In-vitro Diagnostics for Cardiology and Neurology Market Outlook:

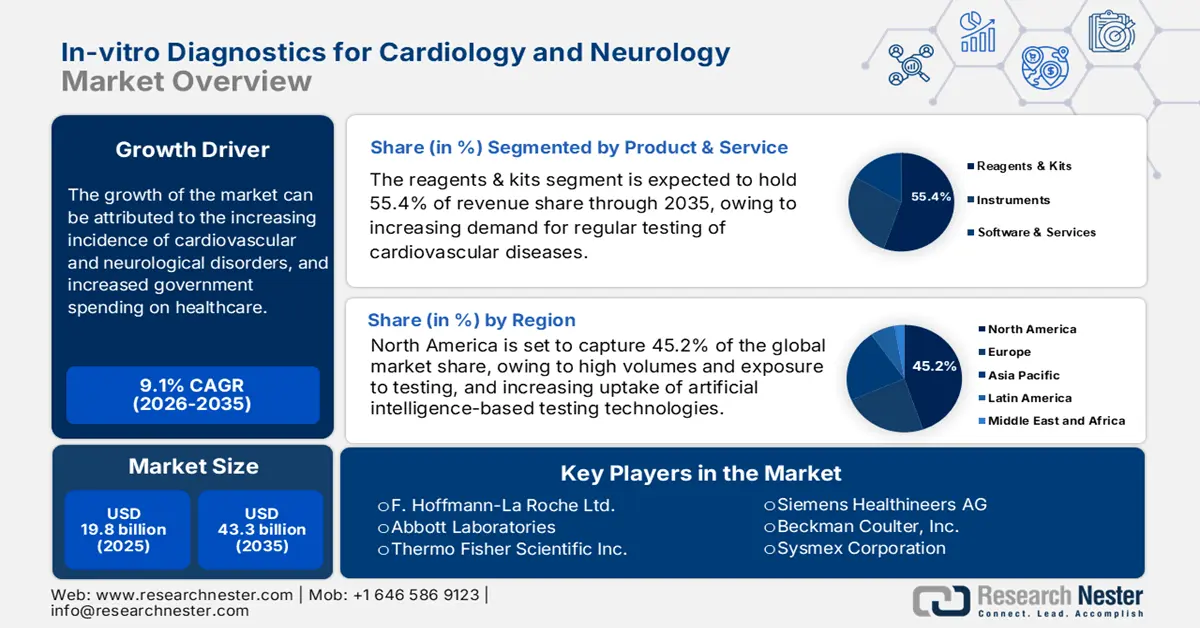

In-vitro Diagnostics for Cardiology and Neurology Market size was valued at USD 19.8 billion in 2025 and is projected to reach USD 43.3 billion by the end of 2035, rising at a CAGR of 9.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of in-vitro diagnostics for cardiology and neurology is assessed at USD 21.6 billion.

The in-vitro diagnostics for cardiology and neurology market caters to a large patient population of cardiovascular diseases (CVD) and neurological disorders. According to an NLM subgroup analysis, CVD-related occurrence, crude mortality, and crude disability-adjusted life years (DALYs) are predicted to increase by 90.0%, 73.4%, and 54.7% between 2025 and 2050 worldwide. It also mentioned that the number of deaths due to this condition is poised to amplify from 20.5 million to 35.6 million during the same timeline. This resembles to the urgent need for the deployment and utilization of advanced diagnostic solutions in order to prevent disease progress and fatalities.

The current dynamics of payers' pricing in the in-vitro diagnostics for cardiology and neurology market are primarily shaped by the increasing pressure on manufacturers to balance cost containment with performance and quality. As major public and private payers in this sector are increasingly prioritizing high affordability benchmarks, the need for both producers and service-providers to adopt value-based pricing models emphasizes. However, the cost-effectiveness of in-vitro diagnostics (IVD) in delivering is helping the sector outperform other testing methods. In this regard, a 2024 NLM study revealed that the full adoption of PrecisionCHD as the primary assessment method for initial coronary heart disease (CHD) can save USD 113.6 million in one year for the U.S. healthcare system.