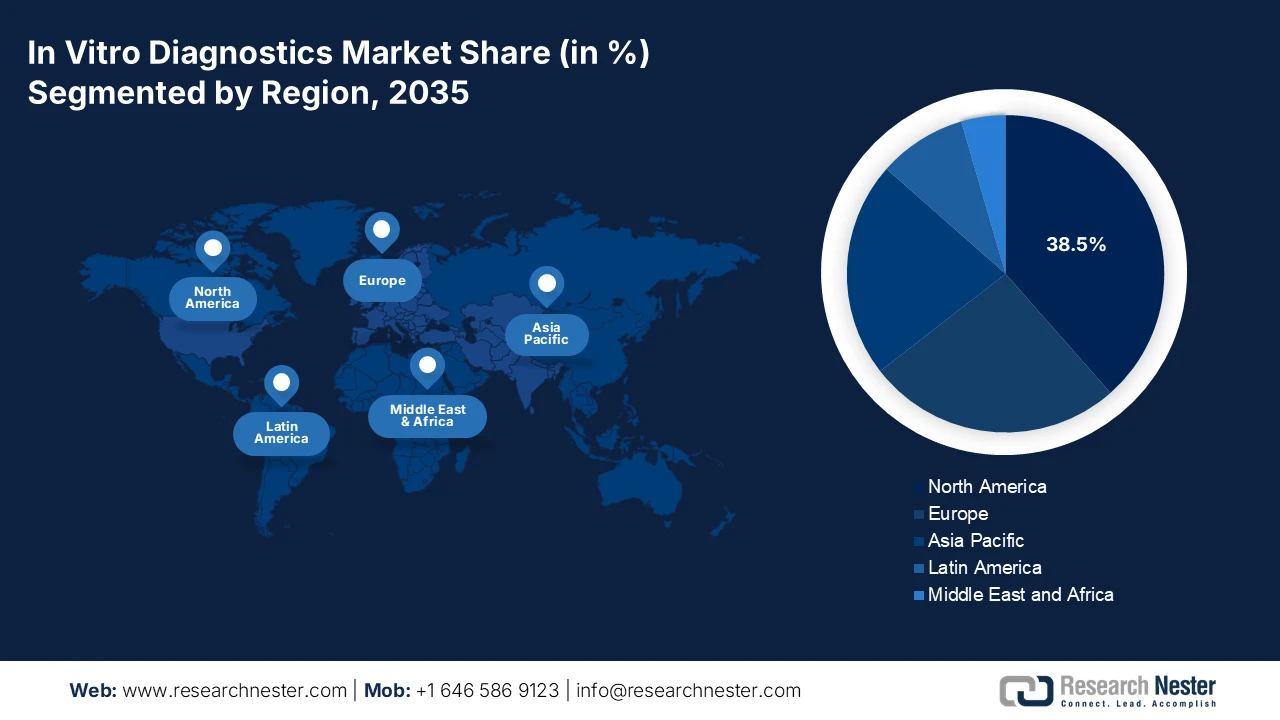

In Vitro Diagnostics Market - Regional Analysis

North America Market Insights

The North America in vitro diagnostics market is dominating and is expected to hold the revenue share of 38.5% during the assessment timeline. The market is driven by the advanced healthcare infrastructure and high healthcare expenditure. The key drivers include the strong adoption of precision medicine, escalating demand for point-of-care and home-based testing, and a robust pipeline of oncology and genomic tests. Regulatory frameworks from the FDA and CMS reimbursement policies shape the landscape, promoting innovation while managing costs. A dominant trend is the integration of AI and big data analytics into diagnostic platforms to enhance accuracy and workflow efficiency. The market also faces consolidation with major players acquiring innovative standardizing care and expanding diagnostic capacity, mainly in response to surgical backlogs highlighted by the pandemic, fostering demand for high-efficiency laboratory automation.

The U.S. in vitro diagnostics market is characterized by high innovation and stringent value demonstration driven by the world’s largest healthcare budget. A primary trend is the shift toward decentralized testing, fueled by the CMS reimbursement for home-use devices such as continuous glucose monitors, aiming to reduce hospitalization in chronic disease management. The Centers for Disease Control and Prevention emphasizes the role of rapid molecular diagnostics and genomic sequencing in public health surveillance for antimicrobial resistance and outbreak response, directing federal procurement. The U.S. FDA has approved several in-vitro diagnostic devices, such as the AAV5 DetectCDx by ARUP Laboratories, underscoring a regulatory pathway that prioritizes the novel biomarkers for targeted therapies.

FDA Approved Companion Diagnostic Devices (In-vitro and Imaging Tools)

