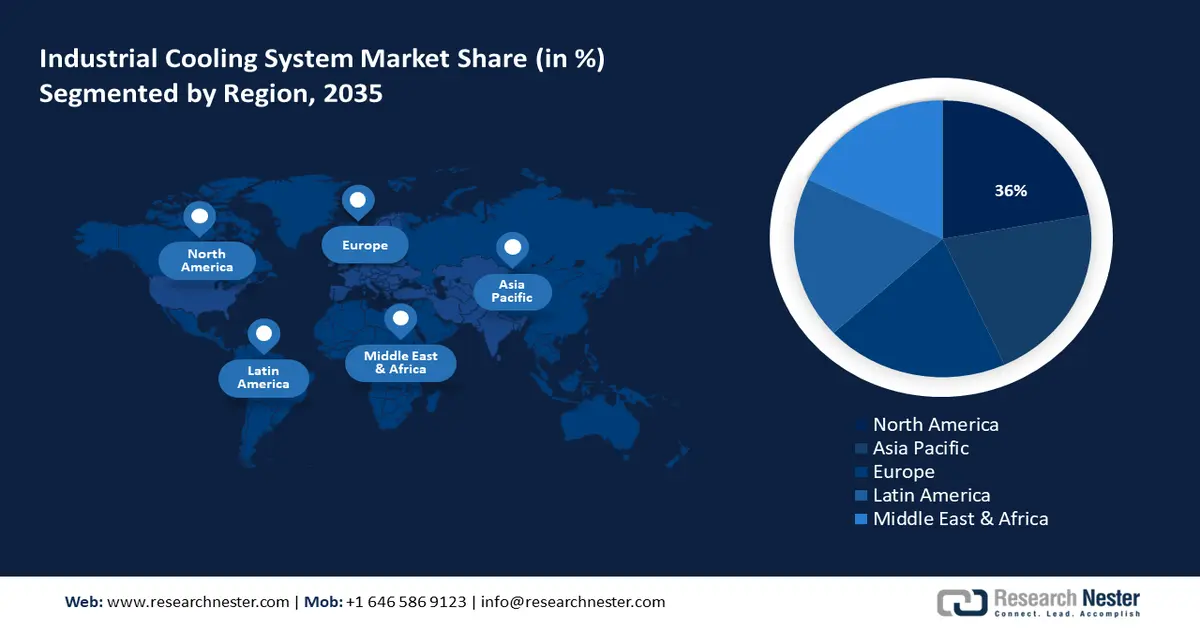

Industrial Cooling System Market Regional Analysis:

North America Market Forecast

North America industry is predicted to account for largest revenue share of 36% by 2035. The market’s growth in the region is attributed to the rising adoption of cold chain logistics driving demand for industrial cooling systems. The rapid growth of data centers is poised to create a steady demand for industrial cooler systems in the region to manage heat generated by large-scale servers. For instance, in July 2024, Airedale by Modine launched the Cooling System Optimizer as a sustainable and secure cooling solution in the U.S. for data centers. The market in North America is positioned to increase its revenue share by the end of the forecast period by leveraging burgeoning demands for sustainable cooling solutions.

The U.S. leads the revenue share in the industrial cooling system market of North America. The market’s growth in the U.S. is attributed to growing demands from the manufacturing sector and data centers. For instance, in October 2024, Advanced Cooling Technologies was poised to receive a USD 1.1 million grant through two subcontracts with the U.S. Department of Energy’s Advanced Research Projects Agency-Energy to manufacture energy-efficient cooling systems for data centers.

Canada is projected to increase its revenue share in the industrial cooling system market during the forecast period. The market’s growth in Canada is owed to rising demands from the energy, manufacturing, and mining sectors. Growing calls for sustainable solutions have prompted companies to invest in energy-conserving cooling systems. For instance, in October 2023, Amaresco and Schaeffler Aerospace Canada Inc. announced a collaboration for clean cooling and decarbonization project. Additionally, data centers are expanding in Canada, creating new opportunities for manufacturers to supply advanced cooling solutions.

APAC Market Analysis

The Asia Pacific industrial cooling system market is poised to register the fastest growth during the forecast period. The market’s growth in the region is attributed to the expanding manufacturing sector driving demands for industrial cooling systems. For instance, in September 2024, Hanhwa Aerospace and SK Enmove launched immersion cooling ESS for lithium-ion battery modules. The rapid urbanization in APAC has boosted industrialization across emerging economies, opening profitable opportunities in the regional market. Additionally, APAC is experiencing growth in data centers owing to increased internet usage and cloud services boosting demands for advanced cooling solutions.

China is projected to register a major revenue share in the industrial cooling system market of APAC. The growth of the market in China is owed to the country’s position as a global manufacturing leader. Significant state-led industrial policies such as Made in China 2025, boost domestic companies to compete globally and domestically, empowering the business landscape in the nation. The trends are poised to drive demands in the high-tech manufacturing sector of China for advanced cooling solutions for precise temperature control. Additionally, the rapid growth of 5G, data centers, and solar power projects is positioned to create a steady demand for industrial cooling systems. For instance, in October 2024, Jinko Solar delivered 123 MWh of liquid cooling utility-scale BESS to Yitong New Energy.

India is projected to increase its revenue share in the industrial cooling system market of APAC. The growth is attributed to rapid industrialization and increasing energy demands across various sectors. The hot and humid climate of India necessitates cooling solutions for industries to maintain equipment longevity. Domestic cooling solutions suppliers are set to benefit from the Make in India initiative that provides incentives to domestic manufacturers. Additionally, global companies are leveraging the opportunities in the domestic market by investing in industrial-scale chillers to cater to rising demands. For instance, in November 2024, Mitsubishi Electric announced the decision to invest USD 4.8 million to open an industrial chiller facility in Karnataka, India.