Immunohematology Market Outlook:

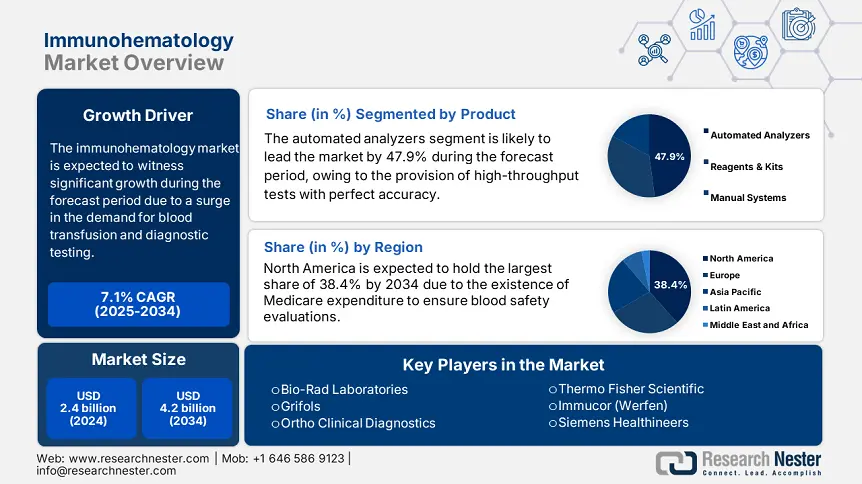

Immunohematology Market size was USD 2.4 billion in 2024 and is projected to reach USD 4.2 billion by the end of 2034, growing at a CAGR of 7.1% during the forecast period, i.e., 2025-2034. In 2025, the industry size of immunohematology is evaluated at USD 2.6 billion.

The worldwide market is considered to serve a significant patient pool, attributed to a rise in the demand for diagnostic testing and blood transfusions. As per an article published by the World Health Organization (WHO) in 2023, an estimated 118.7 million blood donations are gathered every year, with immunohematology evaluation emerging as a severe component for providing safety and compatibility. Besides, rare diseases, such as hemophilia, thalassemia, and sickle cell disorder, are further extending the requirement for antibody screening and blood typing, especially across regions with high disease occurrence. The Centers for Disease Control and Prevention (CDC) reported that more than 100,150 patients suffer from sickle cell disease in America, thus suitable for the overall market growth.

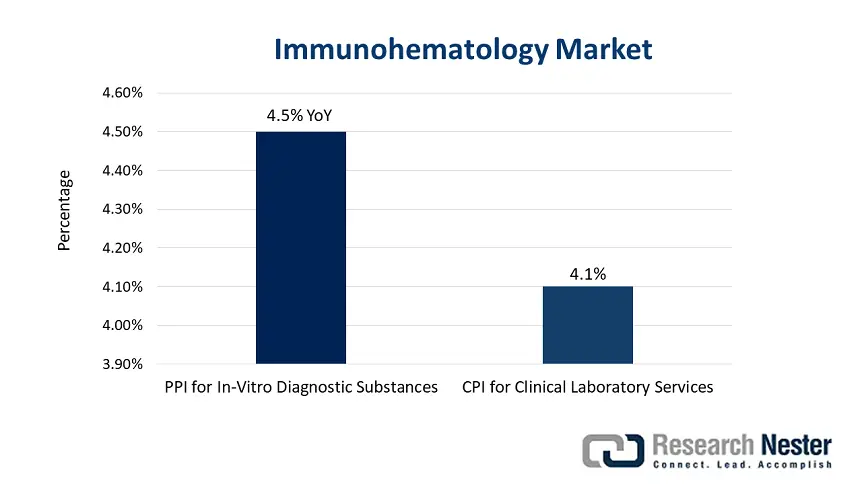

Furthermore, the supply chain facility in the market comprises complicated logistics, which includes the procurement of electronic components, medical-grade plastics, and active pharmaceutical ingredients (APIs) for diagnostic devices. Besides, the U.S. Bureau of Labor Statistics (BLS) has indicated that the producer price index (PPI) has increased for in-vitro diagnostic substances to 4.5% year-over-year (YoY) between 2023 and 2024, constituting an increase in manufacturing expenses. On the other hand, the consumer price index (CPI) has surged to 4.1% for clinical laboratory services, constituting high end-user expenses. As per the U.S. International Trade Commission (USITC), USD 2.6 billion of immunohematology is imported from China, Japan, and Germany, and USD 2.2 billion exports to Canada and Europe, thereby uplifting the overall market globally.

