Industrial PC Market Outlook:

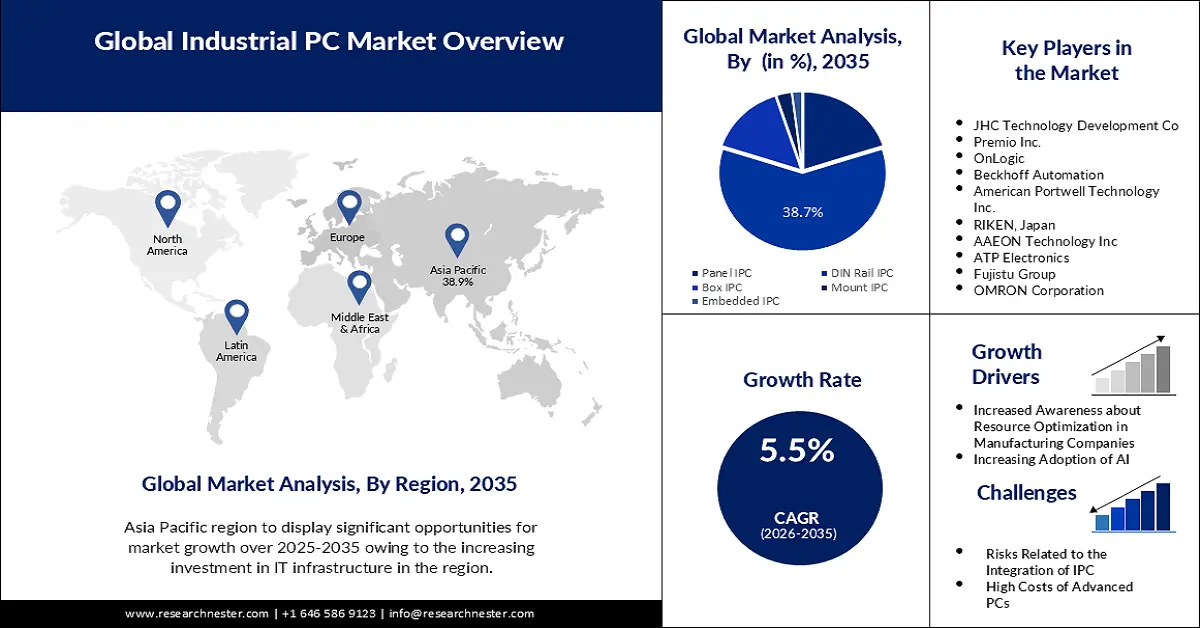

Industrial PC Market size was valued at USD 6.06 billion in 2025 and is expected to reach USD 10.35 billion by 2035, expanding at around 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of industrial PC is evaluated at USD 6.36 billion.

The rising need for reliable high-performance computing solutions is the major factor driving the market. These systems run within challenging conditions, thus becoming vital for multiple industries such as manufacturing, oil and gas, automotive, and logistics sectors. Companies are continually innovating industrial PC systems to increase their capability for operating reliably in harsh conditions. In March 2023, Advantech launched UTC-520IT as a rugged all-in-one touch computer that serves harsh environment demands. The system possesses a stainless-steel body, resistant to corrosion while operating in environments between -10°C to 50°C and preserving its performance integrity. Through innovative device design, IPCs are reaching performance levels that enable them to survive under industrial conditions across various industries.

Key Industrial PC Market Insights Summary:

Regional Highlights:

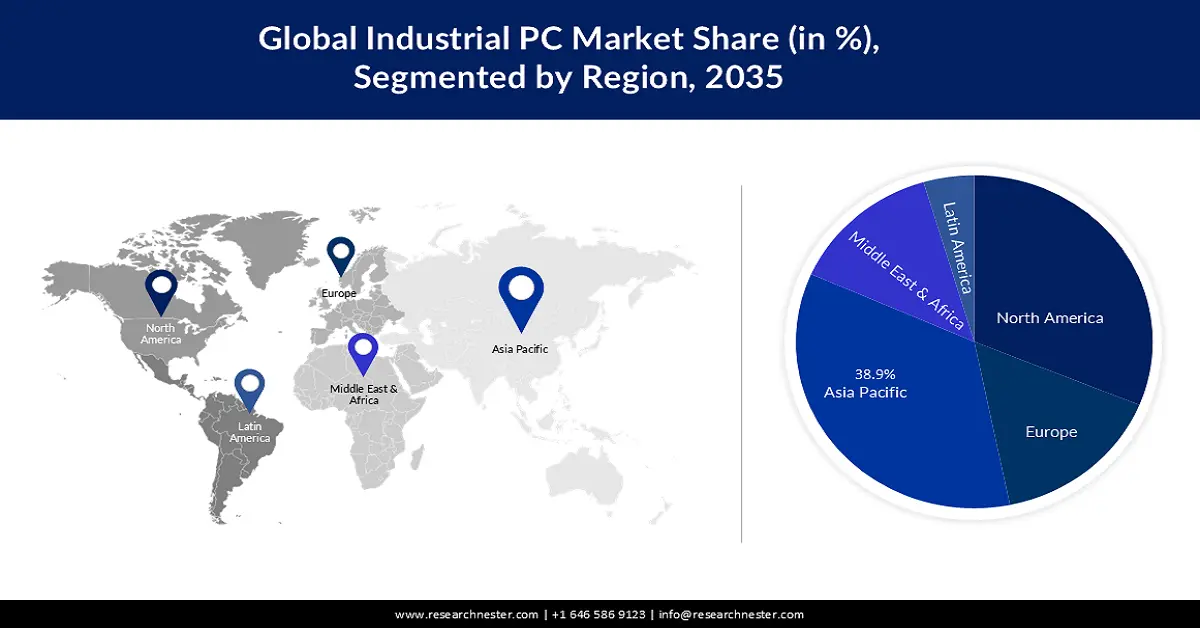

- The Asia Pacific industrial pc market is expected to capture 38.90% share by 2035, fueled by industrial development across India, China, and Southeast Asian countries.

- The North America market will secure the second largest share by 2035, fueled by the manufacturing sector’s adoption of automation and robotic systems to improve production efficiency.

Segment Insights:

- The din rail ipc segment in the industrial pc market is forecasted to achieve a 38.70% share by 2035, influenced by the integration of AI, ML, and IIoT technologies in industrial applications.

- The discrete industries segment in the industrial pc market is expected to hold the largest share by 2035, driven by the use of industrial PCs for AI-driven predictive maintenance and analytics.

Key Growth Trends:

- Remote monitoring and control demand

- Industrial and field service applications

Major Challenges:

- Rapid technological obsolescence

Key Players: OnLogic, JHC Technology Development Co, Premio Inc., Beckhoff Automation, American Portwell Technology Inc., RIKEN, Japan, AAEON Technology Inc., ATP Electronics, Fujistu Group, OMRON Corporation.

Global Industrial PC Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.06 billion

- 2026 Market Size: USD 6.36 billion

- Projected Market Size: USD 10.35 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 11 September, 2025

Industrial PC Market Growth Drivers and Challenges:

Growth Drivers

- Remote monitoring and control demand: Businesses within industrial automation sectors collaborate to develop integrated solutions to cater to growing remote monitoring and edge intelligence requirements. For instance, in September 2023, Advantech partnered with IoTech to provide leading-edge solutions that consolidate data processing for smart manufacturing and industrial automation needs. The companies integrate industrial PCs through Edge Connect software to acquire real-time data and perform remote diagnostics while creating reliable distributed connectivity. The industrial sector is shifting toward distributed management systems and predictive maintenance practices due to these recent advancements.

- Industrial and field service applications: Smart and sustainable energy transformations around the globe are fueling the need for industrial PCs to operate energy management systems and smart grids. Companies are increasingly adopting advanced IPC solutions to advance energy networks. In November 2024, REPLUS Engitech and Green Power Monitor signed a Memorandum of Understanding to improve grid security and stability and make it easier for battery energy storage systems and renewable resources to stay connected to the network while demonstrating the essential nature of IPCs in powering smart energy network development. Such joint ventures affirm the essential role of IPCs in building power infrastructure capable of addressing modern demands.

Challenges

- Rapid technological obsolescence: Industrial PCs possess extended durability through their longevity, yet this durability is presenting challenges in emerging technology environments that demand quick adoption. User-grade computing systems are rapidly adopting AI functionality and better connection capabilities, however, the industrial process control systems are lagging, as they support legacy hardware and software.

Industrial PC Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 6.06 billion |

|

Forecast Year Market Size (2035) |

USD 10.35 billion |

|

Regional Scope |

|

Industrial PC Market Segmentation:

Type Segment Analysis

The DIN Rail IPC segment in the industrial PC market is expected to hold the largest share of 38.7% during the forecast period, due to the implementation of AI, ML, and IIoT capabilities, which serve various industrial sectors. The technology allows users to perform real-time predictive maintenance, data processing, and enhanced automated capabilities for smart factories and industrial automation programs. The high-speed requirements of industrial applications are driving DIN Rail IPCs to become vital elements for the management of complex industrial workflows as they deliver enhanced efficiency and promptness.

