Industrial Brakes and Clutches Market Outlook:

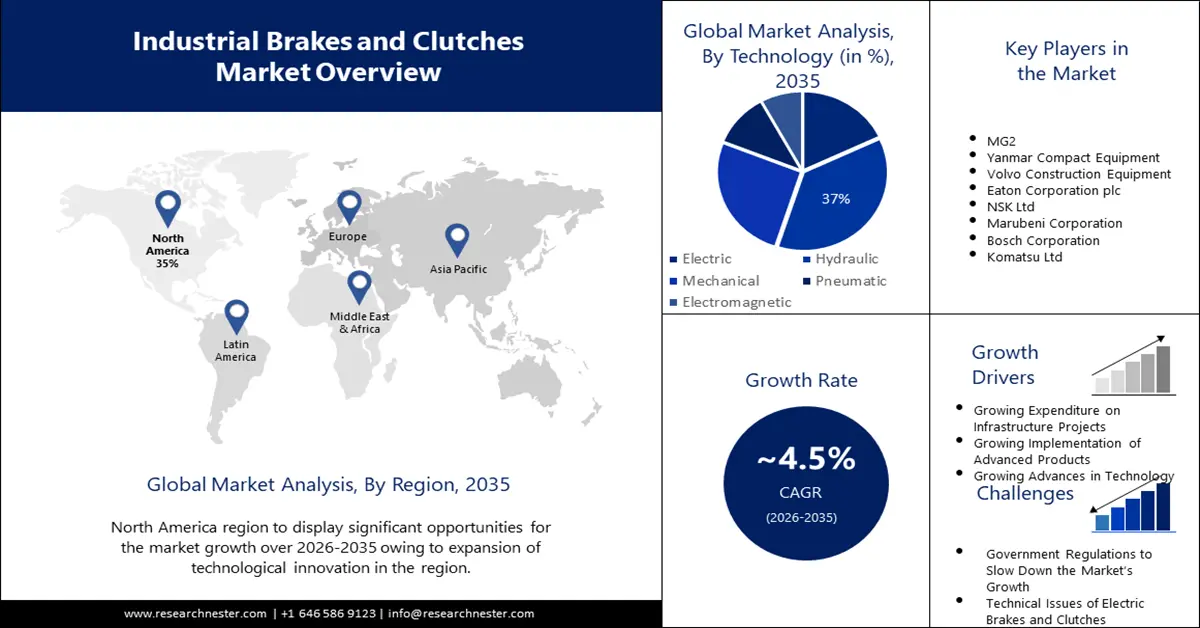

Industrial Brakes and Clutches Market size was valued at USD 1.86 billion in 2025 and is expected to reach USD 2.89 billion by 2035, expanding at around 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of industrial brakes and clutches is evaluated at USD 1.94 billion.

As industrialization and the use of heavy-duty machinery have risen, industrial brakes and clutches have developed into essential parts and have formed the basis for these heavy-duty machines. For a variety of purposes, industrial equipment needs to be correctly constructed with brakes and clutches to guarantee both safety and proper performance.

Due to the ongoing need for MRO services, the industrial brakes and clutches market is anticipated to expand gradually throughout the projected period. Since industrial equipment has a shorter working life than MRO services, OEM needs, or demand from new equipment manufacturers, are expected to expand more modestly than MRO services.

Key Industrial Brakes and Clutches Market Insights Summary:

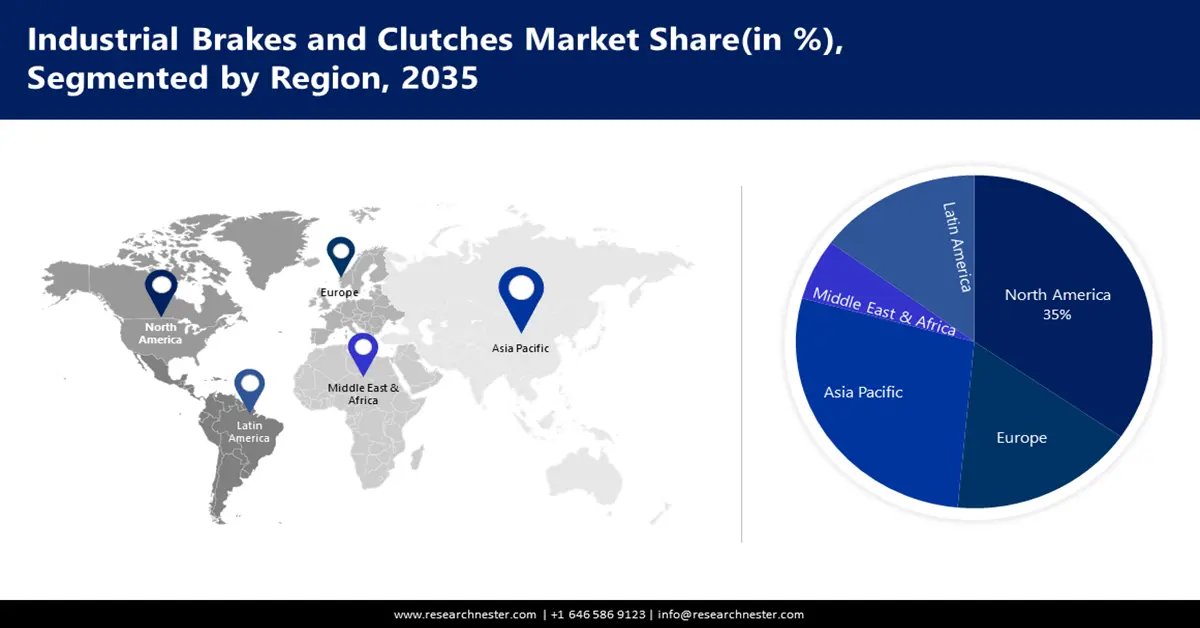

Regional Highlights:

- North America industrial brakes and clutches market achieves a 35% share by 2035, fueled by the creation of braking systems that are more dependable and efficient, boosting productivity and safety.

- Asia Pacific market will attain a 28% share by 2035, fueled by significant industrial growth and infrastructure investments requiring reliable braking systems.

Segment Insights:

- The hydraulic segment in the industrial brakes and clutches market is expected to witness robust growth through 2035, driven by advantages like better heat dissipation, braking power, and extensive usage in heavy equipment.

- The mining & metallurgy segment in the industrial brakes and clutches market is anticipated to secure a 32% share by 2035, driven by rising demand for minerals and the need for efficient braking and clutching systems.

Key Growth Trends:

- Growing Expenditure on Infrastructure Projects

- Growing Implementation of Advanced Products

Major Challenges:

- Government Regulations to Slow Down the Market’s Growth

- Technical Issues of Electric Brakes and Clutches may Hamper the Market Growth

Key Players: ZF Friedrichshafen AG, MG2, Yanmar Compact Equipment, Volvo Construction Equipment, Eaton Corporation plc, NSK Ltd, Marubeni Corporation, Bosch Corporation, Komatsu Ltd, ENEOS Holdings, Inc.

Global Industrial Brakes and Clutches Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.86 billion

- 2026 Market Size: USD 1.94 billion

- Projected Market Size: USD 2.89 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, Italy

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 16 September, 2025

Industrial Brakes and Clutches Market Growth Drivers and Challenges:

Growth Drivers

- Growing Expenditure on Infrastructure Projects – The government increased spending on infrastructure projects and increased demand for commercial and residential segments. Recently, a significant infrastructure investment plan proposed by the European Commission aims to raise USD 328.34 billion in funding for international development by 2027. China's highest legislative body approved the sale of USD 137 billion in national debt last week, and local governments are racing to prepare infrastructure projects to support building and disaster relief. Growth in construction projects is bringing more demand for construction equipment to handle larger amounts of weight. Brakes used help in letting construction equipment handle larger quantities of load. For instance, the construction of a large-scale industrial facility, like a manufacturing plant or a power plant. These projects involve the installation of various machinery, such as conveyor systems, turbines, and pumps. Again, clutches and brakes play a crucial role in controlling the movement and operation of these machines.

- Growing Implementation of Advanced Products - Throughout the projected period, a robust recovery in the industrial brakes and clutches market is anticipated due to the increased demand. The adoption of novel and inventive items, such as backstopping clutches and enhanced material brake shoes & rotors, is predicted to be the primary trend in the industrial brakes and clutches market. For instance, In industrial machine applications, the Tsubaki BR-HT (Backstop Reducer High Torque) family of backstops guards against back running. In the case of an equipment failure, the inner and outer races are locked together with zero back running thanks to the Cam Clutch design. The BR-HT series backstop is perfect for applications where a small installation footprint may be necessary, like industrial gearboxes, which are commonly used on inclined conveyors or bucket elevators, pumps, and winches. This is because the backstop can be directly placed into machinery.

- Growing Advancement in Technology – Throughout the forecast period, the market is anticipated to be driven by innovation in the manufacturing of industrial machinery due to the rapid advancements in technology. Additionally, the use of big data analytics, artificial intelligence, and 3D printing in manufacturing is increasing productivity and lowering operational costs while also increasing margins. Additionally, these devices leverage Internet of Things (IoT) apps to provide additional services and enable features like central feedback systems and remote monitoring.

