Inductor Market Outlook:

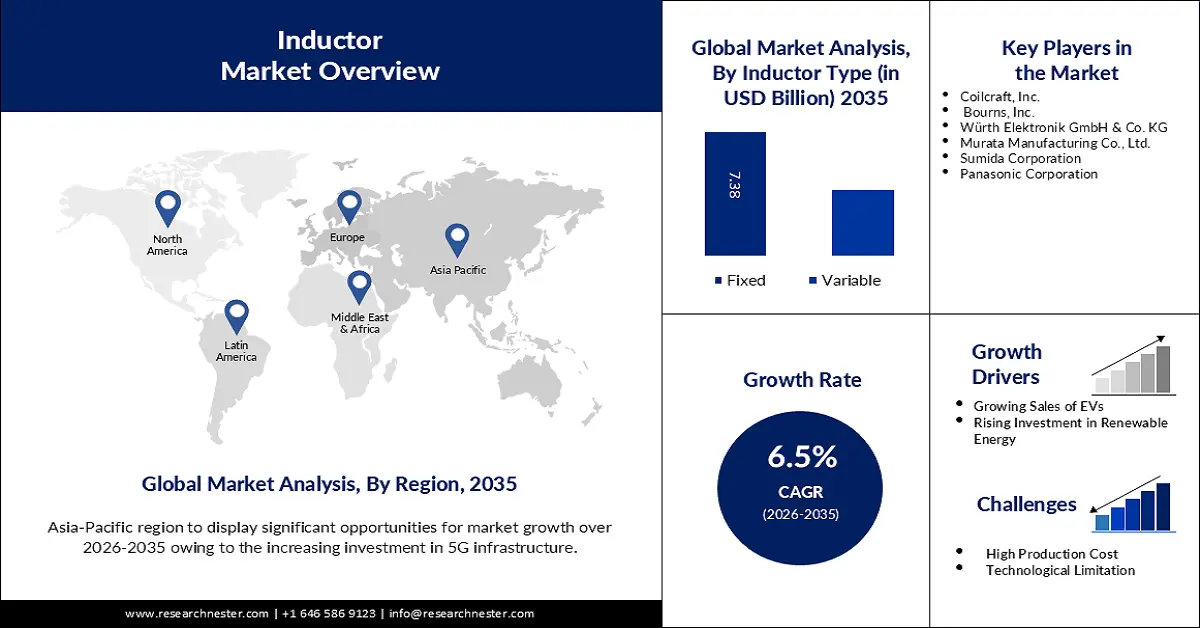

Inductor Market size was valued at USD 8.42 billion in 2025 and is expected to reach USD 15.81 billion by 2035, registering around 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of inductor is evaluated at USD 8.91 billion.

The surging demand for various consumer electronics and communication devices is set to boost the inductor market. The need for inductors increases dramatically with the demand for laptops, smartphones, tablets, and other consumer electronics. The trend of smaller and more compact electronic devices has implored manufacturers to continuously innovate designs for chip inductors. For instance, TDK Corporation, on October 16, 2023, unveiled its new PLEA85 family of high-efficiency power inductors for wearables and other battery-operated devices to improve operating times.

Key Inductor Market Insights Summary:

Regional Highlights:

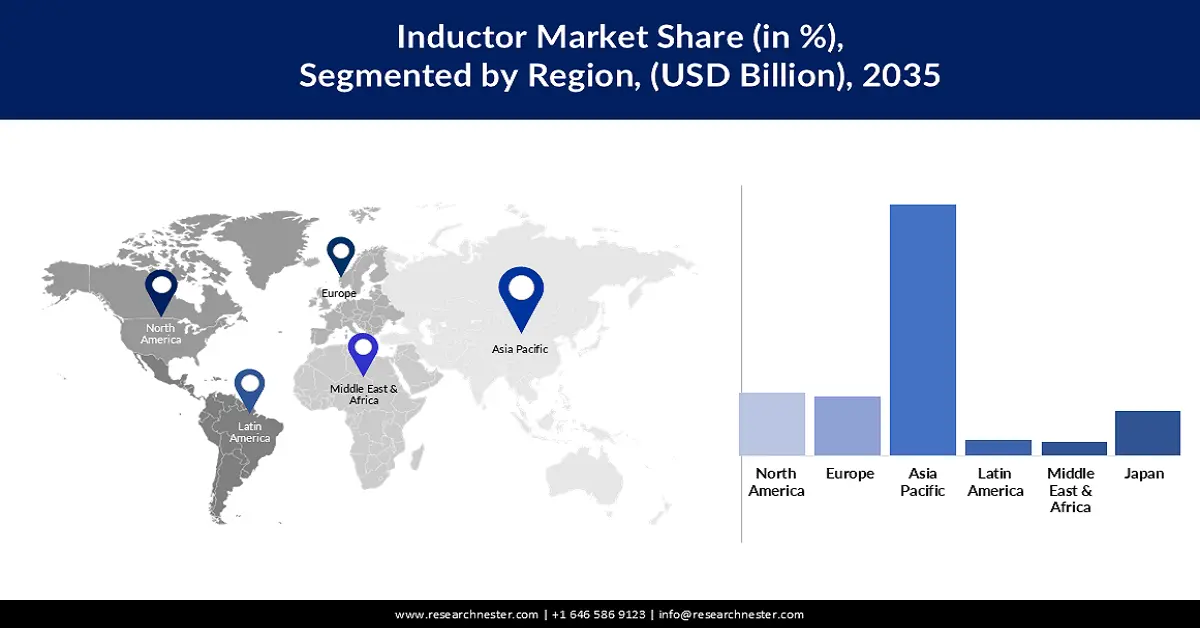

- The Asia Pacific inductor market will dominate around 56% share by 2035, driven by consumer electronics, automotive tech, and 5G investment.

- The North America market will register substantial CAGR during 2026-2035, driven by investments in smart grids and renewable energy in the region.

Segment Insights:

- The fixed inductors segment in the inductor market is projected to secure a 68% share by 2035, driven by their durability and reliability in telecommunication infrastructure, power generation, automotive electronics, and industrial automation.

- The ferrite core inductors segment in the inductor market is anticipated to experience lucrative growth till 2035, driven by high current handling and performance in automotive and telecom uses.

Key Growth Trends:

- Escalating sales of electric vehicles

- Surging renewable energy landscape

Major Challenges:

- High production cost

- Fluctuating raw material prices

Key Players: Coilcraft, Inc., Bourns, Inc., Wurth Elektronik GmbH & Co. KG, Murata Manufacturing Co., Ltd., Sumida Corporation, Panasonic Corporation.

Global Inductor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.42 billion

- 2026 Market Size: USD 8.91 billion

- Projected Market Size: USD 15.81 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (56% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, India, Brazil, Mexico, Taiwan

Last updated on : 17 September, 2025

Inductor Market Growth Drivers and Challenges:

Growth Drivers

-

Escalating sales of electric vehicles - The electronic control unit (ECU) system in an electric vehicle consists of DC-DC converters to regulate the battery’s voltage at ideal levels. These converters regulate the voltage for distributing power to different vehicle components. Inductors are used in the DC converters to maintain a stable voltage output during input voltage fluctuations. Thus, with the shift towards EVs, and hybrid cars over traditional vehicles, the demand for inductors is on the rise. As per the International Energy Agency (IEA) Global EV Outlook 2024, worldwide EV sales grew from 14.0% in 2022 up to 18.0% in 2023.

- Surging renewable energy landscape - The reliance on renewable energy sources has grown as more people recognize the importance of climate change and the finite nature of fossil fuels. Global renewable capacity reached 3,870 gigawatts in 2023, with 86% of capacity increases coming from renewable sources. Inductors play a crucial role in renewable energy generation systems such as solar, and wind power during energy storage, conversion, and transmission. Therefore, the growing adoption of renewable sources to generate energy is expected to drive inductor market expansion.

- High penetration in the aerospace sector - The aerospace industry heavily relies on advanced electronic systems for communication, navigation, and control. Inductors are a key electronic component used in RF circuits for tuning and signaling. Companies are introducing inductors catering to high-end industrial, military, and aerospace end users. In April 2024, Vanguard Electronics expanded its product line of Common Mode Choke Inductors and launched SCMN4, SCMN6, SCMN7, SCMN9, CMN4, CMN6, CMN7, and CMN9 series. Inductors are designed to operate in extreme conditions, with frequency ranges from 100KHz to 600KHZ+. This makes them compatible for GaN, SiC, and GaS-based power supplies.

Challenges

-

High production cost - Compared to resistors and capacitors, inductors are costlier and heavier. There is a requirement for precise materials and cutting-edge manufacturing procedures for producing high-quality inductors. As a result, the finished goods become more expensive, which may restrict their accessibility and market share.

- Fluctuating raw material prices - The inductor market growth is significantly constrained by the volatility of raw material prices. Changes in the price of vital components including ferrite and copper affect the profitability and cost structure of companies that manufacture inductors. The main component used to make inductors is copper, and the price of this material has fluctuated significantly over time due to a variety of factors, including supply chain disruptions, geopolitical tensions, and shifting demand from other industries - electronics, and construction. Therefore, geopolitical tensions, disruptions in the supply chain, and changes in global demand are some of the factors that affect these fluctuations.

