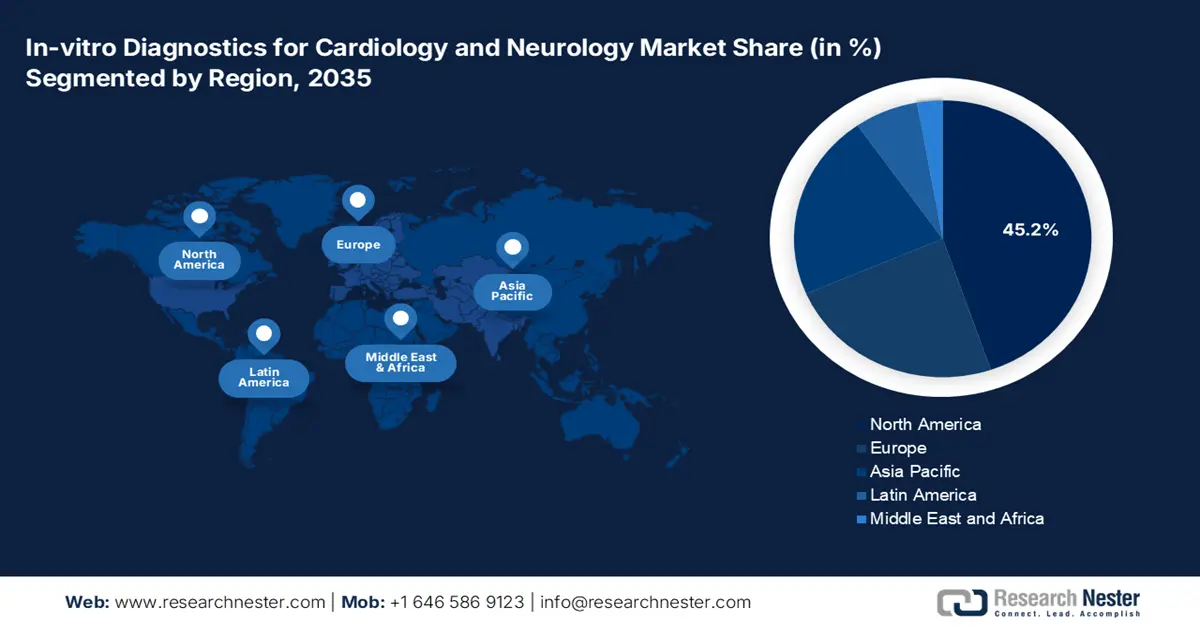

In-vitro Diagnostics for Cardiology and Neurology Market - Regional Analysis

North America Market Insights

The North America in-vitro diagnostics for cardiology and neurology market is anticipated to capture the largest share of 45.2% by the end of 2035. The landscape primarily benefits from the existing and sizable healthcare infrastructure, high volumes and exposure to testing, and increasing uptake of AI-based MedTech technologies. The explosive growth and advancement of the biotech and pathology industries is also responsible for the increasing deployment and utilization of IVD into the mainstream cardiac and CNS-related assessment ecosystem across North America.

The rise in outpatient cardiac and neurological monitoring is supporting the demand for rapid and high-sensitivity IVD tools in U.S.-based private diagnostic networks and academic hospitals. This can be displayed through the country’s internationally leading trade of other diagnostic reagents, accounting for USD 10.1 billion and USD 6.0 billion export and import values in 2023, as reported by the OEC. Besides, government-led initiatives promoting early detection and prevention for CVD, such as the launch of Million Hearts Cardiovascular Disease (CVD) Risk Reduction Model, are also prompting adoption in the U.S. in-vitro diagnostics for cardiology and neurology market.

Massive federal allocations and strategic public-private partnerships are creating lucrative opportunities for the in-vitro diagnostics for cardiology and neurology market in Canada. The nationwide efforts to cultivate novel biomarkers for early identification of cardiovascular and neurodegenerative conditions in hospital networks are expanding the existing pipelines in this sector. Further, ongoing reformation of regulatory bodies are supporting improvement in the pace of the validation of IVD tests.

