Industrial and Automotive Power Transmission Products Market Outlook:

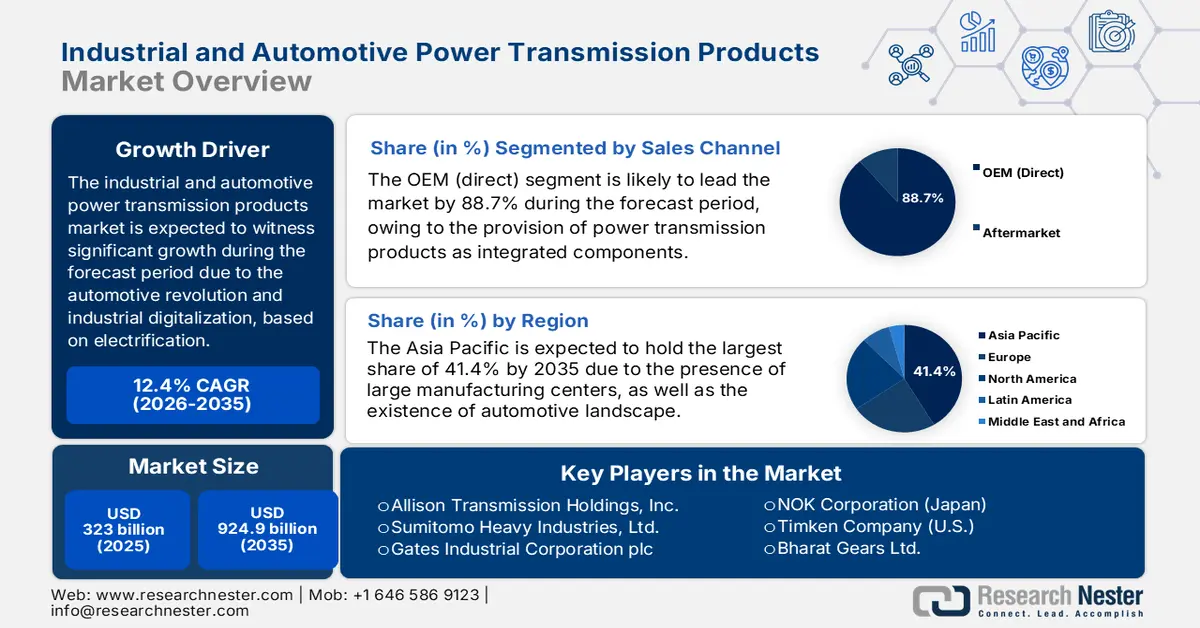

Industrial and Automotive Power Transmission Products Market size was over USD 323 billion in 2025 and is estimated to reach USD 924.9 billion by the end of 2035, expanding at a CAGR of 12.4% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of industrial and automotive power transmission products is evaluated at USD 363 billion.

The industrial and automotive power transmission products market is witnessing a transformative phase, which is driven by the parallel revolutions in automotive electrification and industrial digitalization. In addition, this industrial and automotive power transmission products market has encompassed components, such as actuators, axles, drives, and gears, which are considered the essential electromechanical and mechanical backbone that enable power and motion transfer across vehicles and factories. According to an article published by the IEA Organization in 2025, electric car sales readily topped 17 million globally as of 2024, denoting a rise by over 25%. Additionally, 3.5 million cars have been sold in the same year, in comparison to 2023. Based on this growth, China has significantly maintained its position in this field, with electric car sales increasing by 11 million. Besides, there has been a record surge in sales by almost 40% to effectively reach 1.3 million, with the U.S. selling 1.6 million electric cars, thus making it suitable for the market’s growth.

