Industrial Automation Market Outlook:

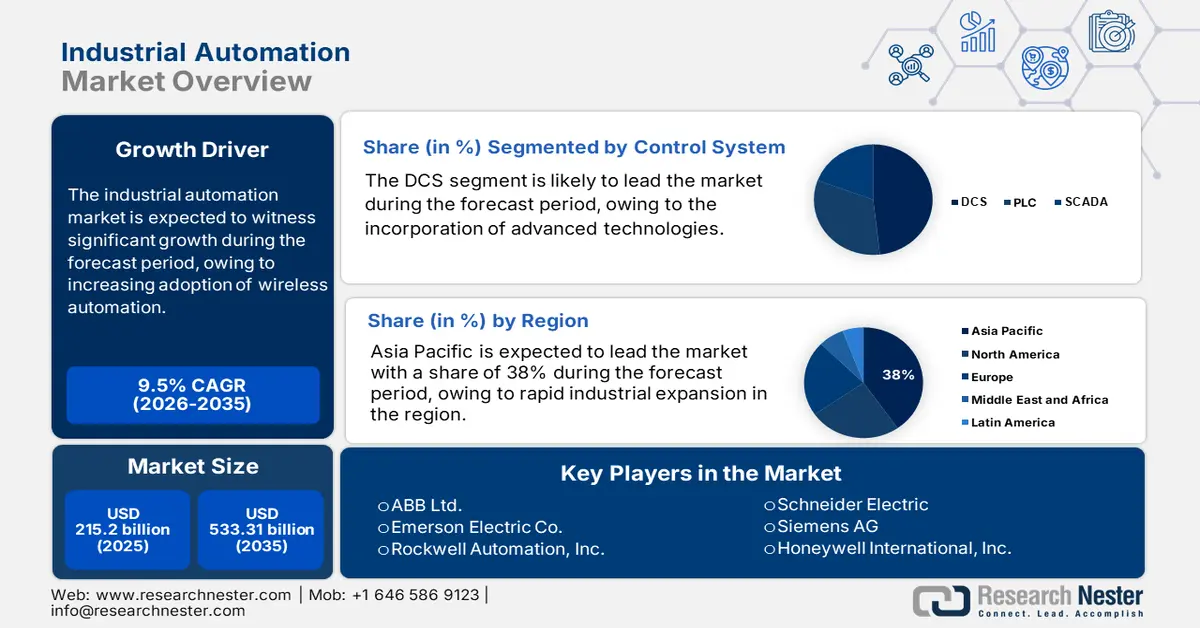

Industrial Automation Market size was valued at USD 215.2 billion in 2025 and is set to exceed USD 533.31 billion by 2035, registering over 9.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of industrial automation is estimated at USD 233.6 billion.

The reason behind the growth is the rising adoption of industrial automation across the globe to improve quality and high efficiency, leading to more options in the industrial automation landscape. According to the International Trade Administration (ITA) for the least robot adopters, productivity increased by 5.1 percent for every 1% rise in industrial robot density. Productivity and industrial robot density were positively correlated across all industries. Despite using fewer industrial robots than other industries throughout this period, the mining and quarrying sector had the most productivity growth.

Key Industrial Automation Market Insights Summary:

Regional Highlights:

