Industrial Heat Pump Market Outlook:

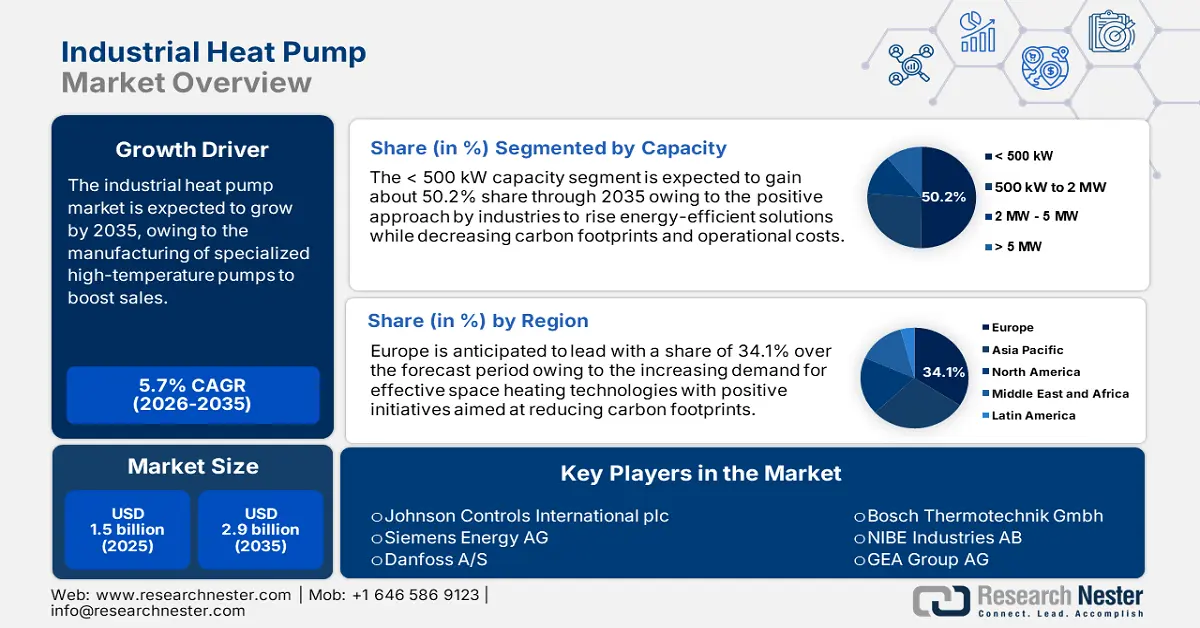

Industrial Heat Pump Market size was valued at USD 10.55 billion in 2025 and is likely to cross USD 20.56 billion by 2035, expanding at more than 6.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of industrial heat pump is estimated at USD 11.21 billion.

The expansion of infrastructure and rapid urbanization particularly in developing countries are catalyzing the demand for heat pumps. According to a 2023 report by the United Nations Development Programme (UNDP), the increasing construction of cities and the growth of new commercial and residential structures drive the need for contemporary energy-saving heating and cooling options in China. Heat pumps are gaining attention in construction for their eco-friendliness, effectiveness, and flexibility. The increasing construction of smart cities and green buildings are encouraging the adoption of heat pumps which are essential in achieving energy efficiency and reducing the environmental impacts of urban infrastructure.

Constant advancement in technology has resulted in improved efficiency, cost-effectiveness, and reliability of such appliances. New refrigerants with low global warming potential are being advanced to ensure greater gains while operating in an ecologically safe way. The incorporation of developed control systems is a significant trend. As a result, these developments in industrial heat pumps are gaining more recognition as economically attractive and environmentally safe tools for heating and cooling in the industrial context. For example, in May 2024, Midea announced the EVOX G3 heat pump system which consists of advanced technologies such as enhanced vapor injection and low GWP refrigerant R454B, intended for effective heating in colder regions.