End use Segment Analysis

The discrete industries segment is expected to hold the largest share in the upcoming years. AI and digital twin technology are transforming discrete manufacturing processes through their ability to run predictive analytics and real-time system simulation. Virtual replicas are possible by these technologies, enabling manufacturers to predict system performance and upcoming issues in advance of their occurrence. The industry requires industrial PCs to operate these advanced systems as they deliver the necessary data-processing capabilities and robust computational power. Through AI and digital twin application deployments, IPCs help manufacturing operations make improved choices while decreasing expenses for operations and boosting total production lines.

The predictive maintenance approach is becoming essential for discrete industries with the need to prevent equipment breakdowns and reduce unexpected downtimes. AI capabilities are enabling companies to improve their industrial automation through strategic collaborations. For instance, in November 2024, Siemens released a new series of Industrial PCs with integrated NVIDIA GPUs, under its Industrial Operations X product line. The integration provides capabilities for predictive maintenance as well as robotics and quality inspection, and it enhances shop floor AI execution by up to 25 times. These developments can monitor and analyze machine performance in real time, so that maintenance can be performed promptly.

Our in-depth analysis of the global industrial PC market includes the following segments:

|

Type |

|

|

Sales Channel |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial PC Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific is poised to experience the largest revenue share of 38.9% in the industrial PC market during the forecast period. The industrial development across India, China, and Southeast Asian countries is resulting in a rising demand for industrial PCs. The industrial revolution requires viable, rugged, high-performance computing systems since industries need durable digital systems to increase operational efficiency. IPCs play integral roles in machine control operations while enabling data acquisition and delivering timed processing across the manufacturing industry, logistics networks, and energy facilities.

The China market is expected to experience robust growth during the stipulated timeframe. The local government is significantly investing in Industrial 4.0 innovation as well as smart manufacturing technology development to upgrade its manufacturing infrastructure. Through initiatives like Made in China 2025, the country is emphasizing automation, artificial intelligence, and smart factories that need industrial PCs for advanced computing solutions. Growing technology adoption across the automotive, textile, and electronics sectors is increasing manufacturer requirements for IPCs whose control and optimization capabilities are crucial for production management.

North America Market Insights

The North America region is expected to hold the second-largest share of the industrial PC market by the end of 2035. The manufacturing sector uses automation and robotic systems to achieve higher production efficiency while cutting expenses to address worker shortage situations. The increasing usage rate of IPCs equates to market growth as the automotive, electronics, and food processing industries use them to stay competitive in today's changing environment.

The market in the U.S. is all set to account for a significant share in the forthcoming years, attributed to the rising adoption of edge computing across industries such as energy, healthcare, and manufacturing. The industrial PCs play a vital role in enabling edge computing by allowing users access to reduced latency, on-site data processing capabilities, as well as ensuring real-time decision-making. This is particularly significant for applications that need immediate responses, including automation, predictive maintenance, and remote monitoring. The continually rising requirement for decentralized data processing is propelling the demand for high-performance industrial PCs.

Industrial PC Market Players:

- OnLogic

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- JHC Technology Development Co

- Premio Inc.

- Beckhoff Automation

- American Portwell Technology Inc.

- RIKEN, Japan

- AAEON Technology Inc.

- ATP Electronics

- Fujistu Group

- OMRON Corporation

The industrial PC market is highly competitive, with key players focusing on innovation, ruggedization, and vertical-specific solutions to gain market share. Leading companies such as Advantech, Siemens, Beckhoff Automation, and Rockwell Automation are investing in advanced technologies such as edge computing, AI integration, and IoT compatibility to meet evolving industrial demands. The market is characterized by strategic partnerships, product launches, and regional expansions aimed at enhancing system reliability and real-time data processing. Customization, durability, and compliance with industry standards remain crucial differentiators. As industries increasingly embrace automation and digitalization, the competitive landscape continues to evolve, driven by performance, connectivity, and adaptability. Here are some key players operating in the global market:

Recent Developments

- In October 2024, Moxa launched the MPC-3000 Series panel computers, featuring Intel Atom x6000E processors. These devices are designed for harsh industrial environments, offering wide operating temperature ranges and certifications for hazardous locations, making them ideal for sectors like oil and gas and marine operations.

- In January 2023, Moxa launched the UC-8200 Series, the world's first industrial computer to achieve IEC 62443-4-2 certification. This certification ensures robust cybersecurity features, making it suitable for IIoT applications requiring high security.

- Report ID: 5208

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial PC Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.