Challenges

- Government Regulations to Slow Down the Market’s Growth – There are various obstacles in the way of manufacturing and distributing this product, including national prohibitions. Every nation has its industry standards and laws. These kinds of machinery are restricted in both their manufacturing and their sale. The import and export rates are regulated by the government, which occasionally affects business earnings and slows industrial brakes and clutches market expansion.

- Technical Issues of Electric Brakes and Clutches may Hamper the Market Growth

- Proper Safety of Workers and Property may Hinder the Growth of the Market

Industrial Brakes and Clutches Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 1.86 billion |

|

Forecast Year Market Size (2035) |

USD 2.89 billion |

|

Regional Scope |

|

Industrial Brakes and Clutches Market Segmentation:

Technology

Industrial brakes and clutches market for the hydraulic segment is expected to hold the largest revenue share of 37% during the forecast period. Advantages such as better heat dissipation than mechanical brakes, better braking power transmission, compact size, and ease of repair due to the ream, daily available brake parts in the aftermarket are propelling the growth of the segment. Hydraulics are simple to operate at the touch of a button since they rely on the continuous circulation of fluid rather than a rising and falling motion. A hydraulic piston's speed and range are easily adjustable by users. Furthermore, hydraulic systems find extensive usage in heavy gear, construction equipment, and industrial manufacturing operations. Their increasing popularity can be attributed to their adaptability and versatility.

End-use

Mining & metallurgy segment in industrial brakes and clutches market is expected to hold a share of 32% by the end of 2035. The demand for minerals such as iron ore, copper, gold, and aluminium is expected to rise in the coming years. This increases the demand for dependable and efficient mining and metallurgical processes, which call for strong clutching and braking systems to manage large machinery and equipment. Additionally, mining activities are extending to new locations and areas due to the increased demand for metals and minerals. As per a report, the global economy depends heavily on the mining industry. In 2022, the aggregate revenue of the top 40 mining corporations worldwide, which account for the great majority of the industry, reached a record 943 billion US dollars. For the mining equipment to remain safe and productive during this expansion, sophisticated braking and clutching systems must be implemented. Additionally, the efficiency and performance of industrial brakes and clutches have increased with the addition of cutting-edge braking and clutching technologies like electromagnetic and hydraulic systems.

Our in-depth analysis of the global industrial brakes and clutches market includes the following segments:

|

Technology |

|

|

Product Type |

|

|

Sales Channel |

|

|

End-user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Brakes and Clutches Market Regional Analysis:

North American Market Insights

North American industrial brakes and clutches market is expected to hold a share of 35% during the forecast period. The expansion of technological innovation, including the creation of braking systems that are more dependable and efficient. These developments boost productivity across a range of industries by improving performance and decreasing downtime. Additionally, industries stress the safety of their personnel and equipment, and the region has strict regulations regarding safety. Industrial clutches and brakes are essential for preserving safety because they offer exact control, holding power, and emergency-stopping capabilities. Furthermore, in North America, the importance of sustainability and energy efficiency is rising. There is a demand for industrial clutches and brakes with energy-saving features such as regenerative braking systems.

APAC Market Insights

Industrial brakes and clutches market in Asia Pacific is anticipated to grow significantly with a share of 28% by the end of 2035. The majority of rising economies, primarily powered by manufacturing, are found in Asia Pacific. The region is making significant investments in the construction of manufacturing, energy, and transportation infrastructure. Industrial clutches and brakes are necessary for these projects because they involve the use of large machinery and equipment, which is necessary to guarantee their safe and effective functioning. Significant industrial expansion is also taking place in the region, with South Korea, Japan, China, and India setting the pace. Because of this industrialization, there is a greater requirement for machinery and equipment, which in turn raises the need for industrial clutches and brakes that are dependable and effective.

Industrial Brakes and Clutches Market Players:

- ZF Friedrichshafen AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- MG2

- Yanmar Compact Equipment

- Volvo Construction Equipment

- Eaton Corporation plc

Recent Developments

- March 2023 - The Industrial Division of ZF debuted its latest brake-by-wire solutions from March 14–18 in Las Vegas at CONEXPO/CONAGG 2023. Leading the world in hydraulic and electrohydraulic braking systems, ZF provides safe and effective brake technology to clients in the heavy duty, off-highway, construction, mining, and agricultural industries.

- September 2023 - Yanmar Compact Equipment North America, which includes the ASV and Yanmar Compact Equipment brands, is getting ready to present new items at the Equip Exposition in Louisville, Kentucky on October 18–20, 2023. The TL100VS from Yanmar Compact Equipment will be on display at the stand. The equipment debuted at CONEXPO 2023 as one of four new compact track loaders. ASV will have multiple Posi-Track® loaders on display. Along with Yanmar's Rural Lifestyle branch, both brands will be present at booth 1230. Additionally, equipment for backfilling, grading, and digging will be on display at demo area booth 7632D.

- Report ID: 5565

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.