Immunoprotein Diagnostic Testing Market Outlook:

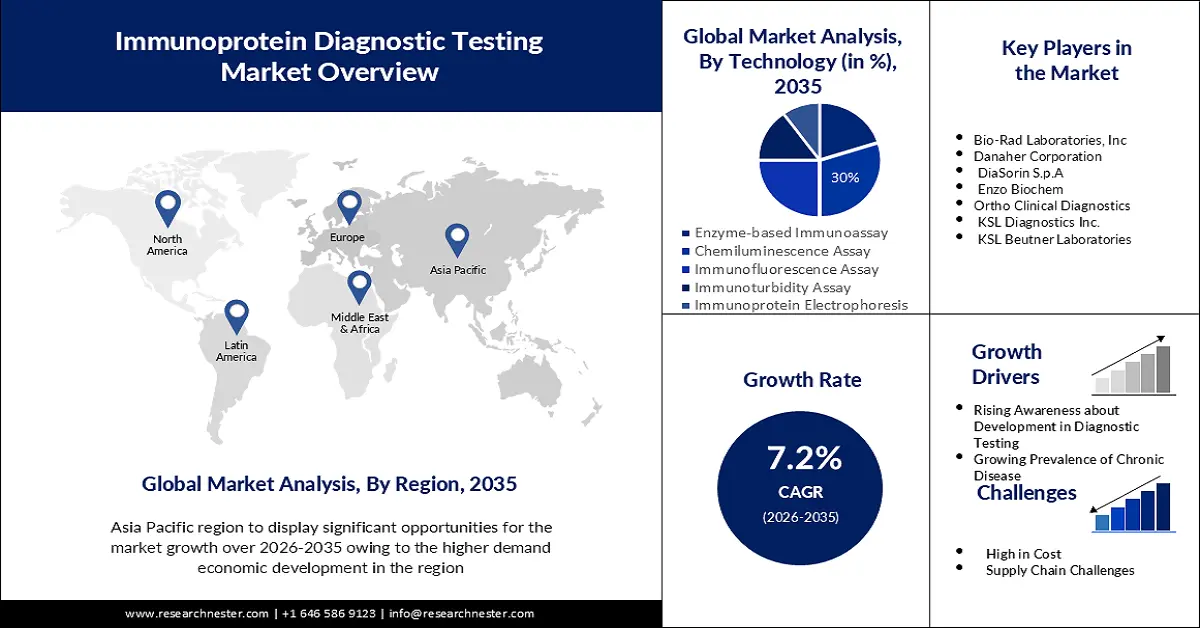

Immunoprotein Diagnostic Testing Market size was valued at USD 9.52 billion in 2025 and is set to exceed USD 19.08 billion by 2035, registering over 7.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of immunoprotein diagnostic testing is estimated at USD 10.14 billion.

The growth of this market can be attributed to the growing presence of infectious and chronic diseases. Products for immunoprotein diagnostic testing have increased in popularity due to the high frequency of chronic diseases like infectious diseases, cardiovascular diseases, cancer, obesity, and rheumatoid arthritis. Rapid diagnosis is urgently required due to the chronic diseases' rising mortality rates. Nearly half of all fatalities globally are thought to be caused by infectious diseases like AIDS, malaria, and tuberculosis, according to the Centers for Disease Control and Prevention (CDC).

Chemiluminescence assays have been developed as a result of technological developments in immunoprotein diagnostics. This technique uses fully automated devices and high throughput to assist in the quick detection of chronic diseases. Chemiluminescence tests only require a brief processing period, often between 30 and 45 minutes. This technology allows for on-board reagent capacity to speed up turnaround time and reduces any system workflow interruptions. Additionally, the launch of a wide range of goods has been facilitated by the fusion of complementing laboratory technologies with technological advancements related to immunological reagents and kits.

Key Immunoprotein Diagnostic Testing Market Insights Summary:

Regional Highlights:

