Automotive Infotainment Market Outlook:

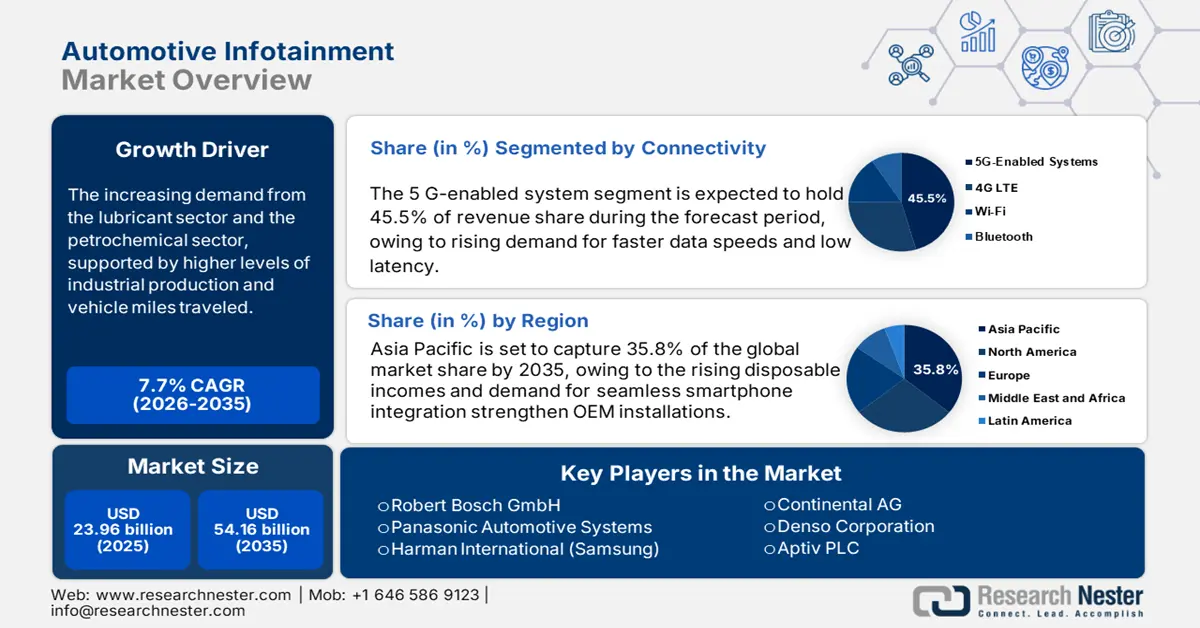

Automotive Infotainment Market size was valued at USD 23.96 billion in 2025 and is projected to reach USD 54.16 billion by the end of 2035, rising at a CAGR of 7.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of automotive infotainment is assessed at USD 25.96 billion.

The supply chain for the automotive infotainment is hugely reliant upon the adequate supply of display technologies, semiconductors, and software components. In 2021, U.S. total exports rose by $32.5 billion (12.9%) to $285.8 billion. Domestic exports grew $15.1 billion (10.3%) to $161.5 billion, while re-exports climbed $17.5 billion (16.4%) to $124.2 billion. U.S. general imports surged $88.3 billion (18.3%) to reach $572.0 billion, reflecting broad trade expansion across both domestic shipments and re-export activities compared with 2020. Additionally, the Bureau of Transportation Statistics shows that the consumer price index for all transportation goods and services increased 1.6% between December 2023 and December 2024, with transportation accounting for 8.8% of the 2.9% annual increase in the price of all goods and services. The largest contributor to inflation was motor vehicle insurance, which increased 11.3% annually and contributed 10.9% to the annual increase in the price of all goods and services.

The government's push for Vehicle-to-Everything (V2X) / connected vehicle technologies for preventing traffic fatalities is accelerating the market for automotive infotainment. One example is the National Deployment Plan for V2X Technologies published by the U.S. Department of Transportation in August 2024, which aims to speed up the introduction of systems that allow vehicles to communicate with each other and with infrastructure to reduce deaths and serious injuries from vehicle crashes.