International Growth of Electric Car Sales (2014-2024)

|

Years |

China |

Europe |

U.S. |

Rest of World |

|

2014 |

- |

0.1 million |

- |

- |

|

2015 |

0.1 million |

0.1 million |

0.1 million |

- |

|

2016 |

0.3 million |

0.1 million |

0.1 million |

- |

|

2017 |

0.5 million |

0.1 million |

0.1 million |

0.1 million |

|

2018 |

0.8 million |

0.2 million |

0.2 million |

0.1 million |

|

2019 |

0.8 million |

0.4 million |

0.2 million |

0.1 million |

|

2020 |

0.9 million |

0.8 million |

0.2 million |

0.1 million |

|

2021 |

2.7 million |

1.2 million |

0.5 million |

0.1 million |

|

2022 |

4.4 million |

1.6 million |

0.8 million |

0.1 million |

|

2023 |

5.4 million |

2.2 million |

1.1 million |

0.2 million |

|

2024 |

6.4 million |

2.2 million |

1.2 million |

1.0 million |

Source: IEA Organization

Furthermore, the aspect of connected and smart components, along with e-axle proliferation, system integration, the presence of advanced and lightweight materials, and digital twin simulation, are other factors that are driving the industrial and automotive power transmission products market’s upliftment globally. As per an article published by the U.S. Bureau of Labor Statistics in February 2023, the electric vehicle sales in the U.S. are poised to reach 40% of overall passenger cars by the end of 2030, as well as 50% by the same year. Besides, as per the 2025 IEA Organization article, there is a huge demand for electric vehicle batteries, which has reached over 750 GWh as of 2023, denoting a 40% rise from 2022. Moreover, internationally, 95% of growth in the battery demand originated from increased electric vehicle sales, and the remaining 5% derived from SUV sales, thereby creating a positive outlook for the overall industrial and automotive power transmission products market’s exposure.

Key Industrial and Automotive Power Transmission Products Market Insights Summary:

Regional Insights:

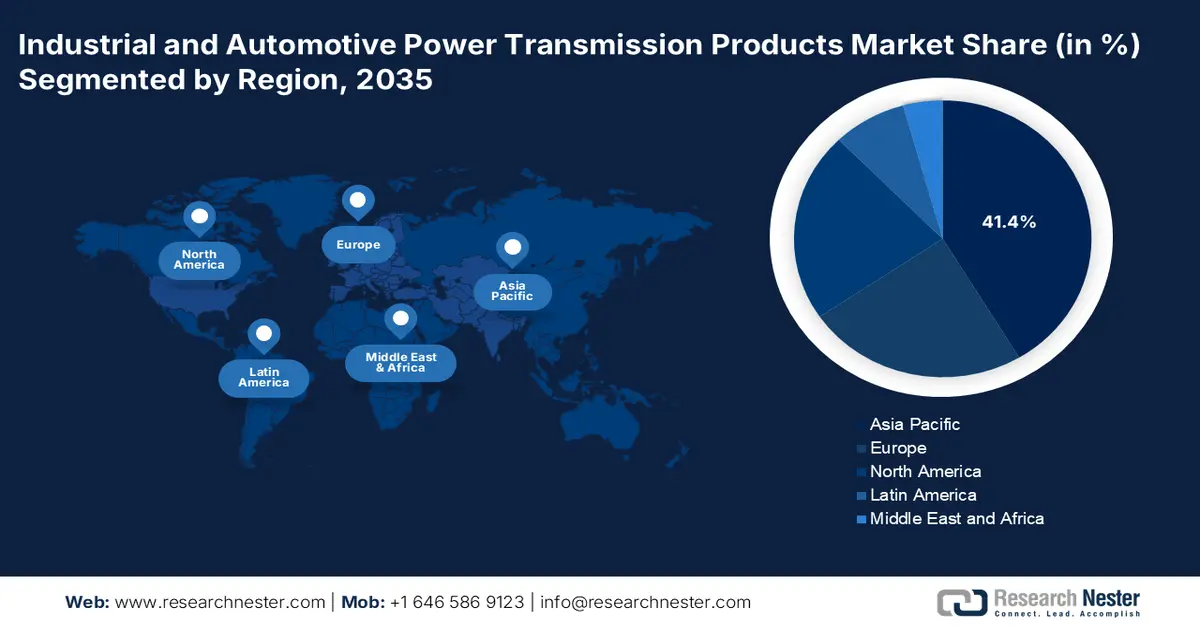

- The Asia Pacific region in the industrial and automotive power transmission products market is projected to secure a 41.4% share by 2035 as its position as a global manufacturing hub and rapidly expanding EV ecosystem continues to elevate demand owing to strong industrial automation investments.