Key Industrial Heat Pump Market Insights Summary:

Regional Highlights:

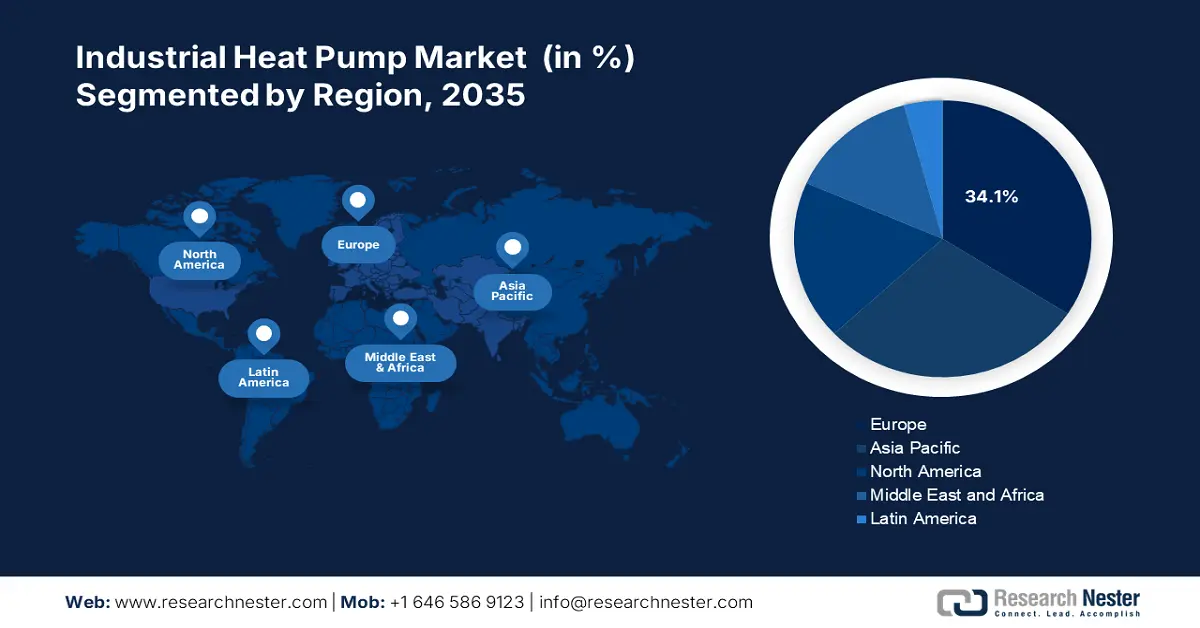

- Europe's 34.1% share in the Industrial Heat Pump Market is propelled by government initiatives and investments promoting sustainable heating technologies, ensuring strong growth through 2026–2035.

- Asia Pacific's Industrial Heat Pump Market is expected to see stable growth through 2026–2035, driven by availability of skilled labor, government regulations, and adoption of heat pumps in industrial sectors.

Segment Insights:

- The Air Source Heat Pump segment is anticipated to exceed 64.2% market share by 2035, driven by rising demand in food & beverage, petroleum, and chemical industries due to its efficiency and carbon neutrality.

- The < 500 kW Capacity segment is projected to reach around 50.2% share by 2035, influenced by demand for energy-efficient, cost-saving heating solutions in power plants and industries.

Key Growth Trends:

- Regulatory framework encouraged by governments and respective authorities

- Manufacturing of specialized high-temperature pumps to boost sales

Major Challenges:

- Climate and geographical restrictions

- Substantial investment essential for installing heat pump systems

- Key Players: Johnson Controls International plc, Siemens Energy AG, Danfoss A/S, Bosch Thermotechnik Gmbh and NIBE Industries AB, and GEA Group AG.

Global Industrial Heat Pump Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.55 billion

- 2026 Market Size: USD 11.21 billion

- Projected Market Size: USD 20.56 billion by 2035

- Growth Forecasts: 6.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (34.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, China, United States, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 14 August, 2025

Industrial Heat Pump Market Growth Drivers and Challenges:

Growth Drivers

- Regulatory framework encouraged by governments and respective authorities: Government regulations and incentives provide widespread use of industrial heat pumps. These stringent regulations regarding energy efficiency standards decrease greenhouse gas emissions and promote sustainable energy. Regulations consist of incentives such as funds, tax breaks, and subsidies for industries that may use heat pumps. The government also offers initiatives to promote some goals such as the usage of renewable energy and the decline of carbon footprints both lead to the usage of heat pumps.