Key Automotive Infotainment Market Insights Summary:

Regional Insights:

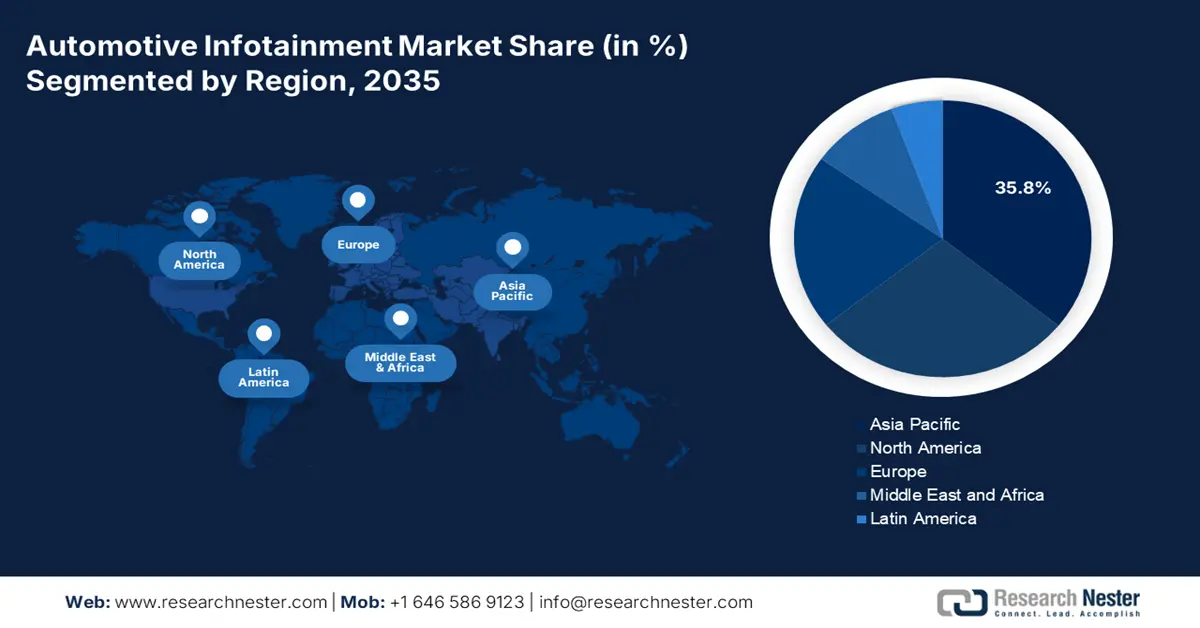

- The Asia Pacific automotive infotainment market is projected to secure a 35.8% revenue share by 2035, fueled by rising disposable incomes and increasing demand for seamless smartphone integration.

- North America is expected to account for 28.5% revenue share by 2037, supported by growing 5G adoption and the surge in AI-driven connected vehicle technologies.

Segment Insights:

- The 5G-enabled system segment is anticipated to command a 45.5% market share by 2035 in the Automotive Infotainment Market, propelled by rising demand for faster data speeds and low latency.

- The passenger vehicles segment is projected to hold a 40.9% share during 2026–2035, bolstered by increasing consumer preference for advanced infotainment features in personal vehicles.

Key Growth Trends:

- Growing demand for connected vehicles

- Cybersecurity compliance & digital trust

Major Challenges:

- High cost for cybersecurity compliance

- Regulatory and compliance challenges

Key Players: Robert Bosch GmbH, Panasonic Automotive Systems, Harman International (Samsung), Continental AG, Denso Corporation, Aptiv PLC, Mitsubishi Electric Corporation, Visteon Corporation, LG Electronics Inc., Pioneer Corporation, Alpine Electronics Inc., Tata Elxsi, Aisin Corporation, Gentex Corporation, Clarion Malaysia Sdn. Bhd.