- North America is expected to become the fastest-growing region by 2035 as regional momentum accelerates, impelled by the CHIPS Act, IRA-driven manufacturing revival, and large-scale digital infrastructure programs.

Segment Insights:

- The OEM (direct) segment in the industrial and automotive power transmission products market is anticipated to command an 88.7% share by 2035 as its role in delivering mission-critical, customized, and integrated components strengthens during equipment design and construction.

- The electrically assisted and integrated systems segment is expected to capture the second-largest share by 2035 as its adoption rises, spurred by grid reliability needs, efficiency gains, and renewable-energy integration to meet sustainability objectives.

Key Growth Trends:

- Investment in robotics and industrial automation

- International push for vehicle electrification

Major Challenges:

- Skill gap and technical complexity in system integration

- Commoditization pressure and intense price competition

Key Players: Siemens AG (Germany), Robert Bosch GmbH (Germany), ABB Ltd. (Switzerland), Dana Incorporated (U.S.), BorgWarner Inc. (U.S.), SKF Group (Sweden), ZF Friedrichshafen AG (Germany), Schaeffler AG (Germany), GKN Automotive Limited (UK), SEW-Eurodrive GmbH & Co KG (Germany), Nidec Corporation (Japan), Regal Rexnord Corporation (U.S.), Allison Transmission Holdings, Inc. (U.S.), Sumitomo Heavy Industries, Ltd. (Japan), Gates Industrial Corporation plc (U.S.), NOK Corporation (Japan), Timken Company (U.S.), Bharat Gears Ltd. (India), Hyundai Wia Corporation (South Korea), Sapura Energy Berhad (Malaysia)

Global Industrial and Automotive Power Transmission Products Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: UUSD 323 billion

- 2026 Market Size: USD 363 billion

- Projected Market Size: USD 924.9 billion by 2035

- Growth Forecasts: 12.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41.4% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Mexico, Brazil

Last updated on : 4 December, 2025

Industrial and Automotive Power Transmission Products Market - Growth Drivers and Challenges

Growth Drivers

- Investment in robotics and industrial automation: The sustained and international investment in automating manufacturing as well as logistics to bolster resilience and productivity is considered the primary driver for the industrial and automotive power transmission products market. This has created a huge demand for servo drives, automated guided vehicle drivetrains, robotic actuators, and precision motors. According to an article published by the Trade Government in 2022, the aspect of foreign direct investment (FDI) in manufacturing, especially in the U.S., demonstrates 40.1% of overall FDI, based on which automation plays a pivotal role in attracting investments. Besides, as stated in the September 2024 Automate Organization article, startup funding in automation and robotics has recovered with an overall USD 748.9 million fund provision by U.S.-based organizations, thus suitable for the market’s growth.

- International push for vehicle electrification: The presence of strict regulations for emissions and customer transition is pressuring rapid automotive electrification. This is directly driving huge investment and increasing the need for electric vehicle-based transmission products, which, in turn, is bolstering the industrial and automotive power transmission products market. As stated in the 2024 Europe Commission report, emissions gradually reduced by 7.5%, resulting in international emissions reduction by 6.8% in 2022 to 6.1% as of 2023. Besides, across all sectors in Europe, the highest drop was witnessed in the power industry field, wherein emissions effectively decreased by 20.1%. In addition, the industrial combustion and processes also displayed the second-highest decrease by 8.1% as of 2022, thus denoting an optimistic outlook for the overall industrial and automotive power transmission products market.

