Image-guided Therapy Systems Market Outlook:

Image-guided Therapy Systems Market size was over USD 5.88 billion in 2025 and is anticipated to cross USD 10.73 billion by 2035, growing at more than 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of image-guided therapy systems is assessed at USD 6.21 billion.

Advanced imaging technologies in image-guided therapy systems are revolutionizing the medical treatment landscape by increasing the accuracy of diagnosis and treatment. For instance, in November 2023, at the Radiological Society of North America's (RSNA) 2023 Annual Meeting, GE HealthCare showcased over 40 innovations that included AI-enabled technologies in the imaging, ultrasound, and digital space. The remarkable catalyst in this market includes the rising incidence of chronic diseases. For instance, in January 2023, it was revealed by the National Library of Medicines that the number of people aged 50 and over who have at least one chronic illness is predicted to rise from 71.522 million in 2020 to 142.66 million in 2050, a 99.5% increase.

In addition, the high demand for outpatient surgical procedures drives the adoption of such systems, as it provides for faster recovery and shorter hospital stays. Also, government programs and funding provided to researchers in medical imaging support innovation and allow the market area to expand in this dynamic field. For instance, in March 2024, the Advanced Research Projects Agency for Health (ARPA-H) announced a collaboration with the Food and Drug Administration’s (FDA) Center for Devices and Radiological Health (CDRH). This partnership aimed to enable access to high-quality, affordable medical imaging data. The U.S. Department of Health and Human Services (HHS) is home to both organizations.

Key Image-guided Therapy Systems Market Insights Summary:

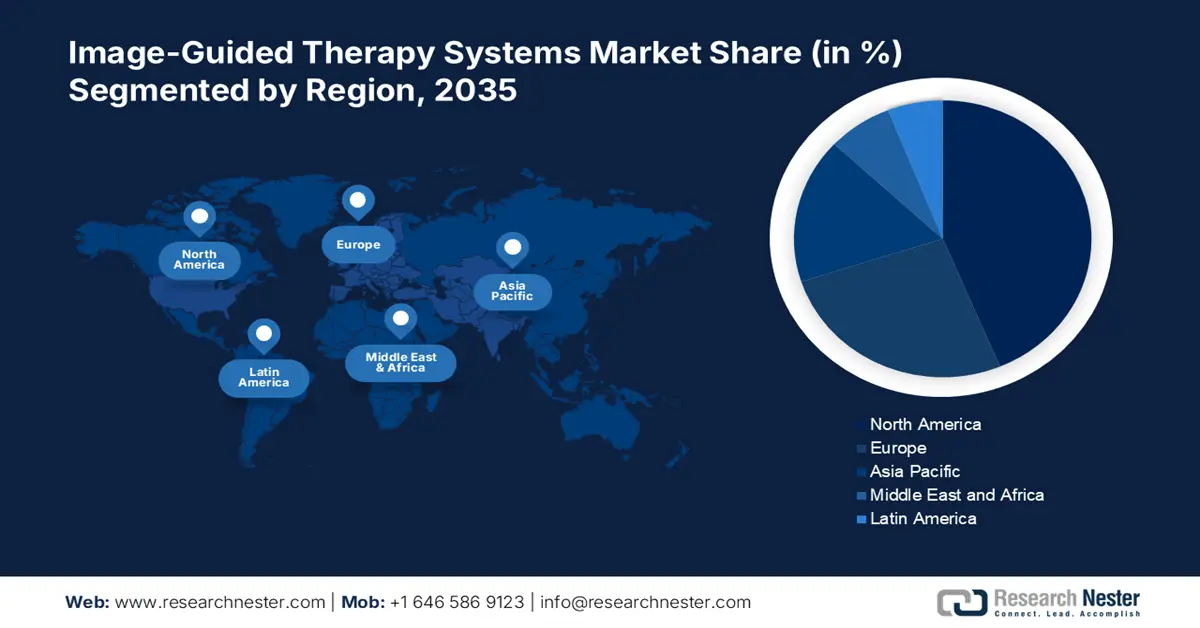

Regional Highlights:

- North America dominates the Image-guided Therapy Systems Market with a 43.7% share, propelled by increased government spending, supportive reimbursements, and technological advancements in image-guided therapy, fostering robust growth prospects through 2035.

- The Asia Pacific Image-guided Therapy Systems Market anticipates lucrative growth by 2035, fueled by rising heart disease rates and growing need for non-invasive diagnostic methods.

