In Vitro Diagnostics Market Segmentation:

Product & Service Segment Analysis

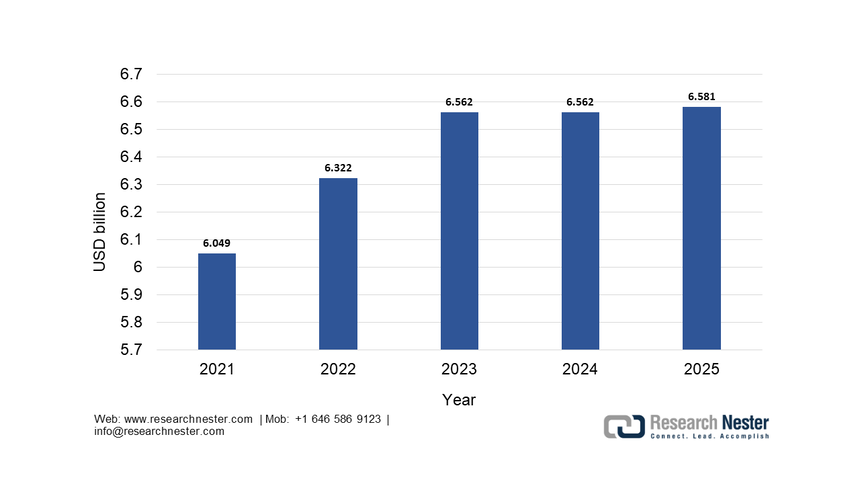

The reagents & kits sub-segment dominates and is expected to hold the share value of 75.4% by the end of 2035. This dominance is due to the high-volume recurring consumption model inherent to diagnostic testing, where instruments are often placed with long-term service contracts to guarantee reagent purchases. The continuous expansion of test menus is driven by the new biomarkers for oncology, neurology, and infectious diseases, which directly fuel the reagent sales. A key statistical driver is the public health investment in infectious disease monitoring. According to the National Institute of Allergy and Infectious Disease 2025 data, the funding for allergy and infectious disease research reached USD 6.581 billion in 2025, primarily allocated for test kits and reagents to sustain the national surveillance and response capabilities. This model of bulk reagents is to sustain national surveillance and response capabilities. This model of bulk procurement for public health underscores the segment’s stability and growth, which is further stimulated by the automation of high-throughput laboratory platforms.

NIAID Research Funding History, through 2025

Source: NIAID 2025

End user Segment Analysis

Hospitals & Clinics remain as the leading end user projected to hold the largest share value in the in vitro diagnostics market. This centrality is due to their role as the primary hubs for acute emergency and high complexity testing that cannot be decentralized. This segment’s growth is powered by the adoption of integrated automated laboratory systems designed to handle vast test volumes efficiently alongside the expansion of specialized testing within hospital-based oncology and cardiology centers. A critical statistical reinforcement comes from U.S. government healthcare expenditure data. According to the Centers for Medicare & Medicaid Services, national healthcare spending in hospital care services grew to USD 4.5 trillion in 2022 and is projected to continue its upward trend. This massive financial flow into hospitals directly supports infrastructure investments in advanced diagnostic equipment and the consumables required for patient care, cementing this segment’s market leadership.

Test Location Segment Analysis

The point of care testing sub-segment is dominating the location segment in the in vitro diagnostics market. Its expansion is driven by the powerful trends of healthcare decentralization, patient self-management, and the demand for immediate clinical decisions. Leading drivers include the integration of continuous glucose monitoring for diabetes management into standard care pathways and the commercialization of advanced CLIA-waived molecular devices for rapid infectious disease diagnostics in clinics. A definitive statistical indicator of this growth is documented in U.S. public health reporting. This trajectory is fundamentally reshaping the diagnostic landscape, moving critical testing from the core lab directly to the patient’s side. As technology advances, PoC testing is becoming more accurate, affordable, and accessible, ensuring its role as the cornerstone of modern responsive healthcare delivery.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product & Service |

|

|

Technology |

|

|

Application |

|

|

Test Location |

|

|

End user |

|

|

Specimen |

|

|

Usability |

|