- Expansion in renewable energy: The worldwide build-out of solar and wind power generation is directly uplifting the demand for large-scale and specialized power transmission products, including solar tracker drives and high-torque wind turbines. As per an article published by the IEA Organization in 2025, the global renewable electricity generation is predicted to climb more than 17,000 TWh, demonstrating an increase by nearly 90% from 2023. Besides, modernized bioenergy is considered the largest source of renewable energy, with over 50% share of worldwide utilization as of 2023. Recently, it has been observed that with yearly additions surging to almost 560 GW, there is a huge growth opportunity for renewable electricity, which creates a positive impact on the industrial and automotive power transmission products market’s growth.

Challenges

- Skill gap and technical complexity in system integration: The aspect of modernized power transmission is no longer considered a purely mechanical approach; instead, it has emerged as a mechatronic field that demands in-depth expertise in power electronics, data analytics, controls, and software. Besides, the trend towards integrated systems has created an effective challenge in the industrial and automotive power transmission products market. This includes a critical shortage of technicians and engineers with cross-disciplinary skills required for maintaining, commissioning, installing, and designing these complicated systems. This particular skill barrier exists both among end user consumers and at manufacturing giants, thus negatively affecting the market’s expansion.

- Commoditization pressure and intense price competition: The industrial and automotive power transmission products market for off-the-shelf and standard power transmission components is significantly competitive, and experiences intensified pressure from low-cost manufacturers, especially in Asia. This particular competition is driving down margins and pushing the overall industrial and automotive power transmission products market towards commoditization, wherein products are eventually differentiated by price rather than technical features. Besides, for established organizations, this has created a challenging balance act, and therefore, to overcome this, they need to compete on cost in volume-based commodity segments, while also focusing on investing in research and development for effectively gaining advanced and high-margin solutions.

Industrial and Automotive Power Transmission Products Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.4% |

|

Base Year Market Size (2025) |

USD 323 billion |

|

Forecast Year Market Size (2035) |

USD 924.9 billion |

|

Regional Scope |

|

Industrial and Automotive Power Transmission Products Market Segmentation:

Sales Channel Segment Analysis

Based on sales channel, the OEM (direct) segment in the industrial and automotive power transmission products market is anticipated to garner the largest share of 88.7% by the end of 2035. The segment’s upliftment is highly attributed to its ability to underscore the fundamental nature of power transmission products as mission-critical and integrated components, in comparison to aftermarket accessories. Besides, in the industrial field, gearboxes, drives, and motors are purchased and specified directly by machinery builders or by end users, particularly during the construction and design of the newest heavy equipment, factories, and production lines. In addition, this direct relationship is crucial, owing to the demand for customized and performance guarantees, along with ensuring technical integration, thus making it suitable for the segment’s increased exposure.

Technology Segment Analysis

The electrically assisted and integrated systems segment, part of technology, is projected to hold the second-largest share in the industrial and automotive power transmission products market by the end of the stipulated timeline. The segment’s growth is highly fueled by its adoption in modern society, primarily driven by grid reliability, cost savings, and enhanced efficiency, along with the vital integration of renewable energy sources. The ultimate purpose is to achieve environmental and sustainability goals, which is suitable for boosting the overall industrial and automotive power transmission products market globally. According to an article published by the Journal of Hazardous Materials Advances in February 2025, the requirement for sustainable urban transportation, along with ambitious climate commitments, is expected to enhance the international number of electric vehicles from 26 million as of 2023 to 145 million by the end of 2030, thus driving the demand for the segment.

Vehicle Type Segment Analysis

The battery electric vehicles (BEVs) sub-segment, which is part of the vehicle type segment, is expected to cater to the third-largest share in the industrial and automotive power transmission products market during the forecast period. The sub-segment’s development is highly propelled by the aspect of permanent and profound reshaping of the automotive power transmission landscape. This dominance is based on a transition in fuel source, but also displays an overall re-architecture of the drivetrain. Besides, BEVs readily eliminate the complicated multi-speed transmissions, extended mechanical linkages, and torque converters of internal combustion engine (ICE) vehicles. This is possible by replacing these vehicles with a current set of high-value components that center around the electric drive unit, thereby denoting an optimistic outlook for the overall segment.

