Industrial Machinery Market Outlook:

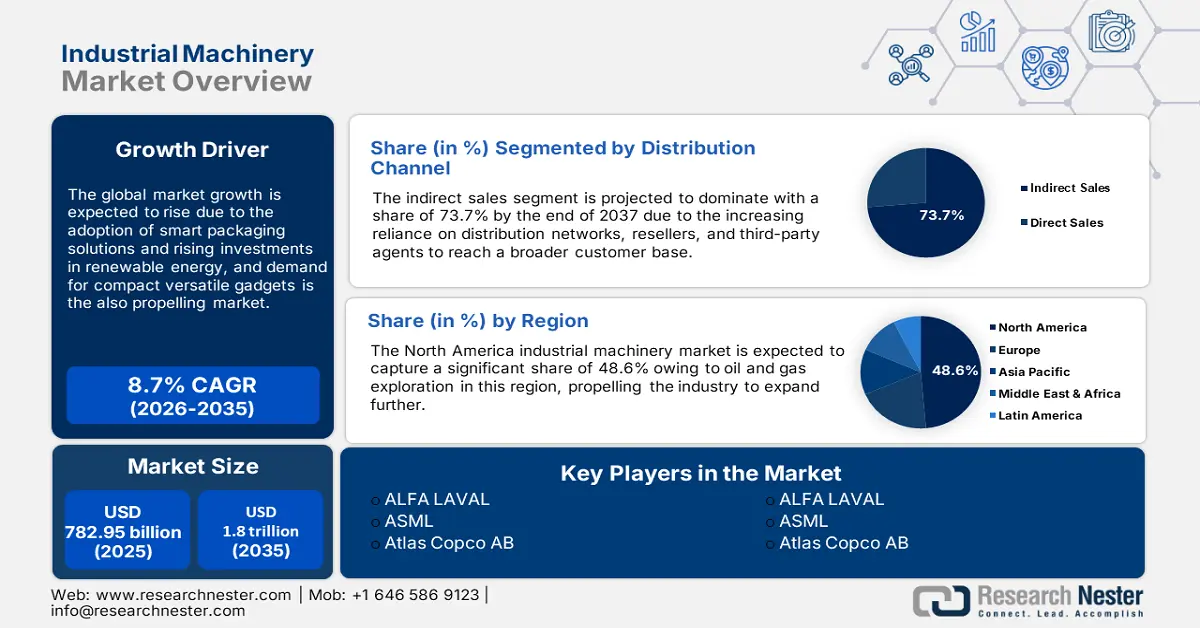

Industrial Machinery Market size was over USD 782.95 billion in 2025 and is poised to exceed USD 1.8 trillion by 2035, witnessing over 8.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of industrial machinery is estimated at USD 844.25 billion.

The shift towards smart manufacturing, driven by Industry 4.0 (allowing smart manufacturing and the creation of intelligent factories) fueling demand for advanced industrial machinery. Automation technologies such as robotics, IoT-enabled machines, and AI integration are transforming production efficiency and reducing operational costs. Artificial intelligence (AI) for manufacturing investment is predicted to increase from USD 1.1 billion in 2020 to USD 16.7 billion in 2026, a 57% increase. This is a huge advancement that will allow machines to automate difficult activities and replicate parts of human intelligence. In addition to increasing income and cutting expenses, this might also lessen risk and revolutionize production.

The global increase in infrastructure projects, especially related to smart city developments and urbanization initiatives, is significantly driving the demand for industrial machinery. Essential equipment, including construction machinery, HVAC systems, and material-handling devices, plays a crucial role in ensuring efficient project execution. These projects, covering residential, commercial, and industrial sectors, are not only contributing to the robust growth of the market but also reflecting nations' commitment to modernization and sustainable infrastructure development.

