Image Recognition in CPG Market Outlook:

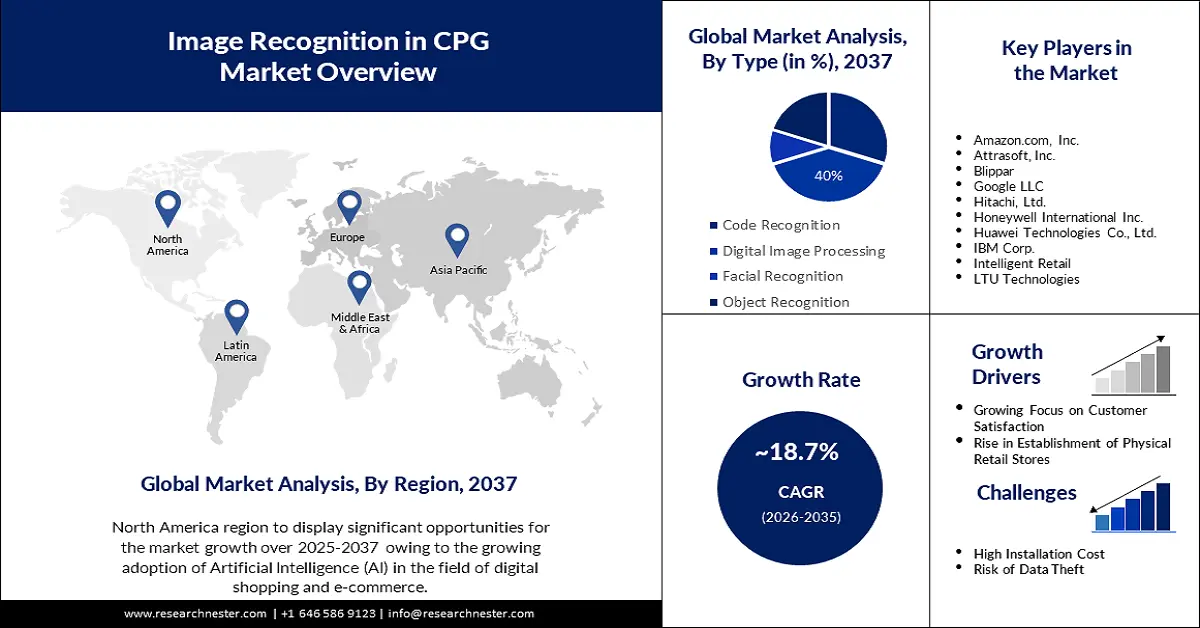

Image Recognition in CPG Market size was valued at USD 4.14 billion in 2025 and is expected to reach USD 22.99 billion by 2035, expanding at around 18.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of image recognition in CPG is evaluated at USD 4.84 billion.

The image recognition in CPG market is primarily driven by the demand for real-time in-store execution and shelf intelligence. Image recognition contributes to real-time visibility in warehouses and logistics. Through automated bar code scanning and package verification, the technology helps minimize human error and enhance traceability across the distribution chain. Modern retail environments require brands to maintain consistent on-shelf availability, pricing accuracy, and merchandising compliance. Image recognition platforms automate shelf audits by using mobile devices or smart cameras to capture images and assess planogram compliance. This ensures compliance, reduces labor costs, and strengthens brand visibility across diverse retail formats.

In addition, the convergence of AI, machine learning, and edge computing has certainly improved image recognition capabilities in terms of speed accuracy, and deployment flexibility. Advancements in image recognition solutions can now process large volumes of visual data through smartphones, in-store kiosks, and embedded cameras eliminating latency and reducing cloud dependency. For instance, in May 2023, PepsiCo embraced AI and edge computing in its warehouse operations by deploying computer vision-enabled robots and sensors for package recognition, damage detection, and inventory checks. These systems process visual data locally in the factory which allows real time quality assurance and workflow optimization without cloud latency. Additionally, federal initiatives such as the National Artificial Intelligence Initiative Act continue to support innovation in edge AI, helping startups and enterprises integrate vision systems into real-world retail and logistics operations.

