Image Sensor Market Outlook:

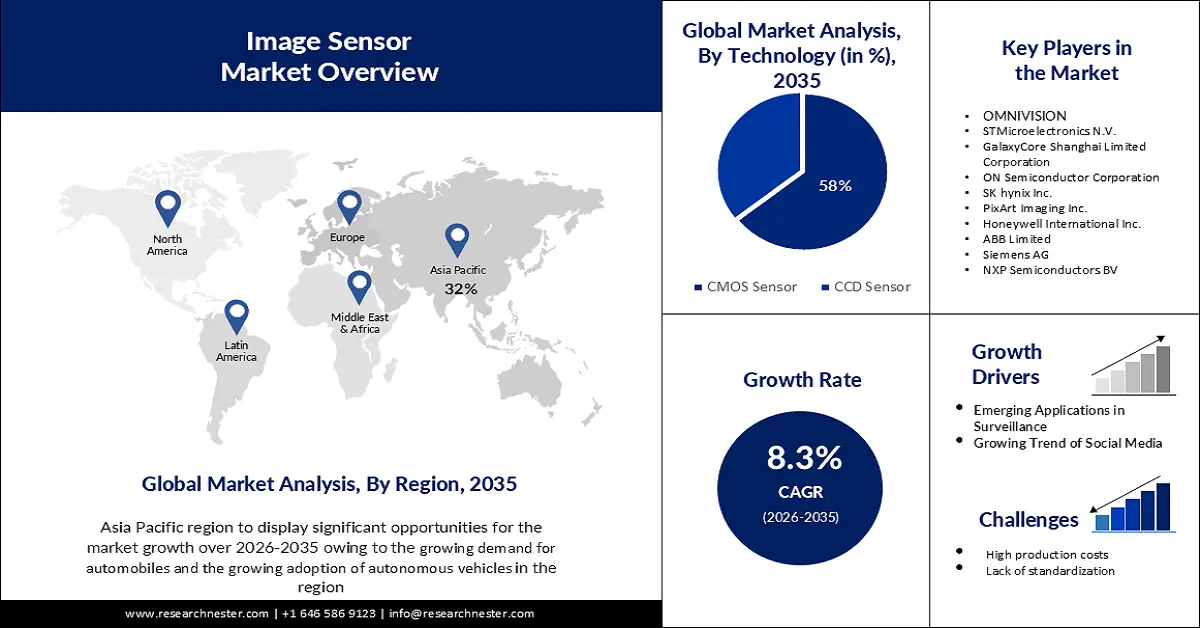

Image Sensor Market size was over USD 28.79 billion in 2025 and is poised to exceed USD 63.9 billion by 2035, growing at over 8.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of image sensor is estimated at USD 30.94 billion.

The market growth is driven by the emerging use of image sensors in healthcare. In healthcare, image sensors are being used for medical imaging, including X-rays, CT scans, and ultrasounds. For instance, the handheld X-ray system from United Imaging Healthcare provides accurate 3D breast imaging while offering high breast biopsy efficiency. These sensors enable high-quality imaging with a low radiation dose, making them a safer and more effective alternative to traditional imaging methods.

In addition, as the demand for higher resolution in electronic devices increases, image sensor manufacturers are working to develop image sensors with smaller sizes but higher resolution, which is more cost-effective. This is expected to drive the growth of the image sensor market over the forecast period.

Key Image Sensor Market Insights Summary:

Regional Highlights:

