Industrial Robotic Arm Market Outlook:

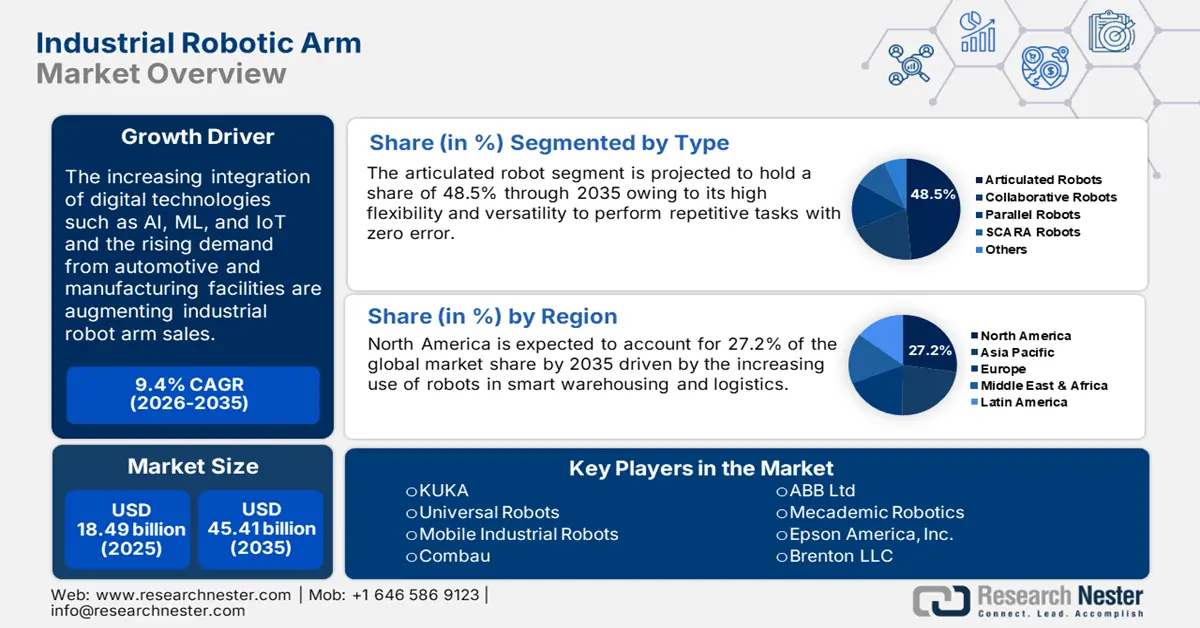

Industrial Robotic Arm Market size was over USD 18.49 billion in 2025 and is anticipated to cross USD 45.41 billion by 2035, witnessing more than 9.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of industrial robotic arm is estimated at USD 20.05 billion.

Industrial arm robots have emerged as a vital solution for end use industries as they significantly reduce human errors, mitigate labor costs, and boost overall operational productivity. Increasing automation is enhancing industrial robotic arms' picking, assembling, sorting, and manufacturing capabilities. Rapid industrialization is increasing the demand for industrial robots, including robotic arms.

For instance, the Industrial Federation of Robotics (IFR) reveals that South Korea (with 1,012 robots per 10,000 employees), Singapore (730), and Germany (415) lead the use of industrial robots. Around 3.9 million industrial robots were operational, globally, in 2022. North America holds a favorable position with a robot density of 188 units, followed by Asia Pacific at 168 units per 10,000 employees, respectively. Currently, over 4 million industrial robots are operating in end use factories including automotive and manufacturing, worldwide.

Furthermore, robot arms widely known as cobots have found a major spot in the automobile production lines. Omron Corporation, FANUC Corporation, ABB Ltd, and Toshiba Corporation are some of the top industrial robotic arm producers targeting the automotive sector. Over 1 million robots are working in the automotive industry, worldwide. Wherein, South Korea holds a dominating position followed by Germany and the U.S. Continuous innovation in the car industry drives the need for high-performance equipment and machines such as robot arms. Thus, technological advancement tactics are anticipated to augment the revenue growth of industrial robotic arm manufacturers in the coming years.

