Industrial Cooling System Market Outlook:

Industrial Cooling System Market size was over USD 23.07 billion in 2025 and is poised to exceed USD 41.71 billion by 2035, growing at over 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of industrial cooling system is evaluated at USD 24.34 billion.

The industrial cooling system market’s growth is attributed to an increasing focus on energy-efficient solutions and a rapid rise in industrialization. The growth of sectors such as power generation, manufacturing, food processing, and data centers, drives demand for industrial cooling systems that assist equipment performance, downtime reduction, and operational safety. Additionally, the global increase in meat exports and the dairy industry is poised to drive demands for industrial cooling systems.

In 2023, a report published in Our World in Data estimated that global meat production and consumption have increased over the past 50 years with Asia Pacific being the largest meat-producing region globally. The trends benefit the industrial cooling system market as an increase in meat consumption correlates with the expansion of meat processing facilities that require cooling systems to maintain food safety and quality. For instance, in September 2024, Wycliff Douglas Provisions (WDP) announced a major expansion at its facility in Mesquite, Texas, by adding another 25,000 square feet to the meat processing facility. The global food supply chain drives demand for efficient cold storage and transportation solutions to ensure that meat products reach the designated market in optimal conditions driving the need for industrial cooling systems. Additionally, rising demands for energy-efficient solutions are poised to increase investments in cooling systems to reduce operational costs for businesses.

The global industrial cooling system market is positioned to benefit from the rapid growth of data centers that require industrial cooling systems. The adoption of advanced cooling systems presents opportunities for manufacturers to introduce environment-friendly cooling solutions, such as hybrid cooling systems that can combine multiple cooling methods to improve efficiency. The burgeoning demand for sustainable solutions creates opportunities within the market to manufacture advanced cooling solutions that align with green initiatives. For instance, in October 2024, Hewlett Packard Enterprise introduced a 100% fan-less direct liquid cooling systems architecture to cool next-generation AI systems. The global market is poised to leverage the favorable trends as digital transformation is likely to spur further demands and continue its profitable growth curve by the end of the forecast period.

Key Industrial Cooling System Market Insights Summary:

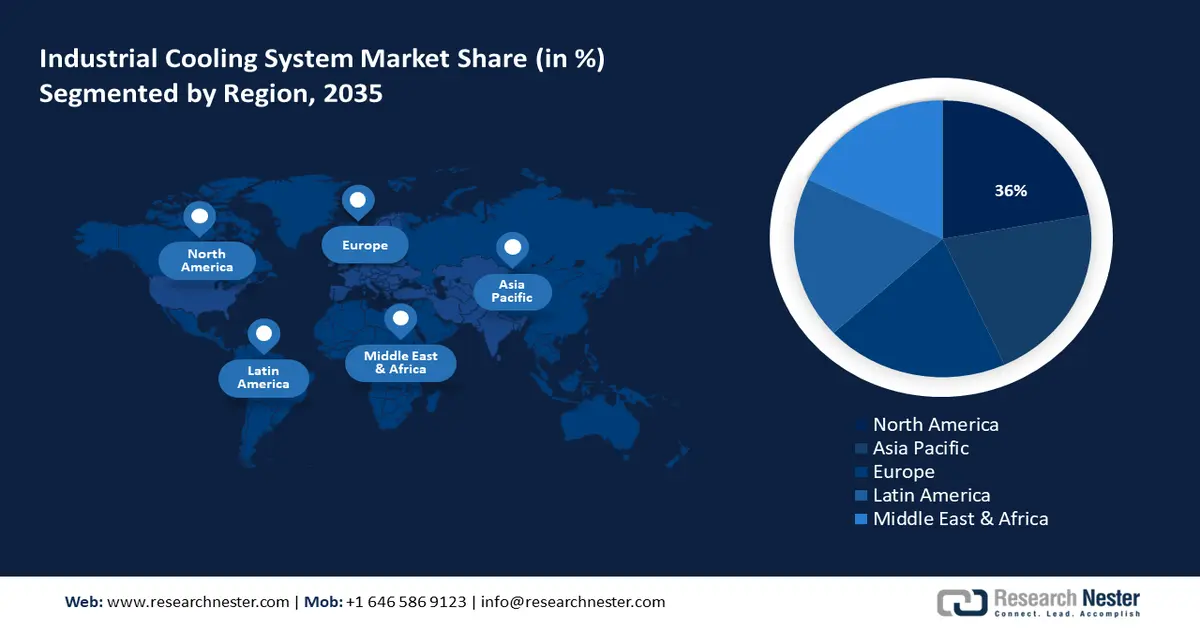

Regional Highlights:

- North America dominates the Industrial Cooling System Market with a 36% share, driven by cold chain logistics and data center demand, bolstering growth through 2026–2035.

- The Asia Pacific industrial cooling system market is projected to grow rapidly through 2035, driven by expanding manufacturing and data center industries.

Segment Insights:

- Evaporative Cooling segment is projected to hold a 42.9% share by 2035, driven by rising demand for sustainable and energy-efficient cooling solutions.