Segment Insights:

- The Endoscope segment is anticipated to achieve around 37.5% market share by 2035, propelled by its critical role in minimally invasive procedures and real-time visualization enhancing diagnostic accuracy.

Key Growth Trends:

- Integration with robotics & AI

- Emerging need for palliative care

Major Challenges:

- Interoperability challenges

- Adequate training requirement

- Key Players: Siemens Healthineers, Analogic Corporation, GE Healthcare, Varian Medical Systems, Inc., Brainlab AG, and more.

Global Image-guided Therapy Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.88 billion

- 2026 Market Size: USD 6.21 billion

- Projected Market Size: USD 10.73 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.7% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Mexico

Last updated on : 13 August, 2025

Image-guided Therapy Systems Market Growth Drivers and Challenges:

Growth Drivers

-

Integration with robotics & AI: In the image-guided therapy systems market, AI & robotics are transforming the landscape of minimally invasive procedures by maximizing precision, efficiency, and outcomes. Robotic-assisted technologies give surgeons better dexterity and control-friendly approaches to complex interventions, while AI algorithms generate real-time analysis into critical insights, as well as predictive analytics based on imaging data. For instance, in June 2024, GE HealthCare and MediView XR Inc. announced the successful installation of OmnifyXR Interventional Suite. This augmented radiology suite incorporates advanced imaging technologies, 3D anatomy model visualization, and a holographic heads-up display streaming live medical imaging.

-

Emerging need for palliative care: The need for palliative care is increasingly being recognized in the market, considering it as a crucial part, especially in advanced or terminal diseases amongst adults. For instance, in November 2023, according to the National Library of Medical, an estimated 56.8 million people worldwide are thought to need palliative care each year, with the majority of these individuals being adults and children who reside in LMICs. With a better interest in holistic care approaches, palliative approaches must be incorporated into image-guided therapy in addressing the multifaceted physical and emotional burdens that arise in the face of serious illness for both patients and their families.

Challenges

-

Interoperability challenges: A significant barrier to the smooth integration of different imaging technologies and electronic health records in the market is interoperability. It makes it difficult for standardized protocols and communication frameworks that ensure the proper and efficient transfer of critical patient data, creating fragmented workflows that can lead to treatment delays. Moreover, different software platforms or hardware incompatibility may result in complexity in combining various medical devices, therefore limiting their ability to work together in harmony in the procedure.

-

Adequate training requirement: The most significant hurdle in the market is to implement the demand for proper training. Since it mandates that healthcare professionals attain the highest level of special skills to be used with advanced imaging technologies and in the accurate interpretation of complex data. Training inadequacy leads to poor utilization of the technology, more procedural risks, and poor patient outcomes. In this regard, investment in quality training programs becomes essential for developing competent medical staff who can manage image-guided systems properly for better care provision to patients in minimally invasive procedures.

Image-guided Therapy Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 5.88 billion |

|

Forecast Year Market Size (2035) |

USD 10.73 billion |

|

Regional Scope |

|

Image-guided Therapy Systems Market Segmentation:

Product (Ultrasound Systems, Computed Tomography (CT) Scanners, Positron Emission Tomography (PET), Endoscopes, Magnetic Resonance Imaging (MRI), X-ray Fluoroscopy, Single Photon Emission Computed Tomography (SPECT))

Based on the product, endoscope segment is anticipated to dominate around 37.5% image-guided therapy systems market share by the end of 2035. It plays a critical role in minimally invasive procedures across various medical specialties. Real-time visualization of inner structures with endoscopic imaging helps in producing accurate diagnoses and interventions by causing less patient trauma and shorter recovery periods. Applications such as gastrointestinal and respiratory, urological procedures are enhanced by the versatility of the endoscope in clinical practice. For instance, in May 2023, the EVIS X1 endoscopy system and two compatible gastrointestinal endoscopes were approved by the FDA. The GIF-1100 gastrointestinal videoscope is for use in the upper digestive tract while the CF-HQ1100DL/I colonovideoscope is approved for use in the lower digestive tract.

Application (Cardiac Surgery, Neurosurgery, Orthopedic Surgery, Urology, Oncology Surgery, Gastroenterology)

One of the most crucial areas of growth in the image-guided therapy systems market is the cardiac surgery segment owing to the incidence of cardiovascular disease that is slowly on the rise, coupled with a greater necessity for accurate interventions. For instance, in December 2024, according to self-reported data from the Australian Bureau of Statistics (ABS) 2022 National Health Survey, 1.3 million Australians aged 18 and over (6.7% of the adult population) were estimated to have one or more heart, stroke, or vascular disease-related conditions (ABS 2023c). Among these, 600,000 adults (3.0%) reported having coronary heart disease, which includes heart attacks and angina. It will thus place more importance on this aspect to provide effective treatment to patients in the domain of image-guided therapies.

