Immersion Heater Market Outlook:

Immersion Heater Market size was valued at USD 987.24 million in 2025 and is likely to cross USD 1.59 billion by 2035, registering more than 4.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of immersion heater is assessed at USD 1.03 billion.

The construction of smart cities and the quick development of green building projects would drive the market expansion. In comparison to typical structures, energy consumption in green buildings can be reduced by 30%–40%. Water consumption in green buildings can be lowered by 20% to 30%. Up to 35% less CO2 can be released from green buildings.

In addition, the demand for immersion heaters has increased as a result of global government programs and legislation encouraging the adoption of energy-efficient heating systems. Also, immersion heaters are becoming more and more appealing because of the rising cost of electricity, as they are frequently less expensive to run than other heating solutions.

Key Immersion Heater Market Insights Summary:

Regional Highlights:

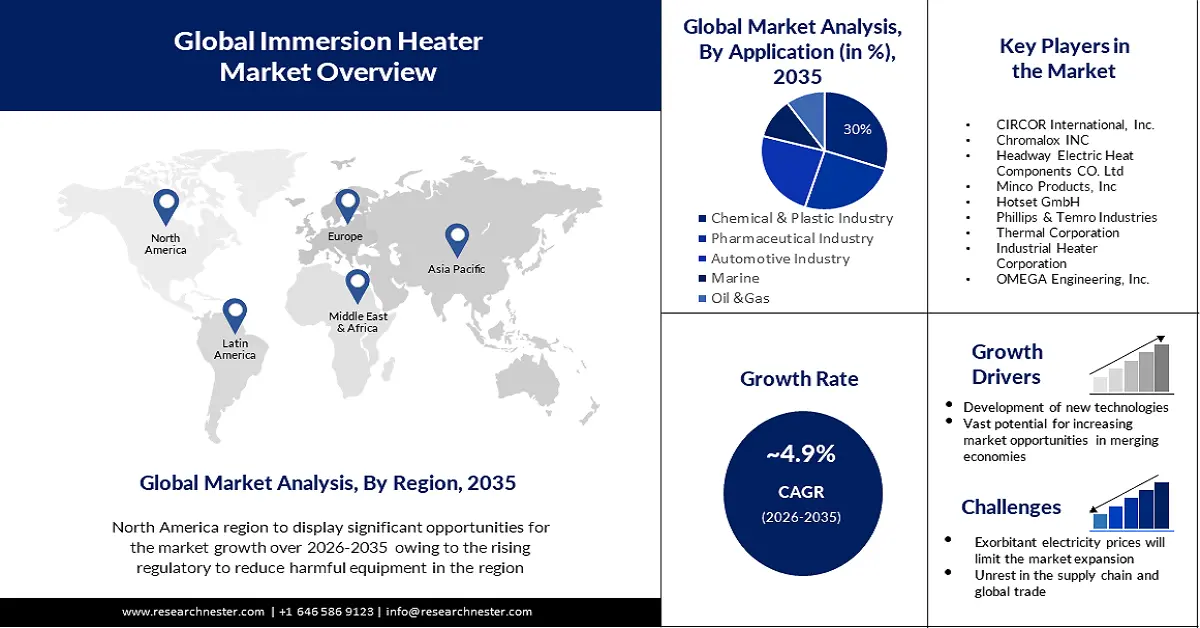

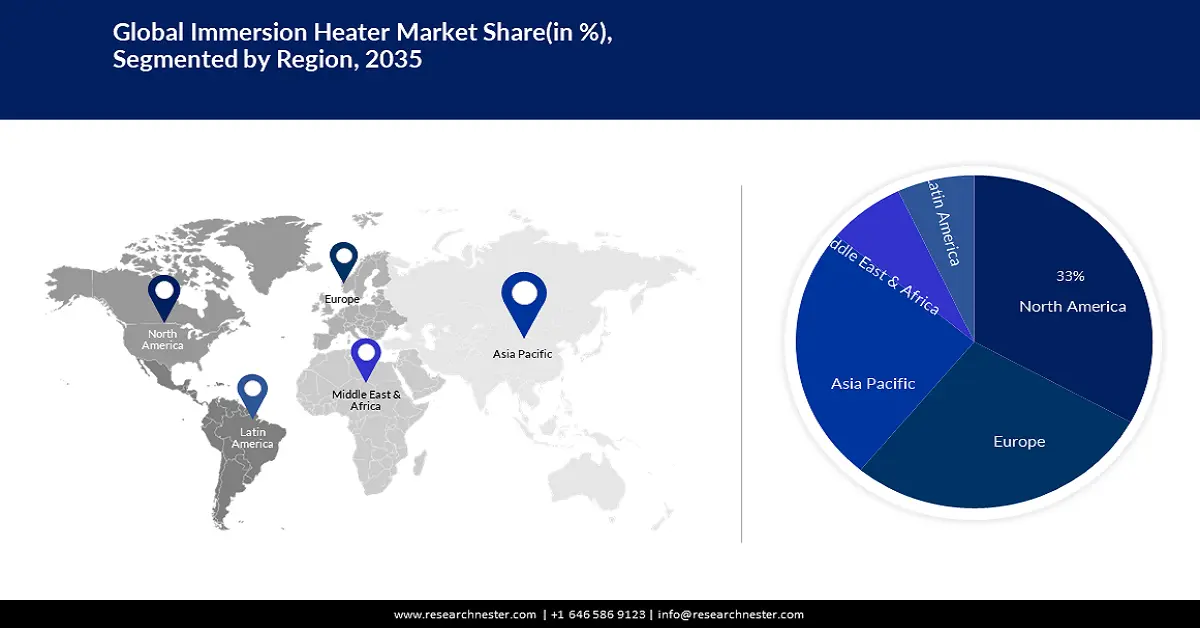

- North America’s immersion heater market will hold over 33% share by 2035, driven by regulatory push for efficient and eco-friendly equipment.

- Europe’s market will capture a 28% share by 2035, fueled by stringent environmental regulations on carbon emissions.

Segment Insights:

- The chemical & plastics industry segment in the immersion heater market is projected to achieve a 30% share by 2035, driven by the growing need for energy-efficient heating systems in these industries.

- The oil immersion heaters segment in the immersion heater market is anticipated to achieve notable growth through 2035, influenced by technological advances making heaters more economical and eco-friendly.

Key Growth Trends:

- Development of New Technologies

- Vast Potential for Increasing Market Opportunities in Emerging Economies

Major Challenges:

- Exorbitant Electricity Prices Will Limit Market Expansion

- Due to unrest in the supply chain and global trade, demand for industrial components like immersion heaters is declining.

Key Players: NIBE Group, CIRCOR International, Inc., Chromalox INC, Headway Electric Heat Components CO. Ltd, Minco Products, Inc, Hotset GmbH, Phillips & Temro Industries, Thermal Corporation, Industrial Heater Corporation, OMEGA Engineering, Inc.

Global Immersion Heater Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 987.24 million

- 2026 Market Size: USD 1.03 billion