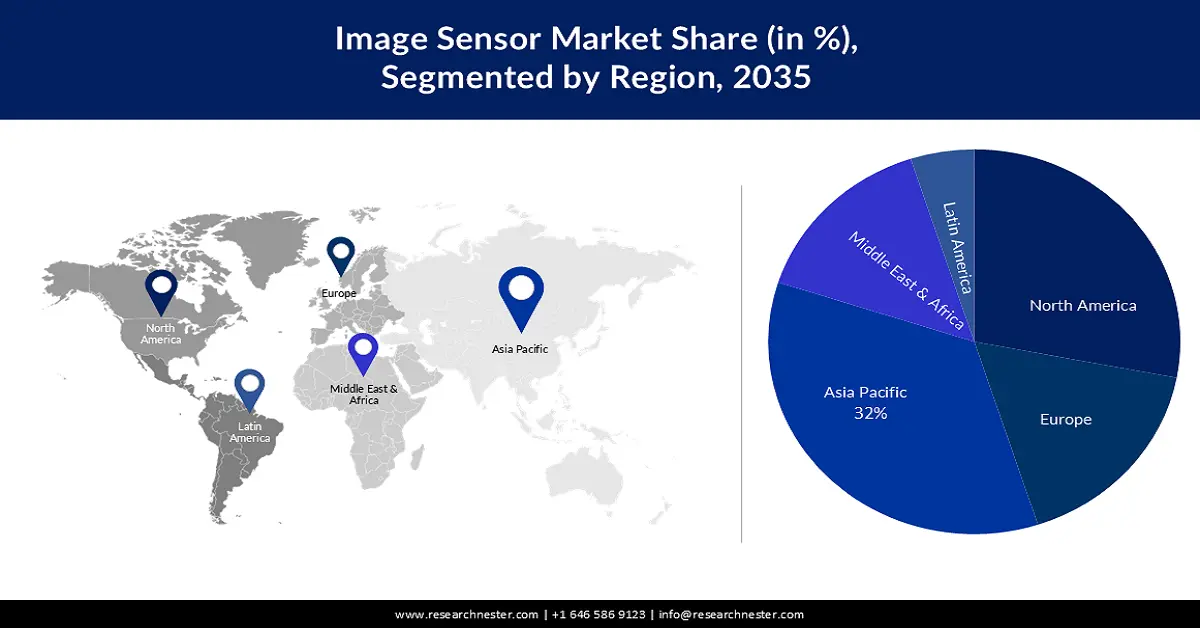

- Asia Pacific image sensor market is projected to capture a 32% share by 2035, driven by growing demand for automobiles, autonomous vehicles, and consumer electronics.

- North America market is anticipated to achieve a 28% share by 2035, driven by increasing demand for imaging technology and smartphone popularity.

Segment Insights:

- The cmos sensor segment in the image sensor market is projected to achieve a 58% share by 2035, driven by widespread use in consumer electronics due to compact size and power efficiency.

- The consumer electronics segment in the image sensor market is expected to witness robust growth over 2026-2035, influenced by the increasing use of image sensors in smartphones, tablets, and digital cameras.

Key Growth Trends:

- Advancements in Camera Technology

- Growing Trend of Social Media

Major Challenges:

- High Competition

- High production costs, the lack of standardization

Key Players: OMNIVISION, STMicroelectronics N.V., GalaxyCore Shanghai Limited Corporation, ON Semiconductor Corporation, SK hynix Inc., PixArt Imaging Inc., Honeywell International Inc., ABB Limited, Siemens AG, NXP Semiconductors BV.

Global Image Sensor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 28.79 billion

- 2026 Market Size: USD 30.94 billion

- Projected Market Size: USD 63.9 billion by 2035

- Growth Forecasts: 8.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Japan, United States, China, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 11 September, 2025

Image Sensor Market Growth Drivers and Challenges:

Growth Drivers

-

Advancements in Camera Technology: The development of smaller, more efficient sensors has allowed for the creation of smaller cameras with higher resolution and better image quality. This has led to an increase in demand for cameras in a variety of industries, including smartphones, tablets, and digital cameras. The introduction of CMOS image sensors has revolutionized the camera industry. These sensors are smaller, consume less power, and are less expensive to produce than CCD sensors. Recent advancements in camera technology have also led to the development of 3D imaging. A variety of applications, including virtual reality, gaming, and medical imaging, can benefit from this technology. Moreover, the use of artificial intelligence in camera technology has also been a major driver of growth in the image sensor market. AI-powered cameras are able to analyze images in real-time, allowing for the creation of smart cameras that can detect and respond to specific events or situations.

-

Growing Trend of Social Media: The rise of social media has significantly impacted the market. According to a detailed analysis, 6.2% of the world's population is using social media as of October 2023, totaling 4.90 billion users. With the increasing use of social media platforms such as Instagram and Snapchat, there has been a growing demand for high-quality cameras in smartphones and other mobile devices. This has led to the development of advanced image sensors that can capture high-resolution images and videos with enhanced color accuracy and low-light performance.

-

Emerging Applications in Surveillance: In surveillance, image sensors are being used for security cameras, facial recognition, and license plate recognition. According to a recent survey, over 57% of Americans believe law enforcement will use facial recognition technology responsibly to assess public security threats. With the increasing demand for security and safety, these sensors are becoming an essential tool for law enforcement and public safety agencies.