Our in-depth analysis of the global market includes the following segments

|

Product |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Image-guided Therapy Systems Market Regional Analysis:

North America Market Statistics

North America image-guided therapy systems market is projected to dominate revenue share of over 43.7% by 2035. The growth is spurred by increased government spending, supportive reimbursement programs, technological developments to improve shift time, the growing prevalence of lifestyle-related diseases, and the growing need for early detection tools.

Image-guided therapy systems growth in the U.S. is propelled by new technologies fostered with the conducive ecosystem for development and innovation. For instance, in July 2024, the U.S. launch of the full BioTrace software suite, which includes the BioTraceIO Vision and BioTraceIO Precision solutions, was announced by Techsomed Ltd. Following FDA approval for liver tumor ablation last year, both products are currently being implemented at top healthcare facilities nationwide, giving patients access to these game-changing technologies.

The market in Canada is witnessing significant growth due to supportive regulatory framework. For instance, in August 2024, INOVAIT, released its first bilingual progress report, titled 2020-2023 Canada's Image-guided Therapy Sector describing developments and impacts of ongoing projects from 2020 to 2023. In addition to this, in January 2025, INOVAIT, Canada is accepting applications for its Pilot Fund. The INOVAIT Pilot Fund is a reimbursement-based funding program for joint research and development (R&D) projects that combine IGT technologies with AI, machine learning, or big data.

Asia Pacific Market Analysis

The image-guided therapy systems market in the Asia Pacific is gaining traction and is expected to witness lucrative growth during the forecast timeline i.e. 2025-2035. The market growth is expanding due to rising heart disease rates and the growing need for non-invasive diagnostic methods. Furthermore, businesses concentrating on creating cutting-edge and ground-breaking cardiovascular ultrasound products are turning out to be one of the main elements influencing the market expansion.

The market in India is expanding due to enhanced expertise of tech giants in delivery reliable and effective diagnostics solutions using advanced techniques. For instance, in November 2024, Tata Elxsi enhanced medical imaging systems through a variety of technological means to improve image quality, reduce noise, and enable more accurate diagnosis. It employed AI and advanced algorithms in its solutions to assist radiologists in interpreting images and identifying abnormalities. In addition, the company has developed cloud-based platforms that facilitate remote image sharing, storage, and access, thereby improving patient care and provider collaboration.

The image-guided therapy systems market in China is gaining noteworthy traction owing to the harmonious relationships being fostered between companies and their unanimous strategies. For instance, in February 2024, to support the high speed, accuracy, and precision of their CT scanners, UIH used magnetic encoders manufactured by RLS. In order to meet the demands of its customers, Renishaw, which adheres to UIH's corporate philosophy of innovation and manufacturing transformation, makes significant investments in the research and development of Computed tomography (CT) scanning tool.

Key Image-guided Therapy Systems Market Players:

- Medtronic

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens Healthineers

- Analogic Corporation

- GE Healthcare

- Varian Medical Systems, Inc.

- Brainlab AG

- Olympus Corporation

- Stryker

Through the ongoing initiatives and launches that drive the demand for image-guided therapy systems market, the major market players are significantly contributing to the growth. For instance, in July 2023, Stryker commercially launched its Q Guidance System with Cranial Guidance Software to provide surgeons with an image-based planning tool and intraoperative guidance that aids in identifying patient anatomy and positioning instruments during cranial surgery. The software can be used for craniotomies, skull base and transsphenoidal procedures, shunt placements, and biopsies.

Here's the list of some key players:

Recent Developments

- In February 2024, Royal Philips announced major enhancements to its image-guided therapy system, Azurion with the launch of its new Azurion biplane system. This new interventional system features enhanced 2D and 3D imaging and X-ray detector positioning flexibility.

- In November 2023, Cleveland Clinic and Canon Inc. announced a partnership agreement. In addition to creating a comprehensive imaging research center, the strategy aims to create state-of-the-art IT solutions for imaging and healthcare to enhance patient outcomes, diagnosis, and treatment.

- In July 2022, Arthrex and Skytron announced a partnership to offer a variety of total room solutions designed to satisfy the needs and difficulties of operative care facilities in the future. This partnership shared the goal of enhancing surgical quality and patient care.

- Report ID: 7128

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Image-guided Therapy Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.