In-building Wireless Market Outlook:

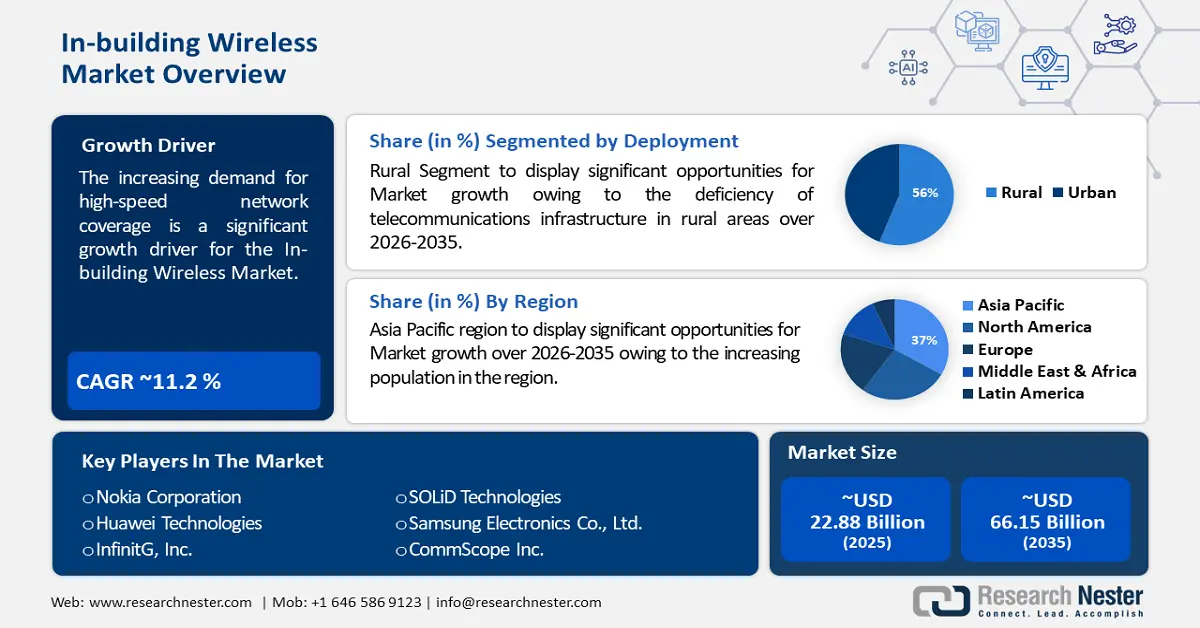

In-building Wireless Market size was over USD 22.88 billion in 2025 and is projected to reach USD 66.15 billion by 2035, growing at around 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of in-building wireless is evaluated at USD 25.19 billion.

To address the instability that cellular carrier networks have when activating data traffic in buildings like workplaces, hospitals, hotels, and retail malls, in-building wireless solutions are implemented. The MNOs/Mobile Virtual Network Operators (MVNOs) and neutral host providers are using in-building wireless solutions due to capacity concerns and a lack of coverage for indoor wireless networks. Therefore, the increasing demand for high-speed network coverage is accelerating the growth of the market. For instance, around 88% of the world's population was served by LTE in 2022, compared to about 35% by 5G, the newest mobile technology. Nonetheless, by 2028, 84% of the population is expected to be covered by 5G.

The significant improvement in building connectivity is the main advantage of IBRES. Consumers benefit from improved voice quality, quicker data rates, and fewer dropped calls, which improves their overall mobile communication experience. This is particularly important in the case of businesses, where seamless connectivity is an integral part of day-to-day operation.

Key In-building Wireless Market Insights Summary:

Regional Highlights:

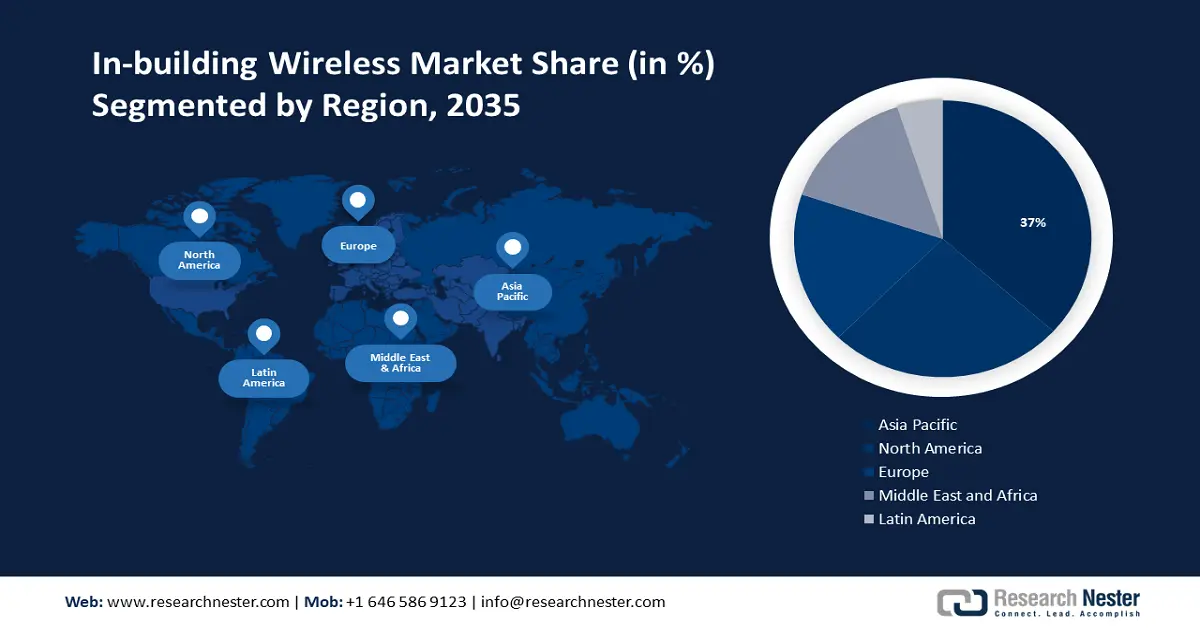

- Asia Pacific in-building wireless market will hold more than 37% share by 2035, driven by the region's large mobile subscriber base and ongoing digital transformation.

- North America market will achieve a 26% share by 2035, fueled by rising mobile device demand, BYOD adoption, and a shift toward 5G networks.

Segment Insights:

- The rural segment segment in the in-building wireless market is anticipated to secure a 56% share by 2035, influenced by the deficiency of telecommunications infrastructure in rural areas driving cellular coverage needs.

- The rural segment in the in-building wireless market is anticipated to experience substantial growth through 2035, driven by the deficiency of telecommunications infrastructure in rural areas, driving cellular coverage needs.

Key Growth Trends:

- Increasing Use of IoT in Industrial and Commercial Settings

- Increased Penetration of Smartphones

Major Challenges:

- Growing Incidence of Cyberattacks

- Higher Upfront Costs May Hinder Market Growth

Key Players: Nokia Corporation, Huawei Technologies, InfintiG, Inc., SOLiD Technologies, Samsung Electronics Co., Ltd., CommScope Inc., Airspan Networks, Dali Wireless, Comba Telecom Systems Holdings Ltd., Zinwave.

Global In-building Wireless Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 22.88 billion

- 2026 Market Size: USD 25.19 billion

- Projected Market Size: USD 66.15 billion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, South Korea, Thailand, Mexico

Last updated on : 16 September, 2025

In-building Wireless Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Use of IoT in Industrial and Commercial Settings - To increase the use of the Internet of Things for the automation of processes and to increase the speed of operations, organizations in different sectors are constantly striving. Therefore, the proliferation of the Internet of Things and related technologies would give rise to numerous opportunities in the wireless market for buildings. Through a variety of applications and use cases, the In-Building Wireless Network allows users to connect various sensors, machines, people, vehicles, or other devices. Issues such as reliability, service quality, security, and compliance are dealt with by any in building a wireless network. Several prominent businesses are striving to integrate in-building wireless networks into the Internet of Things, including Cisco, Samsung, and Nokia.

- Increased Penetration of Smartphones - The desire for smart and intelligent gadgets combined with the growing use of mobile phones is expected to fuel the expansion of the in-building wireless market overall. As per a report, for the first time since 2018, the anticipated 2022 global smartphone penetration rate was 68%. Simple oral communication devices have given way to more complex, intelligent, and multipurpose mobile devices in recent years. In the upcoming ten years, the commercialization of the next-generation 5G network is predicted to have a beneficial impact on the trends in the in-building wireless industry.

- Surge in the Demand for Sustainable and Smart Buildings - It is projected that one of the main contributing factors to the rise in demand for in-building wireless solutions will be the growing number of buildings being constructed with an emphasis on contemporary and sustainable design. In addition, there will be a need for in-building wireless solutions due to the growing trend toward intelligent and smart buildings, the need for reliable and effective in-door connectivity, and the need to increase business assurance for certain important applications. It is expected that the availability of unlicensed and shared spectrum worldwide would influence the direction of the global market.

Challenges

- Growing Incidence of Cyberattacks - Users of RANs and in-building wireless are becoming more concerned about security and privacy because of the increasing number of hacks occurring globally. The design of the C-centralized RAN is susceptible to several dangers, such as cyberattacks, intrusion attacks, and single points of failure. However, it is anticipated that market participants would take proactive steps to enhance the cyber security capabilities of their products to shield users from falling prey to online fraudsters. Therefore, the growing cases of cyberattacks and threats may hinder the growth of the in-building wireless market.

