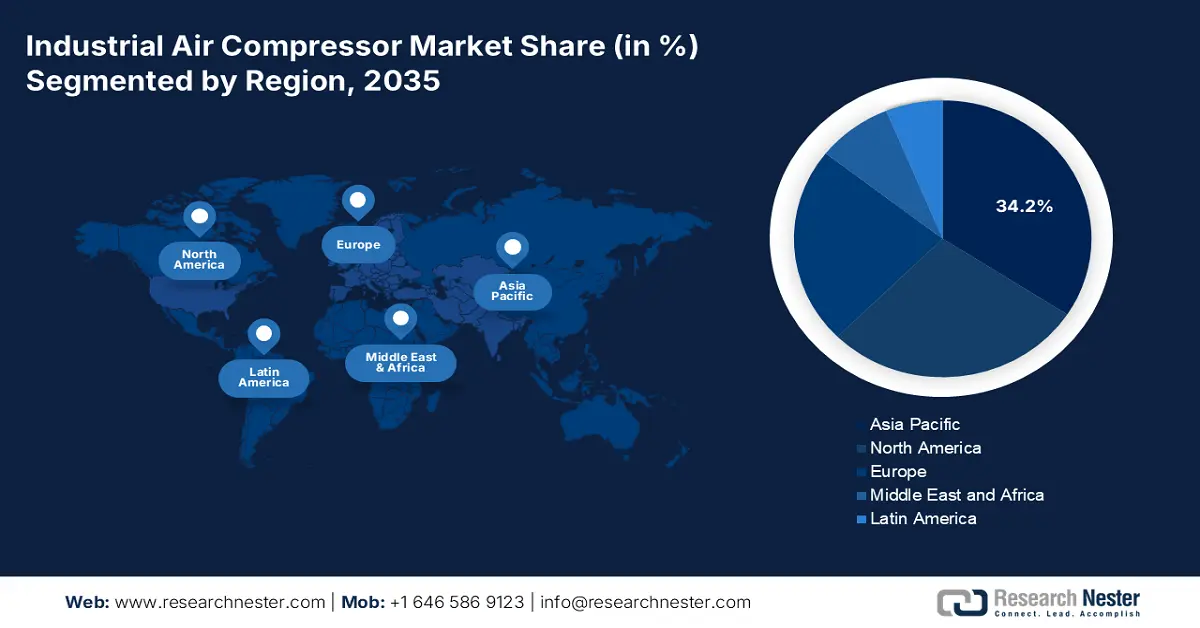

Industrial Air Compressor Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific industrial air compressor market is expected to hold 34.2% of the market share, driven by rapid industrialization, energy-intensive projects, and mining investments. Demand emanates from oil, chemical, construction, and manufacturing domains, while also moving toward automation and green solutions. IoT-enabled compressors for predictive maintenance have come into the limelight. However, sustainability directives emphasizing energy-efficient and oil-free technologies bolster the region's market leadership.

China, driven by automation, refinery expansion, and green regulations, will lead the APAC industrial air compressor industry by revenue in 2035. By 2030, the market share of green and efficient cooling products should rise by 40%, the energy efficiency of major cooling products should increase by more than 25%, and the energy efficiency of large public buildings should increase by 30% over 2022 levels, resulting in a combined 400 billion kWh of electricity savings annually. Needs are further generated via policies of Coal-to-Gas and smart-factory transitions. Improving energy-efficiency investments and standing as a steadily growing manufacturing concern, China cements instant dominance under corroborated backing by global research.

Driven by Make in India, SME automation, and environmental demands, India is predicted to have the highest industrial air compressor CAGR (2026-2035). India is poised to surpass China and Japan due to its young workforce, tech-driven manufacturing growth, robust environmental regulations, and growing industrial GDP. Government funding reached the value of automobiles, and auto components increased significantly from ₹346.87 crore to ₹2,818.85 crore, while electronics and IT hardware increased from ₹5,777 crore (the updated projection for 2024-25) to ₹9,000 crore. Additionally, the textile industry has benefited greatly, as its allocation has increased from ₹45 crore to ₹1,148 crore, and PLI projects have increased domestic output. IoT compressor adoption increased between 2021 and 2024, driven by the chemical, automotive, and pharmaceutical sectors.

