In-Vehicle Networking Chipset Market Outlook:

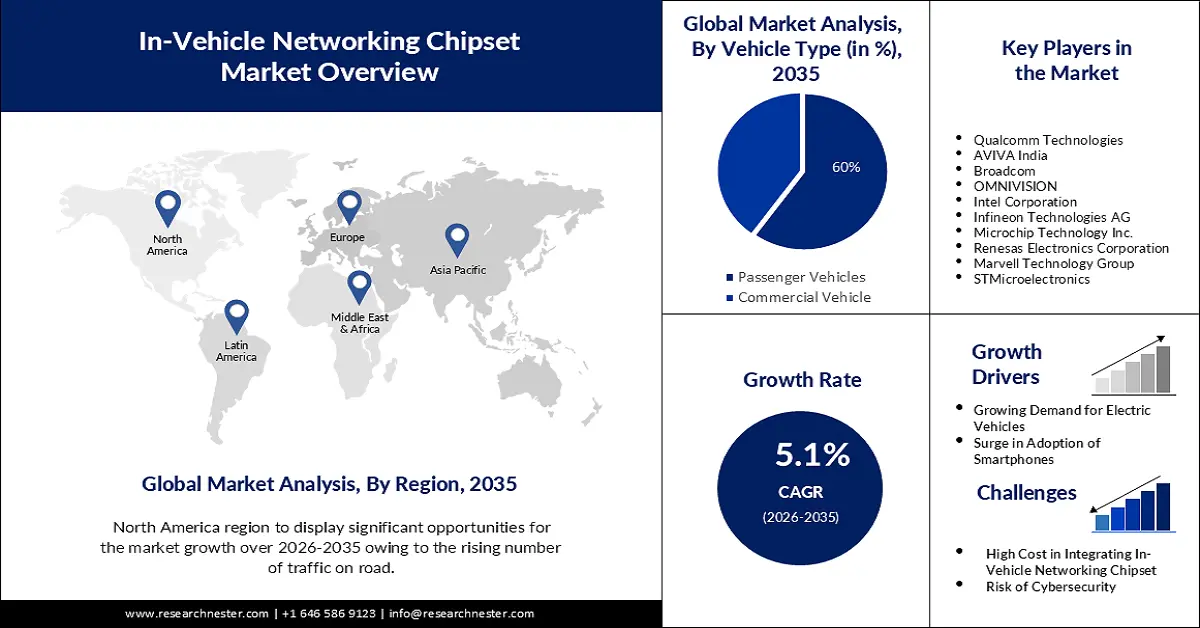

In-Vehicle Networking Chipset Market size was valued at USD 2.22 billion in 2025 and is set to exceed USD 3.65 billion by 2035, registering over 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of in-vehicle networking chipset is evaluated at USD 2.32 billion.

The growth of the market is set to be dominated by the growing computerization and digitalization of automotive parts. About 94 percent of newly sold cars worldwide by 2030 will be connected, up from about 49% at the moment. Approximately 44% of these cars are going to have advanced and intermediate connections. Hence, the deployment of in-vehicle networking chipsets is set to rise.

Furthermore, advancements in in-vehicle network technologies are propelling market revenue growth. Due to advancements including Controller Area Network (CAN) FD, Automotive Ethernet, and Ethernet-based communication protocols, in-car networks may now support larger data rates, better scalability, and higher levels of security. The market revenue growth is being prompted by these changes, which are incentivizing automaker and Tier 1 suppliers to invest in state-of-the-art in-vehicle network systems.

Key In-Vehicle Networking Chipset Market Insights Summary:

Regional Highlights:

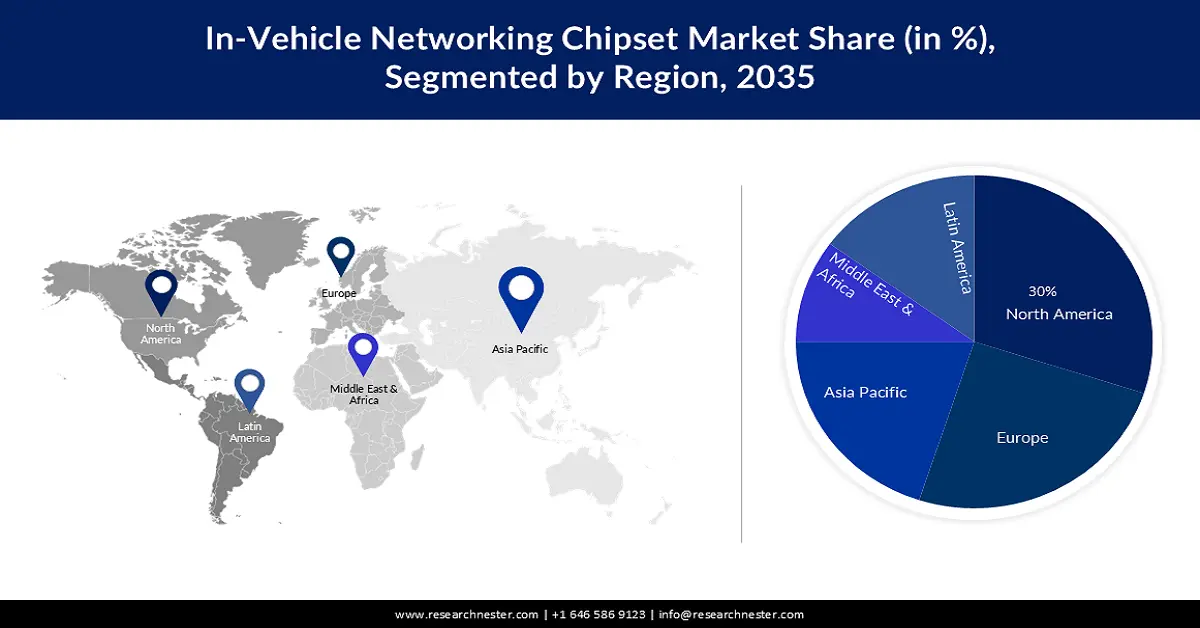

- By 2035, North America is anticipated to capture a 30% share of the in-vehicle networking chipset market, attributed to escalating road traffic volumes.

- By 2035, the European region is poised to expand substantially, underpinned by increasing investment in electric vehicles.

Segment Insights:

- By 2035, the passenger vehicles segment in the in-vehicle networking chipset market is projected to command about a 60% share, bolstered by rising demand for passenger vehicles.

- By 2035, the powertrain segment is expected to hold a 30% share, influenced by stricter emissions regulations.

Key Growth Trends:

- Growing Demand for Electric Vehicles

- Surge in Adoption of Smartphones

Major Challenges:

- High Cost in Integrating In Vehicle Networking Chipset

- Risk of Cybersecurity

Key Players: Qualcomm Technologies, AVIVA India, Broadcom, OMNIVISION, Intel Corporation, Infineon Technologies AG, Microchip Technology Inc., Renesas Electronics Corporation, Marvell Technology Group, STMicroelectronics.

Global In-Vehicle Networking Chipset Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.22 billion

- 2026 Market Size: USD 2.32 billion

- Projected Market Size: USD 3.65 billion by 2035

- Growth Forecasts: 5.1%

Key Regional Dynamics:

- Largest Region: North America (30% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Mexico, Indonesia, Thailand

Last updated on : 19 November, 2025

In-Vehicle Networking Chipset Market - Growth Drivers and Challenges

Growth Drivers

- Growing Demand for Electric Vehicles - In 2022 more than 9 million EVs were sold, accounting for over 13% of total new automobile sales—a significant increase from about 8% in 2021. Hence, in-vehicle networking chipset demand is being driven by the explosive expansion of electromobility. The development of chips in the electric vehicle (EV) industry, along with its precious metals, gives designers the ability to power the battery systems of their vehicles and enable features including firmware upgrades, which have become more important in today's automotive industry. In electric vehicles (EVs), sophisticated electronics and semiconductor chips may improve battery performance by pushing the battery towards higher voltages and more efficient onboard chargers. The automobile designer may promote quick and effective EV charging using a portfolio of real-time microcontrollers, isolated gate drivers, and fully integrated GaN power devices. Hence, the in-vehicle networking chipset market revenue for in-vehicle networking chipset is predicted to grow.

- Surge in Adoption of Smartphones - Based on projections, about 5 billion people use smartphones worldwide as of 2023, or over 84% of the global population. Hence, the adoption of smartphones is also growing in vehicles owing to the development of in-vehicle networking chipset. This has further given luxurious touch to the vehicles. Bluetooth connectivity allows smartphones to be coupled with the car's infotainment system. The individual may utilize the infotainment system to utilize phone capabilities by pairing their smartphone with the system. Using the infotainment system, this function enables customers to control incoming, outgoing, and conference calls. In addition, users can mark favorite contacts, read SMSs, and examine their phone contact list and call logs.

- Rise in Need to Track CO2 - An extended period of driving leads the cabin's CO2 concentration to increase and the oxygen supply to decrease due to respiration. Weariness and sleepy driving are consequent results of O2 depletion. CO2 thus lowers O2 levels, makes drivers tired, and affects their judgement and muscular coordination. Consequently, an autonomous system to detect air pollution in cars while they are travelling as well as enhance air quality is required to improve fatigue prevention strategies.

Challenges

- High Cost in Integrating In-Vehicle Networking Chipset - The advancement of technology also brings in huge cost for manufacturing which further also increase the end product price. As a result, the in-vehicle networking chipset market revenue is poised to hinder.