Key Image Recognition in CPG Market Insights Summary:

Regional Highlights:

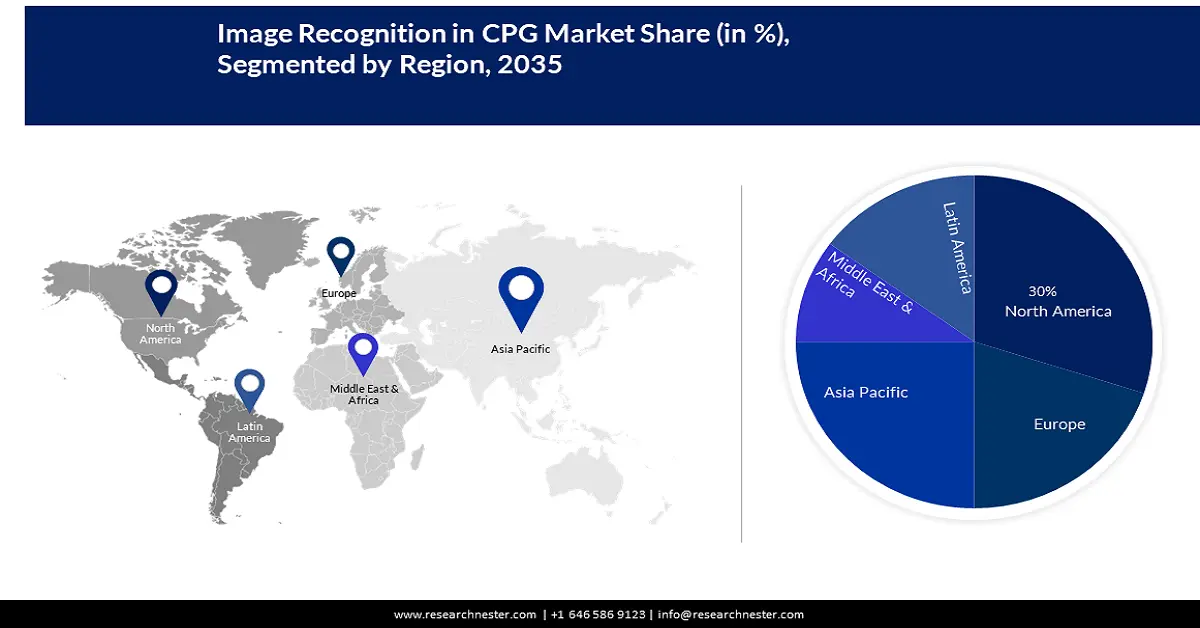

- North America leads the Image Recognition in CPG Market with a 30.9% share, propelled by rising demand for retail automation and data-driven merchandising accelerating adoption, driving growth through 2026–2035.

Segment Insights:

- The Online segment is forecasted to capture a 54.9% share by 2035, driven by the rise of visual search and AI-powered product tagging on e-commerce platforms.

- The cloud segment is expected to capture a significant share by 2035, driven by its scalability, cost efficiency, and real-time processing capabilities in dynamic retail environments.

Key Growth Trends:

- Increasing demand for consumer-centric insights and personalization

- Rising awareness of sustainability and waste reduction

Major Challenges:

- Variability in retail environments and image quality

- Data integration and interoperability with legacy systems

- Key Players: Honeywell International Inc., IBM, Google, Qualcomm, Microsoft, AWS, Trax.

Global Image Recognition in CPG Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.14 billion

- 2026 Market Size: USD 4.84 billion

- Projected Market Size: USD 22.99 billion by 2035

- Growth Forecasts: 18.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Image Recognition in CPG Market Growth Drivers and Challenges:

Growth Drivers

- Increasing demand for consumer-centric insights and personalization: Image recognition technology when combined with behavioral analytics offers unparalleled visibility into how consumers interact with products on the shelf. Retailers can track shopper engagement such as dwell time, product handling, and movement paths that allow a deeper insight into buyer preferences and the effectiveness of in-store promotions. For instance, Unilever has integrated AI-driven image recognition technology in select stores to understand shopper engagement patterns, including where consumers stop, how long they dwell near specific products, and which packaging garners the most attention. By pairing this visual data with promotional performance, Unilever fine-tunes its product placement strategies and launches more personalized campaigns across digital and in-store platforms. This data fuels highly targeted marketing, shelf optimization, and demand forecasting helping CPG brands differentiate in saturated image recognition in CPG markets.