India Semiconductor Devices Trade by Country in 2023

|

Export Destinations |

Value (USD) |

Import Destinations |

Value (USD) |

|

United States |

1.96 B |

China |

3.83 B |

|

Somalia |

9.82 M |

Vietnam |

965 M |

|

Thailand |

8.90 M |

Malaysia |

726 M |

|

Germany |

8.83 M |

Thailand |

288 M |

|

Hong Kong |

7.42 M |

Japan |

252 M |

Source: OEC

North America Market Insights

The North American market is expected to hold 28.3% of the market share by 2035, due to stricter EPA, DOE, and OSHA rules, as well as rising chemical automation. Compressor adoption is further accelerated by cross-border funding, such as the U.S.-Canada Clean Energy Dialogue. Government-led decarbonization roadmaps and net-zero industrial policies in both countries place a strong emphasis on compressors. NIST and cross-border projects—including the U.S.-Canada Clean Energy Dialogue—foster compressor innovation and sustainability.

The U.S. is driven by strong industrialization, automation, and federal programs designed to improve energy efficiency and low-carbon manufacturing. The main industries generating demand are chemicals, food & beverage, and automotive. Programs designed by the government, such as the Department of Energy's Better Plants and various incentives in the Inflation Reduction Act, will stimulate the market by increasing the adoption of high-efficiency compressors. Packages of oil-injected rotary screw compressors with 3-700 horsepower, 8-4,000 cfm of flow, and discharge pressures ranging from 50-250 psig are offered. There are two-stage and single-stage versions available, with the two-stage designs starting at 125 horsepower. Up to 15% more specific power can be achieved with two-stage variants, and some can reach higher discharge pressures. There are 80 to 3,000 cfm rotary screw vacuum pumps that can reach 29.7 in Hg of vacuum.

Canada is driven by strong mining, oil & gas, and manufacturing activity. Both federal and provincial policies designed to foster clean technology adoption and to reduce emissions will drive the oil-free / energy-efficient technology market. Additionally, growing infrastructure investments, especially to upgrade transportation and renewable energy, will increase demand for energy-efficient compressors. Recently, initiatives like the Canadian Net-Zero Accelerator, industrial efficiency programs, and numerous other incentives will contribute to the broader adoption of advanced compressor technologies and energy-efficient industrial air compression systems, boosting the market growth and ensuring improved energy performance across Canada.

Europe Market Insights

The European market is expected to hold 23.1% of the market share by 2035, due to growing automation, environmental rules, and growing demand in the chemical, marine, and manufacturing industries. Key trends include the adoption of oil-free compressors, IoT integration for predictive maintenance, and growing interest in compact, portable systems. EU projects like Horizon Europe and the Green Deal are increasing, and the adoption of sustainability-oriented compressors is leading to an increase in regional demand for energy-efficient compressor technologies.

Germany is expected to dominate the European industrial air compressor market by 2035. This rise can be attributed to heavy manufacturing across prominent areas like Baden-Württemberg and Bavaria. In June 2021, Germany’s revised Climate Change Act set a 2045 net-zero goal. The government plans EUR 500 billion in special debt-financed infrastructure and climate funds over 12 years, including EUR 100 billion dedicated specifically to cutting greenhouse gas emissions. Strong export manufacturing and continuous investments in hydrogen, renewable energy, and high-tech production facilities further strengthen market growth, while strict DIN and EU efficiency standards push industries toward innovative, low-emission compressor solutions.

The UK’s industrial air compressor market is driven by food and beverage processing, pharmaceuticals, and a growing renewable-energy supply chain. As per a report by Cordis, it is expected that Lontra can emerge as a new player in the compressor market, which is valued at over EUR 10 billion in Europe and over EUR 53 billion worldwide. The product's current production projections could result in an annual worldwide energy savings of 0.5 TWh. Post-Brexit industrial modernization, combined with strong chemical and automotive service sectors, fosters investments in compressed-air systems with smart monitoring, ensuring compliance with the UK Energy Savings Opportunity Scheme (ESOS) and other stringent efficiency regulations.