Our in-depth analysis of the industrial and automotive power transmission products market includes the following segments:

|

Segment |

Subsegments |

|

Sales Channel |

|

|

Technology |

|

|

Vehicle Type |

|

|

Material |

|

|

Product Type |

|

|

Drive Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial and Automotive Power Transmission Products Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the industrial and automotive power transmission products market is anticipated to hold the highest share of 41.4% by the end of 2035. The market’s upliftment in the region is highly attributed to its dual role as the international manufacturing center and fastest-growing automotive landscape, especially for electric vehicles. Besides, huge governmental investments in industrial automation, along with the existence of supportive policies for local battery adoption and manufacturing, are also driving the market’s growth in the region. According to an article published by the ITA in September 2025, with over USD 165 billion in investment, there is a growing demand for industrial automation, robotics technologies, and IoT-based services in India, thereby making it suitable for bolstering the market’s exposure in the overall region.

India, in the industrial and automotive power transmission products market, is growing significantly due to the unprecedented confluence of policy-driven manufacturing growth and increased electrification of transport. Besides, the government's Production Linked Incentive (PLI) schemes for advanced chemistry cell batteries, auto components, and automobiles are readily catalyzing massive investments for localized electric vehicles manufacturing. Furthermore, as per an article published by the PIB Government in December 2024, the PLI scheme has outlined a budget of ₹25,938 crore, intended to boost the country’s manufacturing capabilities for Advanced Automotive Technology (AAT) products, combat cost disabilities, and develop a strong supply chain, which denotes an optimistic outlook for the market’s exposure and expansion.

China, in the industrial and automotive power transmission products market, is also growing due to the aspect of unparalleled manufacturing, along with a wide-ranging and state-directed industry policy, which focuses on green transition and technological supremacy. In addition, the Made in China 2025 initiative, as well as its successor approaches, have readily prioritized innovative manufacturing, which comprises new energy vehicles and high-precision robotics. As per the July 2025 State Council Information Office report, the country has significantly registered a record of 5.6 million latest energy vehicles, demonstrating a year-over-year (YoY) increase by 27.8%. Additionally, this also caters to 44.9% of new automobile registrations, which has readily underscored the country’s clean energy transition, thus suitable for boosting the overall market’s exposure.

North America Market Insights

North America in the industrial and automotive power transmission products market is predicted to emerge as the fastest-growing region by the end of the stipulated duration. The market’s development in the region is highly propelled by the CHIPS Act and the U.S. Inflation Reduction Act (IRA), along with rapid automotive electrification and advanced manufacturing reinvestment. As per the 2025 National Telecommunications and Information Administration article, the Broadband Equity Access and Deployment Program (BEAD) Program, functioning under the IIJA, is considered a USD 42.4 billion federal grant program. This has aimed to connect every person in the region to high-speed internet by providing grants for partnerships to develop standard infrastructure. In addition, the NTIA has declared fund allocation for all 56 territories and states as of June 2023, which is also suitable for boosting the market.

The U.S. in the industrial and automotive power transmission products market is gaining increased traction, owing to the strong convergence of technological transformation and industrial policy. In addition, the U.S. Department of Energy (DOE) has highlighted innovative manufacturing, particularly for electric vehicle drivetrains, with generous funding strategies for optimizing drive and motor system efficiency. According to an article published by the U.S. DOE in 2025, the provision of USD 8 billion in commitments and loans to projects has successfully supported the production of over 4 million fuel-efficient vehicles and also ensured more than 35,000 direct employment opportunities across states. Besides, there are other LPO investments that have also escalated the country’s auto manufacturing, thereby making it suitable for the market’s development.