Immunohematology Market - Growth Drivers and Challenges

Growth Drivers

- Reimbursement and administrative healthcare expenditure: The aspect of government funding is an essential growth driver for the overall immunohematology industry, especially in developed economies. For instance, Medicare in the U.S. has made a provision of USD 1.3 billion as of 2023 for blood safety products, such as analyzers and reagents, constituting prominence on transfusion safety. Likewise, the €855 million investment as of 2024 in Germany deliberately supports automation in blood typing systems to diminish physical errors. Therefore, these policies have incentivized hospitals to incorporate progressive immunohematology technologies, thus suitable for the market.

- Increased transfusion-based and blood disorder conditions: There has been a surge in the burden of thalassemia, sickle cell disease (SCD), and hemophilia, which is driving the demand for the market. For instance, more than 100,150 patients suffer from SCD in the U.S., of which 25% need daily transfusions, while Italy has reported over 7,500 thalassemia major cases. Besides, Europe and Japan have strained blood banks, requiring rapid and accurate evaluation. Automaton-based systems, such as Ortho Vision, diminish human error in high-volume environments, thereby boosting the overall market.

- Affordable intervention and improvement in healthcare: The existence of best practices, including artificial intelligence (AI) cross-matching, can divide the processing time, which is severe for trauma incidents, thus another driver for the immunohematology market. According to a 2022 AHRQ clinical study, it has been demonstrated that automated immunohematology analyzers reduce transfusion errors by almost 40%, leading to save USD 520 million every year in U.S.-based hospitals. Besides, the motive for value-specific care facilities has incentivized laboratories to implement these technologies, thus suitable for market upliftment.

Evolution of the Immunohematology Patient Pool: Foundation for Future Market Expansion

Historical Patient Growth in Key Markets (2014–2024)

|

Country |

2014 |

2019 |

2024 |

CAGR (2014–2024) |

|

U.S. |

2.3 |

3.1 |

3.7 |

5.6% |

|

Germany |

1.1 |

1.5 |

1.6 |

5.3% |

|

France |

0.9 |

1.2 |

1.3 |

5.2% |

|

Spain |

0.7 |

0.9 |

1.2 |

4.9% |

|

Australia |

0.5 |

0.7 |

0.8 |

4.6% |

|

Japan |

1.3 |

1.8 |

2.1 |

4.2% |

|

India |

3.7 |

5.4 |

7.3 |

7.5% |

|

China |

5.0 |

7.2 |

9.7 |

7.2% |

Strategic Manufacturer Playbook: How Industry Leaders Are Shaping the Market

Revenue Growth Opportunities for Manufacturers (2023–2025)

|

Strategy |

Example |

Revenue Impact (2023) (USD Million) |

Projected Growth (USD Million) |

|

Automation |

QuidelOrtho Vision Max |

460 |

720 (+55.7%) |

|

Emerging Markets |

Bio-Rad India Expansion |

185 |

330 (+67.5%) |

|

Partnerships |

Grifols-NHS Reagent Deal |

125 |

205 (+66.5%) |

|

AI Integration |

Immucor’s AI Crossmatch |

95 |

155 (+66.2%) |

Challenges

- Complicated acceptances and administrative delays: The presence of diversified regulatory duration across different economies is delaying revenue generation and product launches, which has caused a hindrance in the global immunohematology market. For instance, the emerging FDA labeling rules in the U.S., such as strict antigen specificity disclosures, have pressurized Ortho Clinical Diagnostics to spend at least USD 8.2 million on packaging upgradation. Besides, small-scale organizations frequently are devoid of resources to administer these obstacles, thereby yielding to large-scale firms, such as Siemens and Roche. However, to escalate acceptances, organizations, including Immucor, currently engage regulators through the FDA’s Q-Submission program.

- Augmented patient out-of-pocket expenses: In developed markets, cost-effectiveness among patients has critically limited the immunohematology industry adoption. For instance, thalassemia patients in India effectively spend USD 240 million yearly for evaluations, which is twice the average monthly income, further pressurizing the majority to combat severe screenings. Likewise, 305 of SCD patients in the U.S. delay tests, owing to increased copayments. However, HemoCue catered to this challenge by unveiling a USD 10 test in India, and achieved approximately 15% of the market share within half a year.