Key Growth Trends:

- Rapid urbanization and industrial expansion

- Rising demands for food safety

Major Challenges:

- Issues related to water scarcity

- Fluctuating energy prices

- Key Players: Airedale International Air Conditioning, Baltimore Aircoil, Schneider Electric, SPX Corporation, Vertiv, Asetek, Rittal, EVAPCO, Black Box Corporation, Coolcentric, Emerson Electric.

Global Industrial Cooling System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 23.07 billion

- 2026 Market Size: USD 24.34 billion

- Projected Market Size: USD 41.71 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Industrial Cooling System Market Growth Drivers and Challenges:

Growth Drivers

-

Rapid urbanization and industrial expansion: Rapid urbanization has prompted large-scale industrial expansion that necessitates industrial cooling systems. The global industrial cooling system is positioned to benefit from growing demands from various industrial sectors for robust cooling solutions. For instance, the United Nations estimates that 68% of the world’s population to live in urban areas by 2050. Industries such as steel, petrochemical, manufacturing, etc., rely on cooling systems to stabilize the temperature of heavy-duty machinery.

Additionally, the growth of smart cities is poised to boost demands for cooling solutions in energy plants and construction sites. Manufacturers are poised to find opportunities in demand for specialized cooling systems that are tailored to handle large thermal loads, assisting the continued growth of the global market. - Rising demands for food safety: Growing scrutiny of the food and beverage industry’s standards of food safety drives demands for cooling solutions. The global industrial cooling system market is poised to benefit from growing demands for cooling solutions to preserve perishable products while aligning with health standards. The rapid urbanization drives demand for processed and frozen foods, leading to rising investments in cold storage facilities. Businesses can maintain their edge in the global market by investing in cooling solutions that can effectively meet peak cooling loads.

Additionally, a key driver of the global market is the growth of the dairy products sector evidenced by growing partnerships between businesses. For instance, in April 2024, Delaval announced a partnership with a leading milk cooling tank manufacturing business, Serap where the latter will take over Delaval’s milk cooling tanks on a global scale. - Increase in data centers: A significant growth driver of the industrial cooling system market is the rising prevalence of data centers globally. The digital transformation fueled by industry 4.0 initiatives is driving demands for cooling systems in data center operations. The centers are sensitive to heat and require advanced cooling systems such as liquid immersion cooling to maintain stability. For instance, in October 2024, AAON was awarded liquid cooling data center orders worth USD 174.5 million to provide a custom-designed thermal management system. Advanced HVAC systems are essential to maintain operations in data centers, creating profitable opportunities within the global industrial cooling system market to provide solutions.

Challenges

-

Issues related to water scarcity: Industrial cooling systems can face challenges related to water scarcity. Evaporative cooling methods rely on water to dissipate heat and in regions that face water scarcity, industries may face challenges in cooling solutions. Alternative cooling solutions can increase operational costs posing additional challenges to the sector. Additionally, the global industrial cooling system market’s growth can be stymied by climate concerns.

-

Fluctuating energy prices: Industrial cooling systems are energy-intensive and fluctuations in global energy prices can impact operational costs. Sectors that require large-scale cooling stand to be affected by rising energy prices. Such trends can stymie the growth of the industrial cooling system sector by discouraging industries from investing in upgraded cooling systems as businesses may prioritize short-term cost savings over long-term gains.

Industrial Cooling System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 23.07 billion |

|

Forecast Year Market Size (2035) |

USD 41.71 billion |

|

Regional Scope |

|

Industrial Cooling System Market Segmentation:

Product (Evaporative Cooling, Air Cooling, Water Cooling, and Hybrid Cooling)

By 2035, evaporative cooling segment is anticipated to dominate over 42.9% industrial cooling system market share. The segment’s growth is attributed to rising demand for sustainable and energy-efficient cooling solutions. Evaporative cooling uses water to absorb and dissipate heat and is a cost-effective solution compared to traditional cooling methods, increasing its adoption. The growing adoption is a major driver of the segment. Businesses can leverage the growing opportunities in this segment by providing advanced cooling towers for industries. For instance, in November 2023, Metso Corporation launched an upgraded evaporative cooling tower, i.e., a furnace dry gas cleaning solution via evaporation.

The air-cooling segment of the global industrial cooling system market is projected to increase its revenue share during the forecast period. The segment’s growth is due to rising demands in the food and beverage sector for controlled cooling solutions. Additionally, the segment’s growth is driven by increasing calls to reduce water usage as air cooling solutions require no water. For instance, in September 2022, Novamax announced the launch of industrial air coolers that are shock-resistant and portable. Regions with water scarcity are positioned to drive demands for air cooling solutions boosting the robust growth curve by the end of the forecast period.