Global Automotive Infotainment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 23.96 billion

- 2026 Market Size: USD 25.96 billion

- Projected Market Size: USD 54.16 billion by 2035

- Growth Forecasts: 7.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.8% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Brazil, Indonesia, Mexico, Thailand

Last updated on : 24 September, 2025

Automotive Infotainment Market - Growth Drivers and Challenges

Growth Drivers

- Growing demand for connected vehicles: The advanced features, such as telematics, real-time updates, navigation, smartphone integration, media playback, etc., are some of the prominent features in infotainment-enabled vehicles. Governments supporting smart transportation infrastructure further accelerate this trend, expanding market opportunities. Enhanced connectivity enables advanced safety, remote diagnostics, and over-the-air updates, boosting infotainment adoption. For instance, BMW’s iDrive 8 utilizes Amazon Alexa integration and embedded 5G modems. Tier 1 suppliers are investing in infotainment platforms that are cloud-updatable and modular to remain competitive. For instance, by 2034, China plans to have 30 million more V2X-capable cars on the road annually.

- Cybersecurity compliance & digital trust: Countries are coming up with cybersecurity frameworks, such as the National Institute of Standards and Technology Cybersecurity Framework, and the General Data Protection Regulation in the European Union. These frameworks are laying down guidelines to drive mandatory compliance. For instance, Leidos, serving defense, intelligence, civil, and health sectors globally, partnered with Intel to implement NIST SP 800-207 principles using Confidential Computing via Intel Trust Authority’s attestation service. Market players are ensuring safe data exchange and developing user confidence in connected vehicles. These efforts to adhere to regulatory guidelines and consumer trust are transforming the automotive infotainment industry growth trajectory worldwide.

- Consumer expectations for personalization and UX: Consumers are demanding seamless integration in their connected vehicles with higher personalization and enhanced user experience. Leading market players such as Hyundai are joining hands with Cerence Inc. to enable emotion-based, multilingual voice assistance. Various governments are also aiding these trends by making frameworks on usability and interoperability. For instance, the National Highway Traffic Safety Administration has issued guidelines for the human-machine interface to enhance UX-driver safety.

Emerging Trade Dynamics

Semiconductor devices, nes in 2023

|

Country |

Export Value (US$ Thousands) |

|

Philippines |

221,524.36 |

|

Lebanon |

820.69 |

|

Georgia |

195.75 |

|

Djibouti |

49.99 |

|

Angola |

15.11 |

|

Guyana |

1.34 |

|

Seychelles |

0.08 |

|

Samoa |

0.04 |

|

Cape Verde |

0.03 |

Source: WITS

Challenges

- High cost for cybersecurity compliance: Infotainment systems collect and transmit sensitive user data, including location, contacts, and usage patterns. These systems are increasingly targeted by cyberattacks, making robust cybersecurity essential. Manufacturers must implement encryption, secure over-the-air updates, and strict access controls to prevent unauthorized access. Compliance with global data privacy regulations (like GDPR) adds complexity. A security breach can lead to safety hazards, legal liabilities, and reputational damage, creating a significant barrier to widespread adoption of connected infotainment solutions.

- Regulatory and compliance challenges: Infotainment systems must comply with stringent automotive regulations related to driver distraction, safety, emissions, and connectivity standards. For example, excessive screen interaction can violate driver safety guidelines. Compliance varies across regions, forcing manufacturers to customize systems for multiple markets. Ensuring that voice commands, touch interfaces, and real-time alerts meet legal requirements adds design and testing complexity. Non-compliance can result in fines, recalls, or market restrictions, posing a significant challenge in global infotainment deployment.