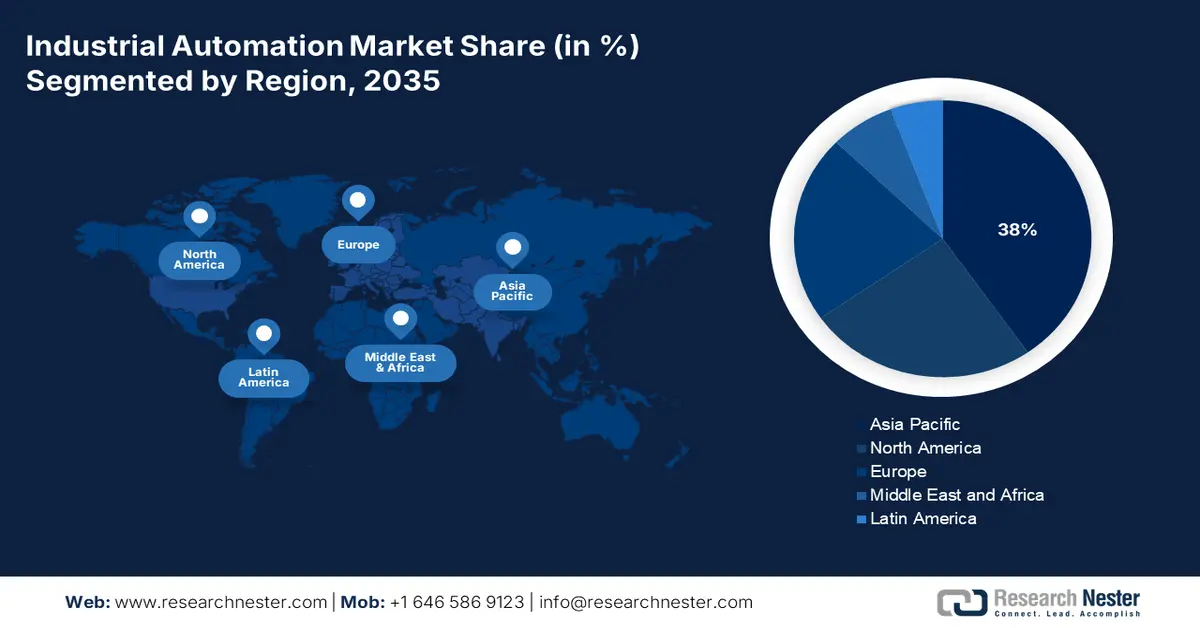

- Asia Pacific industrial automation market will dominate around 38% share by 2035, fueled by the emergence of industrial robots and large-scale industrial growth.

- Europe market will exhibit substantial CAGR during 2026-2035, attributed to rising demand from the automotive and general industries.

Segment Insights:

- The dcs segment in the industrial automation market is anticipated to achieve substantial growth till 2035, driven by rapid industrialization in emerging economies.

- The industrial robots segment in the industrial automation market is projected to achieve a 56% share by 2035, fueled by widespread use in manufacturing and efficiency in production processes.

Key Growth Trends:

- Rising demand for automation for trustworthy and qualitative manufacturing

- Rising adoption of Industry 4.0 globally

Major Challenges:

- Volatility in the end-use industry

- Shortage of competent workforce to implement industrial automation

Key Players: ABB Ltd., Emerson Electric Co., General Electric Company, Honeywell International Inc., Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Endress+Hauser Group Services AG, KUKA AG, Advantech Co., Ltd.

Global Industrial Automation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 215.2 billion

- 2026 Market Size: USD 233.6 billion

- Projected Market Size: USD 533.31 billion by 2035

- Growth Forecasts: 9.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

Industrial Automation Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for automation for trustworthy and qualitative manufacturing - The manufacturing companies to increase accuracy, optimize costs, and boost production efficiency. Automation facilitates the simple flow of information across the company's components and aids in the collection of all of its actions. In the industrial sector, automation reduces the need for human labor while enhancing accuracy, uniformity, and operational effectiveness. It also boosts output while ensuring trustworthy manufacturing.

Moreover, as stated by the International Trade Administration (ITA), the automotive and other transportation manufacturing sectors experienced a positive gain of 15.1 industrial robots per million hours worked, which was the biggest improvement in industrial robot density among all industries

- Rising adoption of Industry 4.0 globally - The industrial revolution of the 21st century is digital. Businesses, consumers, and stakeholders along the value chain may find it easier to access and transmit goods and services due to the Fourth Industrial Revolution. Therefore, companies and industries are more and more incorporating construction 4.0 in their businesses.

According to the most recent Industry 4.0 acceptance report from 2022, businesses have progressed even further. Remarkably, 72% of survey participants said they are putting their Industry 4.0/Smart Factory plans into practice, with many of them already underway and some having been finished.

- Increasing government initiatives to encourage industrial automation - Growing government programs to support industrial automation are opening up a lot of potential for the global industrial automation market. The potential advantages of automation for raising industrial sectors' competitiveness, productivity, and efficiency are being recognized by governments worldwide.

As a result, they are putting in place a number of rules and initiatives to encourage companies to use automation technology. To entice businesses to invest in automation solutions, these programs frequently take kind of tax breaks, grants, subsidies, and training courses.

Challenges

- Volatility in the end-use industry - The rising volatility in different end-use industries can impede the market expansion of industrial automation by the end of 2035. For instance, the recent reduction in global oil demand can affect the market economy. Although the extent of the global recovery is not entirely clear, statistics on oil demand and mobility indicators point to a significant slowdown in the recovery's speed and the end of the period of demand growth above the historical average.

- Shortage of competent workforce to implement industrial automation - The demand for specialized knowledge and abilities has expanded due to the automation technologies' fast progress. Because of this, employees must constantly update their knowledge, which results in a skills gap between the current workforce and the changing needs of the workforce.

Industrial Automation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.5% |

|

Base Year Market Size (2025) |

USD 215.2 billion |

|

Forecast Year Market Size (2035) |

USD 533.31 billion |

|

Regional Scope |

|

Industrial Automation Market Segmentation:

Component Segment Analysis

Industrial robots segment is estimated to hold industrial automation market share of over 56% by the end of 2035. The segment growth can be attributed to modern machinery and industrial robots that are widely used by manufacturing businesses worldwide. Currently, tools like these maximize tasks that call for strength, speed, and precision. Robotic industrial automation lowers waste from raw materials, labor needs, and energy consumption. It also guarantees a smooth and continuous workflow in the production process, all of which are factors that are anticipated to propel industry expansion.