LPO Investments to Escalate Auto Manufacturing in the U.S. (2022)

|

Project Name |

Loan Program |

Owner |

Loan Type |

Loan Amount |

|

FORD |

ATVM |

Ford Motor Company |

Direct Loan |

USD 5.9 billion |

|

NISSAN |

ATVM |

Nissan North America |

Direct Loan |

USD 1.4 billion |

|

TESLA |

ATVM |

Tesla Motors |

Direct Loan |

USD 465 million |

|

ULTIUM CELLS |

ATVM |

Ultium Cells, LLC |

Direct Loan |

USD 2.5 billion |

Source: U.S. Department of Energy

Canada in the industrial and automotive power transmission products market is also developing due to its association with its severe minerals benefit, as well as the presence of the clean industrial policy. In addition, the Innovation, Science and Economic Development Canada (ISED) is proactively supporting the development of a regional electric vehicle supply chain, such as power transmission components, through the Net-Zero Accelerator initiative and the Zero-Emission Vehicles (iZEV) program. As stated in an article published by the Government of Canada in November 2025, the Oil to Heat Pump Affordability Program offers almost USD 10,000 to cover expenses for modifying an oil heating system, and this is readily eligible for homeowners across the country. Meanwhile, the program also provides USD 25,000 in grants for houseowners, especially in territories and provinces, thus stimulating the need for advanced power transmission, which is positively impacting the market’s growth in the country.

Europe Market Insights

Europe in the industrial and automotive power transmission products market is projected to witness steady and considerable growth during the forecast duration. The market’s growth in the region is highly driven by the robust green industrialization agenda, which has been exemplified by the regional Net-Zero Industry Act for mandating domestic manufacturing advantages for clean technologies. This has directly spurred the need for innovative and high-efficiency motors, gearboxes, and drives across industries, such as renewable energy equipment and electric vehicle battery giga factories. According to the 2025 IEA Organization report, there has been a continuous increase in electric vehicle sales, starting from 1.2 million in 2021, which is followed by 1.6 million in 2022, 2.2 million in 2023, as well as 2.2 million in 2024. Therefore, with such an upsurge in sales, there is a huge growth opportunity for the market in the region.

The industrial and automotive power transmission products market in Germany is gaining increased exposure, owing to its emergence as the automotive and industrial manufacturing hub, which is presently undergoing a dual transformation towards Industry 4.0 and electromobility. Besides, the German Federal Ministry for Economic Affairs and Climate Action (BMWK) is proactively funding this transition through the Future Factories program as well as the Digital Now investment grant program. As per an article published by the IEA Organization in 2025, the country’s government has provided financial aid, amounting to EUR 902 million, for successfully installing a battery cell giga factory, particularly in Heide. This funding opportunity is significantly supported by state aid, thereby creating an unprecedented need for power transmission.

The industrial and automotive power transmission products market in France is also growing due to an increase in the push for industrial sovereignty, as well as a rapid transition in energy. According to an article published by the France Government in May 2024, the France 2030 investment plan readily represents €54 billion of investment to significantly ensure transition in the overall economy. In addition, 50% of the fund caters to decarbonizing the economy, and the remaining 50% is dedicated towards innovative and emerging players. Besides, France Relance is yet another exceptional €100 billion recovery plan, which has been initiated by the government to ensure cohesion, competitiveness, and constitute an ecological transition. Therefore, with all these investments, the market is gradually growing in the country.

Key Industrial and Automotive Power Transmission Products Market Players:

- Siemens AG (Germany)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Robert Bosch GmbH (Germany)

- ABB Ltd. (Switzerland)

- Dana Incorporated (U.S.)

- BorgWarner Inc. (U.S.)

- SKF Group (Sweden)

- ZF Friedrichshafen AG (Germany)

- Schaeffler AG (Germany)

- GKN Automotive Limited (UK)

- SEW-Eurodrive GmbH & Co KG (Germany)

- Nidec Corporation (Japan)

- Regal Rexnord Corporation (U.S.)