Challenges

-

High Competition: The image sensor market is highly competitive, with many players vying for market share. This competition can lead to price wars and reduced profit margins for companies. Companies have to try to differentiate their products from one another in order to stand out and gain a competitive edge. This often means cutting prices in order to drive sales, which can lead to lower profit margins. Companies may have to invest more heavily in research and development to stay ahead of the competition.

-

Technology and innovations are constantly evolving, making it difficult for companies to stay competitive and keep up with the latest trends.

-

High production costs, the lack of standardization

Image Sensor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.3% |

|

Base Year Market Size (2025) |

USD 28.79 billion |

|

Forecast Year Market Size (2035) |

USD 63.9 billion |

|

Regional Scope |

|

Image Sensor Market Segmentation:

Technology Segment Analysis

The CMOS Sensor segment is estimated to hold 58% share of the global image sensor market in the year 2035. Segment growth can be attributed to the widespread use of CMOS Sensors in consumer electronics such as digital cameras, smartphones, and tablets. For instance, a new CMOS sensor from Canon features global shutters, which allows it to capture images of moving subjects accurately and distortion-free, as well as images taken by moving cameras. CMOS Sensors are smaller and more power-efficient than other types of image sensors, making them an attractive option for manufacturers. Additionally, CMOS Sensors are more affordable than other image sensors, making them an attractive option for consumers.

Application Segment Analysis

Image sensor market from the consumer electronics segment is estimated to account for 35% in the year 2035. The segment growth can be attributed to the increasing use of image sensors in smartphones, tablets, and digital cameras. As the demand for higher-resolution cameras increases, the demand for image sensors is expected to grow. The total number of shipments of cameras in 2022 was estimated to be 7.4 million. Furthermore, as technology advances, image sensors are expected to become smaller, cheaper, and more energy-efficient, which will further drive the growth of the consumer electronics segment.

Our in-depth analysis of the image sensor image sensor market includes the following segments:

|

Technology |

|

|

Processing Technique |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Image Sensor Market Regional Analysis:

APAC Market Insights

Image sensor market in Asia Pacific is anticipated to hold the largest with a share of about 32% by the end of 2035. Market growth in the region is also expected on account of the growing demand for automobiles and the growing adoption of autonomous vehicles, which require image sensors to function. Additionally, the increasing demand for surveillance cameras and the thriving consumer electronics industry in the region are expected to drive the growth of the image sensor market in Asia Pacific. Globally, China ranks first in consumer electronics production and sales. Moreover, the government initiatives such as Make in India and Digital India to increase public safety in places such as India and the development of infrastructure are expected to increase industry demand.

North America Market Insights

The North America image sensor market is estimated to be the second largest, registering a share of about 28% by the end of 2035. The market's expansion can largely be attributed to the increasing demand for image sensors as a result of an increase in demand for imaging technology as well as an increase in smartphone and tablet popularity in region. Approximately 86% of American adults use smartphones as of 2022, with over 300 million smartphone users. With the rise of social media and digital marketing in region, consumers are increasingly using their mobile devices and tablets to capture and share images and videos. This has led to a surge in demand for high-quality cameras and image sensors that can deliver clear and vibrant images.

Image Sensor Market Players:

- OMNIVISION

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- STMicroelectronics N.V.

- GalaxyCore Shanghai Limited Corporation

- ON Semiconductor Corporation

- SK hynix Inc.

- PixArt Imaging Inc.

- Honeywell International Inc.

- ABB Limited

- Siemens AG

- NXP Semiconductors BV

Recent Developments

- March 2022: OMNIVISION introduced the OS03B10 CMOS image sensor, which is designed to provide notch digital images and high definition (HD) videos for security surveillance, IP and HD analog cameras. This sensor comes with a 3 MP 1/2.7 inch size.

- March 2020, GalaxyCore Shanghai Limited Corporation has signed a collaboration agreement with the management committee of Lingang New Area in China’s Shanghai Free Trade Pilot Zone to expand its operations. The company plans to invest in research and development well as manufacturing activities focused on the advanced technology of 12 inch CIS integrated circuits, within the Lingang New Area.

- Report ID: 5406

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Image Sensor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.