Key Industrial Robotic Arm Market Insights Summary:

Regional Highlights:

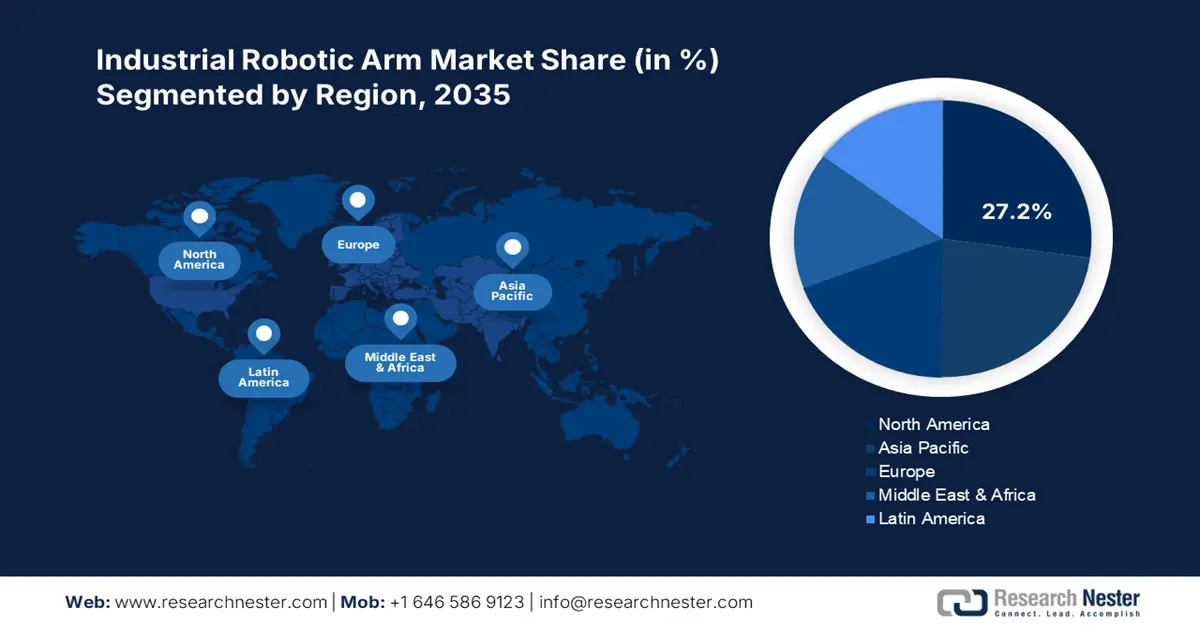

- North America leads the Industrial Robotic Arm Market with a 27.2% share, propelled by digitalization, strong industry presence, and Industry 4.0 adoption, enhancing growth prospects through 2026–2035.

- The Industrial Robotic Arm Market in Asia Pacific is poised for rapid expansion by 2035, fueled by rising automation, logistics activity, and next-gen automobile production.

Segment Insights:

- The Up to 5 kg Payload segment is projected to capture over 30.8% market share by 2035, driven by its versatility, cost-effectiveness, and alignment with sustainable manufacturing practices.

- The Articulated Robot segment is expected to capture around 48.5% market share by 2035, fueled by high task flexibility and demand from automotive, electronics, and manufacturing sectors.

Key Growth Trends:

- Digital technologies transforming robot arm performance

- Use of robot arms in logistics & warehousing

Major Challenges:

- High installation & maintenance costs

- Flexibility issues in some robotic arms

- Key Players: KUKA, Universal Robots, Mobile Industrial Robots, Combau, and ABB Ltd.