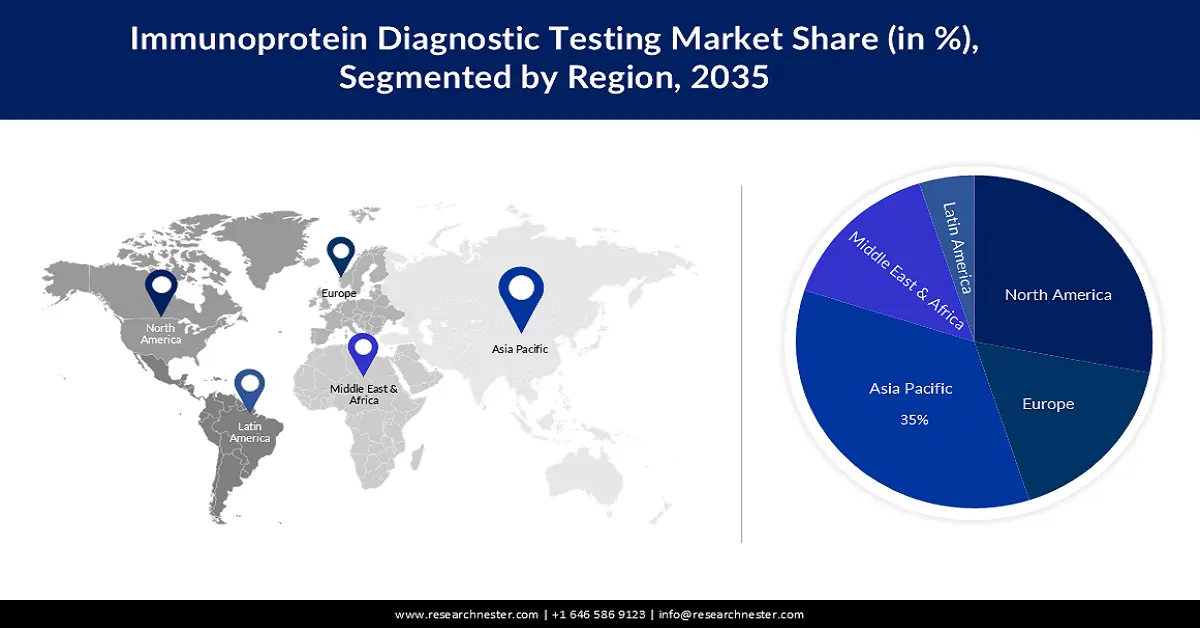

- Asia Pacific immunoprotein diagnostic testing market is projected to capture a 35% share by 2035, driven by rapid economic and healthcare system development in countries like China and India.

Segment Insights:

- The chemiluminescence segment in the immunoprotein diagnostic testing market is expected to see substantial growth through 2035, driven by high specificity and sensitivity in disease identification.

- The endocrine segment in the immunoprotein diagnostic testing market is expected to achieve a substantial share by 2035, influenced by the increasing prevalence of endocrine diseases like diabetes.

Key Growth Trends:

- Rise in Diagnostics Tests

- Increasing Demand for Chemiluminescence Imaging

Major Challenges:

- High Cost of Development and Implementation

- Supply Chain Challenges are Expected to Pose Limitations on the Market Expansion in the Future Times

Key Players: of Bio-Rad Laboratories, Inc, Danaher Corporation, DiaSorin S.p.A, Enzo Biochem, Ortho Clinical Diagnostics, KSL Diagnostics Inc., KSL Beutner Laboratories.

Global Immunoprotein Diagnostic Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.52 billion

- 2026 Market Size: USD 10.14 billion

- Projected Market Size: USD 19.08 billion by 2035

- Growth Forecasts: 7.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 11 September, 2025

Immunoprotein Diagnostic Testing Market Growth Drivers and Challenges:

Growth Drivers

-

Rise in Diagnostics Tests - Numerous diagnostic procedures are assisting in the rise of the immunoprotein diagnostic testing market. Because of the diverse product lines offered by the top market players, C-Reactive Protein (CRP) assays are frequently employed. By calculating the patient's CRP level, these tests assist in identifying inflammation. Additionally, it aids in evaluating the efficacy of cancer and a number of infectious illness treatments. Free light chain diagnostic tests are also anticipated to experience significant growth during the predicted period. This is due to their capacity to support plasma cell diseases' detection, diagnosis, and monitoring. Patients with non-secretory, oligo-secretory, or multiple myeloma with just light chains can benefit from this examination. As a result, the market is growing as a result of all these examinations.

-

Increasing Demand for Chemiluminescence Imaging - Due to its high specificity, sensitivity, and capacity to recognize antigens in human blood and serum samples, the chemiluminescence assay is anticipated to increase at the fastest rate throughout the forecast period. When compared to fluorescence-based detection of tagged probes, chemiluminescence assay is considered to be a more accurate method for making a speedy diagnosis of many diseases.

- Growing Awareness about Development in Diagnostic Tests Among Patients – The market for immunoprotein diagnostic testing is growing as a result of increasing awareness among patients regarding this diagnostic testing.