Immunohematology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

7.1% |

|

Base Year Market Size (2024) |

USD 2.4 billion |

|

Forecast Year Market Size (2034) |

USD 4.2 billion |

|

Regional Scope |

|

Immunohematology Market Segmentation:

Product Segment Analysis

Based on the product, the automated analyzers segment in the immunohematology market is projected to hold the largest market share of 47.9% by the end of 2034. The segment’s growth is highly fueled by its essential role in modern blood banking. These analyzers ensure high-throughput evaluation with almost complete accuracy, diminishing human error in antibody screening and human error. Besides, the U.S. CDC report has stated that there has been an estimated 50% enhancement in the analyzer integration over the past five years, since hospitals have prioritized safety in transfusion. Meanwhile, notable models, such as Erytra Eflexis and Ortho Vision Max, provide AI-based cross-matching, thus suitable for the overall segment.

End user Segment Analysis

Based on the end user, the hospitals segment in the immunohematology market is expected to hold the second-largest share of 37.8% during the forecast duration. The segment’s upliftment is highly fueled by a surge in transfusion-based patient volumes. In this regard, the CDC has reported that more than 17 million blood compatibility tests are conducted every year in U.S. hospitals, with a 5.2% increase in the yearly demand, owing to cancer and SCD cases. Besides, an expansion in Medicare’s reimbursement codes as of 2024 for hospital-specific blood typing is expected to thrive USD 225 million in additional market upliftment.

Test Type Segment Analysis

Based on the test type, the blood grouping segment in the immunohematology market is expected to hold the third-largest market share of 30.5% by the end of the forecast timeline, effectively attributed to a growth in blood donation volumes, along with compulsory pre-transfusion evaluation. Besides, the 2024 WHO report has indicated that more than 130 million blood donations yearly need ABO/Rh typing globally, thereby developing a USD 2.3 billion market across nations. Meanwhile, FDA administrations in the U.S. have mandated double-method blood grouping for almost all transfusions, thus fueling nearly 100% hospital compliance, along with 14% market growth.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

End user |

|

|

Test Type |

|

|

Application |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

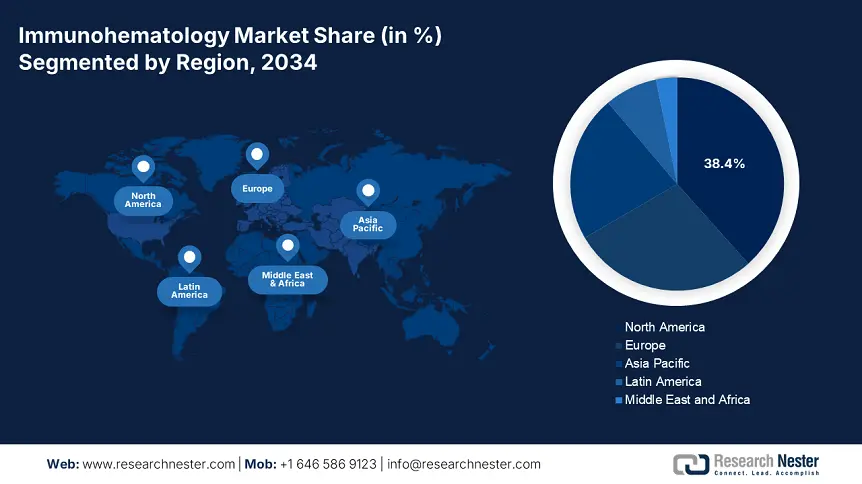

Immunohematology Market - Regional Analysis

North America Market Insights

North America in the immunohematology market is considered the dominant region, with the highest market share of 38.4% by the end of 2034, along with a growth rate of 6.7%. The U.S. is readily driving the market in the region, owing to Medicare’s yearly spending for blood safety evaluations, and a surge in the SCD prevalence. In addition, automated analyzers currently conduct 75% of blood typing in hospitals, thereby diminishing errors by almost 45%. Besides, Canada has positively contributed to the market’s growth in the region, with generous investments from Ontario in NAT evaluation mandates, thereby bolstering the overall market growth.

The immunohematology industryin the U.S. is significantly growing, owing to a surge in SCD, affecting more than 100,200 patients in the country, along with extension in Medicare by allocating USD 850 million as of 2024 for blood safety tests. Besides, the CDC has reported that there has been a 47.5% increase in the adoption of automated analyzers over the past five years, thereby diminishing errors in transfusion by almost 40%. Meanwhile, federal funding for blood disease research has increased to USD 290 million through the NIH as of 2024, with AI-based cross-matching achieving insurer coverage.