Global Industrial Robotic Arm Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 18.49 billion

- 2026 Market Size: USD 20.05 billion

- Projected Market Size: USD 45.41 billion by 2035

- Growth Forecasts: 9.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (27.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Industrial Robotic Arm Market Growth Drivers and Challenges:

Growth Drivers

- Digital technologies transforming robot arm performance: The integration of smart technologies such as artificial intelligence, machine learning, the Internet of Things, cloud computing, and big data analytics are driving the sales of advanced industrial robotic arms. These technologies enhance the capabilities of robot arms such as their ability to perform complex tasks autonomously and seamless adoption into various environments. Digital technologies such as AI and ML algorithms and IoT connectivity also boost productivity, real-time monitoring, predictive maintenance, and performance analysis, reducing downtime and enhancing operation workflows.

The increasing demand for AI-powered industrial robotic arms is necessitating key market players to focus on continuous innovations and production to meet consumer demands. For instance, in September 2024, Inbolt announced that it successfully secured around USD 15 million in series A funding. The company is set to use this fund to make industrial robots smarter with artificial intelligence (AI). Such hefty investments are anticipated to transform the look of modern industrial robotic arms in the coming years. - Use of robot arms in logistics & warehousing: Industrial robotic arms are finding high applications in logistics and warehousing facilities owing to their ability to perform multiple and repetitive tasks. Industrial robotic arms can work for longer durations without breaks, which aids in lowering cycle times and boosting productivity gains. For instance, according to a study by the Association for Advancing Automation Robotics, the demand for logistics robots increased by 18% in 2021. Also, the Information Technology & Innovation Foundation (ITIF) reveals that advancements in robots are efficiently automating various processes in logistic and warehousing facilities. The same source also states that the use of robots in quick sorting and upstream picking increases productivity by 30%.

Challenges

- High installation & maintenance costs: The cost of technologically advanced industrial robotic arms is significant compared to manual counterparts. The high upfront purchasing and installing costs are challenging its adoption in price-sensitive markets. Also, the integration of these advanced technologies with existing infrastructure can be complex leading to the need for expert technicians, driving up the operational costs. Furthermore, high repair and maintenance charges deter budget constraint end use industries from adopting advanced robot arms.

- Flexibility issues in some robotic arms: The limited flexibility of industrial robotic arms challenges their versatility in some operations and leads to human intervention. This not only increases the labor costs, but also limits the potential application of industrial robotic arms. Such factors are expected to hinder the overall industrial robotic arm market growth to some extent.

Industrial Robotic Arm Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.4% |

|

Base Year Market Size (2025) |

USD 18.49 billion |

|

Forecast Year Market Size (2035) |

USD 45.41 billion |

|

Regional Scope |

|

Industrial Robotic Arm Market Segmentation:

Type (Articulated Robots, Collaborative Robots, Parallel Robots, SCARA Robots, Others)

The articulated robot segment is estimated to capture industrial robotic arm market share of around 48.5% by the end of 2035. Articulated robot’s high flexibility in handling various tasks is driving their demand in sectors such as electronics, automotive, and manufacturing. In these industries, particularly in production lines, numerous changes are observed related to designs or configurations. Articulated robot's ability to quickly understand new tasks without much reprogramming is contributing to its sales growth. Furthermore, continuous innovations are augmenting the sales of advanced articulated robots. For instance, in October 2024, Mitsubishi Electric Automation, Inc. announced the launch of MELFA RV-12CRL vertical articulated robot with a 1,504mm reach and 12kg payload capacity. This industrial robotic arm solution is not only advanced but also cost-effective, and set to exhibit high demand for case packing, machine tending, and pick-and-place applications.

Payload Capacity (Up to 5 kg, 5-10 kg, 10-20 kg, 20-50 kg, Over 50 kg)

In industrial robotic arm market, up to 5 kg segment is set to capture revenue share of over 30.8% by 2035. The major user base of up to 5 kg payload capacity industrial robotic arms is small and medium-sized companies driven by their versatility and cost-effectiveness. Smaller payload robots consume less energy leading to low operational costs. Their compact size also mitigates the need for larger space making them a significant advantage for industries. Overall, these features effectively align with sustainable manufacturing practices, uplifting their sales growth.

