivers

-

Rising adoption of Industry 4.0 globally - Only around half of businesses are actively engaged in Industry 4.0; the remaining businesses are either in the planning stages or are utilizing technologies sparingly. Currently, businesses and nonprofits across the globe invest a great deal of time, resources, and effort into creating innovative strategies to combat the negative effects of the past.

Manufacturing lines, business procedures, and teams can work together regardless of network, time zone, geography, or any other factor due to Industry 4.0 technology.

- The rising implementation of the Internet of Things to push the demand for sensing materials - Smart and Internet of Things (IoT) technologies are developing and being used at a rapid pace, opening up new avenues for technical breakthroughs in a variety of areas of life.

As stated in the European Commission Statistics, Internet of Things devices were utilized by 29% of EU businesses in 2021, primarily for security purposes on their property. IoT technologies are primarily intended to streamline various operations, guarantee increased system (technology or process) efficiency, and ultimately enhance quality of life.

- Rising need for industrial automation worldwide - Industrial automation has developed gradually over the last few decades, with few changes to the structure of the market.

The market for industrial IoT (IIoT) and connection is predicted to develop at a rate of eighteen percent, outpacing all other segments of the industrial automation market. This is the primary industrial automation income stream for hyperscalers. The increasing adoption of Industry 5.0 and different 3D sensors has completely changed the market.

Challenges

-

The excessive price of industrial sensors - The maker must select premium raw materials to create a good temperature sensor. Numerous metals and alloys, including copper, platinum, silicon, nickel, tungsten, and various classified alloys, are employed in the manufacturing of these sensors. Platinum has been more expensive in the last few years. In May 2020, the price of 99.95pc min platinum was USD 830/toz, up from USD 621/toz on March 19, 2020.

The cost of temperature sensors rises as a result of this abrupt increase in raw material costs, which also raises the cost of production distribution overall. - Complicacy of design of industrial sensors - Intricacy in the design of the sensors will impede the industrial sensors market expansion by the end of 2035. The best way to construct a RISC sensor is still a problem, though. The lack of quality models is the primary cause.

Industrial Sensors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 29.84 billion |

|

Forecast Year Market Size (2035) |

USD 65.63 billion |

|

Regional Scope |

|

Industrial Sensors Market Segmentation:

Type Segment Analysis

Non-contact segment is poised to hold more than 80% industrial sensors market share by 2035. This can be impelled by the intensive use of non-contact sensors in different procedures like perceiving or quantifying variables including position, velocity, pressure, temperature, humidity, and distance.

According to research from the National Library of Medicine, Doppler-based radio-frequency (RF) non-contact vital signs (NCVS) monitoring systems are particularly appealing for long-term vital sign monitoring because they don't involve wearable technology, wires, electrodes, or contact-based sensors, which may mean that subjects are unaware of the widespread monitoring.

Sensor Type Segment Analysis

By 2035, level sensor segment is expected to dominate over 28% industrial sensors market share owing to the wide adoption of automated equipment and techniques in industrial manufacturing globally.

For instance, in the year 2023, there were over 15 billion Internet of Things (IoTs) that are being used across the world, increasing by over 1 Billion from the year 2022. During the industrial revolution, the growth of the steam engine and water-powered mills converted production and made it feasible to generate items on a far bigger scale.

Application Segment Analysis

In industrial sensors market, manufacturing segment is predicted to dominate around 39% revenue share by the end of 2035 due to the increasing expansion of manufacturing industries globally. Moreover, manufacturing is still expanding worldwide. The manufacturing sector currently comprises about 14% of employment and about 16% of the global GDP.

Our in-depth analysis of the global market includes the following segments:

|

Sensor Type |

|

|

Type |

|

|

Technology |

|

|

Application |

|

|

Industrial Verticals |

|

|

End-Users Industries |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Sensors Market Regional Analysis:

APAC Market Insights

Asia Pacific region in industrial sensors market is estimated to capture revenue share of around 42% by the end of 2035. This growth will be noticed owing to increasing investment by the government in 4.0 industries in growing countries like China, Japan, New Zealand, Australia, etc. Moreover, according to the Asian Productivity Organization, the Internet of Things's capacity to gather and share data connects things, other devices, machines, and people through networks of interconnected computer devices, or the Internet of Things (IoT). These networks allow data to be transferred without requiring human-to-human or human-to-computer communication.

Sensors are widely used in China's food and beverage and electric power-generating industries. According to the International Trade Association, the majority of food and beverage income in China comes from non-franchised locations of food and beverage chemicals, which presents a chance for franchised companies to expand.

In South Korea, the shift to automated or smart manufacturing has quickened as businesses quickly adapt to incorporate Industry 4.0 features since the government is supportive of the business. According to our research, the automotive sector in South Korea is a major contributor to the country's export growth; in 2021, car shipments made up 7% of all export value, or around USD 44.73 billion.

Government regulations and controls are strongly ingrained in industries in Japan, making it a more power-automated industrial hub. With the passage of the Green Transformation Promotion Act by the Diet in May 2023, the government of Japan intends to raise over 150 trillion yen (almost 900 billion USD) in public-private investments over the next ten years.

North American Market Insights

By the end of 2035, North America region in industrial sensors market is poised to hold significant share owing to the rise in the adoption of sensing technologies by the industrial sectors in this region. As per the International Federation of Robotics (IFR), the robotics market in North America has had robust growth overall. Manufacturing installations as a whole increased by 12% to 41,624 units in 2022, nearly matching the record level set in 2018.

High investment in technologies will help to grow the market value of industrial sensors by the end of 2035 in the U.S. With USD 328,548 million invested in AI during the past five years, the US is the nation making the most investments in the field. They have made investments of USD 67,911 million in 2023 alone, up 65.94% from 2019.

Canada will also have huge growth in the industrial sensors industry because of the country's excessive use of industrial automation. For instance, Deloitte opened its smart manufacturing and warehouse in Montreal, Canada, at the beginning of 2023. This facility, according to the business, is a "first-of-its-kind" that is powered only by automated technology.

Industrial Sensors Market Players:

- Rockwell Automation Inc.

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honeywell International Inc.

- Texas Instruments Inc.

- Panasonic Corporation

- Crocus Technology, Inc.

- Te Connectivity

- Siemens AG

- Amphenol Corporation

- Dwyer Instruments, Inc.

- Bosch Sensortec GMBH

The existence of well-established industry players has resulted in a modest level of market fragmentation for industrial sensors. These companies are offering a variety of goods that appeal to different end-user sectors by utilizing and merging cutting-edge technologies.

Recent Developments

- Rockwell Automation unbolted the next generation i/o with HART unification. Industrial producers can easily manage, surge efficiency, and optimize uptime with the latest Allen‑Bradley® Compact 5000 Isolated Analog HART I/O Module. By unifying HART capacities, this module gave conventional I/O capacities while unbolting worthy insights into device health and progressed diagnostics. This allows users to maintain their systems, promotes online addition and substitution of technique devices, and gives entrance to critical diagnostics.

- Rockwell Automation progressed automation effectiveness with increased armor block 5000 io-link master blocks. Producers can further modernize operation techniques and limit placement time with the discharge of an increased firmware and Add-on Profile (AOP) upgrade in the Allen‑Bradley ArmorBlock 5000 IO-Link master blocks. The recently added characteristics, together with the On-Machine ability, give a substantial promotion in practicality and execution for applications inside demanding industrial environments.

- Report ID: 5998

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial Sensors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.