In Vivo CRO Market Outlook:

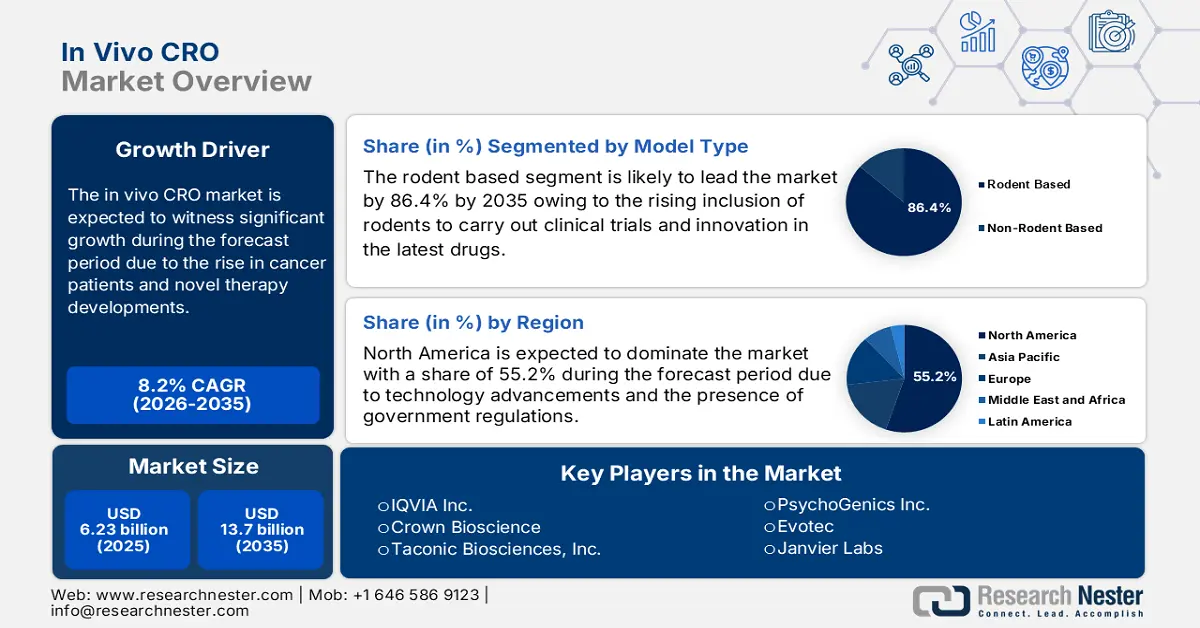

In Vivo CRO Market size was valued at USD 6.23 billion in 2025 and is likely to cross USD 13.7 billion by 2035, expanding at more than 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of in vivo CRO is assessed at USD 6.69 billion.

The contract research organization (CRO) is an independent organization that ensures research services and clinical trials to government agencies, academic foundations, biotechnology, and medical devices. Besides, there has been a growing need for arsenal technologies and medications for the dermatology field, pertaining to skin cancer, which was expected to enhance the field to approximately USD 34.5 billion in 2023, as stated by NLM in September 2022. Therefore, it is the responsibility of CROs to act on behalf of study sponsors to ensure the ethical and efficient operation of clinical trials, thus driving the growth of the market globally.

Moreover, small molecule research initiates drug investigation and development, which is poised to boost the in vivo CRO market. However, small-molecule drugs can be expensive, especially in developing nations. In this regard, a study conducted by Medicine in Drug Discovery in March 2021 denoted the payer’s pricing of a vial of Adalimumab, accounting for USD 1,000. At present, the cost has increased to USD 15.2 billion from USD 18.9 billion. In addition, research-based therapies usually have a price range of USD 10,000 to USD 40,000 each year. These expenses, though challenging for low-income nations, are effectively bolstering the in vivo CRO market globally.

