In Vitro Diagnostics Market Outlook:

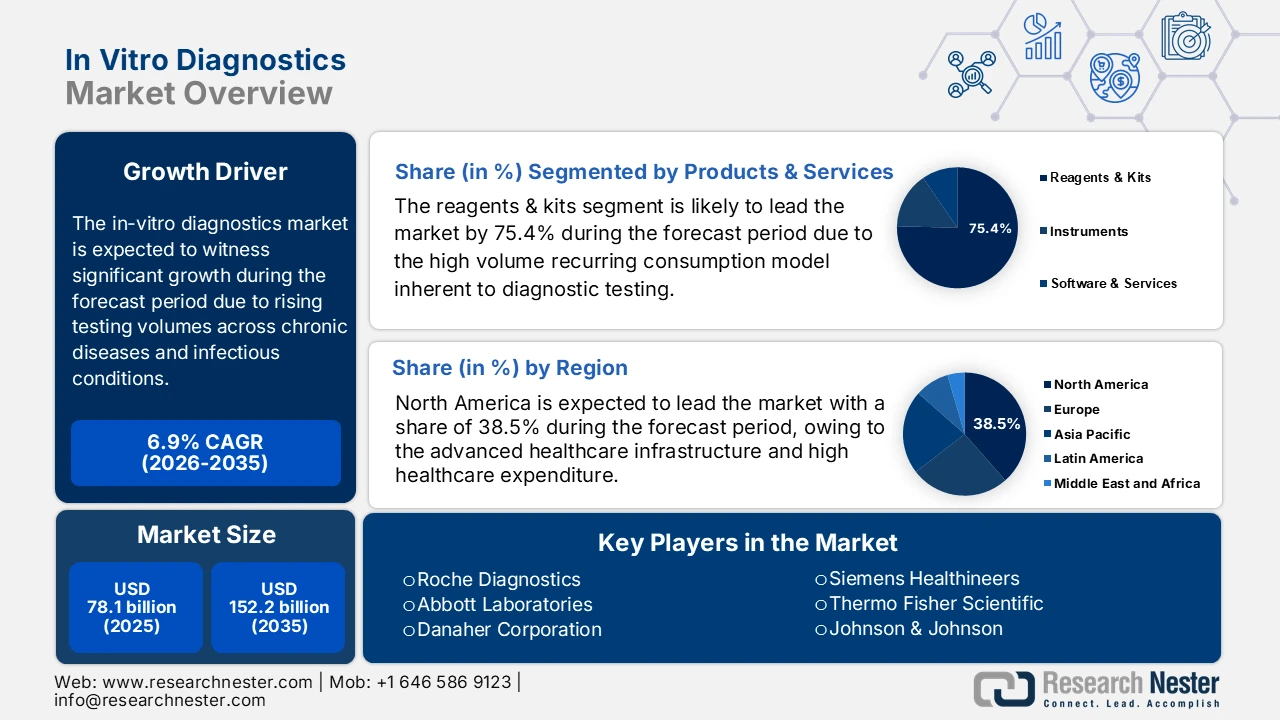

In Vitro Diagnostics Market size was valued at USD 78.1 billion in 2025 and is projected to reach USD 152.2 billion by the end of 2035, rising at a CAGR of 6.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of in vitro diagnostics is assessed at USD 83.4 billion.

The market growth trajectory is shaped by the rising testing volumes across chronic and infectious disease preventive screening programs, driven largely by demographic and public health pressures rather than discretionary demand. According to the NIH study in November 2023, 6 in 10 people in the U.S. live with at least one chronic disease, and 4 in 10 experience multiple chronic diseases, creating a demand for routine and longitudinal diagnostic testing across care settings. The American Diabetes Association report in November 2023 depicts that diabetes alone affects more than 38 million people in the U.S., reinforcing the high utilization of laboratory assays for monitoring and risk stratification. Infectious disease surveillance remains another structural demand driver. The World Health Organization report in November 2025 recorded over 10.7 million tuberculosis cases globally and continued monitoring needs for HIV, hepatitis B, and C, and emerging pathogens.

U.S. Chronic Disease Prevalence and Impact

|

Statistic |

Value |

Details/Source Reference |

|

People with at least 1 major chronic disease |

129 million |

Includes heart disease, cancer, diabetes, obesity, hypertension; defined by HHS. |

|

Leading causes of death linked to chronic diseases |

5 of top 10 |

Preventable and treatable chronic diseases. |

|

Prevalence trend |

Steady increase |

Over past 2 decades; expected to continue. |

|

Multiple chronic conditions |

42% have 2+; 12% have 5+ |

Increasing proportion affected. |

|

Health care expenditure attribution |

90% of USD 4.1 trillion annually |

Managing/treating chronic diseases and mental health conditions |

Source: CDC February 2024

The government-backed screening initiatives, such as the population-level cancer screening programs in Europe and the U.S., further boost the baseline test volumes, while aging populations expand utilization intensity in hospital and reference laboratory networks. These factors collectively support a stable, high-throughput diagnostic testing environment with the predictable procurement cycles for reagents, instruments, and consumables. From a policy and funding perspective, public healthcare expenditure and regulatory oversight play a decisive role in shaping the market. The American Hospital Association report in December 2024 states that the national health expenditure reached USD 4.9 trillion in 2023, with laboratory services representing a consistent non-deferrable component of diagnostic care pathways. Reimbursement frameworks such as the Clinical Laboratory Fee Schedule directly influence the test mix and adoption rates, mainly for high-volume assays.