Industrial Air Filtration Market Outlook:

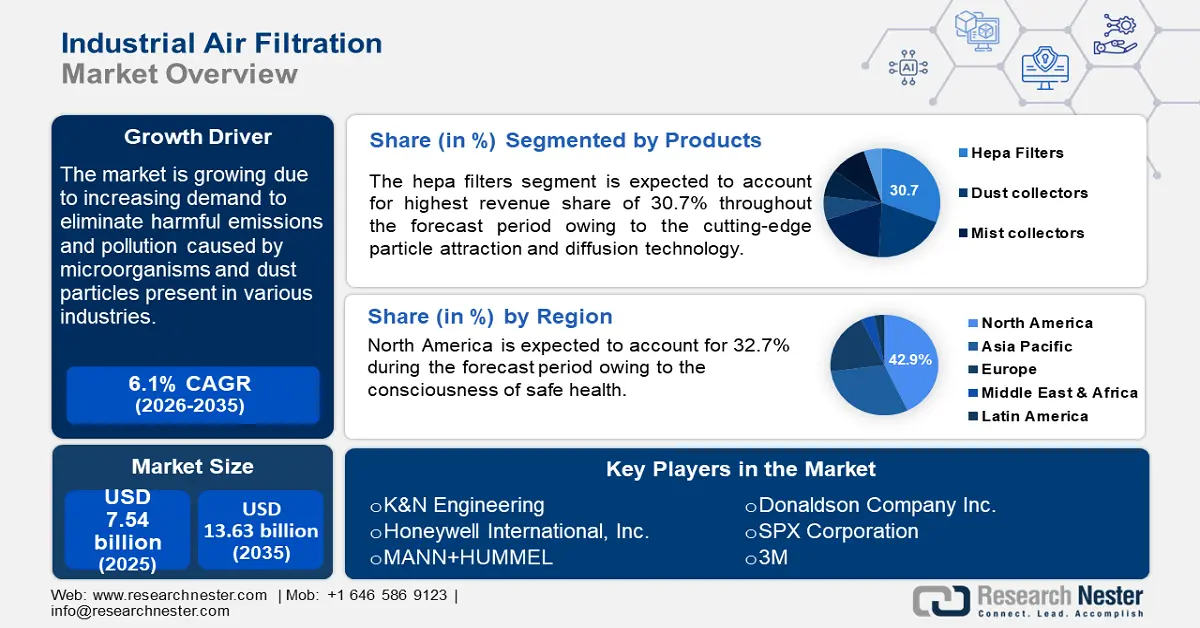

Industrial Air Filtration Market size was valued at USD 7.54 billion in 2025 and is likely to cross USD 13.63 billion by 2035, registering more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of industrial air filtration is assessed at USD 7.95 billion.

The industrial air filtration market is growing due to increasing demand to eliminate harmful emissions and pollution caused by manufacturing and other heavy-duty industrial processes. For instance, the amount of CO2 released into the atmosphere due to burning fossil fuels grew by 8% in 2022 compared to 2020 and 1% in 2021.

In addition, new developments and the introduction of cutting-edge technology promote market expansion for industrial air filtration. Several industries use industrial air filtration systems, including power, food and beverage, cement, metals, and pharmaceuticals. However, it is anticipated that the high initial and ongoing expenses of industrial air filtration systems will impede industrial air filtration market expansion. Advanced filtration equipment is needed to purify contaminated air, which increases capital expenditure. As a result, both energy consumption and maintenance costs are high for the entire system.