As stated in the most recent World Robotics report, an all-time high of 517,385 new industrial robots installed in companies worldwide in 2021. This is a 31% annual growth rate and 22% more than the pre-pandemic record for robot installation in 2018. The number of active robots in the world has just reached a record high of over 3.5 million.

Control System Segment Analysis

In industrial automation market, DCS segment is set to account for revenue share of more than 65% by the end of 2035. The growth of the segment will be propelled by the quick advancement of industrialization in emerging countries. The fast-paced industrial growth in China and other Asian regions, coupled with a focus on economic development above environmental preservation, can lead to significant environmental degradation in emerging nations.

51 emerging economies make up the Economic Transformation Database (ETD): six in developed Asia, nine in Latin America, four in the MENA area, eighteen in SSA, and fourteen in developing Asia.

Vertical Segment Analysis

By 2035, healthcare segment is set to hold industrial automation market share of more than 35% owing to the rising use of automation for consultation and services presented to treat patients. In 2020, a study of significant healthcare and pharmaceutical organizations revealed that 90% of them had an AI and automation plan in place, which is an increase from 53% in 2019. In addition, 66 percent of respondents knew something about robotic process automation in 2020, up from 50 percent the year before.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Control System |

|

|

Vertical |

|

|

Offering |

|

|

Mode of Automation |

|

|

End-Use Industry |

|

|

Type |

|

|

System |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Automation Market Regional Analysis:

APAC Market Insights

Asia Pacific region in industrial automation market is poised to hold more than 38% revenue share by 2035. The region's automation sector is thriving, since a large number of industries are expanding and emergence of different industrial robots are being created especially in China, India, Japan, etc. According to the International Federation of Robotics (IFR), Asia remains the world's largest market for industrial robots. 74% of all freshly positioned robots in 2021 were installed in Asia and in 2020 it was 70%.

The industrial automation market has expanded in China as a result of the country's robust economic growth and technological advancement. According to the World Bank, China is now classified as an upper-middle-income nation. Even though China declared severe poverty to be eliminated in 2020, 17.2 percent of the population was predicted to be living in 2023 below the World Bank's Upper-Middle-Income Country (UMIC) poverty line, which is equal to USD 6.85 a day (in 2017 PPP prices).

The Indian industrial automation development mainly lies in the immense development of the country in making automation products. Moreover, leading Indian software businesses are collaborating with automation solution suppliers to support and install level 2 and 3 automation technologies, including MES, SCADA, and HMI.

Japan is known for being a global leader in the production of robotics and AI tools which will further help the industrial automation revenue to grow in this country. According to the International Federation of Robotics (IFR), with 47,182 collaborative robot installations, there was a 22% increase in 2021. In 2021, Japan's operating stock amounted to 393,326 units (+5%).

European Market Insights

Industrial automation market size for Europe region is poised to regitser substantial growth till 2035, owing to the rising demand for the automotive industry in this region. As stated in the report of the International Federation of Robotics (IFR) while demand from the general industry increased by 51%, demand from the automotive sector remained stable. Additionally, 2021 saw a 24% increase in robot installations in Europe, reaching 84,302 units.

Industrial automation demand in the United Kingdom is driven by the rising operational stock of robots in this country. In fact, in 2021, the number of robots in operation was estimated to be 24,445 units (+6%).

In Germany, industrial automation will encounter massive growth because this country belongs to the five biggest robot markets globally driven by the rising exports of robots from this country. Germany's industrial robot exports increased 41% to 22,870 units, surpassing the pre-pandemic total.

The industrial automation sector will also be huge in France due to the rising annual installation of robots in this country. This country is positioned as the third-largest robot installation market in the European region. Furthermore, robot installations reached 5,945 units in 2021, an 11% increase.

Industrial Automation Market Players:

- ABB Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Emerson Electric Co.

- General Electric Company

- Honeywell International Inc.

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Endress+Hauser Group Services AG

- KUKA AG

- Advantech Co., Ltd.

In addition, industry participants are extending the functionalities of automation control systems to facilitate their application in the industrial automation sector including aerospace and military, mining and metals, and transportation. Leading companies in the industrial automation market and control systems include:

Recent Developments

- Schneider Electric, in collaboration with Intel and Red Hat, launched a ground-breaking Distributed Control Node (DCN) software framework in February 2024, In order to spur innovation, reduce obsolescence, and revolutionize industrial automation infrastructure. This framework replaces vendor-specific hardware with a plug-and-produce solution.

This cooperative endeavor reflects an ambitious vision that is in line with the goals of the Open Process Automation Forum: to enable industrial enterprises with portable, interoperable technology, therefore influencing the direction of industrial control systems in the future. - Siemens AG made approximately USD 500 million in infrastructure investments in the United States in November 2023, including a USD 150 million high-tech factory in Dallas. The investment will help American data centers and vital infrastructure, satisfying the growing demand brought on by the use of generative AI. Siemens AG CEO Roland Busch emphasizes the importance of the action for the advancement of decarbonization and the support of the economy.

- Report ID: 6039

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial Automation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.