Key Industrial Machinery Market Insights Summary:

Regional Highlights:

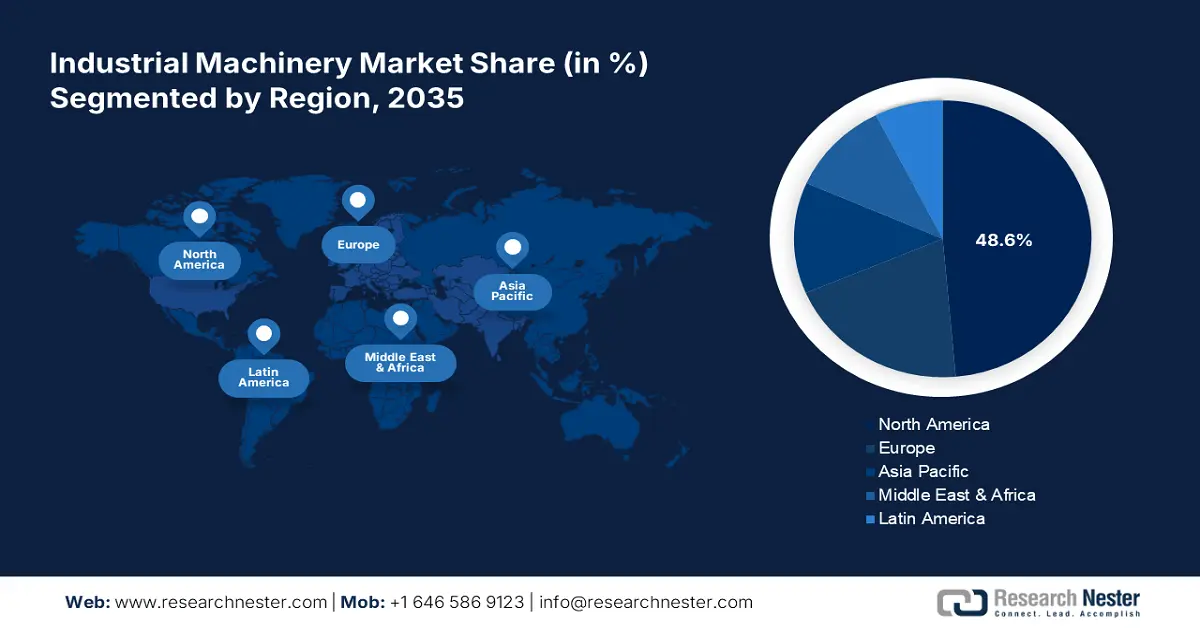

- North America dominates the Industrial Machinery Market with a 48.60% share, propelled by the transition to automated production lines and leadership in oil and gas exploration, fostering strong growth through 2035.

Segment Insights:

- The Indirect Sales segment is expected to dominate with a 73.70% share by 2035, fueled by manufacturers leveraging third-party agents to efficiently expand their customer base.

- The Construction segment is poised for substantial growth from 2026-2035, fueled by increased infrastructure projects, urbanization, and demand for specialized machinery.

Key Growth Trends:

- Rising demand in the food packaging industry

- Rise in e-commerce

Major Challenges:

- Technological restrictions

- High Initial Costs

- Key Players: AGCO Corporation, ALFA LAVAL, ASML.

Global Industrial Machinery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 782.95 billion

- 2026 Market Size: USD 844.25 billion

- Projected Market Size: USD 1.8 trillion by 2035

- Growth Forecasts: 8.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 13 August, 2025

Industrial Machinery Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand in the food packaging industry: The growing demand for processed and packaged food is driving investments in advanced industrial machinery, including automated processing, packaging, and quality control systems. Food manufacturers require efficient, high-speed equipment to meet consumer expectations for safety, hygiene, and variety, fueling the industrial machinery market’s demand in the food production sector. Additionally, owing to this demand the number of food product machinery companies is growing. For instance, in the U.S. alone, 1400 companies are present at the moment, created by product demand, which is propelling the market.

- Rise in e-commerce: The growth of online retail is significantly increasing the demand for advanced warehousing solutions, including automated storage and retrieval systems (AS/RS), forklifts, and industrial robots. These technologies are essential for efficiently managing high order volumes and ensuring quick delivery times. In regard with this, in July 2024, Relevant Industrial has launched a new e-commerce platform (Digital Commerce 360) to enhance the industrial purchasing experience for equipment and custom solutions. Concurrently, industrial expansion in countries such as India, Brazil, and Vietnam is driving the demand for machinery in various sectors, including textiles, food processing, and automotive manufacturing, further contributing to robust market growth.

Challenges

- Technological restrictions: The rapid emergence of new technologies renders existing industrial machinery obsolete, compelling businesses to invest frequently in upgrades or replacements to stay competitive. This constant need for modernization increases operational costs and disruptions workflows, particularly for companies striving to adopt cutting-edge solutions. The challenge is compounded by the significant costs involved in integrating advanced techlikenologies.

- High Initial Costs: Advanced industrial machinery demands significant capital investment, often surpassing the financial capacity of smaller firms. This financial barrier limits their ability to adopt state-of-the-art technology, hindering operational efficiency and innovation. The high costs also slow market penetration, as many businesses delay upgrading their equipment, creating a competitive disadvantage in an increasingly technology-driven industrial landscape.

Industrial Machinery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.7% |

|

Base Year Market Size (2025) |

USD 782.95 billion |

|

Forecast Year Market Size (2035) |

USD 1.8 trillion |

|

Regional Scope |

|

Industrial Machinery Market Segmentation:

Distribution Channel (Direct sales, Indirect sales)

By 2035, indirect sales segment is set to account for industrial machinery market share of around 73.7%. Manufacturers are increasingly leveraging distribution networks, resellers, and third-party agents to effectively expand their customer base, as these intermediaries provide valuable expertise, expedited delivery, and additional support. In 2023, manufacturing contributed an impressive USD 2.3 trillion to the U.S. GDP, accounting for 10.2% of the total GDP. By adopting indirect sales channels, companies can more easily penetrate new markets while minimizing the need for substantial infrastructure investments, ultimately driving overall market growth and fostering a more dynamic business environment.

Application (Agriculture, Construction, Packaging, Food Processing, Mining, Semiconductor manufacturing)

Based on application, the construction segment is anticipated to hold a dominant share over the forecast period in the industrial machinery market. The segment is growing due to increased global infrastructure projects, urbanization, and smart city initiatives are key components of modern development. In June 2024, manufacturing construction spending, or the money spent to construct new or expand existing manufacturing facilities, hit a new high of USD 238 billion. Demand for advanced construction equipment, such as excavators, cranes, and material handling systems, is rising to meet tighter project deadlines and improve efficiency. Additionally, the shift towards sustainable building practices and green infrastructure further drives the need for specialized machinery, making the construction segment a significant growth driver in the market.

Our in-depth analysis of the global market includes the following segments:

|

Distribution Channel |

|

|

Application |

|

|

Operation |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Machinery Market Regional Analysis:

North America Market Statistics

By the end of 2035, North America industrial machinery market is set to capture around 48.6% revenue share. The transition to automated production lines helps industries enhance efficiency and meet rising consumer demand in the region. Automation also compensates for labor shortages and increases output quality, driving the need for high-tech machinery. North America has leadership in oil and gas exploration ensuring steady demand for specialized machinery, from drilling rigs to transportation systems, critical for energy production and distribution. For instance, 32 U.S. states and U.S. coastal water generate crude oil. In 2022, almost 72% of the crude oil produced in the United States came from five states. This increases the demand for industrial equipment by significant folds, propelling the market growth.

The U.S. is dominating the North America industrial machinery market. The country is rapidly adopting smart manufacturing solutions to stay competitive globally. Advanced machinery with integrated IoT and AI capabilities supports precision, real-time monitoring, and scalability, making it essential for modern factories. Robotic equipment capital expenditures in the United States were registered at USD 11,536 million, or 1.1% of all equipment. As manufacturers bring operations back to the U.S., they invest in advanced machinery to build automated, cost-effective production lines. This trend is driven by the need for supply chain resilience and government incentives. For instance, the Biden-Harris Administration has announced USD 22 million to support smart manufacturing at small and medium-sized businesses nationwide.

Canada is heavily investing in infrastructure development, with a focus on essential projects like roads, bridges, and innovative smart city initiatives. Through the Investing in Canada Infrastructure Program, the federal government is committing over USD 33 billion to enhance public infrastructure nationwide. These substantial investments not only create new job opportunities but also foster consistent growth in the market. Furthermore, Canada’s strategic proximity to the U.S., combined with trade agreements like USMCA, provides manufacturers with a valuable opportunity to export industrial machinery efficiently, bolstering overall production and economic activity.

Europe Market Analysis

The industrial machinery market in Europe is poised to garner lucrative market share over the forecast period. Europe is at the forefront of adopting automation technologies and industry 4.0 initiatives. Smart factories, IoT-enabled machinery, and AI-driven processes are transforming manufacturing, boosting demand for advanced industrial machinery. Continuous R&D investing is fostering innovations in robotics, additive manufacturing, and AI-integrated machinery, enabling companies to stay competitive and meet evolving industry demands.

The push for digital transformation in manufacturing is driving demand for advanced industrial machinery with automation capabilities in the UK. In 2022, the total government spending on infrastructure reached USD 33 billion. Of this amount, USD 24.5 billion was sourced from the central government (CG), while the local government (LG) contributed USD 8.5 billion. A significant portion of this spending, amounting to USD 28.6 billion, was allocated to transport infrastructure, which includes roads, airports, harbors, and railways. Government initiatives such as the National Infrastructure Strategy are fueling demand for construction equipment, HVAC systems, and material-handling machinery to support ongoing urban development and infrastructure upgrades.

The market in Germany is poised for growth, driven by strong international demand that highlights its reliability, efficiency, and commitment to global standards. This positions Germany as a key player in the export market. With tightening environmental regulations, there is an increasing demand for energy-efficient machinery, presenting an opportunity for innovation. German manufacturers are actively developing solutions that align with national and EU sustainability goals, focusing on reducing emissions and energy consumption. By setting an ambitious target to cut greenhouse gas emissions by at least 65% by 2030, Germany is not only leading the way in sustainability but also paving the path for a more environmentally responsible future in the industrial sector.

Key Industrial Machinery Market Players:

- Honeywell International Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AGCO Corporation

- ALFA LAVAL

- ASML

- Atlas Copco AB

- Brandt Industries Ltd.

- Caterpillar Inc.

- CNH Industrial N

- Deere & Company

- ESCO Corp.

- Gerdau S.A.

- GEA Group

Key companies in the industrial machinery market are driving innovation through the integration of IoT, AI, and robotics to enhance automation and efficiency. They are developing energy-efficient machinery to meet sustainability goals, investing in advanced materials for durability, and offering customizable solutions tailored to specific industries such as automotive, construction, and food processing, ensuring adaptability to evolving industrial machinery market demands. For instance, AGCO Corporation and Bosch BASF Smart Farming jointly announced that they will work together to develop further new features and integrate and market Smart Spraying technology on Fendt Rogator sprayers.

Recent Developments

- In October 2024, Altair Engineering Inc., a top software supplier in the industrial simulation and analysis market, agreed to be acquired by Siemens. Siemens' position as a top technology business and pioneer in industrial software is strengthened by this acquisition.

- In April 2024, the Brandt Group of Companies announced a significant expansion to its dealer network for material handling equipment, which is anticipated to create up to 300 new jobs and USD 500 million in additional revenue over the next three years.

- Report ID: 6825

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial Machinery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.