Key Industrial Air Filtration Market Insights Summary:

Regional Highlights:

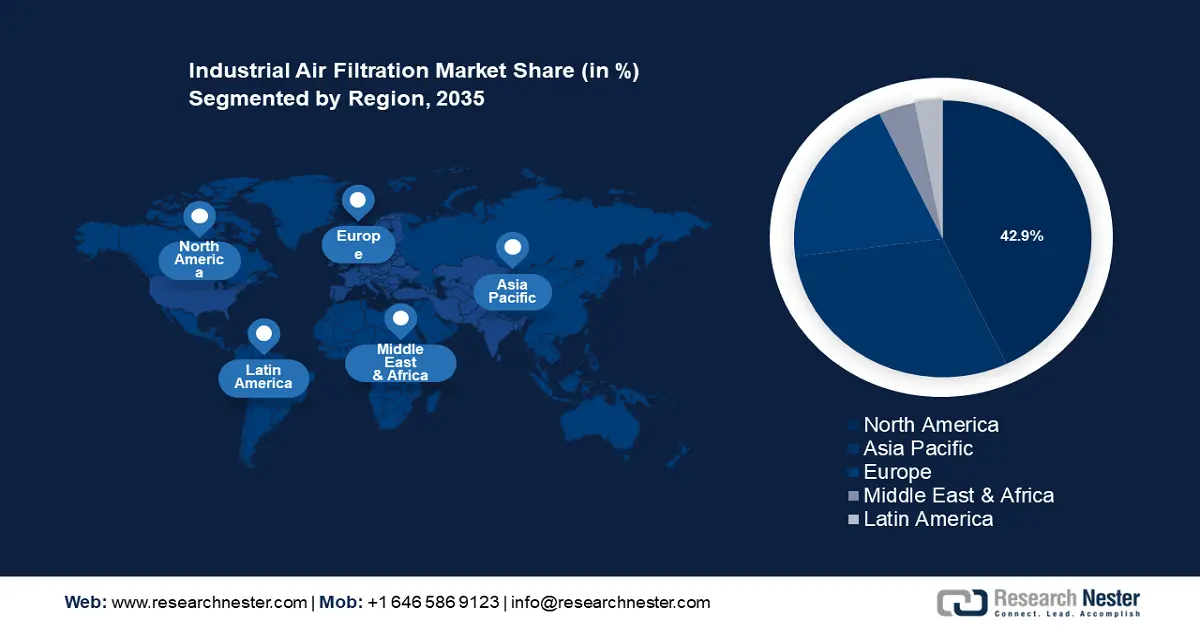

- North America industrial air filtration market is anticipated to capture 42.90% share by 2035, driven by growing consciousness of safe health among industrial users.

Segment Insights:

- The food & beverages segment in the industrial air filtration market is anticipated to experience significant growth till 2035, influenced by stringent laws governing food safety and the need for premium filtered air.

- The hepa filters segment in the industrial air filtration market is projected to achieve significant growth till 2035, driven by the effectiveness of hepa filters in removing harmful airborne particles.

Key Growth Trends:

- Rising concerns about respiratory disorders and allergies

- Artificial intelligence integration with industrial air filtration systems

Major Challenges:

- Financial investments are necessary to create cutting-edge air filtration technologies

- Disturbances in the supply chain for raw materials

Key Players: K&N Engineering, Honeywell International, Inc., MANN+HUMMEL, Donaldson Company Inc., SPX Corporation, 3M, AAF International, Industrial Air Filtration, Inc., Parker Hannifin Corporation.

Global Industrial Air Filtration Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.54 billion

- 2026 Market Size: USD 7.95 billion

- Projected Market Size: USD 13.63 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 18 September, 2025

Industrial Air Filtration Market Growth Drivers and Challenges:

Growth Drivers

-

Rising concerns about respiratory disorders and allergies: The growing industrial air pollution made workers more susceptible to infections and serious illnesses such as lung cancer, heart disease, stroke, chronic pulmonary disorders, and acute respiratory infections. Industries in India contribute to 51% of the overall air pollution. The World Health Organization's recommended limit of 10 micrograms of particulate matter per cubic meter is exceeded by 25 micrograms for Indians.