- Projected Market Size: USD 1.59 billion by 2035

- Growth Forecasts: 4.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 11 September, 2025

Immersion Heater Market Growth Drivers and Challenges:

Growth Drivers

- Development of New Technologies- The immersion heater market is expanding due to the development of new technology. With a smartphone or other device, owners of smart immersion heaters, for instance, can remotely regulate the temperature and energy usage. 6.92 billion people use smartphones globally as of 2023, which means that 85.74% of people on the planet are smartphone owners. This has increased the convenience and usability of immersion heaters, increasing their appeal. The growing use of cutting-edge technologies, like low NOx burners and sophisticated immersion heater materials, presents a significant potential for the immersion heater market. These technologies are anticipated to propel market expansion by enhancing the heaters' longevity and efficiency.

- Vast Potential for Increasing Market Opportunities in Emerging Economies- In the industrialized world, there are still undiscovered immersion heater market. Notwithstanding the fact that non-OECD members account for over 80% of the world's population, their heater purchases pale in comparison to those of member nations. The forecast for instant water heater sales in Asia-Pacific and LAMEA is still good due to the region's sustained economic expansion in recent years. Adjusting hard-sell and soft-sell tactics and letting clients recognize new features from marketing campaigns are critical to future sales. Water-efficient technology that generates saltwater regeneration cycles and tap water is a compelling feature for businesses looking to grow and establish themselves in the Asia-Pacific and LAMEA regions.

- Increasing Demand in Rural Areas to Accelerate Market Development- Immersion heaters are becoming more and more popular in rural areas with robust, fast-paced infrastructure development. These areas also indicate a projected increase in population. Our focal areas have become semi-urban areas, but there has been little shift in the consumer decision-making heuristic. In an effort to save money on power costs, target groups are more likely to buy energy-efficient heaters. Prominent firms including Havells India Ltd., Ariston Thermo S.P.A., and A.O. Smith Corporation are implementing new technology to cater to this consumer mind process. The combined impact of these advancements will support the expansion of the immersion heater market worldwide.