- Manufacturing of specialized high-temperature pumps to boost sales: Rising worldwide emphasis on sustainability and energy efficiency offers a significant opportunity for the production and innovation of specialized high-temperature pumps that are personalized for industrial applications. These pumps are capable of functioning at temperatures beyond 100°C which are suitable for several industrial processes such as food processing, chemical manufacturing, and mental treatment. Developed pumps are in line with the increasing demand for eco-friendly industrial solutions while providing lucrative industries for technology providers and manufacturers. For example, in September 2024, Clivet introduced its water-cooled multipurpose heat pump, which permits the simultaneous production of hot water at up to 55 C and chilled water. The use of non-flammable R513A refrigerant guarantees a decreased environmental impact and provides ease of installation in technical rooms.

- Rapid industrialization: Increasing industrialization with a growing population gives rise to massive energy consumption worldwide. According to the U.S. Energy Information Administration (EIA), a housing energy consumption survey studied cooling, heating, and ventilation reported half of the total house energy consumption. In 2020, natural gas accounted for 58% of homes, and petroleum including heating oil, liquefied petroleum gas (LPG), and kerosene, which is generally propane accounted for 8% of total residential sector energy end-use, while electricity accounts for 44%. Therefore, the growing demand for energy-efficient solutions and rising carbon footprints across the globe are projected to drive market growth during the forecast period.

Challenges

- Climate and geographical restrictions: In colder regions such as Canada and Northern Europe where extremely low temperatures decrease the efficiency of air-source heat pumps occasionally requiring supplementary heating sources to maintain chosen temperatures which surges operating costs. Moreover, high humidity environments such as coastal regions can lead to operational challenges such as frost build-up which demands frequent defrost cycles and decreases efficiency.

- Substantial investment essential for installing heat pump systems: The initial investment required for installing industrial heat pump systems offers a significant challenge to market growth. while these systems provide environmental benefits and long-term energy savings their upfront costs are particularly higher than traditional heating solutions. Moreover, the complexity of integrating heat pumps into present industrial processes can further surge installation costs while making the financial viability less attractive despite potential long-term savings. This financial barrier highlights the need for incentives and supportive policies to boost the broader adoption of industrial heat pumps.

Industrial Heat Pump Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 10.55 billion |

|

Forecast Year Market Size (2035) |

USD 20.56 billion |

|

Regional Scope |

|

Industrial Heat Pump Market Segmentation:

Product (Air Source, Ground Source, Water Source, Closed Cycle Mechanical Heat Pump, Open Cycle Mechanical Vapor Compression Heat Pump, Open Cycle Mechanical Thermocompression Heat Pump, Closed Cycle absorption Heat Pump)

Air source heat pump segment is set to capture over 64.2% industrial heat pump market share by 2035. Heat pumps are used in several industrial processes such as evaporation processes, distillation, dehumidification, and water heating or cooling applications. Also, these products can achieve carbon neutrality and enhance comfort as well as efficiency. Food & beverage, petroleum, and chemical are key end-use sectors of industrial heat pumps that are projected to drive market growth. For example, in February 2024, Ingersoll Rand acquired Friulair to broaden its air treatment expertise, strengthen its presence in the food and beverage (F&B), and pharmaceutical industries, and present new chiller and heat pump technologies.

Capacity (< 500 kW, 500 kW to 2 MW, 2 MW - 5 MW, > 5 MW)

By the end of 2035, < 500 kW segment is estimated to dominate around 50.2% industrial heat pump market share, owing to the growing demand for these pumps in power plants and several other heavy industries. This dominance is due to a positive approach by industries to increase energy-efficient solutions while decreasing carbon footprints and operational costs. Additionally, a growing technological development across various industries including chemical processing, manufacturing, paper & pulp, and food & beverage are others to meet their precise heating and cooling needs that will foster the industry.