Industrial air filters, which help to purify the air and lower the concentration of pollutants such as dust particles and non-volatile gases, are crucial in preventing the spread of these disorders. Industrial operations are supported by clean and safe air as it enhances production and operational efficiency across a broad spectrum. Furthermore, the industrial air filtration market is growing due to the need for air filters and filtration systems in various sectors. - Artificial intelligence integration with industrial air filtration systems: Incorporating cutting-edge technologies like artificial intelligence and the Internet of Things into air filtration systems is crucial for propelling the global market's expansion. The industrial air filtration market is expected to increase significantly due to cutting-edge and creative technologies that enhance filtering capabilities. Real-time monitoring of different air contaminants is possible with filtration systems that have intelligence features. This aids in optimizing filtering processes by air quality requirements. All things considered, it offers a more productive and safe working environment across a range of industries. Investing in these crucial solutions can help the market grow, as the growing demand for air filtration technology drives the industry.

- Favorable government emission standards: Throughout the projection period, the industrial air filtration market is anticipated to be driven by favorable government emission standards along with the enforcement of worker safety and health rules in many areas. For example, the United States federal statute known as the Clean Air Act aims to regulate air pollution on a national level. Several industrial air filtering rules were put into place as a result of the growth of manufacturing and industrial facilities. Managers and designers of filtration systems can save energy expenses and operational costs while maintaining the necessary quality standards owing to contemporary industrial air filtration technologies. To enhance the effectiveness and caliber of industrial air filtration systems, numerous technologies are being developed.

Challenges

-

Financial investments are necessary to create cutting-edge air filtration technologies: The development of the industrial air filtration market is hampered by the requirement for greater capital during the introduction and production of innovative advanced air filtration technologies. Several manufacturers, mainly in emerging and impoverished areas, encounter difficulties when trying to finance the introduction of sophisticated air filtering equipment. Because effective and state-of-the-art technology, filters, and dust controllers like HEPA filters require large investments, these factors also negatively impact the manufacturing processes of other industries, like the food and pharmaceutical industries, where proper air filtration is essential.

-

Disturbances in the supply chain for raw materials: Due to supply chain disruptions involving raw materials and the temporary closure of industrial facilities worldwide, the COVID-19 pandemic has had a detrimental effect on several end use industries, including cement, food and beverage, and manufacturing. It is anticipated that after the pandemic, supply chain normalization, a loosening of regulations, a rise in retail sales, and stability of manufacturing operations will boost economic activity and raise the need for industrial air filtration.

Industrial Air Filtration Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 7.54 billion |

|

Forecast Year Market Size (2035) |

USD 13.63 billion |

|

Regional Scope |

|

Industrial Air Filtration Market Segmentation:

Products (Dust collectors, Mist Collectors, Fume Collectors, HEPA filters, Cartridge Collectors & Filters, Baghouse Filters, Others)

The HEPA filters segment in the industrial air filtration market is projected to gain about 30.7% share through 2035. Using cutting-edge particle attraction and diffusion technology, these filters are effective in removing dust particles, droplets, bacteria, spores, mites, pollen, and other particles that can be harmful if ignored. 99.97% or more of airborne particles with diameters of 0.3 microns or bigger are removed using a HEPA filter.

Also, lung cancer, heart disease, and respiratory infections are just a few of the serious health issues that these filters can help prevent when it comes to bad air quality. Furthermore, these filters are regarded as typical filtration systems that are primarily used in the medical industry, such as clinics and hospitals.

End use (Cement, Food & Beverages, Metal, Power, Pharmaceutical, Chemical & Petrochemical, Paper & Wood Processing, Agriculture, Other)

Based on the end use, the food & beverages segment in the industrial air filtration market is likely to generate a revenue share of 40.6% during the forecast period. Due to stringent laws governing food safety and hygiene, producers in the food sector concentrate on offering premium filtered air. For the food and beverage sectors to comply with standard rules, air filtration is a crucial component. Food items are shielded from microbiological pollutants including dust, mold, and bacteria by an air filtration system.