Challenges

- Exorbitant Electricity Prices Will Limit Market Expansion- Prices for electricity are a crucial expense that either residential or commercial businesses must pay. The cost of developing and running power plants and energy grids is one of these pricing considerations. Variations in the costs of fuel, operations, maintenance, transmission, and distribution have all added to the overall increase in the price of energy. Although supply and demand determine energy and power usage, the general trend is that industrial units pay less for electricity than do commercial and residential users.

- Due to unrest in the supply chain and global trade, demand for industrial components like immersion heaters is declining.

- There are persistent difficulty meeting requirements for energy efficiency and quality. The producers are responsible for making sure their goods adhere to quality and energy efficiency requirements.

Immersion Heater Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 987.24 million |

|

Forecast Year Market Size (2035) |

USD 1.59 billion |

|

Regional Scope |

|

Immersion Heater Market Segmentation:

Application Segment Analysis

The chemical & plastic industry is expected to hold 30% share of the global immersion heater market during the forecast period. The market is expanding due to the growing need for energy-efficient heating systems in the plastic and chemical industries. In 2022, there was a 2.2% global improvement in energy efficiency, which was twice as much as the preceding five years combined. Around 1% more energy was consumed worldwide in 2022. Without advances in energy efficiency, this would have been over three times higher. Immersion heaters have become increasingly common in the chemical and plastics industries over time. They are used for a wide range of applications, such as heating chemical reactions, heating reactor vessels, heating chemical storage tanks, heating viscous liquids, and heating moulds. The chemical and plastic sectors are anticipated to adopt complex technology, such as low-NOx burners and sophisticated materials for immersion heaters, at a faster rate, which will drive the segment's expansion even further.

Product Type Segment Analysis

The oil immersion heaters segment in the immersion heater market is projected to hold the largest revenue share of about 30% due to the growing need for oil immersion heaters in sectors including food processing, chemical processing, and oil and gas extraction. These sectors rely on oil immersion heaters for pipeline, tank, and vessel heating, among other heating applications. Furthermore, technological developments have produced oil-immersion heaters that are more economical and ecologically friendly, which has increased their use across a range of industries.

Our in-depth analysis of the global immersion heater market includes the following segments:

|

Product Type |

|

|

Distribution Channel |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Immersion Heater Market Regional Analysis:

North American Market Insights

North America industry is predicted to hold largest revenue share of 33% by 2035. It is ascribed to the regulatory measures put in place by the government in the region to reduce the number of low-efficiency and environmentally harmful equipment. It is possible to deploy 1,200–2,000 gigawatts of renewable energy in the US to meet planning reserve requirements and generate 70–80% of the country's electricity by 2050. The demand for immersion heaters is also rising as a result of well-known manufacturers producing these heaters in compliance with industry standards like UL and CSA, like Wattco and Tempco Electric Heater Corporation. The COVID-19 epidemic, however, has stopped production and is likely to continue for a considerable amount of time.

European Market Insights

The immersion heater market in the Europe region is expected to rise strongly and hold about 28% of the revenue share during the projected period due to stringent environmental regulations about carbon emissions and fuel efficiency technology in the UK, Germany, Italy, and other European nations. For instance, in February 2020, the NIBE Group bought Nathan Holding B.V. to expand its operations in the Netherlands, Luxembourg, and Belgium offering heating and cooling solutions.

Immersion Heater Market Players:

- NIBE Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CIRCOR International, Inc.

- Chromalox INC

- Headway Electric Heat Components CO. Ltd

- Minco Products, Inc

- Hotset GmbH

- Phillips & Temro Industries

- Thermal Corporation

- Industrial Heater Corporation

- OMEGA Engineering, Inc.

Recent Developments

- NIBE Industries AB has made a bold move by taking over a majority stake of 65% in the Canadian stove company Miles Industries Ltd., with the plan to acquire the remaining shares in the near future by 2026. This acquisition will definitely strengthen NIBE's position in the heating market and bring new opportunities for growth

- Minco Products, Inc. has expanded its product line of ESA (European Space agency) qualified heaters to support their customers in heating applications across missions including, solar system exploration, telecommunication and earth observation.

- Report ID: 5448

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Immersion Heater Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.