Automotive Infotainment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2037 |

|

CAGR |

7.7% |

|

Base Year Market Size (2025) |

USD 23.96 billion |

|

Forecast Year Market Size (2035) |

USD 54.16 billion |

|

Regional Scope |

|

Automotive Infotainment Market Segmentation:

Connectivity Segment Analysis

The 5 G-enabled system is anticipated to register 45.5% market share by 2035 due to rising demand for faster data speeds and low latency. The high speed of the 5G connectivity helps in seamless streaming and real-time navigation. There has been massive government support for the expansion of 5 G-enabled systems across the world. According to data published by the U.S. Federal Communications Commission, the fund for expanding 5G for high-speed mobile broadband access in rural America in 2024 was almost USD 9 billion. Similarly, in April 2025, the Ministry of Industry and Information Technology in China declared the establishment of over 4.39 million 5G base stations. These factors are augmenting the growth of the segment during the forecasted period.

Vehicle Type Segment Analysis

The passenger vehicles segment is projected to garner 40.9% share between 2026-20235 due to rising consumer demand for advanced infotainment in personal cars. Various governments across the world are also supporting intelligent transportation systems and enabling smart mobility. For instance, the U.S. Department of Transportation (DOT) has announced plans to invest up to $20 million in New York City's next-generation connected vehicle technologies. The U.S. Department of Transportation has announced plans to invest up to $42 million in connected vehicle technologies of the future.

Component Segment Analysis

The display units are anticipated to register 35.5% market share by 2035 due to contemporary automobiles increasingly depending on large, high-resolution touchscreens as their primary interface for navigation, audio, climate, and connected services. Touchscreens serve as the only human-machine interface, enabling conduits for consumer demand for smartphone-like experiences, as well as design thinking that integrates other emerging technologies such as voice control and real-time apps. Because of this predominance of adoption and the greatest share of revenue relative to all other component categories, touchscreens are likely the fastest-growing interface in modern vehicles.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Vehicle Type |

|

|

Connectivity |

|

|

Operating System |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Infotainment Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific automotive infotainment market is projected to register staggering growth with a 35.8% revenue share by 2035. Rising disposable incomes and demand for seamless smartphone integration boost OEM installations. The growth of the market can be attributed to the rising sales of the IoT-enabled vehicles. China is offering lucrative opportunities for the market players with the rise in ICT investments and the boom in EV sales. The foundation for a digital panopticon is being laid by the Chinese Communist Party's 2020 deployment of 626 million video cameras, the growing use of artificial intelligence, and the absence of meaningful civil rights protections.

China continues to be the largest infotainment marketplace in the Asia Pacific, with the strongest demand being generated from its automotive passenger-car production and growing electric vehicle (EV) sector. The government’s Intelligent Connected Vehicle (ICV) strategy has promoted and enabled advanced connected services to suppliers such as Huawei and Baidu. Increasing consumer preference for voice-activated navigation and entertainment services will help drive increased adoption.

The expansion of India’s automotive infotainment system market is due to the continued increase in the sale of passenger vehicles, improvement in smartphone integration, and increasing consumer interest in navigation, entertainment, and telematics. The Union Government has endorsed connected-car technology and electric vehicles (EVs) with initiatives such as FAME-II and the Automotive Mission Plan 2026. The International Telecommunication Union reports that there were 5.4 billion Internet users in 2023, up from 1 billion in 2005. Estimates of yearly smartphone shipments more than doubled, from 500 million to over 1.2 billion, between 2010 and 2023. According to certain market projections, the percentage of people with fifth-generation (5G) mobile broadband is predicted to increase from 25% in 2021 to 85% in 2028.

North America Market Insights

The North America automotive infotainment market is anticipated to hold 28.5% revenue share by 2037, owing to a surge in 5G adoption and exponentially rising consumer demand for advanced car technology. Widespread 5G adoption, strong electric vehicle (EV) acceptance, and the proliferation of Artificial Intelligence (AI) voice assistants are expected to support growth. Automotive companies are collaborating with technology companies to develop seamless smartphone integration, subscription services, and over-the-air (OTA) updates for passenger and commercial vehicles, where market growth should be steadily adopted.