Moreover, inadequate or subpar air quality from the filtration system might impact the entire production process, causing edible items to spoil sooner. In the food and beverage business, manufacturers are compelled by all of these cases to utilize high-quality air filters. For instance, in October 2020, Camfil Group obtained a contract from Tönnies Group to install its ProSafe HEPA H14 filter together with the CC 6000 and CC 2000 units in the company's meat processing plant. Sales would rise and the company's reputation in the marketplace would be enhanced by this contract acquisition.

Our in-depth analysis of the industrial air filtration market includes the following segments:

|

Products |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Air Filtration Market Regional Analysis:

North America Market Analysis

North America industry is expected to account for largest revenue share of 42.9% by 2035. The rise in this area is ascribed to industrial users' growing consciousness of safe health. Industries produce hazardous microorganisms and pollutants that must be appropriately eliminated because they can lead to a variety of health problems. Leading provider of industrial and educational air filtration solutions, Clean Air America, announced in September 2023 that it was rebranding to Clean Air Industries, a name that better reflects the company's development and expansion in providing air filtration technology for these uses.

Industrial users in the U.S. use air filtration equipment that has high-performance features, like the ability to effectively remove sub-micron pollutants, to reduce health risks. Additionally, manufacturers concentrate on reducing the pressure drop in air filters because it saves the end user a substantial amount of energy and, as a result, decreases the overall cost of ownership.

Asia Pacific Market Analysis

Asia Pacific industrial air filtration market is expected to experience a stable CAGR during the forecast period due to promising expansion in the manufacturing sector in China and India. Businesses are also paying close attention to how air quality affects employees' health. The use of industrial air filtration devices has increased as a result of this worry.

In China software development, new energy vehicles, tourism, internet shopping, and healthcare are the main sectors driving economic growth. China is a major industrial center that has factories for a variety of products, including steel, chemical fertilizers, and power generation. which will support the expansion of the industrial air filtration industry in China.

India is rapidly becoming more industrialized as a result of progressive government initiatives and a growing number of industrial units moving here. For example, Apple Inc. stated in March 2023 that it was setting up a manufacturing facility in Karnataka. It is projected that as the industrial sector expands, there will be a greater need for industrial air filtration to regulate and enhance indoor air quality in various industrial settings.

Industrial Air Filtration Market Players:

- Hengst Filtration

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- K&N Engineering

- Honeywell International, Inc.

- MANN+HUMMEL

- Donaldson Company Inc.

- SPX Corporation

- 3M

- AAF International

- Industrial Air Filtration, Inc.

- Parker Hannifin Corporation

Large- and medium-sized producers of industrial air filtering equipment are present in the industrial air filtration market. Among the leading companies are 3M, Daikin Industries, Ltd., Honeywell International, Inc., MANN+HUMMEL, and SPX Corporation. To survive in the very competitive market, these companies are making significant R&D investments to create innovative filters. To increase their market presence and get a competitive edge over rivals, the major manufacturers are also placing a strong emphasis on bolstering their regional presence through partnerships with other businesses that provide comparable goods and services. In a similar vein, businesses employ inorganic growth tactics to expand their range of offerings.

Here are some leading players in the industrial air filtration market:

Recent Developments

- In March 2024, Hengst Filtration declared its new manufacturing facility in Bangalore, India. This factory seeks to create and sell filtering solutions that contribute to increased green manufacturing practices and improved air quality for a variety of industries, including the automotive, hydraulic, and medical technology sectors, primarily in the Indian market.

- In September 2023, K&N Engineering, announced the launch of a new industrial group whose goal is to provide mission-critical infrastructure providers such as data centers and other industrial applications and markets with high-performance, sustainable air filtration solutions. The exclusive air filtration technology from K&N Engineering offers substantial financial savings, reduced energy expenses, and substantial environmental advantages for data centers and other industrial applications worldwide.

- Report ID: 6457

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial Air Filtration Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.