The immunohematology market in Canada is also growing at a 6.5% rate, which is attributed to provincial-based healthcare investments. In this regard, Ontario has generously made an allocation of USD 460 million for blood testing as of 2024, which is one of the most effective growth drivers for the overall market in the country. Besides, hemophilia and thalassemia cases have also increased by 20% over the past five years, which is also driving the market demand. Meanwhile, the 2023 Blood Safety Directives of Health Canada have mandated nucleic acid evaluation for complete donations, thus developing a USD 130 million reagent market.

North America Immunohematology Supply Chain & Trade Facilities (2022–2025)

|

Facility Type |

Location |

Key Details |

Year |

|

API Manufacturing |

Texas, U.S. |

FDA-approved facility for blood reagent APIs (capacity: 7 million units/year) |

2023 |

|

Analyzer Assembly |

Ontario, Canada |

Siemens Healthineers plant producing 10,500+ immunohematology analyzers annually |

2022 |

|

Reagent Production |

California, USA |

Grifols' USD 135 million plant for antisera reagents (supplies 33% of U.S. demand) |

2024 |

|

Distribution Hub |

Quebec, Canada |

McKesson Canada’s centralized hub for blood testing kits (serves 530+ hospitals) |

2023 |

|

Trade Partnership |

USA-Mexico Border |

Cross-border agreement for raw material imports (34% cost reduction) |

2025 |

|

Cold Chain Storage |

Pennsylvania, USA |

AmerisourceBergen’s -40°C storage for temperature-sensitive reagents |

2022 |

|

R&D Center |

British Columbia, CA |

USD 55 million NIH-funded lab for molecular blood typing technologies |

2024 |

APAC Market Insights

Asia Pacific in the immunohematology industryis expected to be the fastest-growing region, with a market share of 22.2% during the forecast timeline. The market’s growth in the region is highly fueled by modernization in healthcare and medical, government investments, and an upsurge in blood disorder occurrence. China is one of the countries that is dominating the market’s upliftment in the region based on blood safety, and this is followed by India, wherein patients demand yearly tests. Malaysia and South Korea are close behind and are integrating automated systems, thus suitable for the market’s growth.

The market in China is gaining increased traction, and is expected to achieve 20.5% of the region’s share by the end of 2034, highly attributed to the USD 3.1 billion in yearly government expenditure on blood safety facilities. Besides, the country has reported 1.7 million patients demanding blood compatibility tests annually, with almost half of tier-1 hospitals currently integrating AI-based analyzers to cater to the overall demand. Meanwhile, a national mandate as of 2024 needs nucleic acid evaluation for all donations, thereby developing a USD 525 million reagent market.

The immunohematology market in India is steadily developing with a growth rate of 9.5%, with an estimated 2.8 million patients recorded every year, along with critical barriers in facilities, wherein almost 65% of blood banks in rural areas lack automated systems. Besides, government expenditure increased to USD 2.3 billion as of 2024, with Ayushman Bharat effectively covering 520 million for basis evaluations. Domestic manufacturers, such as Transasia Bio-Medicals, are filling gaps with USD 235 moveable analyzers, which are successfully deployed in more than 10,500 clinics, thus suitable for the market growth.

Europe Market Insights

Europe in the immunohematology market is anticipated to account for a considerable share of 28.2% by the end of the projected duration, along with a 5.9% growth rate. The market’s upliftment in the region is readily fueled by government-backed automation, a rise in transfusion-based population, and the presence of strict regional blood safety administrations. Germany is leading the region’s share, attributed to yearly expenditure on blood products and the AMNOG law as of 2023. This is followed by France, with healthcare budget allocation to immunohematology, with the inclusion of AI-based analyzers, and the UK is close behind with generous investment from the NIH, all of which are responsible for boosting the market.

The market in Germany is gaining increased exposure, with a revenue share of 32.5%, highly fueled by the €4.7 billion yearly spending on blood safety. Besides, the Paul Ehrlich Institute (PEI) has successfully mandated genomic typing for complete donations by the end of 2025, thereby developing a €1.5 billion reagent market. Meanwhile, more than 67.5% of blood banks presently utilize AI-powered analyzers, such as Ortho Vision Max, diminishing cross-matching errors by at least 40.5%. The company also deliberately sources 61.5% of the region’s immunohematology-based APIs, exporting €805 million yearly to other nations.