APAC Market Insights

Asia Pacific is predicted to exhibit the highest CAGR in the global in-vitro diagnostics for cardiology and neurology market throughout the discussed timeframe. The concerning rise in the number of CVD and neurological disorders-afflicted residents, which is also amplified by rapidly aging populations, is fostering a substantial consumer base for the merchandise in this region. Besides, the growing trends of incorporating advanced diagnostics to achieve scalable laboratory workflow are prompting wide acceptance of AI and POCT technologies in remote locations and hospitals.

Government initiatives, such as the Healthy China 2030 program, are the major propelling factors behind the remarkable progress of China in the in-vitro diagnostics for cardiology and neurology market. The enlarging demography of CVD is also a prominent contributor to the nation’s strong foundation in this field. Testifying to the same, a 2024 study unveiled that the mortality rate of CVDs accounts for 46.7%-44.2% of all deaths in rural and urban areas in China. Besides, the country’s impressive emphasis on diagnostic tool production is solidifying its forefront position in APAC.

With the ample AZ patient population, coupled with the world’s largest geriatric demography, Japan represents itself as an attractive landscape of profitable business and innovation in the in-vitro diagnostics for cardiology and neurology market. Additionally, the country’s next-generation healthcare infrastructure and strong adoption rates of AI-assisted medical devices are also marking strides in this field. On the other hand, the nation is strengthening its domestic supply chain of biomarkers and precision medicine, fueling local manufacturers.

Heart Failure (HF)-related Trends in APAC as Opportunities (2023)

|

Parameter |

Value |

Notes |

|

Overall economic cost of HF (annual) |

$25 billion |

Total cost in APAC |

|

Direct costs of HF |

$12 billion (48%) |

Medical expenses, hospital care |

|

Indirect costs of HF |

$13 billion (52%) |

Productivity loss, disability |

|

Crude prevalence of HF in 2050 |

74.5 million |

Projected number of cases in APAC |

|

Percentage increase in HF prevalence (2025–2050) |

127.60% |

Growth rate over 25 years |

Source: APACMed and NLM

Europe Market Insights

Europe is estimated to holds a considerable position in the global in-vitro diagnostics for cardiology and neurology market during the tenure between 2026 and 2035. The favorable government initiatives promoting early disease detection and widespread adoption of screening programs are also fueling growth in this landscape. In addition, the aging population and rising burden of chronic diseases contribute to the explosive demand for accurate and timely IVD solutions. Encouraged by such a progressive environment, in November 2023, Roche launched its LightCycler PRO System commercially. This bridged the gap between translational research and IVD technologies.

Ongoing regulatory reformation and increasing public-private collaboration in the UK support robust growth in the Europe in-vitro diagnostics for cardiology and neurology market. On the other hand, the massive capital influx from the National Health Servuce (NHS) and other government funding are fostering a suitable atmosphere for IVD-related innovation. Exemplifying the same, in May 2025, the National Institute for Health and Care Research (NIHR) set its aim to invest USD 58.6 million in funding to support country-wide CVD-associated research cohorts.

Germany is one of the leading country's in the Europe in-vitro diagnostics for cardiology and neurology market. The nation's forefront position in this sector is highly attributable to its robust medical system and strong emphasis on MedTech innovation. Germany is also home to a widespread network of hospitals and diagnostic laboratories, which ensures adequate patient access to cutting-edge IVD tests. Besides, the enlarging geriatric demography of the country heightens the occurrence and mortality of CVD and neurodegenrative disorders, prompting adoption of IVD as a rapid and scalable preventive measure.

Country-wise Trade of Other Diagnostic Reagents (2023)

|

Country |

Mode of Trade |

Values (in USD) |

|

Germany |

Export & Import |

8.5 billion & 4.0 billion |

|

UK |

Export & Import |

19.1 million & 55 million |

|

Ireland |

Export |

2.2 billion |

Source: OEC