Key In Vivo CRO Market Insights Summary:

Regional Highlights:

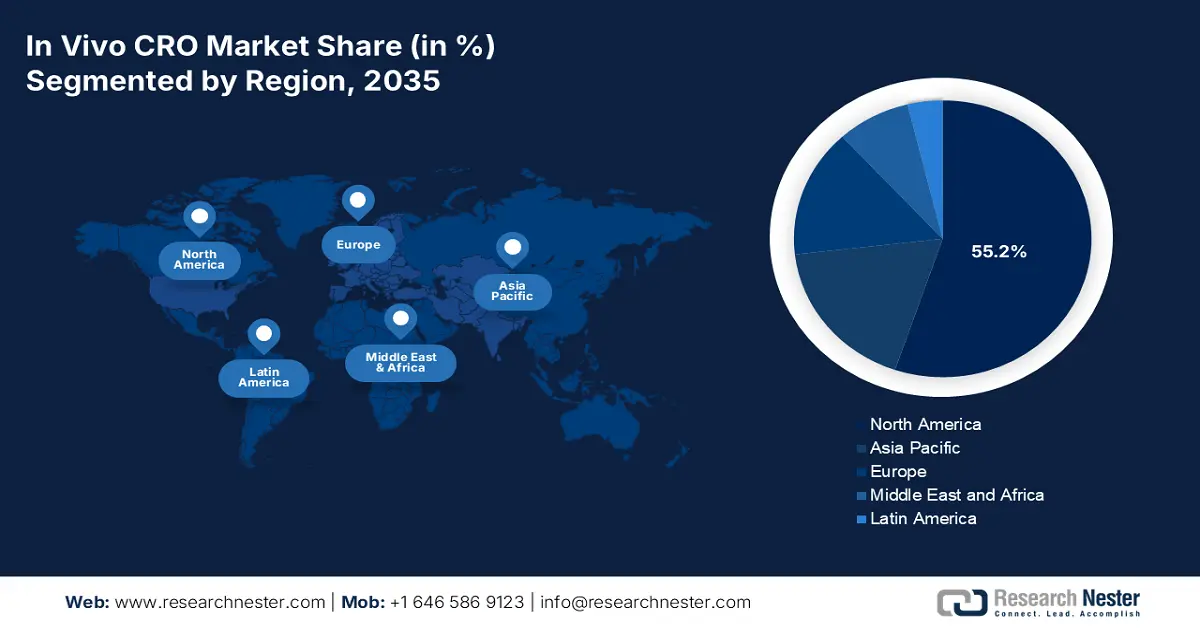

- North America commands a 55.20% share in the In Vivo CRO Market, fueled by the availability of biotechnology facilities, innovation in medication, and clinical studies for drug development, ensuring robust growth by 2035.

- APAC's in vivo CRO market is set for the fastest growth by 2035, attributed to rising population, pharmaceutical industry development, and increasing incidence of diseases driving drug innovation.

Segment Insights:

- The rodent-based segment is expected to hold over 86.4% market share by 2035, fueled by rodents’ biological similarity to humans in research applications.

Key Growth Trends:

- CRO acceptance in clinical trials

- Adoption of technology

Major Challenges:

- Limited research control

- Poor project communication

- Key Players: IQVIA Inc., Crown Bioscience, Taconic Biosciences, Inc., PsychoGenics Inc., Evotec.

Global In Vivo CRO Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.23 billion

- 2026 Market Size: USD 6.69 billion

- Projected Market Size: USD 13.7 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (55.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 13 August, 2025

In Vivo CRO Market Growth Drivers and Challenges:

Growth Drivers

-

CRO acceptance in clinical trials: Clinical upliftment has become a challenging aspect of the health industry due to which there has been the emergence of CRO to cater to the safe and clinical trials of medical procedures. For instance, in February 2025, Novotech signed a Memorandum of Understanding (MOU) with Wonju Severance Christian Hospital to provide a pioneering strategic collaboration engrossed in enhancing clinical research and medical advancements. Both organizations aim to improve the quality of clinical trials and contribute towards the enlargement of radical therapeutics and patient care, thus driving the in vivo CRO market globally.

- Adoption of technology: Technological implementation is relatively driving drug discovery, which in turn is striving to boost the in vivo CRO market. This results in the integration of decentralized trials, tech-based patient management and recruitment, and the provision of bio-simulation as well as wearable devices. Additionally, key pharma companies have adopted the latest technology for clinical trials. For instance, In July 2024, Veridix AI, part of Emmes Group, declared its partnership with Miimansa AI to revolutionize clinical research with the adoption of artificial intelligence (AI).