Application (Automotive, Chemicals, Food & Beverage, Utility & Power, Oil & Gas, Pharmaceuticals, Industrial Manufacturing, and Data Centers)

The automotive segment of the industrial cooling system market by application is positioned to increase its revenue share by the end of the forecast period. The segment’s growth is owed to rising demands for precision cooling solutions that can ensure optimal performance. The automative industry requires cooling systems to manage the heat generated by heavy machinery and other manufacturing processes such as welding. Additionally, the rise of the electric vehicles (EV) sector is positioned to drive demands for industrial cooling solutions boosting the market’s growth. For instance, in April 2024, BASF Plastics announced support for RML group to develop immersion cooling in high-speed hybrid car.

Our in-depth analysis of the industrial cooling system market includes the following segments:

|

Product |

|

|

Application |

|

|

Capacity |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Cooling System Market Regional Analysis:

North America Market Forecast

North America industry is predicted to account for largest revenue share of 36% by 2035. The market’s growth in the region is attributed to the rising adoption of cold chain logistics driving demand for industrial cooling systems. The rapid growth of data centers is poised to create a steady demand for industrial cooler systems in the region to manage heat generated by large-scale servers. For instance, in July 2024, Airedale by Modine launched the Cooling System Optimizer as a sustainable and secure cooling solution in the U.S. for data centers. The market in North America is positioned to increase its revenue share by the end of the forecast period by leveraging burgeoning demands for sustainable cooling solutions.

The U.S. leads the revenue share in the industrial cooling system market of North America. The market’s growth in the U.S. is attributed to growing demands from the manufacturing sector and data centers. For instance, in October 2024, Advanced Cooling Technologies was poised to receive a USD 1.1 million grant through two subcontracts with the U.S. Department of Energy’s Advanced Research Projects Agency-Energy to manufacture energy-efficient cooling systems for data centers.

Canada is projected to increase its revenue share in the industrial cooling system market during the forecast period. The market’s growth in Canada is owed to rising demands from the energy, manufacturing, and mining sectors. Growing calls for sustainable solutions have prompted companies to invest in energy-conserving cooling systems. For instance, in October 2023, Amaresco and Schaeffler Aerospace Canada Inc. announced a collaboration for clean cooling and decarbonization project. Additionally, data centers are expanding in Canada, creating new opportunities for manufacturers to supply advanced cooling solutions.

APAC Market Analysis

The Asia Pacific industrial cooling system market is poised to register the fastest growth during the forecast period. The market’s growth in the region is attributed to the expanding manufacturing sector driving demands for industrial cooling systems. For instance, in September 2024, Hanhwa Aerospace and SK Enmove launched immersion cooling ESS for lithium-ion battery modules. The rapid urbanization in APAC has boosted industrialization across emerging economies, opening profitable opportunities in the regional market. Additionally, APAC is experiencing growth in data centers owing to increased internet usage and cloud services boosting demands for advanced cooling solutions.

China is projected to register a major revenue share in the industrial cooling system market of APAC. The growth of the market in China is owed to the country’s position as a global manufacturing leader. Significant state-led industrial policies such as Made in China 2025, boost domestic companies to compete globally and domestically, empowering the business landscape in the nation. The trends are poised to drive demands in the high-tech manufacturing sector of China for advanced cooling solutions for precise temperature control. Additionally, the rapid growth of 5G, data centers, and solar power projects is positioned to create a steady demand for industrial cooling systems. For instance, in October 2024, Jinko Solar delivered 123 MWh of liquid cooling utility-scale BESS to Yitong New Energy.

India is projected to increase its revenue share in the industrial cooling system market of APAC. The growth is attributed to rapid industrialization and increasing energy demands across various sectors. The hot and humid climate of India necessitates cooling solutions for industries to maintain equipment longevity. Domestic cooling solutions suppliers are set to benefit from the Make in India initiative that provides incentives to domestic manufacturers. Additionally, global companies are leveraging the opportunities in the domestic market by investing in industrial-scale chillers to cater to rising demands. For instance, in November 2024, Mitsubishi Electric announced the decision to invest USD 4.8 million to open an industrial chiller facility in Karnataka, India.

Key Industrial Cooling System Market Players:

- Airedale International Air Conditioning

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Baltimore Aircoil

- Schneider Electric

- SPX Corporation

- Vertiv

- Asetek

- Rittal

- EVAPCO

- Black Box Corporation

- Coolcentric

- Emerson Electric

The global industrial cooling system market is poised to register a profitable growth curve during the forecast period. Key players in the market are investing in expanding their cooling solutions portfolio and entering emerging markets. The competitive market has domestic and international players vying to increase their revenue share in the global industrial cooling system market.

Here are some key players in the market:

Recent Developments

- In October 2024, PRO Refrigeration launched the PRO Chiller PRO4 Series. The new series is poised to support dairy farming, brewing, distilling, and more by providing customized and streamlined cooling solutions. The PRO Chiller PRO4 series premiered at the World Dairy Expo in October 2024.

- In March 2024, Schneider Electric inaugurated a new cooling factory in Bengaluru, Karnataka. The new factory will focus on developing innovative cooling solutions to meet the rising demands from the data center ecosystem in India.

- Report ID: 6697

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial Cooling System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.