- Rising awareness of sustainability and waste reduction: By optimizing inventory accuracy and shelf management, image recognition supports sustainable practices. Image recognition minimizes stockouts and overstock situations leading to accurate, real-time inventory and product condition data enhancing supply chain responsiveness and warehouse operations. Additionally, by reducing waste from expired or unsold products and improving logistics workflows, the technology directly supports environmental, social, and governance (ESG) initiatives outlined by organizations such as the U.S. Environmental Protection Agency. In May 2024, Walmart introduced an AI-powered waste management solution to reduce food waste. This in-house developed AI tool assists employees in making data-driven decisions to minimize waste. It allows the scanning of items to assess ripeness or proximity to expiration and suggests actions such as price reductions, returns, or donations.

Challenges

- Variability in retail environments and image quality: One of the biggest challenges of implementing image recognition at scale in CPG is the lack of standardization across retail environments. Differences in lighting, shelf layouts, camera angles and store formats introduce inconsistencies that can severly impact the accuracy of image capture and analysis. This lack of environmental uniformity makes it difficult to deploy a one-size-fits-all all solution.

- Data integration and interoperability with legacy systems: While image recognition systems can generate vast volumes of visual and shelf-level data, many CPG companies struggle to integrate this data into existing enterprise resource planning (ERP), supply chain management (SCM), and customer relationship management platforms (CRM) platforms. Legacy systems, often fragmented across business units or geographies lack the architecture to ingest and process image-derived data in real-time. As a result, decision-makers may find it difficult to act on insights at the speed required for modern retail operations.

Image Recognition in CPG Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

18.7% |

|

Base Year Market Size (2025) |

USD 4.14 billion |

|

Forecast Year Market Size (2035) |

USD 22.99 billion |

|

Regional Scope |

|

Image Recognition in CPG Market Segmentation:

End user (Online, Offline)

The online segment in image recognition in CPG market is expected to hold a dominant share of 54.9% by 2036 as it is emerging as a key end user in the market. The market is driven by the rise of visual search and AI-powered product tagging on e-commerce platforms. As consumers increasingly rely on images to discover and compare products, brands are leveraging image recognition to enhance digital merchandising. Automated content moderation and quality control are also critical for maintaining consistency across vast product catalogs.

This growth is fueled by the need for faster, visually rich shopping experiences that mirror in-store interactions. A recent example of image recognition enhancing the online CPG market is Amazon’s update to its Amazon Photos service. From March 2025, this feature allows users to search their personal photo libraries for items, and the system identifies products within those images and provides direct links to purchase similar items on Amazon’s platform. This innovation utilizes image recognition to streamline the shopping experience, enabling consumers to move seamlessly from inspiration to purchase.

Deployment Type (Cloud, On-Premises)

The cloud segment in image recognition in CPG market is anticipated to hold a significant revenue share through 2036 due to its scalability, cost efficiency, and real-time processing capabilities. Cloud-based platforms allow brands to deploy image recognition solutions across multiple retail locations without heavy IT infrastructure. This flexibility is crucial for monitoring shelf conditions, promotions and compliance in dynamic retail environments. The growth is also fueled by increased adoption of SaaS based analytics tools that integrate seamlessly with visual data streams.

Our in-depth analysis of the market includes the following segments:

|

End user |

|

|

Deployment type |

|

|

Application |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Image Recognition in CPG Market Regional Analysis:

North America Market Analysis:

North America is expected to dominate the image recognition in CPG market with a 30.9% share through 2037 due to rising demand for retail automation and data-driven merchandising. Retailers use visual AI to enhance shelf compliance, reduce out-of-stock, and boost customer engagement. The prevalent labor shortages in North America and the shift to omnichannel retailing are accelerating adoption. Moreover, brands seek real-time insights to improve inventory accuracy and in store execution further driving the market growth.

