Industrial IoT Market Outlook:

Industrial IoT Market size was valued at USD 276.6 billion in 2025 and is expected to reach USD 964.16 billion by 2035, expanding at around 13.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of industrial IoT is assessed at USD 309.71 billion.

Key factors fueling this expansion include advancements in technologies such as 5G, AI, edge computing, and digital twins, which enable real-time data analysis.

For instance, in February 2024, Digi International Inc. launched Digi IX40, a 5G edge computing industrial IoT cellular router solution. Digi IX40 is purpose-built for Industry 4.0 use cases such as advanced robotics, predictive maintenance, and asset monitoring. The growth of autonomous systems and robotics also drives adoption, addressing labor shortages and increasing operational accuracy. Increasing investments in IoT-enabled cybersecurity solutions help mitigate risks, build trust, and accelerate industrial IoT market growth.

Key Industrial IoT Market Insights Summary:

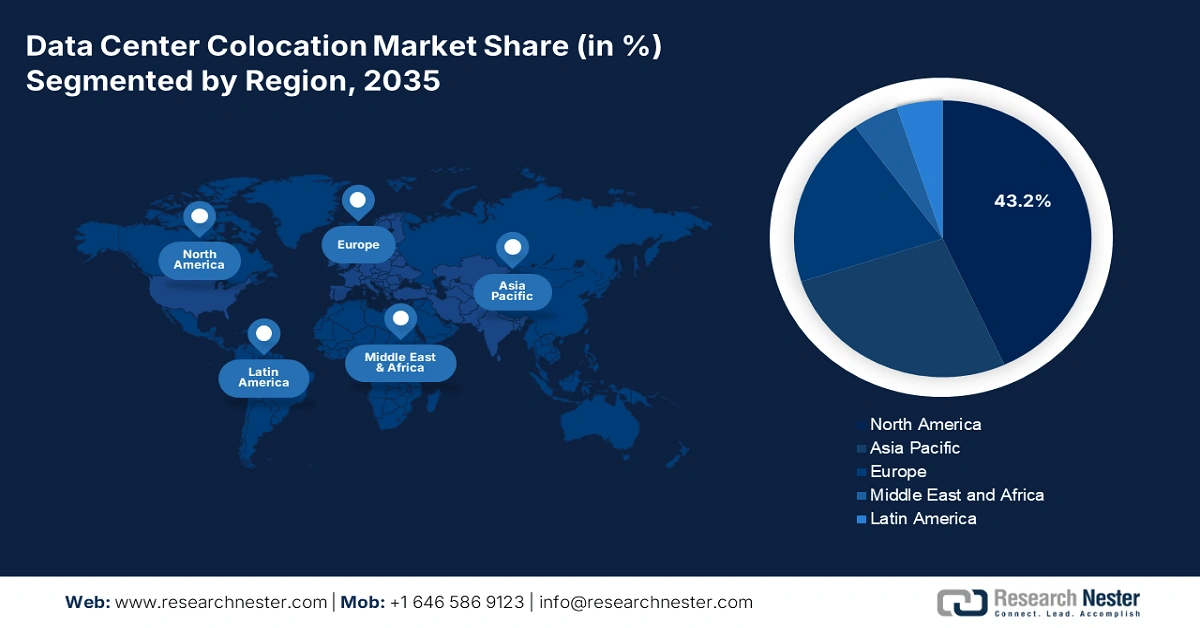

Regional Highlights:

- North America industrial IoT market is poised to capture 36.70% share by 2035, driven by industries such as manufacturing, oil and gas, and automotive leveraging industrial IoT for efficiency, predictive maintenance, and sustainability.

- Asia Pacific market will exhibit the fastest growth during the forecast timeline, driven by rapid industrialization, urbanization, and digital transformation, along with government initiatives like smart factories.

Segment Insights:

- The solution segment in the industrial iot market is anticipated to achieve a 56.10% share by 2035, fueled by the integration of hardware, software, and analytics for end-to-end IoT functionality.

- The manufacturing segment in the industrial iot market is poised for considerable growth over 2026-2035, attributed to early adoption of Industry 4.0 and government-backed smart factory initiatives.

Key Growth Trends:

- Advancements in Connectivity and Technologies

- Increasing focus on automation and smart manufacturing

Major Challenges:

- Interoperability and standardization issues

Key Players: Honeywell International Inc., International Business Machines (IBM) Corporation, Microsoft Corporation, Rockwell Automation, Inc..

Global Industrial IoT Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 276.6 billion

- 2026 Market Size: USD 309.71 billion

- Projected Market Size: USD 964.16 billion by 2035

- Growth Forecasts: 13.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 8 September, 2025

Industrial IoT Market Growth Drivers and Challenges:

Growth Drivers

-

Advancements in Connectivity and Technologies: the rapid development of technologies such as 5G, edge computing, AI, and machine learning is a key driver for the industrial IoT market. High-speed and low-latency networks enable real-time data transfer, while AI-powered analytics enhance decision-making and predictive maintenance. Edge computing reduces dependence on centralized systems, allowing for faster data processing and improved operational efficiency. These advancements are making industrial IoT solutions more reliable, scalable, and accessible to industries across the globe. For instance, in July 2024, Cisco and Rockwell Automation collaborated to boost the digital transformation of the Asia Pacific industrial IoT market, including Japan and the Greater China region.

- Increasing focus on automation and smart manufacturing: The global shift toward Industry 4.0 and smart manufacturing is another major growth driver. Industries are leveraging IIoT to automate processes, optimize supply chains, and improve production efficiency. The demand for predictive maintenance, energy management, and real-time monitoring systems is growing as companies aim to reduce operational costs and enhance productivity. For instance, in November 2021, ABB launched ABB AbilitySmart Melt Shop, the first smart factory digital application of its kind for the metals industry, to enhance productivity, save energy, and improve employee safety.

Challenges

-

Data privacy concerns: It is one of the biggest challenges in the global industrial IoT market. As IIoT systems involve extensive connectivity between devices, sensors, and networks, they become more vulnerable to cyberattacks, data breaches, and ransomware. The lack of standardized security protocols across industries exacerbates the issue, leaving critical infrastructure at risk. Additionally, compliance with global data privacy regulations, such as GDPR and industry-specific laws, further complicates security implementation, creating barriers to wider industrial IoT adoption.

- Interoperability and standardization issues: This remains a significant challenge due to the diverse range of devices, platforms, and communication protocols used in IIoT ecosystems. Manufacturers often adopt proprietary systems that are not compatible with others, leading to fragmented ecosystems and inefficient operations. This lack of standardization hinders scalability and the seamless exchange of data, limiting the ability of industries to fully leverage the benefits of industrial IoT technologies.

Industrial IoT Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.3% |

|

Base Year Market Size (2025) |

USD 276.6 billion |

|

Forecast Year Market Size (2035) |

USD 964.16 billion |

|

Regional Scope |

|

Industrial IoT Market Segmentation:

Component Segment Analysis

Based on component, the solution segment is poised to account for industrial IoT market share of more than 56.1% by the end of 2035. Solutions offer integrated platforms that combine hardware, software, and analytics to deliver end-to-end functionality. It further encompasses predictive maintenance systems, digital twins, and real-time monitoring platforms that optimize industrial processes. Moreover, the increasing focus on interoperability and seamless connectivity has made solutions more attractive, as they provide comprehensive frameworks for managing IoT ecosystems. For instance, in April 2024, ABB, Capgemini, Microsoft, Rockwell Automation, Schneider Electric, and Siemens announced a collaboration for a new initiative to deliver interoperability for Industrial IoT ecosystems.

End use Segment Analysis

Based on end use, the manufacturing segment is projected to register considerable growth in the industrial IoT market by 2035. The segment’s early adoption of advanced technologies such as smart factories and industry 4.0, supported by government initiatives ensures that manufacturing remains at the forefront of IIoT innovation. In June 2023, ABB Measurement & Analytics China Technology Center and E Surfing IoT announced a collaboration to unveil a joint digitalization and industrial IoT lab. It is intended to support manufacturing industries with end-to-end industrial IoT solutions that help with real-time, data-driven decisions for safer, smarter, and more sustainable operations.

Our in-depth analysis of the market includes the following segments:

|

Component |

|

|

End Use |

|

|

Software |

|

|

Connectivity Technology |

|

|

Device and Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial IoT Market Regional Analysis:

North America Market Insights

North America industry is poised to dominate majority revenue share of 36.7% by 2035. Industries such as manufacturing, oil and gas, and automotive leverage industrial IoT for efficiency, predictive maintenance, and sustainability. An established industrial base and significant investments in innovation also drive the market significantly. In February 2022, Lantronix Inc. launched its application-specific industrial IoT solutions to address concerns in Industry 4.0, Security, and Transport markets with its G520 Series Smart cellular IoT devices and services.

U.S. dominates the North America industrial IoT market owing to early adoption of cutting-edge technologies. Industries such as aerospace, automotive, and manufacturing utilize industrial IoT for real-time monitoring, automation, and operational optimization. Additionally, the strong presence of global technology leaders and an innovation-driven economy make the U.S. a hub for IIoT advancements.

Canada industrial IoT market is growing steadily with several collaborative approaches, including public-private partnerships, ensuring a robust IIoT adoption across key sectors. Government programs, including the Innovation Superclusters program, draw funding and foster collaboration to boost industries' digital transformation. As per Budget 2022, USD 750 million was earmarked for Canada's Global Innovation Clusters, for over five years. So far, the local government has invested USD 2 billion in the Global Innovation Clusters to strengthen their ecosystems and position Canada for global markets.

APAC Market Insights

APAC industrial IoT market is anticipated to grow at the fastest rate during the forecast period. The market is majorly driven by rapid industrialization, urbanization, and digital transformation. Governments in the region actively promote initiatives such as smart factories and digital economies, further accelerating IIoT adoption. In March 2024, Rockwell Automation announced the launch of the Customer Experience Centre (CEC) in Singapore, intending to help the region’s manufacturing, mining, and heavy industry sectors embrace digital transformation.

China is a leader in the industrial IoT market supported by the Made in China 2025 initiative which emphasizes smart manufacturing and technological self-reliance. The country’s manufacturing dominance and robust investments in AI, robotics, and 5G connectivity drive the adoption of IIoT across industries. As a global hub for innovation and manufacturing, the country’s market continues to expand rapidly, shaping the region’s technological landscape.

India industrial IoT market is gaining momentum, fueled by the government’s Digital India, and Make in India initiatives. Rising investments in smart factories and automation, coupled with the deployment of 5G, are key growth drivers. Additionally, the push for sustainability and energy efficiency is prompting industries to adopt industrial IoT technologies, making India a rapidly emerging player in the global market.

Industrial IoT Market Players:

- ABB Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ARM Holding Plc

- Atmel Corporation

- General Electric Company (GE)

- Honeywell International Inc.

- International Business Machines (IBM) Corporation

- Microsoft Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Intel Corporation

- Qualcomm

Companies in the industrial IoT market are emphasizing customization and scalability to cater to diverse industry needs. Many focus on strategic partnerships and collaborations, and geographical expansion to accelerate adoption and expand market presence. For instance, in December 2018, General Electric (GE) established a new, independent company for Industrial Internet of Things (IIoT) software with USD 1.2 billion in annual software revenue and an existing global industrial customer base. Some of the prominent market players are:

Recent Developments

- In October 2024, Qualcomm Technologies, Inc. a new product portfolio for the IoT, the Qualcomm IQ series, at Embedded World North America, developed for the most challenging safety-grade operating environments that extreme industrial applications with wide temperature ranges and integrated safety features demand.

- In March 2023, Rockwell Automation launched FactoryTalk Optix which is a modern, cloud-enabled HMI platform, allowing users to design, test, and deploy applications directly from a web browser anywhere, anytime.

- In February 2021, Siemens, IBM, and Red Hat announced a collaboration intending to use a hybrid cloud that is designed to bring an open, flexible, and secure solution for manufacturers and plant operators to drive real-time value from operational data.

- Report ID: 2145

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial IoT Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.