Industrial Air Compressor Market Outlook:

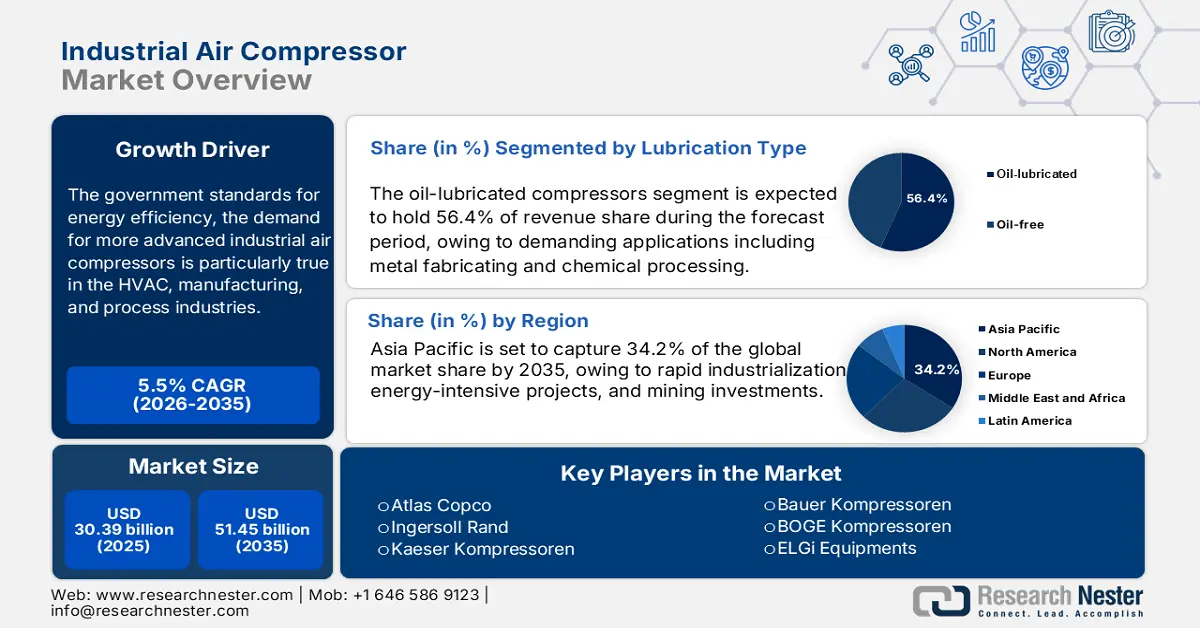

Industrial Air Compressor Market size was estimated at USD 30.39 billion in 2025 and is expected to surpass USD 51.45 billion by the end of 2035, rising at a CAGR of 5.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of industrial air compressor is estimated at USD 32.03 billion.

Driven by government standards for energy efficiency, the demand for more advanced industrial air compressors is particularly true in the HVAC, manufacturing, and process industries. The U.S. Department of Energy estimates compressed air systems account for 10% of all electricity and roughly 16% of all motor system energy use in U.S. manufacturing industries. The DOE supports variable-speed rotary compressors and offers incentives to buyers that may include tax rebates. On the supply side, there has continued to be stability in the raw materials used to manufacture compressors, particularly steel and nonferrous metals, although prices were up a year ago.

Alliance Compressors just invested $45 million into a new facility in Louisiana to add 30% more assembly capacity, along with financing from the state government. Through the expansion, Alliance, a joint venture between Emerson, Trane Technologies, and Lennox Industries, will be able to expand its Natchitoches facility, which is 400,000 square feet in size, to include a third assembly line. Some key component facts include imports of control electronics remain high, but R&D activities continue to grow, particularly with inverter controls and lubricants, and the Producer Price Index for air and gas compressor manufacturing increases from 371.919 in June 2024 to 401.340 in August 2025. The regulatory and supply environments support manufacturing growth and global trade of compressors and compressor-related systems.