|

Diagnostic Name |

Indication - Sample Type |

Drug Trade Name |

Biomarker |

Biomarker (Details) |

Approval Date |

|

AAV5 DetectCDx (ARUP Laboratories) |

Hemophilia A Patients - Plasma |

ROCTAVIAN |

Anti-AAV5 Antibodies |

Antibodies to the adeno-associated virus serotype 5 (AAV5) viral vector |

06/29/2023 |

|

Abbott RealTime IDH1 (Abbott Molecular, Inc.) |

Myelodysplastic Syndromes (MDS) - Peripheral Blood or Bone Marrow |

Tibsovo |

IDH1 |

R132 mutations (R132C, R132H, R132G, R132S, and R132L) |

10/24/2023 |

|

Abbott RealTime IDH1 (Abbott Molecular, Inc.) |

Acute Myeloid Leukemia - Peripheral Blood or Bone Marrow |

Rezlidhia |

IDH1 |

R132 mutations (R132C, R132H, R132G, R132S, and R132L) |

12/01/2022 |

|

Agilent Resolution ctDx FIRST assay (Resolution Bioscience, Inc.) |

Non-Small Cell Lung Cancer (NSCLC) - Plasma |

Krazati |

KRAS |

KRAS G12C |

12/12/2022 |

Source: FDA December 2025

The in-vitro diagnostic market in Canada is shaped by its single-payer, provincially administered healthcare system, prioritizing cost control and equitable access. A major trend is federal and provincial investment to address diagnostic backlogs exacerbated by the pandemic, with initiatives such as Ontario’s USD 324 million investment to expand the MRI and CT scanning capacity, which includes supporting laboratory infrastructure, based on the Government of Ontario’s March 2022 report. Procurement is heavily influenced by the health technology assessments conducted by the CADTH, which evaluates clinical and cost effectiveness before provincial adoption. The public health agency of Canada focuses on strengthening the national surveillance for infectious diseases and antimicrobial resistance, creating a demand for standardized high-throughput laboratory platforms.

APAC Market Insights

The Asia Pacific in-vitro diagnostic market is the fastest growing and is expected to grow at a CAGR of 6.8% during the forecast period 2026 to 2035. The market is driven by the confluence of expansive healthcare investment, rising disease burden, and technological adoption. The primary catalysts include massive government-led healthcare infrastructure expansion, such as China’s Healthy China 2030 initiative and universal health coverage drivers in India and Thailand, which are significantly increasing diagnostic accessibility. A rising middle class, an aging demographic facing a high prevalence of diabetes and cancer, and increasing health awareness are fueling private sector demand. The trend is decisively toward local manufacturing to reduce the import dependency, rapid uptake of point-of-care and molecular diagnostics for infectious disease management, and digital health integration.

China market expansion is centrally planned and executed via the Healthy China 2023 strategy, which prioritizes early screening and preventive care, driving massive procurement for public health programs. Government mandates for local innovation and Made in China self-reliance have surged the dominance of the domestic players, such as Mindray, in core laboratory segments. The National Medical Products Administration has streamlined approvals for critical tests, including high-throughput platforms for oncology and infectious diseases. A key statistical driver is the scale of public investment. According to the NLM study in September 2024, the total health expenditure in the nation reached 8,532.749 billion yuan and has maintained a high baseline, directly funding the deployment of the diagnostics across counties and community health centers.

The India in vitro diagnostics market is positioned for sustained long term growth supported by demographic, economic, and policy-driven factors. An aging population, rising disposable incomes, and increasing prevalence of lifestyle-related diseases are expanding the demand for routine and preventive diagnostic testing. Shifting patient attitudes toward early detection, wider insurance coverage, and growing adoption of point-of-care diagnostics are further increasing the test volumes across the urban and semi-urban settings. On the supply side, the report from Invest India in June 2021 states that the government of India’s production-linked incentive scheme 2.0 is a structural catalyst aimed at strengthening domestic in-vitro manufacturing and reducing import dependence. By targeting companies with the local manufacturing revenues of 5,000 crore or more, the scheme seeks to create globally competitive Indian manufacturers capable of integrating into international value chains and scaling advanced diagnostic technologies.

Europe Market Insights

The Europe market is a mature, evolving and is defined by the robust regulation cost containement pressures and a strong push toward integrated healthcare. The implementation of the in-vitro diagnostic regulation is the dominant force raising compliance barriers that favor large established players with robust quality systems while potentially slowing the innovation from smaller entrants. The key drivers include the region’s aging population, increasing the prevalence of chronic diseases requiring monitoring, and a strategic focus on personalized medicine and early diagnosis to improve outcomes and reduce the long term costs. The European Commission’s EU4Health programme represents a significant demand catalyst funding initaitive to strengthen the health systems including a cross border health threats.

The Germany in-vitro diagnostic market is led by its extensive statutory health insurance system and dense network of hospitals and independent laboratories. The growth is structurally driven by the aging demographic and strong emphasis on early diagnosis and outpatient care, increasing the test volumes. The implementation of the Digital Healthcare Act and Hospital Future Act is a critical catalyst providing billions in funding for digital infrastructure that mandates the integration of diagnostic data into electronic patient records, fueling the demand for connected devices. The report from the Federal Statistical Office in April 2023 states that the healthcare expenditure in Germany reached 474.1 billion euros in 2021, representing a continued growth, providing a substantial and expanding financial base for diagnostic services and procurement.

The UK in vitro diagnostics market operates under a distinct regulatory framework post Brexit, governed by the UK Medicines and Healthcare products Regulatory Agency. A primary growth driver is the NHS Long Term Plan, which prioritizes early cancer diagnosis and community-based care, directing the demand toward rapid diagnostic centers and point-of-care tests. The UK’s world-leading Genomics Medicine Service creates a high-value niche for advanced molecular diagnostics and companion diagnostics. A key statistical indicator of the NHS diagnostic activity is the backlog for elective care. The report from the NHS England in February 2024 indicates that the number of patients waiting over 6 weeks for a key diagnostic test stood at 334,900, highlighting the sustained high demand and system pressure, which drives the ongoing investment and procurement in diagnostic capacity to reduce the wait times.