Challenges

-

Limited research control: CROs often limit a company’s capability to adjust preclinical studies to developing goals. Also, medical organizations reduce their abilities to allow them to take liberty and conduct clinical processes that are original and diverse. Moreover, there has been a shift from full-service outsourced (FSO) to functional service provider (FSP) models due to which there is a negative impact on the revenue opportunities. This has raised concerns about mergers and acquisitions, leading to the decline of FSO services, hence a restraint in the growth of the market.

- Poor project communication: Lack of structure and clarity along with ineffective models of communication are challenges that are adversely affecting the in vivo CRO market. Besides, unfulfilled expectations, wasted time due to work inefficiency, non-compliance, possible harm to subjects, and probable invalidation of data are other gaps of breakdowns in clinical trial communications. Also, improper emphasis on treatment provision to patients creates a barrier to the successful completion of research and trials, ultimately negatively impacting the market upliftment.

In Vivo CRO Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 6.23 billion |

|

Forecast Year Market Size (2035) |

USD 13.7 billion |

|

Regional Scope |

|

In Vivo CRO Market Segmentation:

Model Type (Rodent Based, Non-Rodent Based)

Rodent based segment is likely to hold in vivo CRO market share of more than 86.4% by 2035. Rodents possess similar genetics, behaviors, and biology, constitute the same immune system, and experience the same disease and similar bodily systems as humans. As per a study conducted by the Boston Institute in January 2022, more than 90% of animals utilized for research purposes comprised mice and rats. For instance, an NCI study conducted on mice in December 2022 stated the evolution of ganitumab, combined with trametinib, as a probable treatment for children suffering from rhabdomyosarcoma tumors, thus a positive impact on the market development.

Indication (Oncology, CNS Conditions, Diabetes, Obesity, Pain Management, Autoimmune/Inflammation Conditions)

Based on indication, the oncology segment is expected to influence the in vivo CRO market at a considerable rate by the end of 2035. The rise in the worldwide prevalence of cancer due to changing lifestyle habits is the utmost reason behind the expected segment growth. According to the February 2024 WHO report, more than 35 million new cancer cases are to be recorded by 2050, accounting for a 77% increase from the estimated 20 million cases in 2022. However, Charles River Laboratories International, Inc. partnered with Cypre, Inc. in January 2021 to ensure a proprietary 3D tumor model platform, Falcon-X, and expand in vitro services for cancer immunotherapy and targeted therapy drug screening, a suitable solution to overcome the spread.

Different Cancer Prevalence Rate

|

Cancer Type |

Number of Cases |

Relevance (%) |

|

Lung cancer |

2.5 million |

12.4% |

|

Female breast cancer |

2.3 million |

11.6% |

|

Colorectal cancer |

1.9 million |

9.6% |

|

Prostate cancer |

1.5 million |

7.3% |

|

Stomach cancer |

970,000 |

4.9% |

Source: WHO 2024

Our in-depth analysis of the global in vivo CRO market includes the following segments:

|

Model Type |

|

|

Indication |

|

|

Modality |

|

|

GLP Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

In Vivo CRO Market Regional Analysis:

North America Market Analysis

North America in vivo CRO market is likely to hold revenue share of over 55.2% by the end of 2035. The availability of biotechnology facilities, innovation in medication, and clinical studies for the drug development formulation for the treatment of disorders are factors driving the market growth. For instance, in March 2022, Zurko Research declared its global expansion through the formation of a US subsidiary- Zurko Research USA Inc. The organization has tripled its number of employees, expanded its services, and carried out in vivo, in vitro, and ex vivo studies to evaluate the safety and efficacy of medical devices, cosmetics, and chemical and household products.

The U.S. in vivo CRO market is gaining traction due to the existence of local CROs across the country, the presence of high healthcare expenditure per capita, and the availability of government funds for R&D actions in cancer. According to the November 2024 U.S. FDA report, the Real-Time Oncology Review (RTOR) Guidance for Industry was issued for the suitability and proposal requirements for aspirants interested in submitting the latest drug applications (NDAs) or biologics license applications (BLAs). Therefore, contributions initiated by regulatory bodies for developments in cancer are positively set to impact the market upliftment.