- Supplying affordable backhaul connectivity for small & medium-sized buildings could potentially impede the market's growth.

- Higher Upfront Costs May Hinder Market Growth

In-building Wireless Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 22.88 billion |

|

Forecast Year Market Size (2035) |

USD 66.15 billion |

|

Regional Scope |

|

In-building Wireless Market Segmentation:

Business Model Segment Analysis

Neutral host operators segment for the In-building wireless market is expected to hold a share of 46% during the forecast period. Businesses and property owners are opting for either of these business models, as required by their commercial needs. The bodies providing funds for installing these systems determine how these models function. An in-building wireless network for businesses is managed by neutral host operators. A neutral host operator that oversees the whole in-building wireless network is the owner of DAS and small cell networks under the neutral host ownership model. These operators shall also be responsible for obtaining carrier consent and selecting the appropriate frequency source in line with the design of the facilities where DAS or small cells are to be used. The development of multicarrier DAS and carrier invoices are the main funding sources for the neutral host operators. Thus, the need for high-performing indoor connections has never been greater due to the growing number of data-driven applications, which is driving the segment's growth. Recent data in 2022, indicates that over 70% of 4G services take place indoors, and industry forecasts indicate that this number will rise to over 80% as 5G expands service diversity and blurs corporate borders.

Deployment Segment Analysis

Rural segment for the in-building wireless market is anticipated to hold a share of 56% during the forecast period. The rise of this segment can be ascribed to the deficiency of telecommunications infrastructure in rural areas, which hinders the provision of improved cellular service to users. Using conventional LTE techniques to bring cellular coverage to faraway locations is costly. Several businesses are forming alliances to provide their services to rural regions. For instance, in 2022, the RuralLink solution was introduced by Huawei during the MBBF2022, the Global Mobile Broadband Forum. This solution makes it possible for green sites, site simplification, and simple evolution through site-level innovations. Because of this, operators can create mobile networks that link the disconnected and promote good business cycles in rural areas.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Business Model |

|

|

Venue |

|

|

Deployment |

|

|

End-user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

In-building Wireless Market Regional Analysis:

APAC Market Insights

In-building wireless market in Asia Pacific is poised to hold a share of 37% during the forecast period. Because of APAC's enormous population, telecom companies have access to a sizable pool of mobile subscribers. With additional customers expected to join its network in the upcoming years, the region accounts for the largest portion of all mobile subscribers worldwide. Many different countries in this diverse region are undergoing digital change. Due to its size, variety, and the logical lead taken by nations like South Korea, China, Australia, and Japan, it is expected to dominate in-building wireless deployments. The two biggest manufacturing economies are those in China and Japan, which manufacture electronics, vehicles, and IT goods. The industry's pursuit of cutting-edge technology has resulted in a significant shift in the production paradigm, with big data analytics and robotics becoming increasingly popular among them.

North American Market Insights

North American in-building wireless market is expected to hold a share of 26% by the end of 2035. A more tech-savvy generation and rising mobile device demand are expected to fuel market growth. Furthermore, the market is expanding due to the existence of a few notable in-building wireless carriers in the US. The growing acceptance of BYOD (Bring-Your-Own-Device) across the nation is also thought to benefit players. For instance, 59% of organizations adopted BYOD in the US in 2022. Furthermore, demand for connectivity, environmental restrictions, and a shift toward 5G networks are encouraging businesses to increase their investments in in-building wireless services.

In-building Wireless Market Players:

- Nokia Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Huawei Technologies

- InfintiG, Inc.

- SOLiD Technologies

- Samsung Electronics Co., Ltd.

- CommScope Inc.

- Airspan Networks

- Dali Wireless

- Comba Telecom Systems Holdings Ltd.

- Zinwave

Recent Developments

- After years of unwavering innovation and working with the biggest names in the business, InfiniG is pleased to introduce its revolutionary Neutral Host as a Service (NHaaS). This innovative solution raises the bar for in-building mobile coverage by seamlessly combining shared spectrum with cutting-edge cloud technology. Leading the way in neutral host innovations, InfiniG extends an invitation to businesses throughout the country to try out this revolutionary service.

- Two new SOLiD ALLIANCE 5G distributed antenna systems (DAS) in-building connectivity solutions were unveiled by SOLiD, the industry leader in cellular in-building mobile coverage. These solutions are specifically made to support the C-Band spectrum (3.7-3.98 GHz), with add-on options for the mid-band Auction 110 spectrum (3.45-3.55 GHz). With the full C-Band frequency allocations supported by the new DAS remote units, mobile network operators (MNOs) and third-party operators may optimize coverage and capacity to provide a true 5G experience indoors right away.

- Report ID: 5902

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

In-building Wireless Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.