Inductor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 8.42 billion |

|

Forecast Year Market Size (2035) |

USD 15.81 billion |

|

Regional Scope |

|

Inductor Market Segmentation:

Inductor Material Type Segment Analysis

Ferrite core inductors segment in the inductor market is expected to grow at more than 6.42% CAGR through 2035. The material has the potential to handle high current and maintain significant performance at high temperatures. This makes the material indispensable and thus utilized in various applications, for example, automotive electronics, power distribution systems, and telecommunication infrastructure. In February 2024, Bourns, Inc. announced the launch of its new Model SRR5228A and SRR5828A Series Shielded Power Inductors. These are the newest automotive-grade power inductors from Bourns, with a ferrite core and ferrite shield, and they comply with AEC-Q200. Hence, the benefits attached to the ferrite core material is predicted to boost the segment growth.

Inductor Type Segment Analysis

Fixed segment in the inductor market is expected to reach USD 7.3 billion by 2035. The use of fixed inductors is prevalent in telecommunication infrastructure, power generation, automotive electronics, and industrial automation due to their durability and reliability. This feature is suitable for critical systems where dependability is important, and its compact size is ideal for use in applications with limited space.

In addition, the fixed inductors are used in electronic filters to separate frequency signals and mix capacitors to tune circuits utilized in TV receivers and radios. Thus, the rapid expansion of the sophisticated electronic components sector is predicted to upsurge the growth of the segment in the upcoming years.

Our in-depth analysis of the global market includes the following segments:

|

Inductor Material Type |

|

|

Form |

|

|

Inductor Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Inductor Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is poised to account for largest revenue share of 56% by 2035. The increasing penetration of consumer electronics, developments in automotive technology, and investments in 5G infrastructure and Internet of Things applications contribute to the market's expansion. Between 2023 and 2030, telecom providers in the Asia Pacific region are expected to spend USD 259 billion on networks, most of which will go toward fifth-generation, or 5G, deployments.

The dominance of electronics manufacturing in China propels the inductor market. For instance, China exported USD 4,234.93 million worth of inductors to other countries in 2022. Also, the inductor sector in China is predicted to reach USD 1.95 billion by the year 2035.

The escalating investment in the consumer electronics and automotive industries in South Korea is poised to boost the inductor market growth in the region. Also, the region is technologically advanced, which is expected to fuel the market in many ways.

The growing use of consumer electronics and improvements in automotive technology are driving inductor market expansion in India. Additionally, the rising need for power and power management systems is a significant reason behind the growth of the sector in this region.

North America Market Insights

Inductor market size for North America region is projected to grow substantially till 2035. The market is expanding due to growing investments in smart grid technologies and renewable energy. American Clean Power Association on July 31, 2023, announced USD 270 billion in federal incentives for utility-scale clean energy projects and manufacturing facilities.

Strong demand for inductors in Canada is a hallmark of the market, which is fueled by substantial R&D expenditures and technological advancements. Automotive, consumer electronics, and industrial automation are the key users of inductors in the country.

The U.S. inductor market is predicted to witness revenue of USD 1.31 billion by the end of 2035. The adoption of high-speed broadband infrastructure and the growth of 5G networks in the country have made the use of inductors in communication equipment, such as base stations, routers, and switches, necessary.

Inductor Market Players:

- Vishay Intertechnology, Inc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Taiyo Yuden Co., Ltd.

- Samsung Electro-Mechanics

- Chilisin Electronics Corp.

- Coilcraft, Inc.

- Bourns, Inc.

- Würth Elektronik GmbH & Co. KG

- Murata Manufacturing Co., Ltd.

- Sumida Corporation

- Panasonic Corporation

Recent Developments

- In February 2024, TDK Corporation introduced the MHQ1005075HA family of inductors for automotive high-frequency circuits, offering exceptional safety and dependability. These inductors have 1.0 × 0.5 × 0.7 mm diameters and inductance ranges of 1.0 nH to 56 nH. They are designed with fail-safe technology using TDK's unique internal structure, which gives them higher frequency characteristics than other products.

- In May 2024, Würth Elektronik releases eight new WE-XHMI SMT power inductor package sizes, providing a high current capacity up to 56 A saturation current. These small, powerful inductors are perfect for high-current filters, DC/DC converters, and point-of-load converters in a variety of applications, such as industrial PCs, graphics cards, and mainboards.

- Report ID: 6274

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Inductor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.