- Allison Transmission Holdings, Inc. (U.S.)

- Sumitomo Heavy Industries, Ltd. (Japan)

- Gates Industrial Corporation plc (U.S.)

- NOK Corporation (Japan)

- Timken Company (U.S.)

- Bharat Gears Ltd. (India)

- Hyundai Wia Corporation (South Korea)

- Sapura Energy Berhad (Malaysia)

- Siemens AG is considered an international technological powerhouse and is one of the leaders in industrial digitalization and automation, offering a wide-ranging portfolio of integrated drives and motors, along with automated systems that create the smart manufacturing backbone and process industries globally. The organization’s Simotics motors and Sinumerik CNC systems are essential for high-precision motion control, thus cementing its position in the progressive industrial power transmission ecosystem. Based on these, and as stated in its 2024 annual report, the organization achieved €8,301 million in net income, €1,020 million in other interest expenses, and €1,004 million in SFS income.

- Robert Bosch GmbH is regarded as the dominating force in both the industrial and automotive industries, well-known for its advanced mechatronic systems, hydraulic components, and electric drives. Through its very own Rexroth division, the company significantly supplies crucial components for factory and mobile automation, while its automotive provision caters to transmission control units and electric axle drives, which are essential for vehicle electrification.

- ABB Ltd. is one of the global leaders in automation and electrification, providing an expanded range of variable speed drives, robotic solutions, and high-efficiency motors that improve energy productivity and consumption across diversified industries. Besides, its ABB Ability digital platform offers predictive performance and maintenance for power transmission assets, fueling the transition to data-driven and connected industrial operations. Therefore, as per its 2024 annual report, the company generated H 9,380 Crore in revenue through innovation, and continuously delivers a 20% growth over the past 4 years.

- Dana Incorporated is considered the foremost international supplier of highly engineered propulsion and drivetrain systems, which include thermal management technologies, driveshafts, and axles for both electric and conventional vehicles. The organization’s Long and Spicer brands are synonymous with strong commercial and off-highway vehicle components, while its focus is on the integrated electromechanical propulsion that has positioned the organization at the electric vehicle transition forefront.

- BorgWarner Inc. is considered a propulsion technological leader, specializing in innovative combustion, electric, and hybrid vehicle solutions, with core expertise in electric drive modules, turbochargers, and transmission systems. Its tactical acquisitions, including AKASOL and Delphi Technologies, have rapidly extended its portfolio to emerge as the notable provider of high-voltage and complete e-Propulsion systems.

Here is a list of key players operating in the global industrial and automotive power transmission products market:

The international industrial and automotive power transmission products market is readily characterized by high concentration, with Europe, the U.S., and Japan-based firms holding dominant shares through technological leadership in electrification and digitalization. Notable strategies, such as the vertical integration for electric vehicle components, strategic mergers and acquisitions to achieve the newest capabilities, and strong research and development investment in smart, integrated systems, including e-Axles. Moreover, organizations are making expansions in high-growth Asia Pacific economies through localized partnerships and production infrastructures to gain automation and automotive booms. Besides, in February 2024, ZF has declared the first-ever PowerLine 8-speed automatic transmissions at the South Carolina manufacturing facility. This announcement is part of a USD 200 million investment, based on which the organization is currently boosting its production to 200,000 transmissions every year by the end of 2025, thus suitable for uplifting the industrial and automotive power transmission products market.

Corporate Landscape of the Industrial and Automotive Power Transmission Products Market:

Recent Developments

- In October 2024, Allison Transmission declared the successful expansion of its state-of-the-art manufacturing facility in India, especially in Chennai, with the objective of supporting the increased international demand for its complete automatic transmissions.

- In September 2024, Eaton notified that it displayed a huge number of transmissions for both conventional and electrified commercial vehicles in Germany, suitably designed for commercial vehicles with the availability of internal combustion engines.

- Report ID: 3145

- Published Date: Dec 04, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial and Automotive Power Transmission Products Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.