The in vivo CRO market in Canada is witnessing significant growth owing to the increasing demand for clinical trials catering to the evolution of the latest medical devices. As per the 2024 Government of Canada report, 60% of innovator small molecules and 82% of innovator biologics comprise their roots in research carried out by pharmaceutical companies externally. Additionally, manufacturing and service organizations play a pivotal role in supporting the growth of emerging biotechnology companies that include engineering biology and stem cell research by providing essential support in achieving severe regulatory reviews. Hence, with sufficient cutting-edge research and organizational efforts, the market is poised to grow in the country.

APAC Market Statistics

The in vivo CRO market in APAC is the fastest-growing region and is poised to witness lucrative growth during the forecast timeline. The rising population, pharmaceutical industry development and increasing incidence of diseases driving drug innovation are factors positively impacting the market growth. In August 2024, Kyowa Kirin Asia Pacific Pte. Ltd. notified the plan to transform its Asia-Pacific business for profitable and sustainable operations, through partnerships with DKSH Holding Ltd. and Hong Kong Winhealth Pharma Group. Additionally, the organization also focussed on in-house resources for rare diseases by establishing its APAC cluster covering South Korea, Taiwan, and Australia markets.

The in vivo CRO market in India is expecting substantial growth since there has been an enhancement in the research services based on the offerings of biotechnology, pharmaceuticals, medical devices, and healthcare. According to a study conducted by the Department of Pharmaceuticals Ministry Chemicals & Fertilizers in August 2023, the regional pharmaceutical sector is ranked third in pharmaceutical invention along with a growth rate of 9.43%. Additionally, the industry is poised to be valued at USD 130 billion by the end of 2030. Moreover, the country comprises 500 assistance to pharmaceutical industry (API) producers with over 50% of global demand for vaccines, 40% of generic demand in the US, and 25% of medicine in the UK.

The in vivo CRO market in China is gaining exposure owing to the continuous commercialization and development of diagnostic products for illnesses. For instance, in July 2021, Invivoscribe. Inc. stated its market entry in China for its business expansion. Besides, Invivoscribe Diagnostic Technologies (Shanghai) Co., Ltd. escalated its presence as a China-based CRO by building a lab to offer flow cytometry testing services through the LabPMM network of clinical laboratories. With personalized assay development solutions, clinical trial management, internationally standardized kits and services, and regulatory expertise, the organization strengthened its capabilities in the country, thus contributing to amplifying market growth.

Key In Vivo CRO Market Players:

- IQVIA Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Crown Bioscience

- Taconic Biosciences, Inc.

- PsychoGenics Inc.

- Evotec

- Janvier Labs

- Biocytogen Boston Corp

- GemPharmatech

- Charles River Laboratories

- Icon Plc

- Labcorp Drug Development

- Parexel International Corporation

- SMO Clinical Research (I) Pvt Ltd.

- PharmaLegacy Laboratories

Companies dominating the in vivo CRO market are gaining rapid exposure due to the outsourcing aspect that initiates drug inventors to stay agile while directing internal resources on later phase trials and commercialization. Besides, key companies are also making expansions in their business unit to ensure advanced CRO services globally. For instance, in December 2023, QPS Holdings, LLC stated to sell its neuropharmacology business unit to Scantox. This resulted in the organization gaining more than 300 employees across six sites offering lead optimization, neuropharmacology research services, regulatory toxicology, and CMC/analytical services, thus having a positive impact on the in vivo CRO market.

Here's the list of some key players:

Recent Developments

- In October 2024, Crown Bioscience declared the expansion of its facility in Singapore with the provision for the latest oncology research models and state-of-the-art imaging technologies. The purpose was to expand its support for both local and global biotech and pharmaceutical organizations affiliated with translational and preclinical oncology drug detection and advancement.

- In September 2024, PharmaLegacy Laboratories acquired BTS Research to ensure its continuous growth by providing CRO-based preclinical pharmacology services. The acquisition further allowed biotechnology, medical device, pharmaceutical, and diagnostics companies to gain reliable and rapid pharmacology data to develop ailments for patients.

- Report ID: 7222

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

In Vivo CRO Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.