Challenges

-

High Cost of Development and Implementation – Immunoprotein diagnostic tests are complex and expensive to develop and implement. This is because they require substantial research and development, as well as validation processes. This can be a barrier to entry for new companies and can also make it difficult for smaller companies to compete with larger, more established players. Therefore, it is predicted to hamper the market expansion of immunoprotein diagnostic testing in the projected time period.

-

Regulatory Hurdles Associated are Expected to Restrict the Market Growth in the Upcoming Time Period.

- Supply Chain Challenges are Expected to Pose Limitations on the Market Expansion in the Future Times.

Immunoprotein Diagnostic Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 9.52 billion |

|

Forecast Year Market Size (2035) |

USD 19.08 billion |

|

Regional Scope |

|

Immunoprotein Diagnostic Testing Market Segmentation:

Technology Segment Analysis

Immunoprotein diagnostic testing market from the chemiluminescence essay segment is set to hold the largest revenue share of 30% by the end of 2035. The growth may be attributable to a high degree of specificity and sensitivity as well as the ability to identify antigens in human serum or plasma samples. The Chemiluminescence assay is often regarded as an important tool for the rapid identification of a particular disease and it has been shown to be more precise than fluorescently detecting probes, which are labeled. Furthermore, the enzyme-based immunoassay is estimated to offer lucrative growth opportunities for the market in the upcoming time period. In a large number of companies and laboratories, it can also be used to diagnose disease, as well as for quality control. In addition, a large number of EIA analyzers are at the disposal of most major companies. For example, this technology is used for diagnostic purposes in the Human Complement C3 ELISA Kit by Abcam.

Application Segment Analysis

The endocrine segment in the immunoprotein diagnostic testing market is estimated to hold a substantial revenue share during the forecast period. The growing burden of endocrine diseases, such as diabetes, and the development of products related to immunodiagnostic testing are driving the growth of this segment. According to 2022 statistics, in the United States, type 1 diabetes increased by 2.9% per year, compared to 4.5% for type 2 diabetes. Similarly, according to the US CDC, in 2022, 96 million adults have prediabetes in the U.S., and 8 out of 10 of them don't know if they have the condition. More than 37 million people are living with diabetes and one in five are undiagnosed. Therefore, the significant increase in the prevalence of diabetes is increasing the demand for immunoprotein testing diagnostics, which will have a positive impact on the market.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Immunoprotein Diagnostic Testing Market Regional Analysis:

APAC Market Insights

The immunoprotein diagnostic testing market in the Asia Pacific is estimated to hold the highest share of 35% during the forecast period. This can be assumed due to the extremely rapid economic development coupled with the rapid development of medical health systems in countries such as China and India. Collaboration between public health organizations in China, such as the Ministry of Health, China CDC, and the US CDC, focuses on China's healthcare structure related to HIV/AIDS, vaccination, emerging infectious diseases, non-communicable diseases, and laboratory quality control, have also driven the growth of the market in this area.

North America Market Insights

The North America immunoprotein diagnostic testing market is expected to grow substantially during the forecast timeframe. Key factors driving market growth in North America include increased healthcare spending and increased awareness of products related to autoimmune disease diagnostics. North America is expected to emerge as a dominant region due to the growing disease burden as well as the development and launch of new products. Furthermore, new product approvals and launches in the region along with collaborations among key market players will drive market growth. For example, in May 2022, OmegaQuant launched an HbA1c test with a sample collection kit for at-home testing. This simple, safe, and practical test measures the amount of sugar (glucose) in the blood. Therefore, it will positively influence the market and witness significant growth in North America during the forecast period due to the above-mentioned factors.

Immunoprotein Diagnostic Testing Market Players:

- Thermofisher Scientific Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott Laboratories

- Abcam plc

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- DiaSorin S.p.A

- Enzo Biochem

- Ortho Clinical Diagnostics

- KSL Diagnostics Inc.

- KSL Beutner Laboratories

Recent Developments

- In July 2022, KSL Beutner Laboratories launched the first indirect immunofluorescence (IIF) serum blood test to market in the United States, which positively identified laminin 332, an antigen associated with mucosal pemphigoid (MMP), a chronic and debilitating autoimmune disease.

- In April 2022, KSL Diagnostics, Inc launched the first antibody test that detects an individual's immune response to COVID-19 and assesses the risk of infection if exposed. The COVID-19 Immunity Index can help monitor protection against the COVID-19 virus with a simple blood test.

- Report ID: 5311

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.