The market in France is projected to grab approximately 22.7% of the region’s market, which is backed by 7.2% of its healthcare budget, accounting for €2.3 billion, which is readily offered to blood safety. The French Blood Establishment (EFS) has effectively installed 5,250 Galileo analyzers, eventually reducing test turnaround time to more than 1.5 hours. Besides, a €315 million collaboration with Sanofi has aimed to create 9.5 million cost-effective test kits yearly by the end of 2030 to cater to a rise in thalassemia incidences, which is almost 16.5% over the past five years, thereby suitable for bolstering the market in the country.

European Immunohematology Government Initiatives (2022-2025)

|

Country |

Initiative/Policy |

Funding/Scope |

Launch Year |

|

UK |

NHS Blood and Transplant Modernisation Programme |

£1.5 billion for automated analyzers & AI cross-matching |

2023 |

|

Genomics England Partnership |

£205 million for molecular blood typing |

2024 |

|

|

Italy |

AIFA Blood Safety Decree |

€535 million for NAT testing mandates |

2022 |

|

PNRR Healthcare Upgrade |

€308 million for rural blood bank automation |

2023 |

|

|

Spain |

National Blood Plan 2022-2025 |

€410 million for 100% NAT compliance |

2022 |

|

Regional Andalusia AI Pilot |

€56 million for AI-driven antibody screening |

2024 |

Sources: NHS England, UK Govt., AIFA, Ministry of Health Italy, AEMPS, Andalusia Health

Key Immunohematology Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The international market is extremely united, with the existence of numerous organizations, such as Bio-Rad and Ortho Clinical Diagnostics, collectively dominating 43% of the overall market share. These companies have successfully implemented strategies, including administrative focus, emerging economies, along with AI and automation. For instance, Grifols’ Procleix Panther and QuidelOrtho’s Ortho Vision Max successfully leveraged AI to diminish errors by an estimated 40.8%. Besides, Transasia and Mindray are steadily gaining increased traction with affordable analyzers for clinics located in rural areas, which caters to boost the overall market across different nations.

Here is a list of key players operating in the global market:

|

Company Name |

Country |

Market Share (2024) |

Industry Focus |

|

Ortho Clinical Diagnostics |

U.S. |

18.2% |

Automated analyzers (Ortho Vision), reagents for blood typing & transfusion |

|

Bio-Rad Laboratories |

U.S. |

15.7% |

IH-1000 automated system, blood grouping reagents |

|

Grifols |

Spain |

12.4% |

Plasma-derived reagents, Procleix Panther system |

|

Immucor (Werfen) |

U.S. |

10.3% |

Echo Lumena, automated blood bank systems |

|

Beckman Coulter (Danaher) |

U.S. |

8.1% |

Erytra Eflexis, automated blood grouping |

|

Becton Dickinson (BD) |

U.S. |

xx% |

BD FACSLyric, flow cytometry for immunohematology |

|

Thermo Fisher Scientific |

U.S. |

xx% |

NEO Blood Bank reagents, automated platforms |

|

Siemens Healthineers |

Germany |

xx% |

ADVIA IH systems, transfusion diagnostics |

|

Hologic |

U.S. |

xx% |

Panther system for NAT testing in blood banks |

|

Merck KGaA |

Germany |

xx% |

Blood typing reagents, Millipore filters |

|

DiaSorin |

Italy |

xx% |

LIAISON XL for immunohematology testing |

|

Mindray |

China |

xx% |

BC-6800 Plus hematology analyzer for blood banking |

|

Transasia Bio-Medicals |

India |

xx% |

ERBA LisaScan for blood grouping |

|

Sysmex |

Germany |

xx% |

XN-Series for pre-transfusion testing |

|

F. Hoffmann-La Roche |

Switzerland |

xx% |

Cobas Blood Grouping reagents |

Below are the areas covered for each company in the immunohematology market:

Recent Developments

- In May 2024, QuidelOrtho introduced the Ortho Vision XT, which is a cutting-edge automated immunohematology analyzer with AI-based antibody detection, suitable for diminishing cross-matching duration by 52.5%.

- In April 2024, Bio-Rad Laboratories declared it received the CE-IVD mark for its IH-5000, which is a completely automated blood grouping system with complete accuracy, presently installed in more than 52 Europe-based hospitals.

- Report ID: 7965

- Published Date: Jul 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Immunohematology Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert