In-vitro Colorectal Cancer Screening Tests Market Outlook:

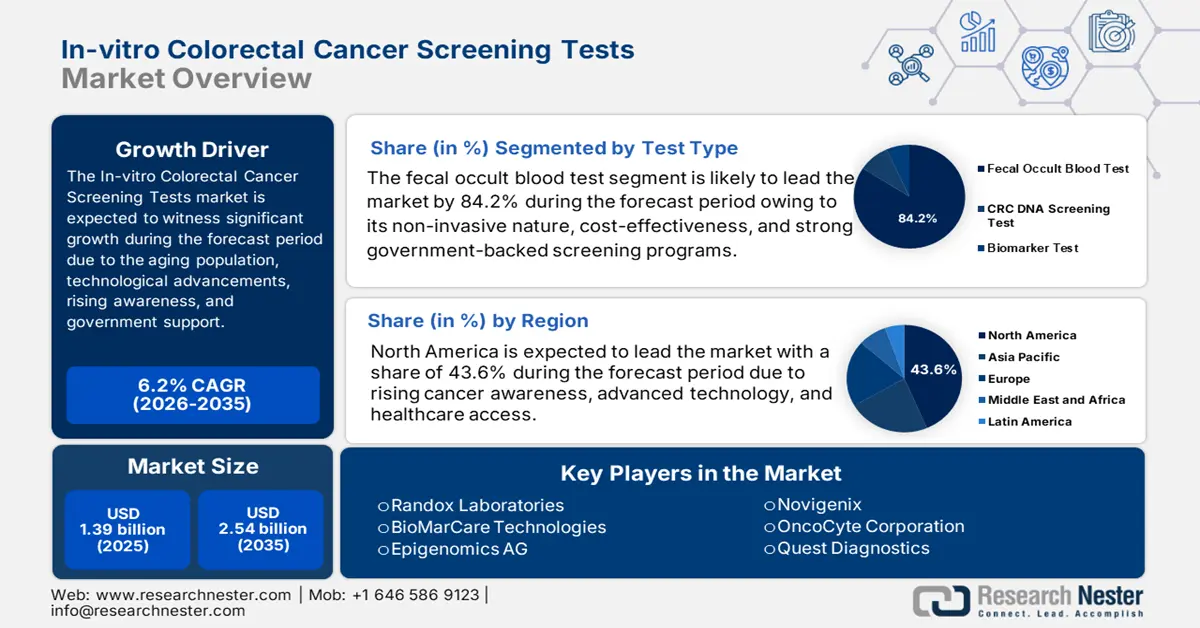

In-vitro Colorectal Cancer Screening Tests Market size was valued at USD 1.39 billion in 2025 and is likely to cross USD 2.54 billion by 2035, registering more than 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of in-vitro colorectal cancer screening tests is assessed at USD 1.47 billion.

According to a report by WHO in July 2023, more than 1.9 million new instances of colorectal cancer were registered, and over 930,000 deaths from the disease occurred globally in 2020. The increasing prevalence of colorectal cancer globally is a significant driver for the in-vitro screening test market. Colorectal cancer (CRC) is one of the most common and deadly cancers, contributing to a high number of cancer-related deaths worldwide. Early detection is crucial in improving survival rates, as identifying cancer in its early stages allows for timely intervention and better treatment outcomes. As awareness of preventive healthcare grows, the demand for effective, non-invasive screening solutions continues to rise.

Additionally, advancements in diagnostic tools and highly sensitive biomarker tests are improving the accuracy, efficiency, and accessibility of colorectal cancer screening, driving industry escalation. These innovations make tests more reliable and encourage broader adoption.

Comparative analysis of screening interventions (March 2020)

|

Screening Method |

Sensitivity for CRC Detection |

|

FIT (100g/mL) |

73.8% |

|

Stool DNA Testing (KRAS, NDRG4, BMP3 Methylation |

92.3% |

Source: NLM

Also, public awareness campaigns and healthcare initiatives are increasing participation rates by highlighting the benefits of early detection. In March 2023, the Louisiana Department of Health launched a campaign for Colorectal Cancer Awareness Month aimed at increasing screenings throughout the year. As patients and healthcare providers recognize that early screening leads to better treatment outcomes, demand for in-vitro colorectal cancer screening tests market continues to rise.

Key In-vitro Colorectal Cancer Screening Tests Market Insights Summary:

Regional Highlights:

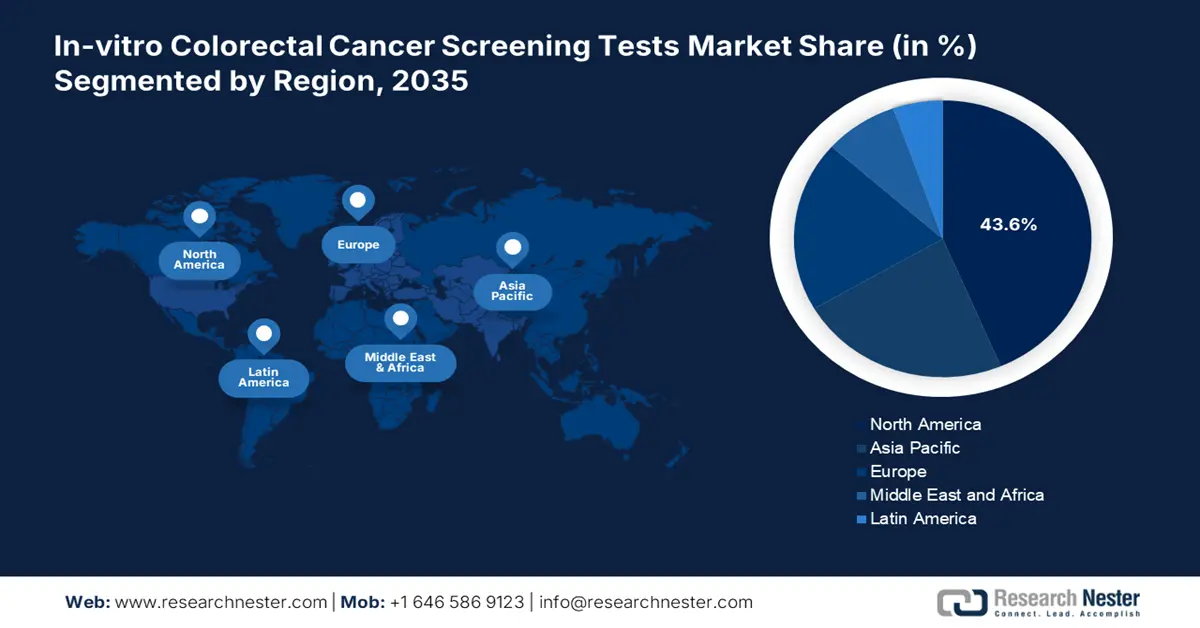

- North America’s 43.6% share in the In-vitro Colorectal Cancer Screening Tests Market is driven by high incidence of colorectal cancer increasing demand for in-vitro screening tests, boosting growth through 2035.

- The APAC region is poised for the fastest growth in the In-vitro Colorectal Cancer Screening Tests Market through 2026–2035, fueled by aging populations and growing medical tourism increasing demand for screening.

Segment Insights:

- The Fecal Occult Blood Test segment is projected to capture more than 84.2% market share by 2035, fueled by its affordability, non-invasive nature, and widespread adoption.

- Diagnostic Laboratories segment are projected to hold the majority share by 2035, driven by increased demand for accurate early cancer detection and supportive government programs.

Key Growth Trends:

- Increased at-home screening options

- Rise in non-invasive testing methods

Major Challenges:

- Cost constraints and insurance coverage limitations

- Regulatory and compliance hurdles

Key Players: Quest Diagnostics, Randox Laboratories, BioMarCare Technologies, Epigenomics AG.

Global In-vitro Colorectal Cancer Screening Tests Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.39 billion

- 2026 Market Size: USD 1.47 billion

- Projected Market Size: USD 2.54 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.6% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 13 August, 2025

In-vitro Colorectal Cancer Screening Tests Market Growth Drivers and Challenges:

Growth Drivers

-

Increased at-home screening options: The availability of self-screening kits, such as fecal immunochemical test (FIT) kits, is significantly driving the growth of the in-vitro colorectal cancer screening tests market. For instance, in May 2024, ColoSense, a stool screening test for colon cancer in average-risk persons over 45, received FDA approval. It has a 93% accuracy rate. These kits enable individuals to conduct tests privately and conveniently, eliminating the need for hospital visits. This ease of use encourages higher participation rates, particularly in remote or underserved areas with limited access to healthcare facilities. As a result, early detection rates improve, boosting demand for reliable in-vitro screening tests in the market.

- Rise in non-invasive testing methods: The development of non-invasive screening options, such as stool-based DNA tests and blood-based biomarker tests, is fueling the growth of the in-vitro colorectal cancer screening tests market. In this regard, in July 2024, the FDA approved Guardant Health's Shield blood test to screen for CRC in patients aged 45 years and older at average risk for the disease. These advanced tests provide a more comfortable and accessible alternative to traditional colonoscopy procedures, reducing patient hesitation. Their convenience, combined with high accuracy, is increasing participation rates in screening programs. As more individuals opt for these user-friendly methods, the market continues to expand.

Challenges

- Cost constraints and insurance coverage limitations: While some colorectal cancer screening tests are covered by insurance, others may not receive full reimbursement, making affordability a significant challenge for many patients. This issue particularly affects lower-income groups and those in regions with limited healthcare funding. Additionally, advanced biomarker-based tests, though highly accurate, come at a high cost, restricting widespread adoption. In developing regions, where healthcare budgets are constrained, the high price of innovative screening methods further limits access and market expansion.

- Regulatory and compliance hurdles: The In-vitro colorectal cancer screening tests market faces significant challenges due to stringent regulatory requirements before approval, which can delay product launches and increase costs for manufacturers. The need for extensive clinical trials and adherence to safety standards complicates the development process. Additionally, evolving healthcare policies and reimbursement frameworks add further complexity to market expansion. Manufacturers must navigate various regulatory environments, including changes in reimbursement rates and insurance coverage, which can impact the accessibility and affordability of these tests.

In-vitro Colorectal Cancer Screening Tests Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 1.39 billion |

|

Forecast Year Market Size (2035) |

USD 2.54 billion |

|

Regional Scope |

|

In-vitro Colorectal Cancer Screening Tests Market Segmentation:

Test Type (Fecal Occult Blood Test, CRC DNA Screening Test, Biomarker Test)

Based on test type, the fecal occult blood test segment is projected to hold in-vitro colorectal cancer screening tests market share of more than 84.2% by 2035. The segment’s growth is attributed to its non-invasive nature, affordability, and ease of use. It allows individuals to test for hidden blood in stools, which can be an early sign of colorectal cancer. Additionally, FOBT is recommended in many national screening programs, enhancing its accessibility and encouraging widespread adoption. As awareness of early cancer detection rises, more people are opting for this cost-effective and reliable screening method. For instance, in December 2023, the FDA approved OTC at-home fecal occult blood test to enable early detection of colorectal cancer, boosting in-vitro colorectal cancer screening tests market escalation.

End user (Clinics, Hospital, Diagnostic Laboratories, Others)

By end user, the diagnostic laboratories segment is slated to hold the majority of in-vitro colorectal cancer screening tests market share over the forecast period. The segment is surging due to increased demand for accurate, early detection of colorectal cancer. These laboratories offer advanced testing solutions, including fecal occult blood tests and molecular diagnostics, ensuring reliable results. With the rise in preventive healthcare and government-supported screening programs, diagnostic labs are becoming more accessible to a wider population. Their capability to deliver rapid, precise, and thorough testing services significantly enhances their competitive edge, driving market overall market growth and increasing customer satisfaction levels.

Our in-depth analysis of the global market includes the following segments:

|

Test Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

In-vitro Colorectal Cancer Screening Tests Market Regional Analysis:

North America Market Statistics

North America in-vitro colorectal cancer screening tests market is set to account for revenue share of more than 43.6% by the end of 2035, attributable to the high incidence of colorectal cancer in the region. Approximately 107,320 new cases of colon cancer were reported by the American Cancer Society (54,510 in males and 52,810 in women) in January 2025. The figure particularly originated in the U.S. and Canada, which is driving demand for screening tests, as early detection significantly improves survival rates. The adoption of in-vitro screening tests such as fecal immunochemical tests (FIT) and stool-based DNA tests is increasing. Additionally, growing healthcare expenditure is fueling a focus on preventive care and early disease detection.

The U.S. healthcare system is increasingly prioritizing preventive care and early diagnosis, driving growth in the in-vitro colorectal cancer screening tests market. Federal and state investments in cancer prevention programs, along with growing spending on advanced diagnostic tools, support the development and adoption of in-vitro screening technologies. For instance, in October 2024, CRCCP clinics increased colorectal cancer screenings by 35%, reaching 198,000 people, from July 2021 to June 2022. Insurance coverage for preventive screenings enhances accessibility, making tests more widely available to the population. These efforts collectively boost market surge by improving early detection and expanding the use of innovative screening solutions.

The rising preference for non-invasive screening methods such as FIT kits and stool DNA tests, compared to traditional colonoscopies, is driving the in-vitro colorectal cancer screening tests market in Canada. These tests offer greater comfort and privacy, encouraging more individuals, particularly those hesitant about invasive procedures, to participate in regular screenings. Additionally, the aging population in Canada increases the number of individuals at risk for colorectal cancer. The growing elderly demographic is undergoing routine screenings, further boosting demand for non-invasive in-vitro screening options.

APAC Market Analysis

The APAC in-vitro colorectal cancer screening tests market is expected to garner the fastest growth over the forecast period. Many Asia Pacific countries, such as Japan, South Korea, and China, have aging populations, increasing colorectal cancer risk and driving demand for routine, non-invasive screening methods. Early detection improves treatment outcomes, boosting the adoption of in-vitro colorectal cancer screening tests. Moreover, the region experiences a growing medical tourism sector, offering high-quality healthcare at lower costs and attracting international patients seeking advanced diagnostic tests. This trend further accelerates industry expansion by increasing access to comprehensive colorectal cancer screening solutions.

Leading global and domestic diagnostic firms in China are investing in R&D to develop advanced screening solutions, improving test accuracy and accessibility. Collaborations and partnerships are expanding market reach and enhancing the availability of high-quality screening tests. Additionally, increased healthcare spending and the expansion of diagnostic laboratories and hospitals are strengthening healthcare infrastructure in China. As a result, more individuals can avail of affordable, reliable detection purposes, driving early detection and boosting in-vitro colorectal cancer screening tests market growth across the country.

India is rapidly expanding its healthcare infrastructure, particularly in rural and semi-urban areas, with new diagnostic laboratories, hospitals, and telemedicine services improving access to cancer screening. The healthcare sector in India generated about USD 370.0 billion in 2022, according to the International Trade Administration, in January 2024. Additionally, a growing middle-class population with higher disposable incomes is driving demand for advanced healthcare services, including in-vitro screening tests. Improved insurance coverage further enhances accessibility, making early detection more affordable and widespread. These factors are collectively boosting the adoption of in-vitro colorectal cancer screening tests market across the country.

Key In-vitro Colorectal Cancer Screening Tests Market Players:

- Abbott Molecular

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novigenix

- OncoCyte Corporation

- Quest Diagnostics

- Randox Laboratories

- BioMarCare Technologies

- Epigenomics AG

- Exact Sciences Corporation

- Immunostics.

Key companies in the in-vitro colorectal cancer screening tests market are driving innovation through advanced biomarker-based tests, AI-powdered diagnostics, and non-invasive screening solutions. They are developing high-sensitivity fecal occult blood tests and liquid biopsy techniques for early cancer detection. Automation and digital pathology integration are enhancing test accuracy and efficiency. Additionally, companies are focusing on at-home test kits and rapid diagnostic tools, making screening more accessible and encouraging early disease detection. Here are some of the leading companies in the in-vitro colorectal cancer screening tests market:

Recent Developments

- In January 2025, Sysmex America partnered with Sentinel Diagnostics to distribute and service SENTIFIT 270 and 800 analyzers in Canada, enhancing fecal immunochemical test (FIT) availability and colorectal cancer screening from 2025.

- In April 2020, Epigenomics AG launched proColon, the first FDA-approved blood test for colorectal cancer, which included NCCN guidelines, offering an alternative for patients refusing traditional screening methods.

- Report ID: 7211

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

In-vitro Colorectal Cancer Screening Tests Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.