The U.S. image recognition in the CPG market is predicted to witness significant growth in image recognition technology adoption primarily driven by the need for enhanced retail execution and real-time shelf monitoring. By automating shelf audits, CPG companies can ensure products are correctly placed and adequately stocked, leading to improved sales and customer satisfaction.

The market in Canada is accelerating driven by the need for enhanced shelf management and real time inventory insights. This technology enables retailers to ensure optimal product placement and availability which directly impacts the sales performance. A notable example is the introduction of TELUS Agriculture & Consumer Goods Retail Rapid Image Recognition Software in July 2022. This innovative solution enables in store staff to capture shelf images and receive immediate feedback on product assortment and promotional compliance, facilitating prompt corrective actions. This advancement reflects Canada’s commitment to integrating these solutions that streamline retail operations and improve customer satisfaction.

Europe Market Analysis

The image recognition in CPG market in Europe is expanding and is anticipated to garner a significant share from 2025 to 2037 as brands seek scalable solutions for real-time shelf visibility across fragmented retail environments. Growing pressure for omnichannel consistency is pushing companies to adopt AI-powered visual tools for in-store execution. For instance, in March 2021, Trax and European technology company Roamler launched a crowd-based store auditing service, enabling CPG firms in Belgium, France, Germany, Italy, Netherlands, Spain, and the UK to gather granular shelf data. This collaboration not only enhances the speed and accuracy of retail audits but also reduces the dependency on traditional field teams. By utilizing crowdsourced image data, CPG companies can make faster, more informed decisions about product placement.

The image recognition in the CPG market in Germany is experiencing significant growth due to the need for enhanced inventory analysis and product placement trend analysis. This technology enables precise tracking of stock levels and consumer purchasing patterns, leading to optimized inventory management and strategic marketing decisions. Additionally, the integration of artificial intelligence with image recognition solutions is improving store performance by providing real-time insights into shelf conditions and product availability. These advancements reflect Germany’s commitment to leveraging innovative technologies to enhance retail efficiency and customer satisfaction.

In the UK, image recognition in the CPG market is growing due to rising retailer adoption of AI to streamline shelf auditing and reduce manual stock checks. A surge in demand for personalized shopping experiences is driving brands to analyze visual data from in-store behavior. The country’s strict regulatory focus on product labeling and traceability has further spurred investments in visual verification tools. Additionally, the rise of cashier-less convenience stores across urban centers is accelerating real-time image-based inventory systems.

Key Image Recognition in CPG Market Players:

- Trax

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IBM

- Qualcomm

- Microsoft

- AWS

- Catchoom

- Slyce

- LTU Tech

- Imagga

- Vispera

- Blippar

- Ricoh innovations

- Clarifai

- Deepomatic

- Wikitude

- Honeywell

- Oracle

The competitive landscape of image recognition in CPG market is shaped by tech driven firms such as Trax, Pensa Systems and Planorama which specialize in shelf analytics and retail execution. These players deploy AI and computer vision to offer real time insights into in-store conditions, giving brands a strategic edge. Hence, partnerships with major retailers and CPG companies are intensifying competition as vendors race to deliver scalable, cloud based solutions across global markets. For instance, in January 2024, IBM collaborated with SAP specifically for consumer packaged goods (CPG) and retail sectors to introduce new AI solutions to develop sales, finance, and supply chain operations. Here are some leading players in the image recognition in CPG market:

Recent Developments

- In November 2024, Google Cloud and Infilect partnered to offer advanced real time shelf tracking using image recognition and AI. Their goal is to help Consumer Packaged Goods (CPG) companies improve in-store profits by spotting out of stock products quickly, improving shelf availability and increasing product visibility.

- In September 2024, Google Cloud collaborated with ParallelDots, a leader in retail image recognition solutions, to provide fast advanced, real-time AI solutions to global CPG manufacturers and retailers. This partnership boosts customer satisfaction and sales.

- Report ID: 7603

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Image Recognition in CPG Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.