Our in-depth analysis of the global industrial heat pump market includes the following segments:

|

Product |

|

|

Capacity |

|

|

Temperature |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Heat Pump Market Regional Analysis:

Europe Market Analysis

Europe industry is poised to dominate majority revenue share of 34.1% by 2035. Moreover, several government initiatives and investments are promoting the usage of sustainable heating technologies. According to European Commission in 2020, the economic potential of geothermal power comprising improved geothermal systems was projected to increase from 19 GWe in 2020, to 522 GWe in 2050. Geothermal energy has several applications including district agriculture, heating, and industrial processes. With two million systems installed, ground source heat pumps are the most extensively adopted technologies for geothermal energy usage in the EU.

UK is projected to witness a considerable rise in the regional market. The local government has made ambitious targets to grow heat pump installation from 55ooo yearly in 2021 to 600,000 by 2028, with a plan to produce at least 300,000 units domestically every year by that time period. This commitment is supported by significant investment including up to 12 billion euros (USD 12.7 billion) which are allocated for low-carbon heating solutions and energy efficiency. Such factors are expected to boost the country’s market development during the forecast period.

Germany is also anticipated to garner a substantial share during the forecast period. The local government provides subsidies covering up to 70% of the installation costs for heat pumps with a standard subsidy of 30% and more incentives for replacing fossil-based boilers. These incentives coupled with rising awareness of environmental sustainability are boosting the adoption of industrial heat pumps across multiple sectors contributing to the country's efforts to decrease greenhouse gas emissions and change towards renewable energy sources.

Asia Pacific Market Analysis

Asia Pacific is expected to experience a stable CAGR during the forecast period due to the availability of large skilled labor at low cost. Also, government regulations and initiatives encouraging the adoption of heat pumps in the industrial sector are driving the market growth. The increasing trend of shifting production base to developing economies, particularly China and India are projected to influence market growth throughout the forecast period. Energy-saving solutions are predicted to gain high prominence in countries such as China, Indonesia, Japan, and India.

The local government in China has set targets to peak carbon emissions by 20230 and attain carbon neutrality by 2060, which has encouraged industries to adopt low-carbon technologies with industrial heat pumps. To support this China has implemented several initiatives and policies such as subsidies for energy-efficient equipment and tax breaks for companies that decrease carbon footprints. China industrial heat pump market is now all set for sustainable growth.

Japan, known for its technological developments and growth in the industrial heat pump market, is expected to witness considerable growth. The country works to decrease its reliance on fossil fuels and cut emissions. In January 2023, according to the World Economic Forum, Japan set a target to accomplish carbon neutrality by 2050, which includes a strong focus on adopting energy-efficient technologies across various industrial sectors. Additionally, Japan emphasizes integrating industrial heat pumps with renewable energy sources such as geothermal and solar energy to create a robust market for industrial heat pump that aligns with countries environmental goals.

Key Industrial Heat Pump Market Players:

- Johnson Controls International plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens Energy AG

- Danfoss A/S

- Bosch Thermotechnik Gmbh

- NIBE Industries AB

- GEA Group AG

Top players such as Johnson Controls International plc, Daikin Industries, Ltd., and Mitsubishi Heavy Industries, Ltd. in the industrial heat pump market are driven by some key factors including service & support, technological innovation, customized solutions, and many others. Top Industrial Heat Pump Market players are also capitalizing on research and development to progress the performance and efficiency of their products. Here are some leading players in the industrial heat pump market:

Recent Developments

- In October 2024, Copeland, a provider of sustainable climate solutions, launched the Vilter VQ95 industrial heat pump to help customers decrease their carbon footprints. Its innovative Vilter VQ95 heat pump is a single-stage heat pump created to decarbonize industrial process heating and district heating applications while including food and beverage production.

- In July 2024, Danfoss launched a new compressor for comfort and industrial heat pumps. It is ideal for large-capacity heat pumps, the 6-cylinder semi-hermetic BOCK HGX56 CO2 T provides an efficient alternative to synthetic and ammonia refrigerants.

- Report ID: 6686

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial Heat Pump Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.