- Risk of Cybersecurity - Like numerous of our other smart, connected IoT gadgets, cars actually offer a lot of potential sources of security risk due to the quantity of hardware and software content that enables increased automation. One of the threats is to the electronic control units (ECUs). Cars can have additional security flaws besides ECUs that could let an attacker move seamlessly from one internal component of the car to another. The infotainment system, for instance, is linked to cellular networks to perform functions including remote vehicle diagnostics, location-based roadside assistance, and firmware upgrades for automobiles from automakers. Hence, the market expansion is expected to be restricted over the coming years.

- Lack of Awareness Among People Regarding Its Use

In-Vehicle Networking Chipset Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 2.22 billion |

|

Forecast Year Market Size (2035) |

USD 3.65 billion |

|

Regional Scope |

|

In-Vehicle Networking Chipset Market Segmentation:

Vehicle Type Segment Analysis

In-vehicle networking chipset market from the passenger vehicles segment is projected to capture the largest revenue share of about 60% over the forecast period. The major element to drive the expansion of this segment is growing demand for passenger vehicles. For instance, the world's sales of passenger cars increased by almost 2 percent in 2022 to reach over 56 million. In recent years, passenger cars have been increasingly popular among drivers as a result of attributes including their fashionable styling, small size, and affordability. In a number of developed nations passenger vehicles are the most popular form of transportation. As people's purchasing power rises, the number of these cars is rising in emerging nations. Furthermore, with the growing integration of in-vehicle networking chipset this segment is expected to grow even further hence dominating the market revenue.

Application Segment Analysis

The powertrain segment is predicted to hold 30% share of the global in-vehicle networking chipset market during the coming years. To minimize pollutants and save energy consumption, the engine management unit of every road vehicle must control the powertrain. Nearly 29% of greenhouse gas emissions come from transportation (source), and stricter emissions laws are being enforced to lessen the impact on the environment. Hence, further with the employment of in-vehicle networking chipset this process is predicted to become more efficient.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Vehicle Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

In-Vehicle Networking Chipset Market - Regional Analysis

North American Market Insights

The North America industry is anticipated to account for largest revenue share of 30% by 2035. This could be owing to the rising number of traffic on the road. As of the third quarter of 2021, the United States ranked among the nations with the highest volume of traffic on the roads, with over 283 million automobiles in use. Hence, this has further boosted the growth of accidents on the road. Additionally, according to a survey conducted in 2021, automotive safety is more crucial for Americans than fuel economy, good quality, and affordability when choosing a new vehicle. Hence, with the utilization of in-vehicle networking chipsets, these accidents are set to be lowered in this region. Therefore, the market share in North America is growing. Additionally, the government has launched various stringent laws to mitigate these accident cases which is also predicted to influence the market growth.

European Market Insights

The European region is also set to have significant growth in the global in-vehicle networking chipset market over the coming years. This growth of the market is set to be dominated by growing investment made in electric vehicles. Additionally, Europe government is predicted to launch various subsidies for the adoption of electric vehicles. EVs are substantially more costly than ICE vehicles in the absence of subsidies. However, due to government subsidies, EV cars are less expensive than ICE models in some particular situations. Considering electric vehicles (EVs) offer a cost-effective mobility solution amid the recent spike in fuel costs in Europe, consumers intending to take advantage of these kinds of restrictions are drawn to them. However, people in this region are also aware about the emission cause by fossil fuel. As a result, there demand for EV is poised to rise in projected timeframe.

In-Vehicle Networking Chipset Market Players:

- Qualcomm Technologies

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AVIVA India

- Broadcom

- OMNIVISION

- Intel Corporation

- Infineon Technologies AG

- Microchip Technology Inc.

- Renesas Electronics Corporation

- Marvell Technology Group

- STMicroelectronics

Recent Developments

- September 18, 2023: TE and AVIVA have collaborated to create an ASA-based connectivity solution that can support data rates of up to 16 Gbps per lane over longer distances than 10 metres of STP cable and 15 metres of coaxial cable. This solution allows high-bandwidth video and data to be transmitted in real-time for cameras, sensors, lidar, and radar systems that are essential to autonomous technology.

- May 9, 2022: A MIPI A-PHY-compliant camera solution for the automotive industry has been brought to market by OMNIVISION, a leading global developer of semiconductor solutions, advanced digital imaging, analogue, touch & display technology, and Valens Semiconductor, a leading provider of high-speed connectivity solutions for the automotive and audio-video markets. The new VA7000 A-PHY-compliant chipsets from Valens Semiconductor will be installed in OMNIVISION's Automotive Reference Design System (ARDS) camera modules. The OMNIVISION OX08B40 image sensor will also be a part of the first camera module.

- Report ID: 2914

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.