The U.S. automotive infotainment sector is driven by consumer demand for smart features, such as voice recognition, real-time navigation, and streaming services. Federal incentives for EVs and 5G infrastructure will help drive the adoption of connected car services. Telecommunications equipment imports increased by $16.4 billion, or 17.3%, to $111.3 billion. The main cause of the increase was the rise in imports of switches, routers, and cell phones as the demand for fifth-generation (5G) infrastructure and technologies increased globally in 2021. Cell phones saw the biggest gain in this breakdown, rising $12.0 billion (24.8%) to $60.7 billion. As manufacturers released more 5G smartphones onto the market, pent-up customer demand for these devices was partially satisfied, leading to an increase in cell phone imports. Switches and routers saw the second-largest gain in this breakdown, rising $3.7 billion (9.6%) to $42.3 billion.

The automotive infotainment market in Canada is expected to grow steadily, driven by increased adoption of electric vehicles and growing interest from consumers in connected services such as cloud-based navigation, music streaming, and driver-assistance displays. Federal and provincial incentives for purchasing electric vehicles (EVs) will encourage consumers to adopt smart infotainment technologies, aided by the substantial expansion of 5G networks. Collaboration between automotive and technology companies has led to devices utilizing next-generation connected infotainment technology features. The bilingual interface (English-French) demand among Canadian drivers is also helping drive customized infotainment solutions.

Europe Market Insights

The European automotive infotainment market is anticipated to hold 20.5% revenue share by 2037, owing to a growing demand for more EVs being sold, related connectivity is improving, and safety regulations are becoming stricter, all of which encourage the growth of telematics integration and navigation. As consumers increasingly choose connected cars, the rollout of 5G, coupled with government sponsorship of intelligent transport systems, promotes market growth. Leading auto brands are investing in embedded intelligent interfaces that apply AI and voice assistants for conversational dialog, and the EU is also pushing in-vehicle cybersecurity and over-the-air software updates to support demand, and you can see this in premium or midline car sales.

The German automotive infotainment market is the leader of the general European market based on the volume of auto OEMs with strong automotive manufacturing and rapid digitalization. The premium automotive OEMs such as BMW, Mercedes-Benz, and Volkswagen have embedded heads-up displays, voice recognition capabilities based on AI, and connected vehicle capabilities with smartphones as well. In 2024, more than 17 million electric cars were sold worldwide, accounting for more than 20% of total sales. Just the 3.5 million more electric vehicles sold in 2024 than the year before surpasses the global amount of electric vehicles sold in 2020. It is anticipated that more than 20 million electric vehicles will be sold globally in 2025, making up more than 25% of all automobile sales. The first three months of 2025 saw a 35% increase in global sales of electric vehicles.

Key Automotive Infotainment Market Plyers:

- Robert Bosch GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Panasonic Automotive Systems

- Harman International (Samsung)

- Continental AG

- Denso Corporation

- Aptiv PLC

- Mitsubishi Electric Corporation

- Visteon Corporation

- LG Electronics Inc.

- Pioneer Corporation

- Alpine Electronics Inc.

- Tata Elxsi

- Aisin Corporation

- Gentex Corporation

- Clarion Malaysia Sdn. Bhd.

The competitive landscape of the market is rapidly evolving as established key players, automotive giants, and new entrants are investing in IoT technologies. Key players in the market are focused on developing new technologies and products that cater to the stringent regulatory norms and consumer demand. These key players are adopting several strategies, such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global market:

Recent Developments

- In December 2024, Tenstorrent and South Korean BOS Semiconductors unveiled "Eagle-N," the industry's first automotive chiplet AI accelerator designed for in-vehicle infotainment and autonomous driving. These chips, manufactured using Samsung's 5nm process, offer customizable and cost-efficient solutions for automakers.

- In August 2023, Harman introduced the Ready Care system, leveraging AI and machine learning to monitor driver behavior and provide personalized interventions. This system enhances safety by detecting cognitive load and tailoring responses accordingly.

- Report ID: 4599

- Published Date: Sep 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Infotainment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.