Manufacturers are also investing in R&D to develop durable and efficient 5 kg loading capacity industrial robotic arms. For instance, in March 2021, Comau announced the launch of the RACER-5-0.80 (Racer-5 COBOT) collaborative robot arm with a loading capacity of up to 5 kg. This advanced and compact cobot offers high accuracy, speed, and, versatility to carry out repetitive work effectively.

Our in-depth analysis of the global industrial robotic arm market includes the following segments:

|

Type |

|

|

Payload Capacity |

|

|

Application |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Robotic Arm Market Regional Analysis:

North America Market Forecast

North America industrial robotic arm market is expected to capture revenue share of over 27.2% by 2035. The swift digitalization in several industries, the strong presence of industry giants, and the adoption of Industry 4.0 practices are augmenting the adoption of industrial robotic arms in the region. The expanding metal & machinery and e-commerce sectors are also boosting the sales of industrial robotic arms. As per the International Federation of Robotics (IFR), over 50,000 units of robots were installed in North America end use industries in 2023.

The U.S. being the largest marketplace for industrial robotic arm market manufacturers accounted for 68.0% of North America industrial robot installations, in 2023. The steady use of industrial robots was observed in the electronics/electrical sector. Continuous innovations in electronics and the high adoption of smart home ecosystems are generating lucrative opportunities for industrial robotic arm manufacturers.

In Canada, industrial robot installation increased by 37% to 4,311 units in 2023. The high vehicle ownership in the country is majorly driving the sales of industrial robotic arms. The automotive sector investments in the industrial robots hold around 58% in 2023. Thus, Canada is a booming for key industrial robotic arm market stakeholders.

Asia Pacific Market Statistics

The Asia Pacific industrial robotic arm market is foreseen to increase at a rapid pace during the projected period. The rising automation, increasing logistics & warehouse activities, and booming next-gen automobile production are augmenting the demand for advanced industrial robotic arms. The automated cobots efficiently aid in multiple tasks such as material handling, welding assembling, picking, sorting, and packaging in industries such as automotive, logistics, warehouses, and manufacturing.

China is one of the largest adopters of industrial robotic arms, where 276,288 units were installed in 2023. The Chinese manufacturers hold dominant shares in the domestic market making the landscape more competitive to international players. Furthermore, in the long-term view, automotive facilities are expected to augment a significant demand for industrial robotic arms market.

In India, a 54% hike was observed in the installation of industrial robots, a record of 4945 units in 2023. The country’s rapidly developing manufacturing sector is driving significant opportunities for industrial cobot manufacturers. The foreign direct investments (FDI) in the country’s manufacturing sector have reached around USD 165.1 billion over the past 10 years with a hike of 69%, says the India Brand Equity Foundation. Considering the increasing FDIs, the operational stocks of industrial robotic arms are expected to double in the coming years.

Key Industrial Robotic Arm Market Players:

- KUKA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Universal Robots

- Mobile Industrial Robots

- Combau

- ABB Ltd

- Mecademic Robotics

- Epson America, Inc.

- Brenton LLC

- Krones AG

- Rockwell Automation, Inc.

- Flexiv

- Asimov Robotics

- Gridbots Technologies Private Limited

- Dobot

- Inbolt

Key players in the industrial robotic arm market are investing heavily in research and development activities to introduce innovative solutions. Collaborations with tech firms are aiding them to develop industrial robotic arms with AI power. The integration of digital technologies including machine learning and IoT is transforming the design and structure of industrial robots. Strategic partnerships are substantially accelerating their market reach. Furthermore, regional expansions and mergers & acquisitions are helping industry giants to cater to a wider consumer base.

Some of the key players include in industrial robotic arm market:

Recent Developments

- In November 2024, Mobile Industrial Robots introduced the MC600 mobile collaborative robot (cobot). This cobot is capable of handling payloads up to 600 kg and effectively automates complex workflows in industrial environments.

- In May 2024, Combau announced the launch of a smart and automated piece-picking robot arm MI.RA/ONEPICKER. This AI-powered robotic arm utilizes vision-based piece-picking technology to boost overall productivity in the warehouse and e-commerce facilities.

- Report ID: 6763

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial Robotic Arm Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.